Building Smarter Financial Assistants with Advanced AI Development

AI is changing finance fast. Companies want tools that give quick, trusted answers. Investors want better insights, faster. Meyka helps bring those tools to life. We build enterprise-grade assistants that blend AI, security, and deep financial logic.

This post explains what AI personal finance assistant development means, why it matters, and how Meyka leads the space.

What is AI Personal Finance Assistant Development?

AI personal finance assistant development is the process of designing and building smart software that helps people and businesses manage money. These assistants can answer questions, run scenarios, and automate tasks. They use natural language, live data, and secure links to banks, markets, and corporate systems.

How do enterprises benefit?

- Faster client service, with instant answers.

- Scaled advisory, without adding headcount.

- Consistent, audit-ready decision trails.

Enterprises use these assistants for client support, internal reporting, and investor workflows.

How Advanced AI Development is Revolutionizing the Financial Industry

Advanced AI makes assistants smarter and safer. Models read documents, track accounts, and produce clear advice. They spot risk, suggest actions, and generate reports on demand.

Meyka ties AI to enterprise systems and market signals. That includes AI Stock research models that surface trends, AI Stock Analysis dashboards for portfolio review, and AI Stock alerting for real-time moves. Each is integrated with secure data flows and compliance checks.

Why does this matter to business? Because firms need reliable, explainable tools. Meyka builds them with enterprise practices and real finance expertise.

Why Enterprises and Investors Should Prioritize AI Personal Finance Assistant Development

AI finance assistants are not a nice-to-have. They are a competitive advantage. They save costs, speed decisions, and open new products.

Market growth and opportunity

Investor demand for automation is rising. Firms that adopt AI assistants can scale advice and build new revenue streams. Enterprises gain faster time-to-value on analytics and better control of client relationships.

Return on investment

A well-built assistant reduces manual work, cuts errors, and increases client retention. For enterprises, that often means lower operating costs and higher lifetime value.

Scalability

AI assistants scale: one system serves many clients, with consistent governance and logging. That makes them ideal for banks, wealth managers, and corporate finance teams.

Intelligent Automation and Predictive Analytics

Smart assistants automate routine tasks like reconciliations, bill reminders, and compliance checks. They also use predictive models to forecast cash flow and market shifts.

Benefits:

- Reduced manual errors.

- Faster month-end close.

- Early risk flags for liquidity or market moves.

Meyka builds models that connect forecast outputs with concrete actions. The assistant can suggest hedges, rebalances, or funding moves, and then generate a clear audit trail.

Personalized Financial Insights for Better Decision-Making

Assistants can tailor advice to a client’s goals and risk profile. They deliver simple narratives: “If you rebalance now, this is the expected outcome.”

Benefits:

- Clients get human-style explanations.

- Advisors save time on research.

- Firms offer scalable personalized products.

Meyka uses LLMs combined with domain logic, so answers are accurate and explainable. This helps both retail customers and enterprise clients.

Enhanced Risk Management and Data Security

Security is not optional. Financial assistants must protect data and meet compliance. That means encryption, audit logs, role-based access, and certified cloud infrastructure.

Benefits:

- Reduced compliance risk.

- Clear records for regulators.

- Safer client data handling.

Meyka builds assistants with enterprise controls, private deployment options, and secure connectors to banking systems. Security is part of the product, not an afterthought.

Meyka’s Role in Building Smarter Financial Assistants

Meyka brings product, tech, and finance expertise together. Our enterprise services focus on secure, scalable assistant development.

What Meyka offers:

- Custom AI development: Tailored models and flows for specific finance tasks. See our platform at Meyka Enterprise.

- Secure chat and workflows: Enterprise chat that links to corporate data, built on Meyka AI Stock Chat.

- Integration services: Connectors for market data, ERPs, and bank APIs, explained at About Meyka.

- Enterprise onboarding: Rapid pilot and roll-out via Contact Us.

Meyka’s approach blends LLM-powered assistants with rule-based controls. We train models on client data, then wrap them in governance and testing. This delivers useful answers and a reliable audit trail.

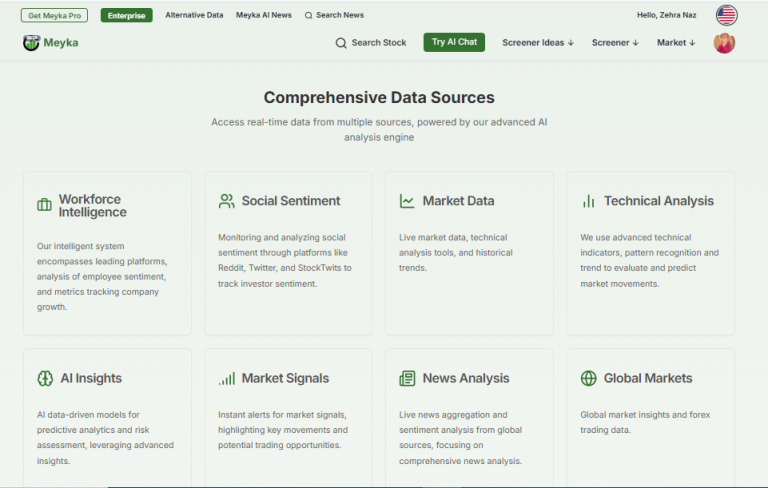

Key Features and Integrations Meyka Provides

Feature highlights

- Secure data connectors to market feeds and internal databases.

- Explainable AI that shows why a recommendation was made.

- Workflow automation to act on insight quickly.

- Custom dashboards for investors and finance teams.

Explore core features at Meyka AI.

How do integrations help? Connecting to existing systems avoids data duplication. Meyka integrates with CRMs, trading systems, and accounting platforms. This lets assistants pull live balances, position data, and transaction history for accurate answers.

Real Market Opportunities for Investors and Enterprises

The market for AI in finance is growing fast. Firms that add AI assistants can capture new client segments and create efficiency gains.

Adoption trends

- Banks are automating client advice.

- Wealth managers use AI for research and reporting.

- Corporations deploy assistants for treasury and FP&A.

Why investors care? AI-driven assistants unlock recurring revenue, lower costs, and faster product launches. For investors, that translates to better margins and higher growth potential.

Industry examples

Large banks and fintechs are already deploying AI helpers for client queries and risk monitoring. These real examples show how assistants can cut response times and boost client satisfaction.

Queries About AI Finance Assistants

Why is AI transforming the financial sector? AI automates research, personalizes advice, and scales expertise. It turns large datasets into clear actions, so teams move faster and make better choices.

How can enterprises ensure secure AI integration? Use private deployments, encrypted connectors, role-based access, and continuous auditing. Test models with sandbox data and enforce approval workflows.

How do assistants stay compliant? Design them with logging, version control, and approval gates. Meyka embeds compliance checks into every workflow so outputs are traceable.

How fast can one build a pilot? A focused pilot might run in weeks. Meyka helps set the scope, integrate data, and deliver a working assistant for testing.

Implementation Roadmap: From Pilot to Production

Step 1: Define use-cases

Start with high-impact tasks like cash forecasting, client Q&A, or automated reporting.

Step 2: Data and security design

Map systems, set security boundaries, and choose deployment (cloud or private).

Step 3: Build and test

Train models on real data, test output quality, and validate compliance.

Step 4: Pilot with users

Run with a small user base. Gather feedback, refine prompts, and fix edge cases.

Step 5: Scale and govern

Deploy across teams with monitoring, model refresh schedules, and governance workflows.

Meyka supports each step with templates, connectors, and enterprise SLAs.

How Meyka Helps Investors and C-Suites

For investors:

Meyka’s assistants provide faster, cleaner reporting and insights. They boost decision speed and show clear ROI on AI projects.

For enterprises:

Meyka delivers reliable automation, stronger client experiences, and better risk controls. Our team focuses on measurable outcomes and operational safety.

See how to engage Meyka on our Contact Us Page.

The Path Forward

Is this technology ready now? Yes. LLMs and API-driven integrations make assistant deployment practical today, with enterprise controls in place.

Will assistants replace human advisors? No. They augment experts by handling routine work, so human advisors focus on complex strategy and client relationships.

Conclusion

AI personal finance assistant development is a strategic move for any finance leader. It brings faster decisions, better client service, and strong operational benefits. Meyka builds these assistants with enterprise-grade security, integrations, and financial logic.

If you are an investor or enterprise leader, now is the time to explore pilots. Let Meyka help you design, build, and scale smart assistants that deliver measurable value.

Get started: Contact Meyka to discuss a pilot or demo. Learn how your firm can harness AI-driven financial insights and build a future-ready finance team.

FAQ’S

An AI personal finance assistant is a digital tool that uses artificial intelligence to automate budgeting, investments, and financial planning for users or enterprises.

It helps companies streamline financial processes, improve decision-making, and deliver real-time insights through predictive analytics.

AI-powered finance tools offer high scalability, automation, and return on investment, making them a fast-growing market segment.

Meyka provides enterprise-grade AI solutions that integrate automation, data analytics, and financial intelligence for smarter decision-making.

The future lies in hyper-personalized financial assistants using LLMs and predictive algorithms to offer real-time financial guidance and risk management.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”