Celestial AI Nears Acquisition as Marvell Enters Advanced Talks

On 2 December 2025, reports emerged that Marvell Technology was to buy startup Celestial AI. If the deal closes, it could be a major shift in the race for powerful AI hardware. Celestial AI builds “photonic” technology using light instead of copper wires to speed up data flow inside data centers. That kind of speed matters a lot for today’s huge AI models.

Marvell already makes chips for cloud servers and networks. By adding Celestial’s photonic tech, Marvell might deliver much faster and more efficient AI infrastructure. In simple terms: this deal could bring “light-speed data” to next-gen AI.

This partnership could reshape how data centers handle massive AI workloads. And for companies working on advanced AI, that could start a new era.

Who is Celestial AI and what does it build?

Celestial AI is a Santa Clara startup that focuses on silicon photonics. The company calls its core product the Photonic Fabric. This tech uses light to move data between chips. The approach promises higher bandwidth and lower energy use than copper traces. Celestial AI raised a major funding round earlier in 2025 to push commercialization and production scale. The company has partnerships and early design wins with large cloud customers, signaling real traction beyond the lab.

Marvell’s Position and Why the Fit Makes Sense

Marvell is a long-established vendor of data center and networking semiconductors. The firm has moved aggressively into AI infrastructure over recent years. Marvell sells high-speed SerDes, switch silicon, link chips, and interconnect IP that cloud operators use. Adding photonic interconnects could strengthen Marvell’s product stack. It would bridge the gap between electrical chips and optical scales. That gap is now a key bottleneck for very large AI models. Marvell’s public event material has highlighted integrated photonics as a strategic area.

What Sparked the Talks and Why Timing Matters?

The talks surfaced in market reports on 1-2 December 2025. The Information first reported that Marvell entered “advanced talks” to acquire Celestial AI, and Reuters later summarized that report. The timing matters because hyperscalers are already designing photonic modules into next-generation systems.

Recent funding and product demos from Celestial show the startup moved from prototype to customer trials in 2025. That made Celestial an attractive, near-term strategic buy rather than a long-shot R&D play.

How Photonic Interconnects Change AI System Design?

Photonic interconnects push light through waveguides and modulators. Light carries far more data per second than copper at similar power. This reduces the thermal and latency costs of moving huge parameter sets between processors and memory. The result is faster model training and lower rack-level energy use. In practice, photonics enables new chip placement.

Designers can cluster memory, accelerators, and other blocks without being limited by electrical wiring. Celestial’s Photonic Fabric demonstrates exactly this flexibility in Hot Chips and other shows.

What Marvell Might Gain Technically and Commercially?

Marvell could integrate photonic modules into its existing switch and NIC portfolios. That integration may enable end-to-end optical fabrics inside and between servers. Customers would get higher throughput per rack and a smaller power bill.

For Marvell, the acquisition would also mean not depending solely on third-party optical IP. Owning the IP shortens product cycles. It could open cross-selling paths into hyperscaler procurement channels already familiar with Marvell silicon. Analysts say such a move would position Marvell to more directly compete with larger incumbents in AI infrastructure.

Possible Deal Shape and Market Valuation Signals

Reports indicate the talks could lead to a multi-billion-dollar deal. Some coverage suggests total consideration, including earnouts, might top $5 billion. These figures match the startup’s strong fundraising history and recent customer momentum. Neither company confirmed terms at the time of reporting.

If the deal is announced, the market will look for structure: cash versus stock split, retention incentives for Celestial’s engineering team, and milestones tied to product deployments.

Competitive Response and Industry Impact

An acquisition like this would nudge other vendors to speed photonics work. NVIDIA, AMD, Intel, and Broadcom already explore optical I/O and co-packaged optics. Mergers and talent buys in 2024-2025 show the sector is consolidating. Hyperscalers may accelerate their in-house options or favor suppliers who can deliver integrated optical-electrical stacks.

Startups in optical interconnects will face pressure to either partner with large suppliers or become acquisition targets. Market trackers note increased M&A activity in the optical component space through late 2025.

Integration Hurdles and Technical Risks

Merging photonics into an established silicon roadmap is hard. Packaging and yield present real manufacturing challenges. Photonic components need tight thermal and alignment control.

Foundry partnerships matter. Celestial has reportedly worked on supply chains and TSMC-qualified flows, but scaling to mass production remains non-trivial. Integration will also require software and firmware work to expose optical fabrics to data-center orchestration stacks. If Marvell handles these issues poorly, customers will delay adoption.

Financial and Strategic Risks for Marvell

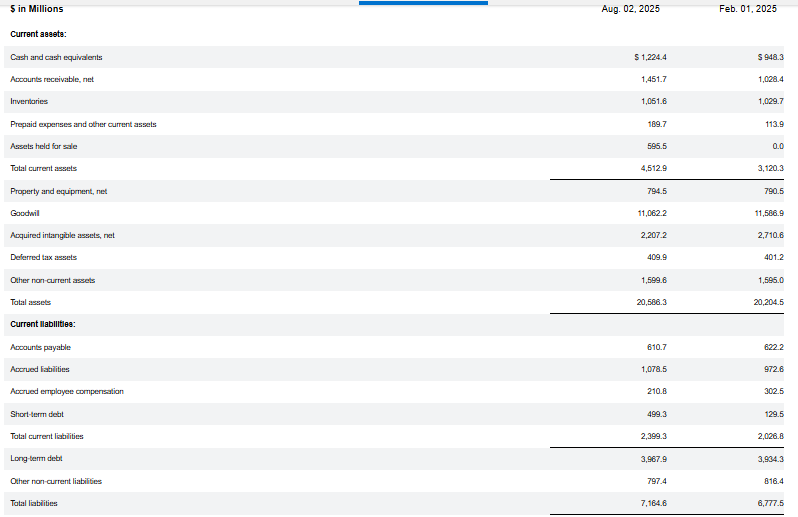

Marvell faces real financial and strategic risks if it moves ahead with a Celestial AI acquisition. Reports on 1-2 December 2025 suggest the potential deal could exceed US$5 billion, a figure almost equal to Marvell’s full-year revenue of US$5.77 billion.

The company already holds about US$4.47 billion in total debt, which means taking on a large purchase could pressure its balance sheet and limit cash flexibility. Investors may worry about share dilution or heavy borrowing if the deal relies on new financing.

A purchase of this size would also raise expectations for quick revenue gains from photonic products, but any delay in product ramp or customer adoption could hurt valuation. While regulatory hurdles are not expected to be major, a deal of this scale will draw scrutiny from investors and cloud customers concerned about supplier concentration. Market analysts will closely watch Marvell’s guidance in the quarters following any

The Short-Term Roadmap If the Deal Closes

Customers should expect product announcements within 6-18 months after closing. Early steps will focus on co-packaged or in-package modules. Later work will aim at server-to-server optical fabrics. Marvell’s existing sales channels could accelerate adoption. Proof-of-concept deployments at hyperscalers will be crucial to convert design wins into volume. Analysts often use tools like an AI stock research analysis tool to model revenue scenarios once a public company announces such a strategic M&A.

Longer-Term Market Outlook

If Marvell successfully integrates Celestial’s photonics, data centers could shift faster toward optical-heavy architectures. That would lower costs per training hour for large AI models. The change would also redistribute value across the stack, from discrete transceivers into integrated optical subsystems. A successful integration would not make photonics universal overnight. Instead, it would mark a clear step toward mainstreaming optical interconnects for high-end AI infrastructure.

Final Notes on What to Watch Next

Watch for formal announcements and regulatory filings. Check Marvell’s investor updates and Celestial AI press releases for timeline specifics. Look for initial product demos and hyperscaler pilot reports. Also track supply-chain indicators, such as foundry engagements and packaging partnerships. Those signals will show whether the acquisition truly moves photonics from specialist labs into broad data-center deployment.

Frequently Asked Questions (FAQs)

Reports on 2 December 2025 said Marvell is in advanced talks to buy Celestial AI. The deal is not confirmed yet. Neither company has shared official statements.

Celestial AI uses light to move data faster between chips. This reduces heat and power use. The tech helps large AI systems handle heavy data loads more smoothly.

If the deal happens, data centers may get faster data flow and lower power use. This could improve AI training speeds. The impact will depend on the final rollout of the product.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.