Bitcoin Price Today: Up as Investors Brace for U.S. Inflation Figures

Bitcoin started on Thursday, October 23, 2025, on a positive note, climbing as traders waited for the latest U.S. inflation figures. The world’s largest cryptocurrency rose above key resistance levels, signaling that investors are becoming more confident after a week of uncertainty. Inflation data from the U.S. often sets the tone for global markets, and this time, crypto traders are paying close attention.

Why? Because inflation affects how the Federal Reserve sets interest rates. When inflation cools, risk assets like Bitcoin often gain as money moves back into the market. But if prices rise faster than expected, investors turn cautious, leading to sharp pullbacks.

Bitcoin’s movement today shows how tightly it’s linked to broader economic trends. It’s no longer just a “digital coin.” It reacts to policy, data, and investor mood just like gold or stocks. As new inflation numbers approach, the crypto world is holding its breath to see which way the tide turns next.

Market Snapshot: Bitcoin’s Current Position

As of October 23, 2025, Bitcoin traded near $109,512 after a day of mixed moves. Volume stayed robust, showing active buying and selling across exchanges. The coin is close to recent intraday highs. Alternatives like Ethereum moved with lower volatility. Open interest in futures markets rose slightly, hinting at positioning by leveraged traders. These flows kept volatility within a measured range but left room for sudden swings if a macro surprise hits.

Inflation Data and Its Impact on Crypto

The U.S. Consumer Price Index for September is due October 24, 2025, at 08:30 AM ET. That print will guide Fed expectations. Cooler inflation data would ease rate-hike fears. That often lifts risk assets. Hotter-than-expected inflation tightens financial conditions. That can trigger quick crypto selloffs.

Bitcoin has shown both reactions in the past. On average, hotter CPI has led to short-term dips while cooler prints have supported rallies. Traders watch the headline number and core readings. The market also gauges the tone in the Federal Reserve’s post-data messaging. Small changes in wording can shift sentiment fast.

Investor Behavior Ahead of CPI Data

Traders moved into a cautious stance as the report approached. Some reduced leveraged positions. Others increased stablecoin balances to stay liquid. Spot exchanges saw modest withdrawals, signaling accumulation off-exchange.

Derivatives desks reported varied hedging. Options traders bought near-term protection against a sudden drop. Short-term wallets showed less activity than during sharp rallies. Institutional desks balanced ETF flow signals with macro hedges. An AI tool scan of recent fund flows highlighted quick reversals of sentiment over the last week.

Broader Market Context: Stocks, Dollar, and Gold

Equities and the dollar set the backdrop for crypto moves. The S&P and Nasdaq traded with muted gains ahead of CPI. The U.S. dollar index held steady, narrowing room for sudden dollar-led moves in crypto. Gold showed small gains as risk and inflation fears lingered.

When the dollar weakens, Bitcoin often finds additional support. But a strong dollar or equity selloff can push traders toward cash and safe havens, amplifying crypto declines. Traders now watch cross-asset cues to judge whether Bitcoin acts like risk-on or a digital safe haven.

Technical Analysis: Key Levels and Momentum Indicators

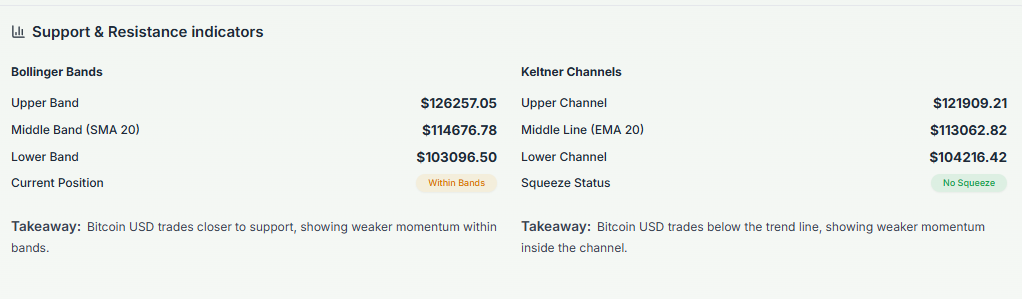

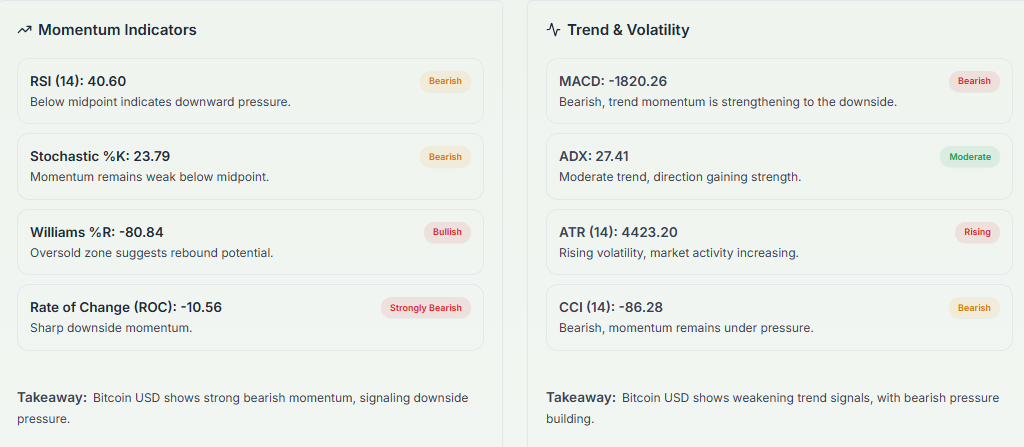

Short-term charts point to clear levels. Support sits near $106,700-$107,500. Resistance is close to $112,000-$114,500. The 50-day moving average tracks below the price, offering dynamic support. The 200-day moving average remains well below current levels, signalling a longer-term bull trend.

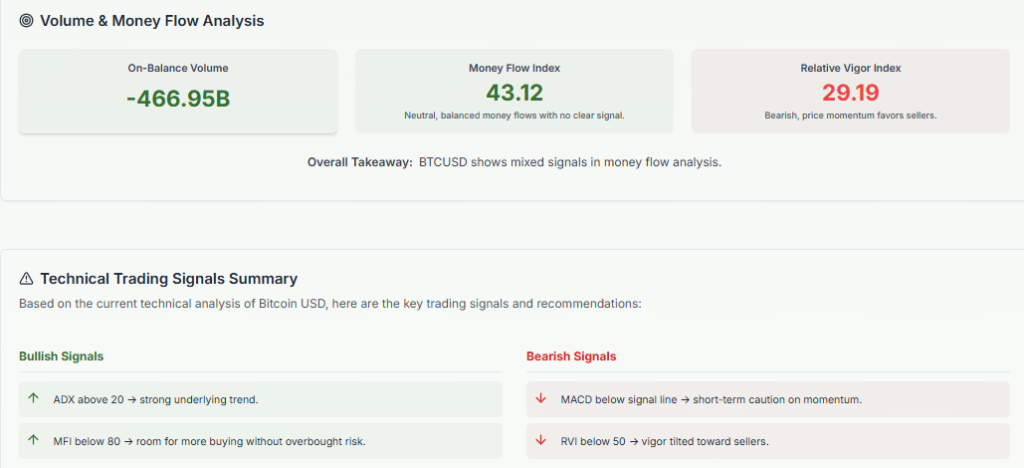

RSI readings show neutral to slightly overbought conditions on hourly frames. MACD momentum is mixed after recent swings. On-chain data show steady exchange outflows, which can lower immediate sell pressure. Traders should watch whether buyers defend the $107,500 area. A decisive break below that could invite deeper corrections.

Institutional and Retail Sentiment

Institutional flows turned choppy this month. Spot Bitcoin ETFs logged both large inflows and quick outflows in recent sessions. One multi-day stretch saw $1.2 billion redeemed from ETFs, only to see partial inflows return days later. That push-pull shows institutions are profit-taking and quickly reallocating.

Retail sentiment stayed mixed. Social chatter rose ahead of CPI, but on-exchange retail positions did not spike to extremes. Large wallet activity, so-called whale moves, showed periodic accumulation. That pattern suggests patient buyers remain, while fast money reacts to headlines.

What to Watch Next?

Focus on the CPI print on October 24, 2025. Watch headline and core inflation. Track immediate reaction in ETF flows. Check dollar moves and short-term rates. Monitor options skew and futures funding rates for stress signs. Pay attention to any Fed commentary that follows. Also watch for geopolitical headlines that could shift risk appetite. A cooler CPI may extend the recent rally. A hotter CPI could spark sharp selling and volatility spikes. Traders should size positions with risk controls.

Wrap Up

Bitcoin’s current moves reflect a delicate mix of macro and market forces on October 23, 2025. Traders are pricing in tomorrow’s inflation read. ETF flows and on-chain metrics offer clues. Short-term swings are likely once the CPI lands. Keep position sizes prudent and watch cross-asset signals closely.

Frequently Asked Questions (FAQs)

When inflation in the U.S. rises, Bitcoin often drops as investors seek safety. If inflation cools, Bitcoin may rise.

As of October 23, 2025, Bitcoin shows support near $107,500 and resistance around $114,000. Traders watch these levels for signs of the next market move.

Bitcoin can act as an inflation hedge over time, but its short-term price often changes with market trends. It’s not fully stable like gold yet.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.