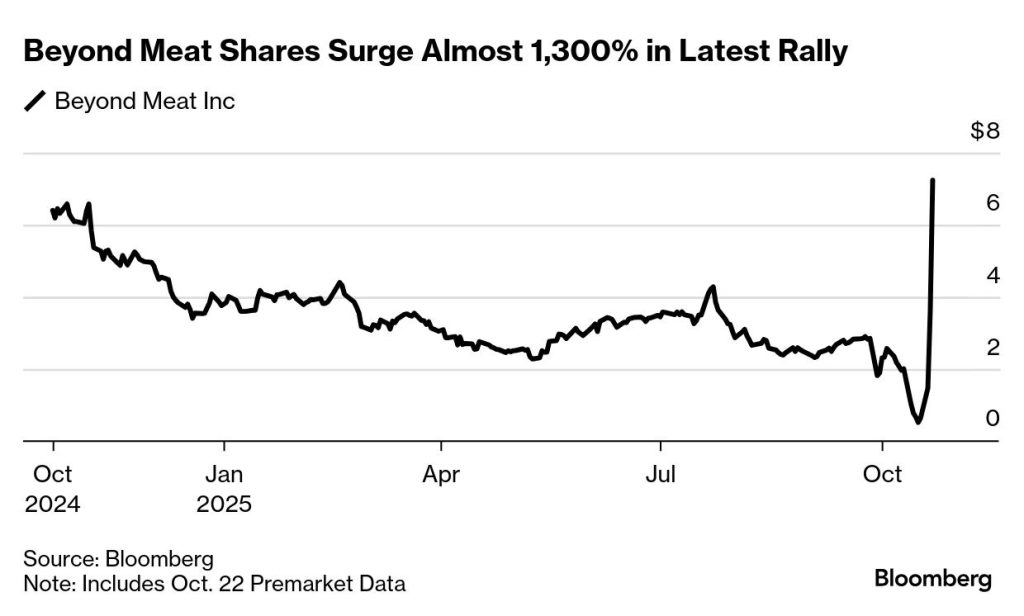

BYND Stock Meat: Incredible 1,300% Rally Marks Stunning Comeback

When we look at Beyond Meat, Inc. (BYND), often shorthand for “BYND stock meat” in trading circles, we witness one of the most dramatic turnarounds in recent equity-market memory. After enduring years of deterioration, this plant-based meat company has suddenly found itself at the centre of a historic rally, reportedly up by as much as 1,300% in very short order.

What Happened? The 1,300% Surge Explained

The extraordinary rally in BYND stock meat is driven by several converging forces:

- Short-squeeze dynamics: The stock was heavily shorted, with short interest estimated at around 50% or more of the float. When short-sellers face a squeeze, the technical upward pressure becomes tremendous.

- Dilution & debt-exchange triggers: Earlier this year, Beyond Meat initiated an exchange offer to convert over $800 million of convertible notes due in 2027, issuing hundreds of millions of new shares. The sudden lock-up expiry on October 16, 2025, freed up a flood of shares. The result: the conditions for a scramble among short-sellers (and opportunistic retail traders) became ripe.

- Retail investor momentum & meme-stock influence: Social-media platforms like Reddit’s r/WallStreetBets and X/Twitter saw chatter pushing BYND as a “meme” revival, akin to the moves seen in AMC or GME.

- Volume explosion & trading frenzy: Trading volume spiked to multiples of average, signalling a surge in interest.)

Together, these factors contributed to the “incredible” rally in BYND stock meat, one of the most spectacular rebounds in recent memory.

Navigating the Fundamentals: How “Strong” Is the Underlying Business?

While the rally is spectacular, we cannot ignore the underlying fundamentals of Beyond Meat. As part of prudent stock research, we must consider both sides.

Weak revenue trends & profitability challenges

- In Q1 2025, U.S. retail revenues fell 15.4% and food-service declined 23.5%.

- Operating margins remain deeply negative. According to recent analysis, the company posted a three-year revenue-growth rate of –12.4% and a net margin of approximately –50.9%.

- A recent report warned of potential bankruptcy risk: the Altman Z-Score sat around –2.57, placing the firm in the “distress zone.”

Recent structural moves & debt relief

- Beyond Meat’s debt exchange offer reduced its convertible note burden, but at the cost of massive dilution (share count quintupling).

- The lock-up expiry mentioned above meant holders could dump shares, raising concerns of supply pressure.

- Analysts remain cautious: some major firms rate BYND as a “Moderate Sell” or “Sell,” with a median target price near $2.20.

Interpretation for Investors

In short: yes, the rally is real, but it appears to be driven more by trading dynamics (short squeeze, retail buzz) than by a clear turnaround in fundamentals. As we always stress in stock research, momentum is not the same as durable value.

Why This Rally Matters in the Broader Stock Market Context

The BYND phenomenon says something about how markets are evolving:

- Retail power & meme-stocks are back: The surge aligns with a broader re-awakening of retail investor influence, especially around names that are highly shorted and easy to understand (like a “plant-based meat” company).

- “Narrative + technical” can overpower fundamentals, at least briefly: Even stocks with weak business pictures can move dramatically when narrative, social-media hype, and technical pressure collide.

- Volatility & risk have risen for the unknown: When a stock can rally 1,300% on speculative interest, it can just as easily collapse when sentiment reverses, especially when the business remains distressed.

- Intersection with AI / alternative-protein & sustainability themes: Though BYND is not an AI stock, its positioning within the “food tech / plant-based protein” ecosystem means it taps into higher-level sustainability and tech-disruption themes. That means some investors may lump it in with “future-food / food-tech” stories.

What Investors Should Do Now

Given the unique situation of BYND stock meat, here is how we suggest approaching it:

1. Define your time horizon & risk tolerance

If you’re a short-term trader or speculative investor, the momentum may offer an opportunity. But if you’re a long-term investor seeking stable growth, note that the fundamentals are challenging.

2. Use stop-losses & discipline

Because this is in many ways a sentiment-driven rally, the risk of a sharp reversal is real. Apply risk-controls.

3. Don’t get caught in the hype without a plan

Ask yourself: What would need to happen for the business to truly turn around (demand growth, margin improvement, debt reduction)? Without that, you may be betting purely on sentiment.

4. Monitor key indicators

– Short interest levels

– Outstanding share count/dilution risk

– Company earnings or cash-flow improvements

– Retail/social-media buzz (for signal of momentum shifts)

5. Consider hedging or alternatives

If you like thematic exposure (plant-based foods, alternative proteins) but want less risk, you may look at other stocks with stronger fundamentals or ETFs that spread the risk.

The Bottom Line on BYND Stock Meat

The rally of BYND stock meat is nothing short of extraordinary. A stock once languishing under negative growth, heavy dilution risk, and severe short-squeeze potential has shot up by over 1,000%. The driving force? A classic cocktail of short-squeeze mechanics, retail investor frenzy, and momentum trading.

But our stock research perspective demands caution: the underlying company still faces deep problems, weak demand, losses, and dilution. If the momentum dies, the stock could reverse just as quickly.

For investors, the choice is clear: Are you riding a speculative wave or investing in a long-term business turnaround? Each path calls for very different strategies. At the very least, BYND serves as a cautionary case study in the evolving world of markets where narrative and social-media clout increasingly influence stock outcomes.

FAQs

By “BYND stock meat,” we refer to the shares of Beyond Meat (ticker BYND) – a plant-based meat company and the phenomenon where its stock is treated like a “meme” or speculative vehicle rather than a classic food company investment.

The rally is largely driven by a short-squeeze (very high short interest), the expiry of a lock-up that freed many shares, and renewed retail investor interest via social media. It is not primarily driven by a sudden leap in the company’s earnings or fundamentals.

From our analysis: probably not, unless you believe the company will truly reverse its negative revenue growth, stop burning cash, and achieve meaningful margin improvement. As of now, the fundamentals remain weak. Use caution and consider whether you are trading momentum rather than investing in a turnaround.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.