BofA Sees Positive Outlook for Novartis and GSK With Upcoming Milestones

The pharma sector is walking into 2025 with fresh momentum, and two big names are getting extra attention. Bank of America (BofA) recently shared a positive outlook on Novartis and GSK, pointing to several major milestones expected in the coming months. These updates matter because both companies are entering a crucial phase in their research pipelines and commercial plans.

Investors are watching closely. Novartis is pushing deeper into high-value areas like cancer, immunology, and gene therapy. GSK is building on strong vaccine demand and new data releases expected in early 2025. BofA says these milestones could shape the next stage of growth for both firms.

The tone from analysts is upbeat. They believe steady drug demand, clearer regulations, and strong clinical progress are helping these companies stand out in a crowded market. The message is simple. With the right approvals and solid data, Novartis and GSK could see real gains. And the next few months may decide how much upside is ahead.

BofA’s Thesis: Why the Outlook Is Positive?

Bank of America (BofA) recently upgraded its view on Novartis to Buy and raised its target for GSK, citing a wave of important pipeline readouts and product launches ahead. The thesis is clear: both companies are entering a critical phase where data from late-stage trials and commercial launches could unlock meaningful growth.

BofA analysts argue that these upcoming milestones can help balance out the challenges from patent expirations. There is also confidence in a favorable regulatory backdrop and stable demand for innovative medicines.

Novartis: Current Positioning and Strategy

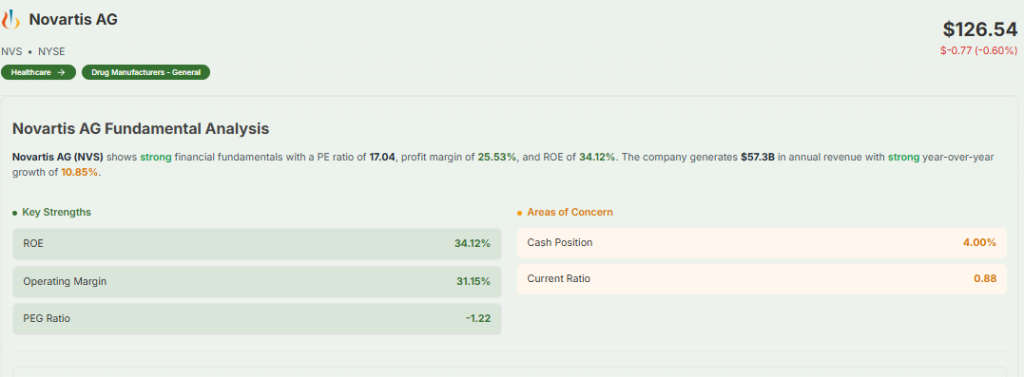

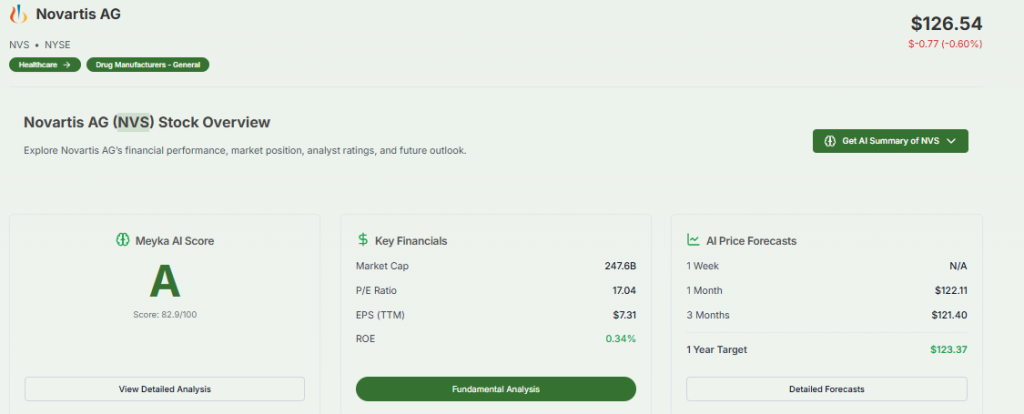

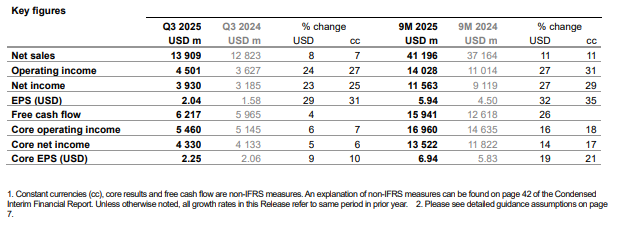

Novartis has refocused itself as a pure-play medicines company. It concentrates on four core therapeutic areas: oncology, immunology, neuroscience, and cardiovascular-renal-metabolic disease. In the first nine months of 2025, Novartis grew its core operating income margin to 41.2 percent.

That’s ahead of its own plan. It expects margins to stay strong even after closing on its $12 billion Avidity Biosciences deal. The Avidity acquisition will bring in RNA-based muscle therapies, which diversifies Novartis’s pipeline. On the financial side, it’s also returning cash to shareholders via a share buyback.

Upcoming Milestones for Novartis

According to Novartis, more than 15 submission-enabling readouts are expected over the next two years. These include pivotal trials for drugs like pelacarsen, remibrutinib, ianalumab, and abelacimab.

Among its existing brands, Novartis is seeing strong momentum: Pluvicto, Scemblix, Kisqali, Leqvio, Kesimpta, and Rhapsido are all scaling. For example, its Q3 2025 results showed Pluvicto sales up ~45 percent (cc) and Scemblix up ~95 percent.

These launches could help Novartis offset future revenue decline from older drugs losing patent protection. BofA sees this as a key piece of its upside case.

GSK: Current Landscape and Business Momentum

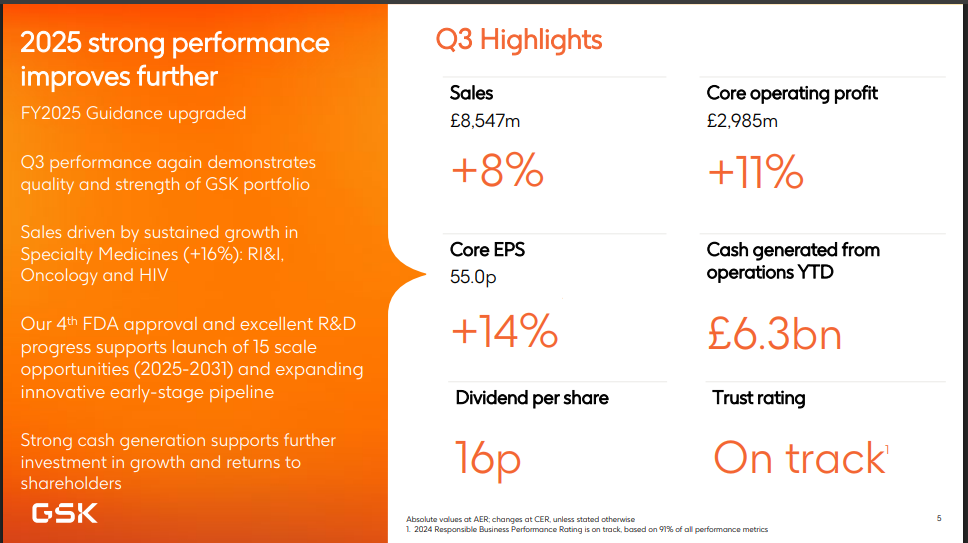

GSK has shown strong specialty medicines in 2025. In Q1 alone, its specialty sales rose 17 percent, driven by respiratory, oncology, and HIV medicines. Meanwhile, its vaccines business is more volatile, but GSK is still investing heavily in its R&D pipeline.

It is also executing a £2 billion buyback program, signaling confidence in its long-term strategy. On the corporate side, GSK remains committed to its long-term target of generating more than £40 billion in sales by 2031.

Upcoming Milestones for GSK

BofA highlights a “busy 2026” for GSK. Key upcoming catalysts include:

- Blenrep (multiple myeloma), with a resubmission or decision expected.

- Depemokimab (IL-5 biologic) for type 2 inflammation, including asthma and nasal polyps.

- Phase III data for camlipixant, targeting chronic cough.

- Phase III readout for bepirovirsen, a hepatitis B drug.

Also important is GSK’s acquisition of efimosfermin, a liver-disease asset from Boston Pharmaceuticals. That drug is expected to be filed and potentially launched by 2029, offering long-term upside. Plus, GSK is eyeing more research in respiratory disease, including ultra-long-acting IL-5 blockers for COPD and other conditions.

Risks and Challenges for Both Companies

Even with strong pipelines, both companies face risk. For Novartis, patent risk is real: its heart-failure drug Entresto could face generic competition in the U.S. by mid-2025. Patent litigation over Kisqali also poses a threat if unfavorable rulings emerge.

In GSK’s case, key upcoming readouts are binary. If Phase III trials fail or approvals are delayed, investor sentiment may sour. Regulatory timing is also a risk: even if data are positive, approvals or label expansions can take time. Furthermore, the cost of strengthening their pipelines through R&D and acquisitions is high, and margin pressure may follow.

What does this mean for Investors?

According to BofA, now is a pivotal moment for both Novartis and GSK. The combination of late-stage readouts and commercial scale helps to de-risk their growth narratives.

If things go well, these catalysts could boost revenues and reshape their mid-term growth trajectories. From an investor’s perspective, exposure to their pipelines now gives a lever to capture upside, provided the data play out as expected. However, this is not a risk-free bet. The payoff depends heavily on trial success and the companies’ ability to execute on launches. A disciplined investor might weigh the potential rewards against scenarios where regulatory, clinical, or competitive headwinds emerge.

Final Words

BofA’s upgrade of Novartis and GSK hinges on one core idea: both companies are entering a catalyst-rich phase. Novartis is banking on multiple pivotal readouts and scaling commercial launches. GSK is also preparing for major events, including oncology, respiratory, and hepatitis B catalysts. If these milestones land as expected, they could drive a meaningful re-rating for both companies. But investors should stay alert to risks around patents, trials, and regulation.

Frequently Asked Questions (FAQs)

BofA turned positive because both firms have important drug updates and trial results coming in 2025. These events may help improve sales and support steady growth if results stay strong.

Novartis expects major trial results, new drug filings, and stronger sales from recent launches in 2025. These milestones may guide its future plans and shape investor expectations.

GSK has rising demand for vaccines and several key Phase III results due in 2025-2026. Analysts think these updates may support its long-term growth outlook.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.