Canara Bank, NMDC & Deepak Fertilizers: Trading Strategy for Today

The Indian stock market opened with mixed signals on 24 September 2025. Global cues are cautious, while traders look for stock-specific action. In such times, having a clear trading strategy becomes important. We know that even small intraday moves can decide profit or loss. That is why we focus today on Canara Bank, NMDC, and Deepak Fertilizers.

These three stocks come from different sectors: banking, metals, and fertilizers. Each sector has its own drivers. Canara Bank is gaining attention with strong credit growth in public sector banks. NMDC reflects the pulse of the metal and mining industry. Deepak Fertilizers often reacts to government policies and seasonal demand.

By studying both fundamentals and charts, we can plan better entries and exits. We also reduce risk by setting the right stop-loss and targets. Let’s break down the short-term outlook of these stocks. We will also suggest strategies for intraday and positional trades.

Trading is never about luck. It is about preparation and discipline. Let us explore how these three stocks can shape our trades today.

Market Overview for Trading Strategy

Markets opened flat to weak on 24 September 2025. Global worries and new U.S. visa rules dented sentiment. Domestic benchmarks slipped at the bell. Foreign investors have been net sellers in recent weeks. That added pressure to the rally. Domestic buyers (DIIs) are still active. Crude and currency moves are important today. Banking, metals, and fertilizers show mixed strength. Traders are watching volume and stock-specific news more than broad market gains. Short trades and quick scalp setups look practical in this mood.

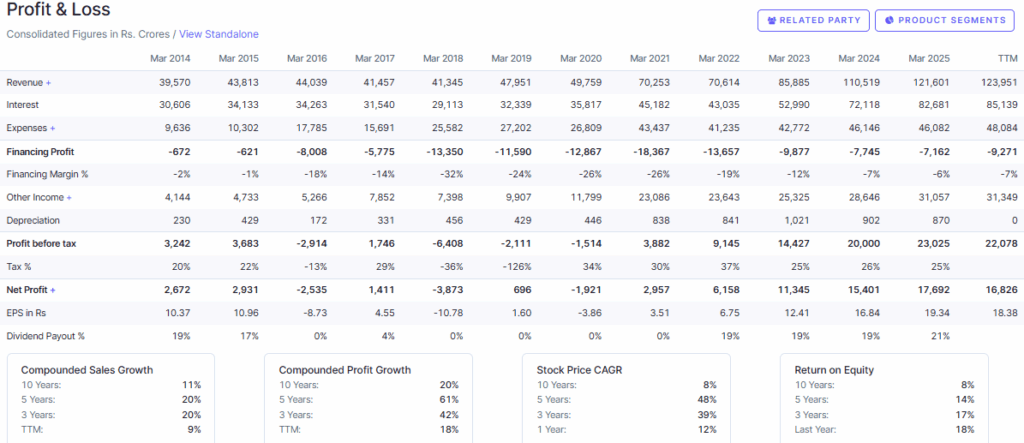

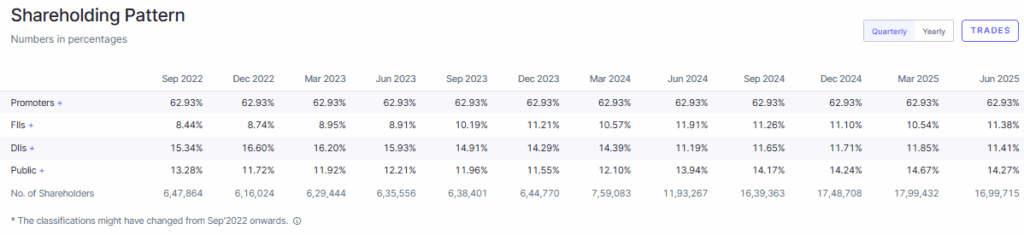

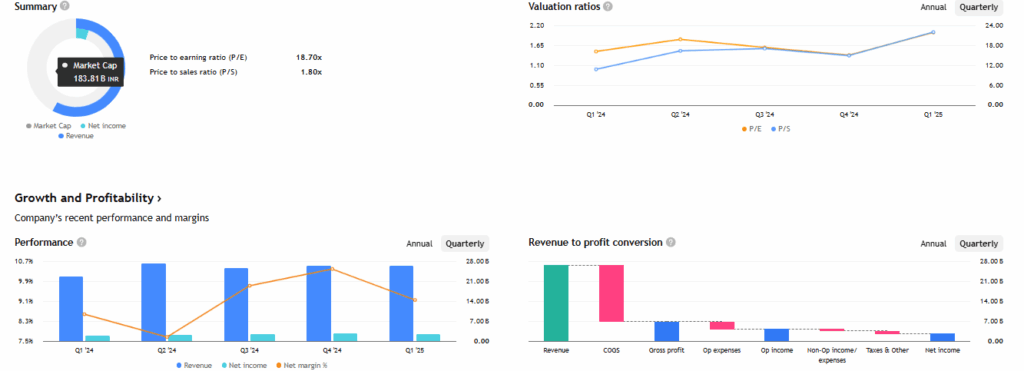

Canara Bank: Fundamental Snapshot

Canara Bank is a large public sector lender. The bank has shown steady credit growth this year. Asset quality has been improving, but watch for quarterly updates. PSU banks are sensitive to policy rates and government bond yields. Any RBI guidance or PSU recapitalisation talk can change the stock fast. Traders should also check quarterly loan growth and fresh slippage numbers. These are the facts that move price in the short term.

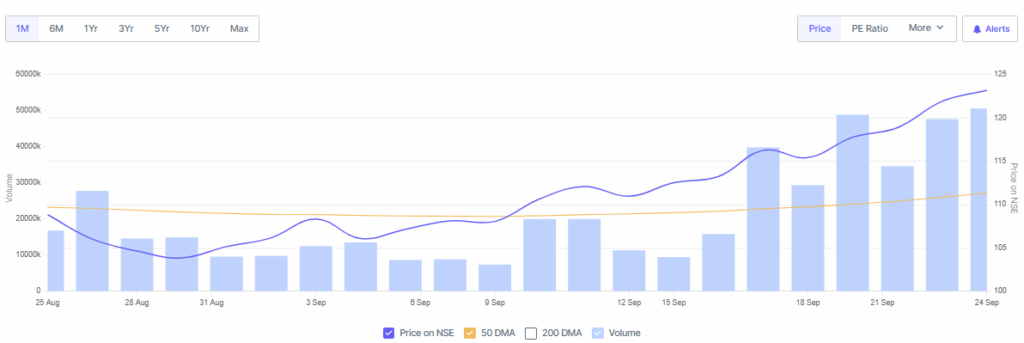

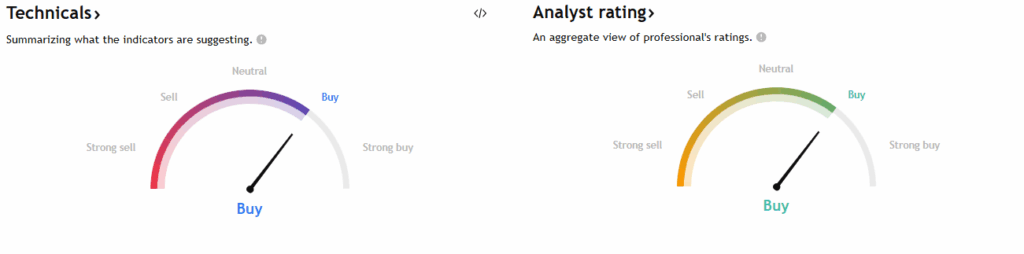

Technical Analysis & Trading Plan

The weekly chart shows recent bullish moves. Watch 50-day and 200-day averages for trend context. Intraday traders can use the previous day’s high as a breakout reference. If price breaks above that with volume, long entries can be attempted. Use a tight stop loss below the breakout candle. For short trades, a clean break below key intraday support with rising volume signals downside. Keep targets small for scalps. For positional trades, aim for 1.5-2.5x the stop size as reward. Use stop orders to protect capital. Check NSE live pivots before entry.

NMDC: Fundamental Snapshot

NMDC is India’s top iron-ore miner. Production and dispatch numbers matter most. Recent quarterly data showed higher output and better sales volumes. Steel demand in India and abroad drives NMDC’s realisation. Policy moves regarding mining permits or environmental clearances can change the outlook quickly. Monitor domestic steel prices and pellet demand. These carry a direct impact on NMDC profits and margins.

Technical Analysis & Trading Plan

NMDC often trades in clear ranges. Look for range breakouts with above-average volume. A breakout above recent highs can lead to a swing trade. Place a stop loss just below the breakout candle or the range low. On breakdowns, shorting near rebounds to resistance gives lower risk. Use volume as a confirmation. If volume is thin on a move, avoid big positions. For swing trades, hold for 3-15 sessions and trail stops as the price rises. Risk allocation should be smaller when FIIs are net sellers.

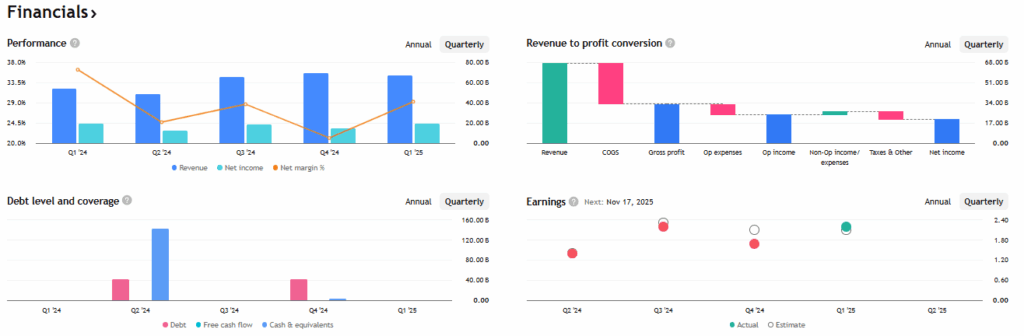

Deepak Fertilisers: Fundamental Snapshot

Deepak Fertilisers is linked to the agriculture demand and input costs. Government subsidy news and seasonal buying both affect volumes. The firm has a mixed product mix, so margins vary by quarter. Raw material costs and international ammonia/urea prices matter. Also, watch channel restocking before the Rabi season. Positive policy announcements can trigger sharp buying interest. Check company sales updates and dealer dispatches for real signals.

Technical Analysis & Trading Plan

The stock has traded with wide intraday swings. For intraday longs, a gap-up on rising volume is a clean entry if price holds above the first support. For shorts, a clear failure at resistance with rising volume is a signal. Use 1-2% intraday stop loss for small trades. For positional buys, wait for pullbacks to the 21 or 50 moving average on daily charts. Consider partial profit booking on achieving 20-30% gains. Keep a close watch on news about subsidy changes or feedstock costs, as these can nullify technical levels fast.

Comparative Insights

Canara Bank looks sensitive to macro cues and rate talk. NMDC is tied to steel demand and mining headlines. Deepak Fertilisers moves with seasonal demand and policy steps. If market breadth is weak, prefer picking single-stock setups rather than broad longs. If volume confirms a breakout, NMDC and Deepak can give good swing gains. Canara Bank is better for range-trading and momentum plays on banking days. Allocate risk by appetite: aggressive traders can take NMDC or Deepak swings. Conservative traders may limit position size in Canara Bank until trend clarity returns.

Wrap Up

On 24 September 2025, the market is choppy. Trade flows from FIIs matter. Use strict stop loss rules. Do not increase position size after a losing trade. Check volume and company updates before taking a call. Use small position sizes when global cues are weak. Keep a trading journal. Review entries and exits each day. This will improve discipline and reduce avoidable losses. For fast scans and news checks, one can use an AI stock research tool to save time. Trade with a clear plan. Protect capital first.

Frequently Asked Questions (FAQs)

The strategy for Canara Bank on 24 September 2025 is to watch support and resistance levels. Traders may consider intraday scalps with a strict stop loss to manage risk.

On 24 September 2025, NMDC shows range-bound movement. It can be a buy above breakout levels with strong volume. Use stop loss to protect against sudden price swings.

On 24 September 2025, Deepak Fertilisers needs careful entries near support zones. Stop loss should be tight for intraday trades. News on subsidies or costs may quickly affect the price.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.