Capgemini Q3 Results: Strong 3% Organic Growth Drives Forecast Upgrade

Capgemini Q3 delivered a clear beat and a cleaner outlook. The firm reported 3% organic growth, stronger than some expected, and lifted its full-year revenue forecast as demand for AI, cloud, and digital services picked up. This result sent a confident signal to investors and helped reframe the company’s 2025 growth story.

Capgemini Q3 Growth Surpasses Market Expectations

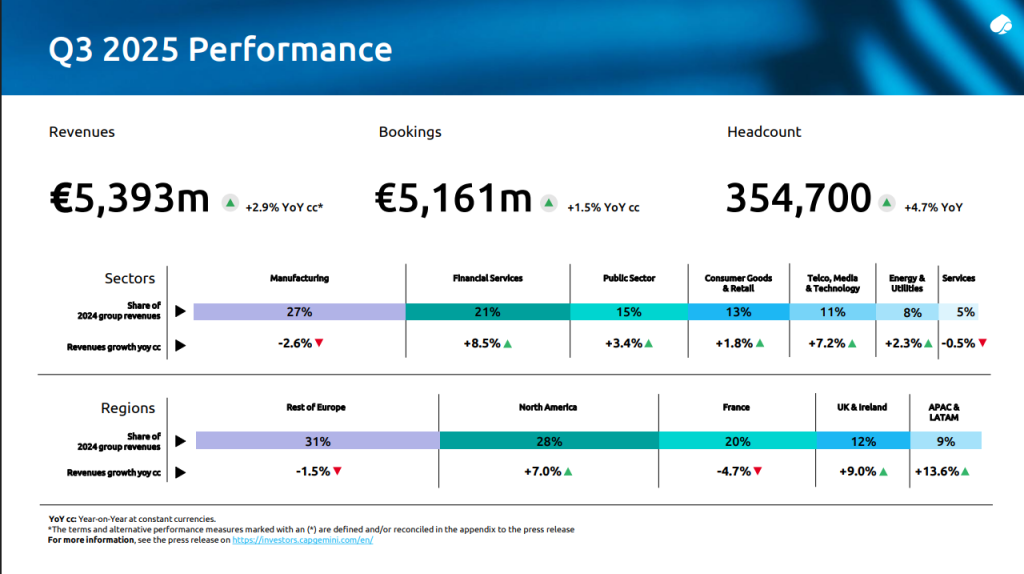

Capgemini (CAPMF) reported 3% organic growth in the quarter, with revenues rising versus the prior year in constant currency terms. Management cited healthier deal flow in North America and stronger demand for transformation projects as key drivers behind the beat. The improved performance prompted the group to lift its outlook for the year.

Key facts at a glance:

- Organic growth: 3% for Q3.

- Revenue trend: Management reported growth in constant currency, highlighting a recovery in digital and consulting contracts.

Why is that happening? Because clients are spending more on AI projects and cloud programs, Capgemini’s consulting and engineering arms saw stronger demand.

Key Drivers Behind Capgemini’s Growth

Capgemini’s Q3 strength came from a mix of services: AI, digital transformation, cloud modernization, and consulting. These areas saw higher client budgets, especially for projects tied to automation and large-scale AI pilots.

- AI and digital services accelerated revenue, with clients investing in proof of value work and industrializing pilots.

- North America showed notable momentum, reflecting stronger enterprise spending on cloud and analytics.

- Europe remained steady, benefiting from long-term contracts and transformation programs.

Why is Capgemini outperforming other IT firms in Q3? Its broad consulting footprint, plus targeted AI and cloud services, helped offset weakness in legacy IT work.

AI and Cloud Fuel Momentum in Capgemini Q3 Results

AI and cloud are central to Capgemini’s Q3 story. Client spending on generative AI, data platforms, and automation lifted project pipelines. This trend supports both short-term revenue and a more durable services backlog.

Capgemini’s (CAPMF) commentary and market reports point to increasing enterprise budgets for AI transformation, which raises demand for consulting, integration, and managed services. This is why many models from market watchers now incorporate stronger AI assumptions.

AI Stock research is increasingly flagging firms with deep AI delivery capabilities, and Capgemini fits that profile.

What Analysts Are Saying About Capgemini Q3

Market coverage from Reuters, Investing.com, and TradingView highlights a broadly positive analyst reaction. Analysts praised the revenue beat and the forecast upgrade, noting the recovery in North America and AI-related contracts.

Summing up sentiments: analysts view the update as evidence that Capgemini can convert AI interest into paid projects. This view comes up often in AI Stock Analysis notes and brokerage comments.

What does this mean for investors? Analysts upgraded expectations for revenue growth, and investors see less downside risk if Capgemini keeps turning AI demand into billable work.

Market Reaction and Investor Sentiment Toward Capgemini Q3

Shares (CAPMF) reacted positively as markets digested the beat and the raised forecast. On Euronext Paris, the stock showed buying interest on the update, reflecting improved sentiment among institutional and retail holders. News wires and trading platforms highlighted the AI angle, which drew extra attention from tech-focused money managers.

Social and market feeds echoed the same themes: stronger North American bookings, AI consulting wins, and a clearer path to the upgraded outlook. These snippets and market comments helped shape immediate investor response.

Is this a long-term signal or short-lived? The improvement is meaningful, but durability depends on continued conversion of AI deals into revenue and stable macro conditions.

Comparison with Peers and Sector Outlook

Compared with peers like Accenture, Infosys, and Cognizant, Capgemini’s 3% organic growth is notable for a firm with a strong European base. Its edge comes from deep consulting capabilities and a fast-expanding AI services portfolio.

Forecast Upgrade and Future Outlook

Capgemini raised its 2025 outlook, signaling management’s confidence that momentum will continue. The upgraded forecast reflects both near-term contract wins and a belief that AI and cloud demand will remain strong.

To keep momentum, Capgemini plans to deepen partnerships, hire AI and cloud talent, and pursue strategic M&A where it makes sense. Those moves aim to expand delivery capacity and secure larger transformation programs.

These steps tie directly into broader phrases like AI consulting demand surge and enterprise automation growth, which analysts use when modeling future revenue.

How will Capgemini maintain growth? By scaling AI capabilities, strengthening cloud partnerships, and converting pilot projects into multi-year engagements.

Conclusion

Capgemini Q3 shows a solid 3% organic growth that supports a raised forecast and renewed investor interest. The results underline how AI, cloud, and digital consulting are driving recovery in tech services.

For investors, the beat is a confirmatory data point: Capgemini is converting AI demand into revenue, but execution and macro stability will determine how far the stock can run. Overall, the Q3 update repositions Capgemini as a credible beneficiary of the current AI investment cycle.

FAQ’S

Capgemini reported a net profit of approximately €1.56 billion in 2024.

It depends on region, services mix and client focus: Tata Consultancy Services (TCS) is a large Indian-origin IT services exporter with steady global growth, while Capgemini has strong European presence and rising AI/cloud focus; “better” depends on the investor’s target market and risk profile.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.