Bitcoin Price Today: Dips below $90,000 as risk-off mood prevails

Bitcoin slipped below the $90,000 mark on December 15, 2025, sending a clear signal that the market mood has turned cautious. The drop came during a broader risk-off phase across global financial markets. Stocks weakened. Bond yields stayed firm. The US dollar held strength. In this environment, investors chose safety over growth.

The move surprised many short-term traders. Bitcoin had been holding strong above key levels for weeks. But sentiment shifted fast. Small sell-offs turned into wider exits. Profit booking increased. Volatility returned.

This dip is not just about price. It reflects changing behavior. Traders are reacting to global signals, not crypto headlines alone. Bitcoin, once seen as a hedge, is still treated like a risk asset in tense moments. That reality matters.

Despite the fall, market activity remains high. Long-term holders appear calm. Short-term players are more nervous. The $90,000 level now carries emotional weight. How Bitcoin behaves around it could shape near-term confidence.

What Triggered Bitcoin’s Slide Below $90,000?

Bitcoin fell below $90,000 on December 15, 2025, as risk appetite dropped across global markets. Tech stocks pulled back. Bond yields moved higher. The dollar stayed firm. These moves drained liquidity from risky assets and pushed traders to cut positions in crypto.

Short-term profit-taking added fuel to the decline. Funding rates for perpetual swaps also fell sharply in early December, hinting that leveraged long bets were being closed. Such derivative signals often accelerate price drops when sentiment turns.

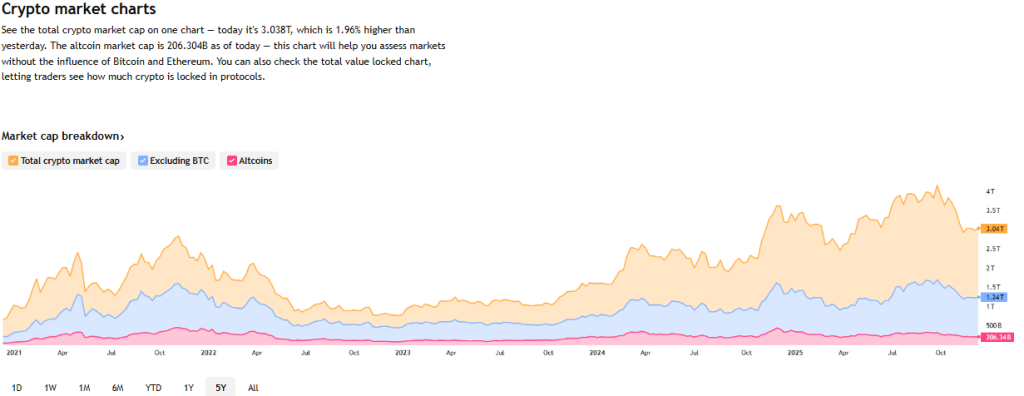

Crypto Market Reaction: Altcoins Feel Deeper Pain

Major altcoins underperformed Bitcoin during the dip. Ethereum, Solana, and several high-beta tokens slid more than BTC’s move. Stablecoin balances on exchanges rose, showing traders sought safety. Lower-cap tokens showed the biggest losses. This pattern suggests risk-off flows hit speculative assets first. On-chain activity rose for some pairs as traders shifted into stablecoins and liquidated margin positions.

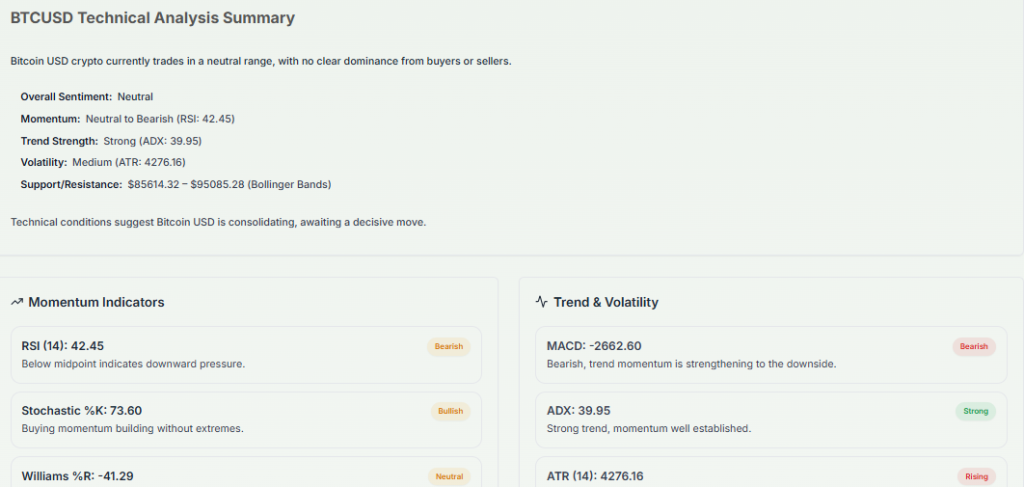

Key Technical Levels Traders are Watching Now

$90,000 had become a psychological pivot by mid-December. The next clear support zones lie near $85,000 and $77,000, based on recent swing lows and horizontal price clusters. Immediate resistance sits around $93,000-$95,000.

Volume tapered during the decline, which means moves could intensify on renewed selling. Options and futures open interest remain high, keeping the market sensitive to large flows. Watch funding rates and open interest for clues on whether liquidation risk is rising again.

Is This a Healthy Pullback or Start of a Deeper Correction?

Historical patterns show both outcomes are possible after sharp rallies. A healthy pullback keeps higher time-frame structure intact. A deeper correction breaks key support levels and triggers larger risk-off selling. Long-term holder metrics still show sizable accumulation.

At the same time, shorter-term metrics like falling funding rates and growing options hedging point to higher near-term caution. Traders should treat the move as a tense rebalancing rather than an outright market failure until major supports break.

Institutional and ETF Flows: What the Smart Money Is Doing

Spot Bitcoin ETFs showed mixed flows in early December. Some days recorded notable inflows concentrated in a single large fund. Other days saw outflows across the board. Net inflows around December 12 indicated selective buying, but total flows were not uniformly bullish.

Data from an AI stock research analysis tool highlighted that BlackRock’s IBIT led inflows on certain days, while other ETFs lagged. This uneven pattern suggests institutions remain active but cautious. ETF flow swings can amplify spot moves when liquidity is thin.

Macro Events Keeping Bitcoin Under Pressure

Central-bank signals shaped risk appetite in mid-December. Hawkish comments from major central banks tightened sentiment. Geopolitical news and year-end position squaring also reduced market depth.

The Bank of Japan’s more hawkish stance and ongoing Fed rate expectations added pressure on risk assets. When global rates rise or stay high, investors often prefer cash and sovereign debt over volatile assets like crypto. These macro forces explain why Bitcoin moved with equity markets rather than acting as a hedge on December 15, 2025.

Short-Term Outlook: What Could Move Bitcoin Next?

A rebound above $93,000-$95,000 is needed to restore short-term bullish bias. Continued ETF inflows and lighter macro risk could spark a quick recovery. Conversely, a breakdown below $85,000 would open the path to $77,000 or lower.

Expect sharp swings while derivatives open interest stays elevated. Traders should watch funding rates, ETF daily flows, and US equity moves for early signals. Newsflow on regulation, including new rules being discussed in major markets, could also sway sentiment quickly.

Wrap Up

The drop below $90,000 on December 15, 2025, reflects a short-term shift in risk appetite. Macro headlines and derivatives activity pushed traders to reduce exposure. Long-term on-chain signs still show resilience. The market now watches ETF flows, funding rates, and key support levels. Short-term moves may remain choppy, but a clear break of major support would change the outlook materially.

Frequently Asked Questions (FAQs)

Bitcoin fell on December 15, 2025, due to a risk-off mood. Investors moved away from risky assets as stocks weakened, bond yields stayed high, and profit-taking increased.

Bitcoin may recover if market sentiment improves. A rebound depends on global markets, ETF inflows, and whether buyers defend key support levels over the next few trading sessions.

After breaking $90,000 on December 15, 2025, traders are watching support near $85,000. A deeper fall could test lower zones if selling pressure continues.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.