Building Smarter Conversations: The Rise of Advanced Chatbot Development Services

The way companies talk to users is changing fast. Smart, AI-driven chat systems are no longer just customer support tools; they are becoming essential partners for data-driven decisions. In finance, especially in stock market research, chatbots are helping analysts, investors, and traders make faster and smarter choices.

Chatbot development services let businesses and research teams access real-time insights, interpret trends, and automate queries around the clock. These systems save time, reduce manual work, and improve how organizations interact with large volumes of market data.

So, why are businesses and financial institutions racing toward advanced chatbot development services today? Because speed, personalization, and scalability are now the core of every digital strategy. Meyka builds AI-powered chatbots that understand market context, analyze financial sentiment, and keep conversations clear and human.

For research-driven enterprises, Meyka’s combination of AI, UX, and data integrations makes automation not just efficient but insightful. Let’s explore how this market is growing, why enterprises are investing, and how Meyka is helping companies build smarter conversations for stock market intelligence.

The Global Shift Toward AI-Powered Chatbot Development Services

The global market for AI chatbot development services is expanding at record speed. Industry analysts estimate it will reach $25–30 billion by 2030, driven by rising demand for AI automation, data analytics, and natural language understanding.

In the finance world, this growth is even more pronounced. Investment firms, fintech startups, and data research companies now rely on AI chatbots to deliver faster insights, reduce costs, and maintain accuracy in volatile markets.

Across industries like banking, stock trading, e-commerce, and SaaS, enterprises are deploying chatbots to streamline workflows and offer consistent service 24/7. What began as a customer service tool is now an integral part of digital transformation and business automation strategies.

Did you know? Nearly 80% of financial institutions plan to integrate AI chatbots or virtual assistants within the next three years to improve research, analytics, and investor engagement. The opportunity for AI-driven insights is massive, and Meyka is helping businesses capture it.

The Technology Behind Smarter Conversations

Modern chatbot development services are built on sophisticated AI architectures that make conversations natural and context-aware.

Here’s how it works:

- Natural Language Processing (NLP): Understands investor queries such as “What’s Tesla’s stock performance this week?” and interprets intent accurately.

- Machine Learning (ML): Continuously improves predictions and responses based on historical trading and market data.

- Contextual Understanding: Keeps track of multi-step conversations, such as analyzing different stock comparisons or portfolio updates.

- Voice Recognition & Sentiment Analysis: Detects tone, urgency, and even market sentiment, useful for identifying bullish or bearish signals.

Meyka’s chat platform combines these elements to power enterprise-grade financial assistants. Its chatbots can connect to stock APIs, CRMs, and analytics dashboards, enabling real-time updates on prices, trends, and forecasts. Whether on a trading terminal, a mobile app, or social media, Meyka delivers a seamless, multi-channel experience that feels intelligent and personal.

Why Enterprises Are Investing in Chatbot Development Services

Enterprises across industries, especially in financial research and investment analytics, are turning to AI chatbots to handle the growing demand for real-time insights and faster communication.

Here’s why they’re making that shift:

- Faster access to insights: Investors and analysts need data instantly. Chatbots help users pull stock data, market news, or forecasts in seconds.

- Cost efficiency: Chatbots automate repetitive queries, freeing analysts to focus on strategy, not data entry.

- Improved operations: They handle updates, track portfolios, and respond to market changes without fatigue.

- Enhanced accuracy: AI chatbots reduce human errors in fast-moving financial environments.

- Data security: Enterprise-grade encryption ensures confidential market research stays protected.

Meyka’s financial chatbots don’t replace analysts, they assist them. Built on a model of assisted automation, Meyka ensures human experts remain in control while AI accelerates insight delivery. This balanced approach helps firms operate faster and smarter, without losing the human element that drives trust and interpretation.

Business Benefits of Adopting Chatbot Development Services

When enterprises integrate AI chatbots, they gain measurable performance, productivity, and profitability benefits.

1. 24/7 Availability

Chatbots provide round-the-clock access to data and market information. Traders can ask for trend analysis or stock summaries anytime, even after market hours.

2. Cost Reduction

AI-driven chatbots can cut operational costs by up to 40%, reducing the need for manual research and repetitive reporting.

3. Scalability

Meyka’s chatbots manage millions of financial data points and support high user volumes simultaneously, perfect for large trading firms or fintech platforms.

4. Personalization

Bots tailor responses using historical investment data, risk profiles, and trading preferences to deliver context-aware insights.

5. Real-Time Analytics

Every chatbot interaction produces data that helps teams refine strategies and understand market behavior. Meyka’s dashboards visualize this data for faster decision-making.

Can chatbots really improve the research experience? Yes. Meyka’s AI-powered chatbots enhance speed, accuracy, and personalization, key factors that build analyst confidence and client trust in financial conversations.

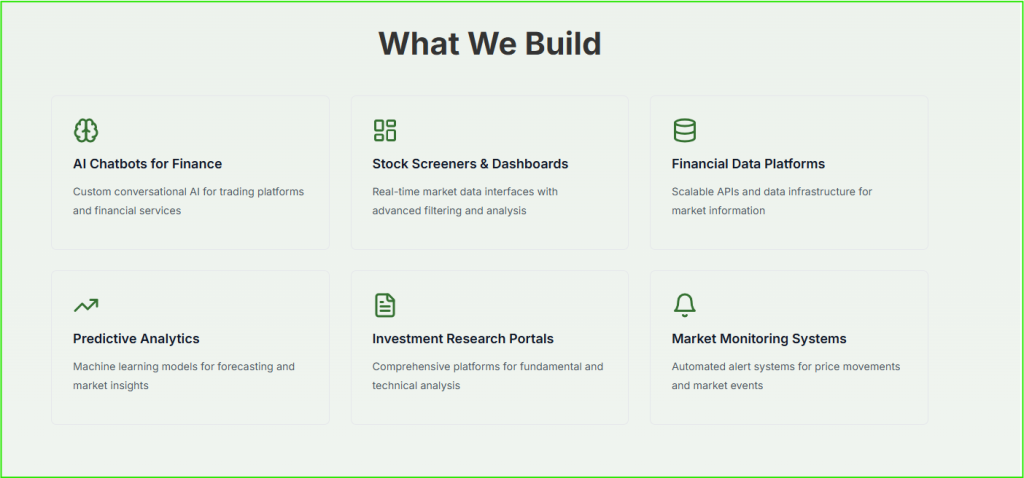

Meyka’s Chatbot Development Services: Building Conversations That Convert

Meyka provides enterprise-grade chatbot development services designed to transform stock market research and analytics.

Its solutions include:

- Custom financial chatbots for trading desks, analysts, and investment firms

- Integration with APIs, CRMs, and financial databases

- Voice and text-based stock analysis bots

- Automated sentiment tracking for market intelligence

- AI-powered portfolio monitoring for clients and advisors

Meyka’s enterprise platform offers fast deployment, simple customization, and secure integration with financial systems. It helps research teams access real-time data, respond faster to market shifts, and engage investors in more meaningful ways.

Unlike generic chat solutions, Meyka’s bots are built for precision, data accuracy, and financial compliance, essential for institutions that depend on reliability.

Key Features That Make Meyka Stand Out

- Human-like interactions powered by NLP, so conversations feel natural.

- Multilingual capabilities, ready for global audiences.

- Easy integration with websites, mobile apps, and cloud tools, reducing implementation time.

- Omnichannel experience across WhatsApp, Slack, and Messenger, to meet customers where they are.

- An advanced analytics dashboard, giving teams visibility into sentiment, intent, and conversion.

- Robust data security, built to meet enterprise privacy and compliance needs.

Meyka’s clients report improved response accuracy, lower support costs, and stronger customer loyalty after deployment. The platform supports iterative improvement, so bots grow better with each interaction.

The Market Opportunity for Chatbot Development Services

The coming years present a major growth window for AI chatbots in finance. As AI and conversational intelligence evolve, chatbots will move from being tools for support to becoming core engines for financial research automation.

The global chatbot market is expected to surpass $30 billion by 2030, with finance and investment management among the top adopters.

Why invest now? Because speed and insight define success in the stock market. Firms that deploy chatbots gain a real-time advantage, faster data interpretation, instant risk updates, and smarter trade decisions. Meyka enables organizations to enter this market quickly, without large infrastructure costs or long development cycles.

Real-World Applications of Meyka’s Chatbot Development Services

Meyka’s financial chatbots are already transforming how businesses and investors use market data. Some real-world applications include:

- Stock Market Research: Instantly fetch live stock prices, performance summaries, and news sentiment.

- Investment Advisory: Provide real-time recommendations based on user portfolios and market movement.

- Trading Assistance: Help traders analyze charts, track indicators, or summarize reports via natural conversation.

- Portfolio Management: Monitor investment performance and notify users of changes in real time.

- Client Communication: Offer investors 24/7 access to their portfolio data with personalized insights.

Meyka tunes every chatbot to match financial tone, compliance, and security requirements, ensuring safe and regulated use in industries where data integrity is non-negotiable.

The Future of Chatbot Development Services and Meyka’s Vision

The future of chatbot development lies in intelligent automation for data-driven industries. With finance and stock trading moving toward AI-powered decision systems, conversational interfaces will become essential research companions.

Meyka’s roadmap focuses on:

- More human-like financial dialogue

- Voice and emotion recognition for natural investor interactions

- Predictive conversation modeling to forecast market questions

- Integration with Generative AI for deeper stock analysis and personalized investment insights

Will chatbots replace human analysts? No, they will enhance them. The future belongs to organizations that blend human intuition with AI precision. Meyka leads this transformation, helping financial institutions and enterprises build smarter conversations that drive smarter investments.

For examples and demonstrations, explore Meyka’s chatbot demos at Meyka AI Chat or visit LinkedIn for case studies showcasing how enterprises use conversational AI in stock research.

Conclusion

Chatbot development services have moved from simple automation to strategic business intelligence tools, especially in financial markets. The demand for real-time, data-driven conversations is at an all-time high, and Meyka is leading this change.

With its AI expertise, secure integrations, and financial-grade accuracy, Meyka empowers organizations to research, analyze, and act faster.

If your enterprise aims to deliver smarter, AI-powered financial insights and build conversations that truly convert, visit Meyka AI Chatbot and start your journey toward intelligent market automation today.

FAQ’S

Meyka specializes in AI-powered chatbots for stock market research and enterprise use, offering deep data integration, contextual understanding, and human-like responses. Its assisted automation model ensures AI precision with human oversight, making conversations both smart and trustworthy.

For finance and stock market sectors, chatbots help by analyzing real-time data, answering investment queries, sharing insights, and guiding users through complex information. They allow investors to get instant updates on trends and stock movements, without waiting for a human analyst.

No. Chatbots are designed to support, not replace, human experts. They automate repetitive queries and data retrieval, while human professionals handle strategy, risk assessment, and personalized financial advice.

Meyka uses enterprise-grade security, encryption, and compliance controls to protect sensitive financial data. All integrations follow strict data privacy standards, making them safe for finance, banking, and research institutions.

The future lies in AI-driven predictive insights and emotionally aware conversations. Chatbots will soon help users make informed decisions with real-time stock analysis, trend forecasting, and voice-enabled financial interactions, all while keeping a human touch.

Disclaimer

This is for information only, not financial advice. Always do your research.