Burberry Set to Rejoin FTSE 100 as Taylor Wimpey and Unite Exit

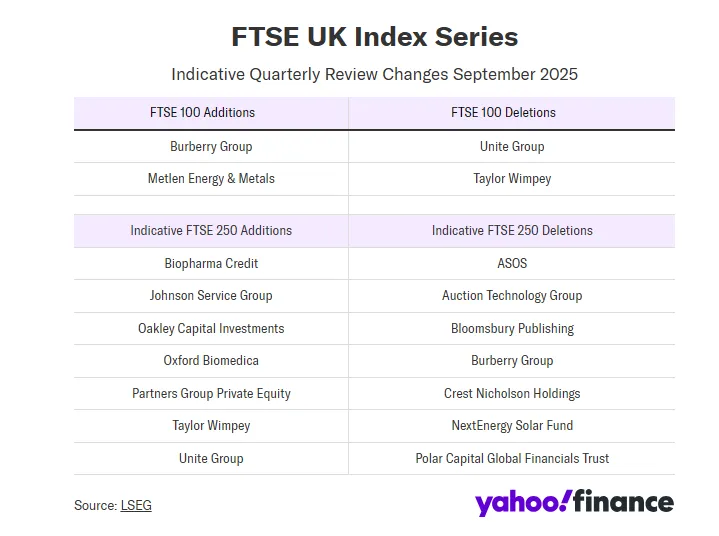

Burberry makes a triumphant return to the FTSE 100 index following the quarterly reshuffle announced by FTSE Russell. The luxury fashion house will rejoin Britain’s premier stock market index alongside Metlen Energy & Metals. This move reflects changing market dynamics and shifting investor confidence across various sectors.

The quarterly review, confirmed on September 3, will take effect from September 22. Taylor Wimpey and Unite Group face demotion to the FTSE 250, highlighting the challenges in homebuilding and property investment sectors.

These changes demonstrate how market performance directly impacts index composition and investor portfolios.

Index Changes Overview

New FTSE 100 Entrants

Burberry leads the new additions to the prestigious index. The luxury brand’s return marks a significant milestone after previous market challenges. Metlen Energy & Metals joins as the second new entrant, bringing industrial strength to the index.

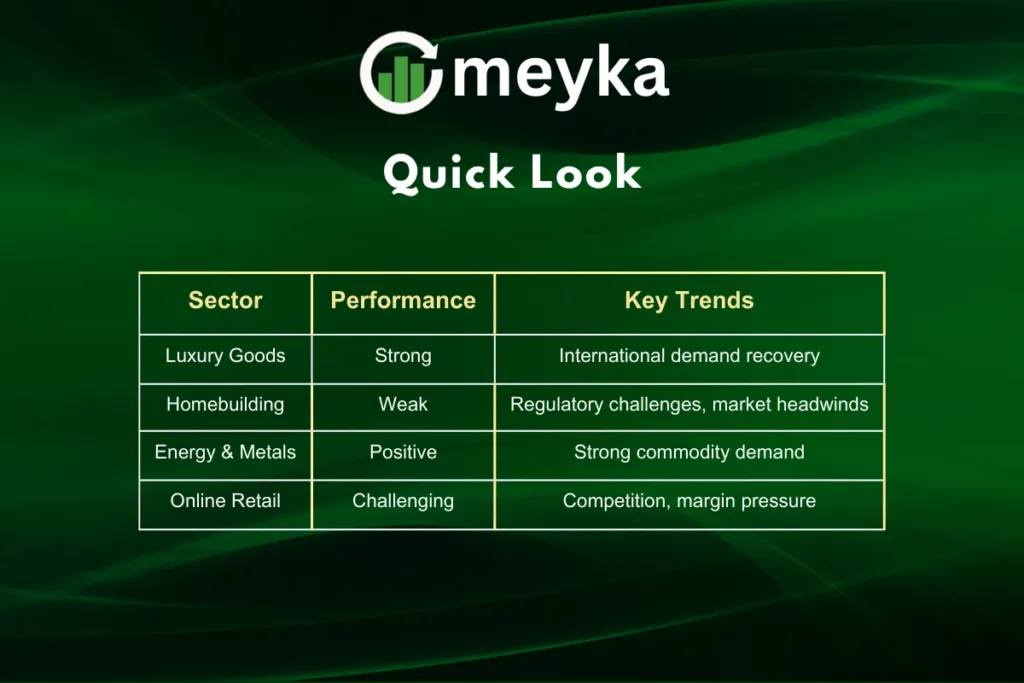

Metlen Energy & Metals commands a market capitalization of £6.08 billion. The company reported impressive first quarter results with 31% year over year sales growth. Revenue reached €1.5 billion, demonstrating strong operational performance in challenging market conditions.

FTSE 100 Departures

Taylor Wimpey exits the FTSE 100 after a difficult year. The homebuilder’s shares declined over 20% year to date. The company reported a first half loss of £92.1 million following a £222.2 million provision for cladding fire safety issues.

Unite Group also moves to the FTSE 250. The student accommodation provider faces headwinds in the property investment sector. Market conditions and changing investor sentiment contributed to its index exclusion.

FTSE 250 Movements

New Departures from FTSE 250

Asos faces removal from the FTSE 250 following significant share price declines. The online fashion retailer’s stock fell nearly 34% year to date. Current market capitalization stands at £356.8 million, reflecting challenging retail market conditions.

Bloomsbury Publishing also exits the FTSE 250. The publisher’s shares dropped approximately 28% year to date. Annual profit before tax fell 22% to £32.5 million, highlighting pressures in the publishing industry.

Market Performance Context

Broader Index Performance

The FTSE 100 demonstrates strong performance with gains exceeding 13% year to date. This outpaces the FTSE 250, which gained nearly 4% over the same period. The performance gap highlights investor preference for larger, more established companies.

Stock market conditions favor companies with strong fundamentals and clear growth strategies. Burberry’s return reflects improved investor confidence in luxury goods and international brand strength.

Sector Analysis

Investment Implications

Opportunities and Risks

Burberry’s FTSE 100 inclusion creates potential index tracking fund inflows. Passive investment strategies must adjust portfolios to reflect new index composition. This mechanical buying could provide additional share price support.

Taylor Wimpey’s demotion may create short term selling pressure from index funds. However, fundamentally sound companies often recover after temporary index exclusions. Patient investors might find value opportunities in demoted stocks.

Portfolio Considerations

Index changes affect investment fund allocations and individual portfolios. Stock market participants should monitor these movements for potential impacts. Diversification remains crucial during periods of index volatility.

Risk management becomes particularly important during index transition periods. Market makers and institutional investors adjust positions, potentially creating short term price volatility.

Final Thoughts

Burberry’s return to the FTSE 100 represents more than a simple index change. It reflects evolving market dynamics and sector rotation within the UK stock market. The luxury brand’s improved position contrasts with challenges facing homebuilders and retailers.

These quarterly adjustments highlight the importance of consistent performance and market positioning. Companies must maintain strong fundamentals to secure and retain premier index status. Burberry’s success demonstrates the potential for recovery and growth in competitive market environments.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.