Buffett ‘disappointed’ in Kraft Heinz merger, stock drops 7%

Warren Buffett, one of the most respected investors in the world, has openly expressed disappointment over the Kraft Heinz merger. This comes as a shock to many because Buffett is usually known for his calm, long-term investment approach. The news hit the stock market hard, with Kraft Heinz shares dropping by 7% almost immediately. We need to look closely at what went wrong and why investors are concerned.

The Kraft Heinz merger was meant to create a food industry powerhouse. When it was announced, expectations were high. Analysts predicted strong growth, cost savings, and better market positioning. Buffett himself, through Berkshire Hathaway, had put his trust and billions into the deal.

Now, we see that the results are not matching the promises. We have to ask: were the goals too ambitious? Or were there hidden challenges the company did not foresee?Let’s explore Buffett’s disappointment, the market reaction, and what lessons we can learn as investors from this unexpected turn of events.

Background on Kraft Heinz and the Merger

Kraft Heinz was formed in 2015 through a $45 billion merger between Kraft Foods Group and H.J. Heinz Company. This deal was orchestrated by Warren Buffett’s Berkshire Hathaway and Brazilian investment firm 3G Capital. The merger aimed to create a global food giant by combining Kraft’s strong presence in North America with Heinz’s international reach. The hope was that the combined company would benefit from economies of scale, cost-cutting initiatives, and a diversified product portfolio.

At the time, the merger was seen as a strategic move to compete more effectively in the global food industry. Berkshire Hathaway, which owned a significant stake in the new entity, was a major proponent of the deal. However, over the years, the anticipated benefits have not materialized as expected. The company faces challenges like declining sales, especially in North America. It also struggles to integrate the two companies’ operations. These problems caused Kraft Heinz’s stock to drop and raised doubts about the merger’s long-term success.

Buffett’s Disappointment

Warren Buffett has expressed his disappointment with the Kraft Heinz merger and the subsequent decision to split the company. In a recent interview, he acknowledged that the original merger was not a “brilliant idea” and that the breakup would not resolve the underlying issues facing the company. Buffett’s candid assessment highlights the challenges of large-scale mergers and the complexities involved in integrating two major companies.

Despite his reservations, Buffett has maintained Berkshire Hathaway’s stake in Kraft Heinz, which currently stands at 27.5%. This decision reflects his long-term investment strategy and belief in the company’s potential, even amidst current challenges. However, the company’s ongoing difficulties and its decision to split show that it has not fully realized the anticipated synergies from the merger.

Stock Market Reaction

The announcement of Kraft Heinz’s decision to split into two separate companies had an immediate impact on its stock price. Shares fell nearly 7% following the news. This reflects investor concerns about the company’s future direction. Also this decline is part of a broader trend, with the stock having lost over 60% of its value since the merger in 2015. The market’s reaction underscores the uncertainty surrounding the company’s restructuring efforts and the challenges it faces in regaining investor confidence.

Challenges Facing Kraft Heinz

Kraft Heinz is grappling with several significant challenges that have affected its performance. One of the primary issues is declining consumer demand for its traditional products, such as processed foods and snacks. As consumer preferences shift towards healthier and fresher options, Kraft Heinz has struggled to adapt its product offerings accordingly.

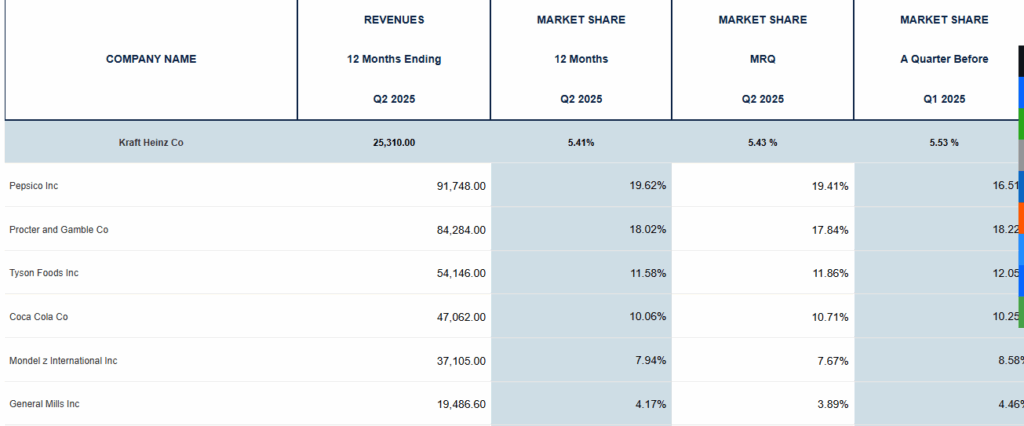

Additionally, the company has faced difficulties in differentiating its brands from private-label competitors, which often offer similar products at lower prices. This price competition has eroded Kraft Heinz’s market share and put pressure on its profit margins.

Operational inefficiencies and challenges in integrating the two companies’ operations have further complicated matters. The complexity of managing a vast portfolio of brands across different regions has hindered the company’s ability to streamline operations and achieve the expected cost savings from the merger.

Buffett’s Investment Philosophy and Lessons Learned

Warren Buffett’s approach to investing is grounded in long-term value creation and a deep understanding of the businesses in which he invests. His involvement in the Kraft Heinz merger was based on the belief that combining the two companies would create a stronger entity capable of competing effectively in the global market.

However, the challenges faced by Kraft Heinz highlight the risks associated with large-scale mergers and the importance of thorough due diligence and integration planning. Buffett’s candid acknowledgment of the merger’s shortcomings serves as a valuable lesson for investors and companies considering similar strategies.

Future Outlook

Looking ahead, Kraft Heinz faces a critical period as it works to implement the planned split into two separate companies. The success of this restructuring will depend on the company’s ability to address its operational challenges, adapt to changing consumer preferences, and restore investor confidence.

Analysts remain cautious, with some expressing concerns about the company’s growth prospects and the effectiveness of the split in resolving its underlying issues. The coming months will be crucial in determining whether Kraft Heinz can navigate these challenges and position itself for future success.

Wrap Up

The decision to split Kraft Heinz is a major moment in the company’s history. It reverses a merger once seen as a smart move in the food industry. The split aims to solve the company’s problems but also highlights the risks of large mergers. Buffett’s disappointment shows how hard it is to get the expected benefits. It reminds companies of the need for careful planning and strong execution in business strategies.

Frequently Asked Questions (FAQs)

On September 3, 2025, Buffett said he was disappointed because Kraft Heinz did not meet expected growth and cost savings. The merger faced challenges in sales and company integration.

On September 3, 2025, Kraft Heinz shares fell about 7% after Buffett’s comments and news of the company’s split. Investors showed concern about its future performance and plans.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.