Centrelink Payments and Pension to See Modest Increase

Centrelink payments and pensions are a lifeline for millions of Australians. Every year, these payments are reviewed to keep up with the rising cost of living. From September 2025, we will see a modest increase across several Centrelink benefits, including the Age Pension, JobSeeker, and other support programs.

This change may look small on paper, but it matters. Prices for groceries, rent, and electricity have climbed sharply. Families and pensioners are feeling the pressure. A few extra dollars each fortnight can help ease that stress, even if it does not solve every problem.

We should also see this as part of a bigger picture. Australia’s welfare system aims to provide a safety net, not a luxury. By linking payments to inflation, the government tries to balance support

Let’s explore what the new rise means, why it was introduced, and how it impacts everyday lives. We will also look at the reactions, the criticisms, and what may come next.

Background of Centrelink Payments

Centrelink in Australia delivers social security support to people who need help. Payments include the Age Pension, JobSeeker, Carer Payment, Disability Support Pension, Parenting Payment, ABSTUDY, and more. The government sets rules on who qualifies. You must meet tests on your income, assets, age, residency, or caring responsibilities.

These payments are not static. The government adjusts many of them twice a year. The adjustments happen in March and September. They usually follow rises in inflation or increases in wages to protect living standards. If the price of food, housing, and fuel goes up, fixed payments lose value. That is why indexation matters. It keeps support closer to reality.

Details of the Latest Increase

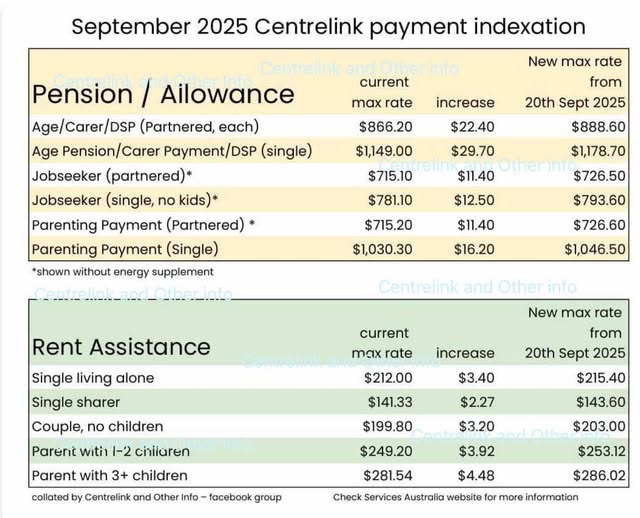

From 20 September 2025, many Centrelink payments will increase. The Age Pension, Carer Payment, and Disability Support Pension for a single person will rise by $29.70 per fortnight. For couples, the increase is $44.80 combined (so about $22.40 each).

JobSeeker for a single adult (22 or older, without children) rises by $12.50 to $793.60 per fortnight. Parenting Payment for single parents goes up by $16.20, partnered parents by $11.40.Rent Assistance increases are smaller: a few dollars more fortnightly.

Also, income and asset thresholds used in means tests will rise. That change means some people who previously got lower amounts or did not qualify may benefit.

Another key change: deeming rates. These are used to estimate income from assets like bank accounts or investments. The lower deeming rate rises to 0.75% for singles for assets up to around $64,200. The higher rate becomes 2.75% above that threshold.

Why was the increase introduced?

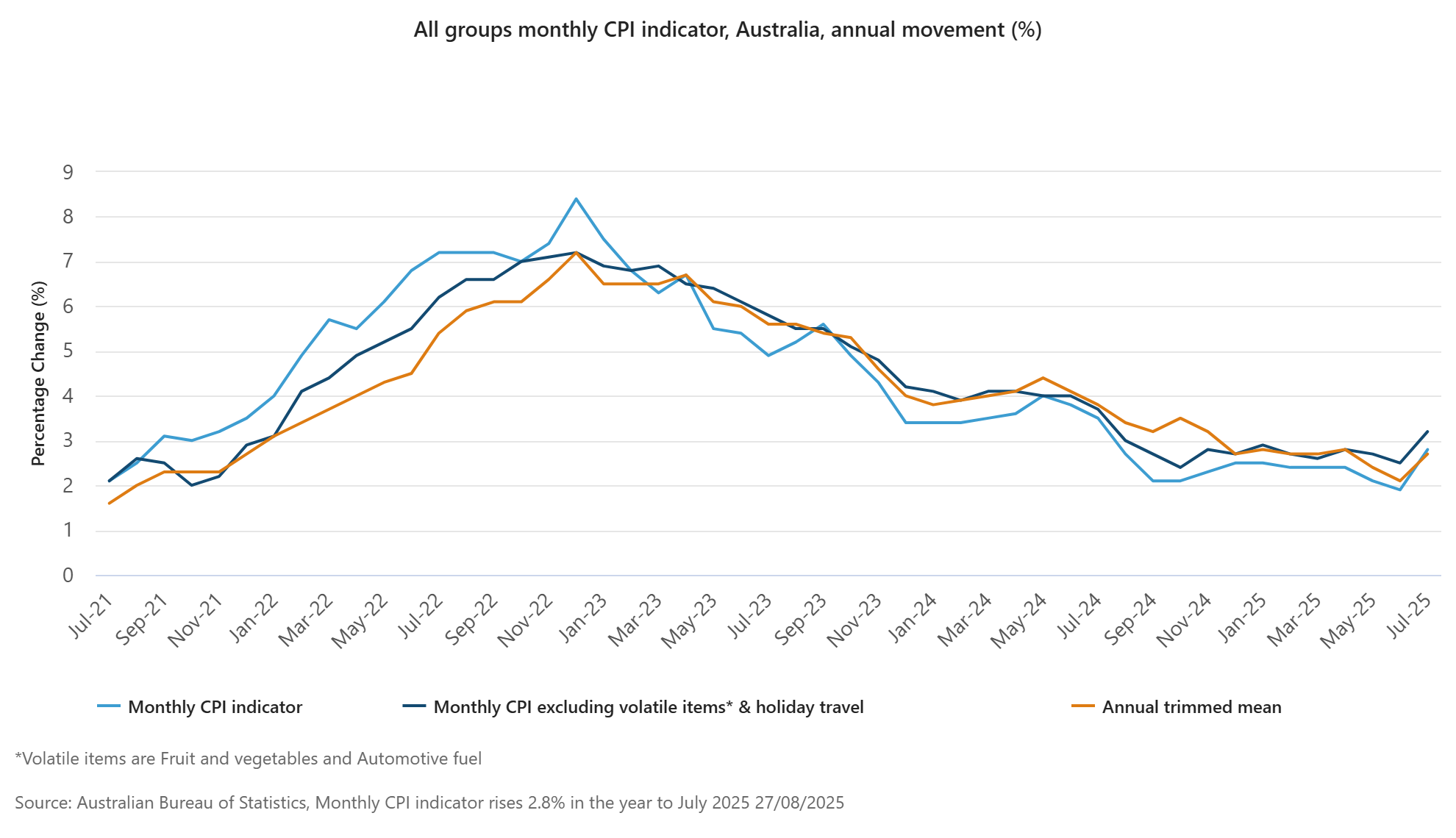

Inflation in Australia has been rising. Prices for groceries, energy, and rent have jumped. Support recipients face a heavier burden. The government uses several inflation measures: the Consumer Price Index (CPI), weekly wage changes, and the Pensioner and Beneficiary Living Cost Index. It picks the highest measure among them for indexation.

The aim is fairness. Payments should not lose value over time. Without adjustment, purchasing power falls. That makes it harder for people relying on fixed support.

At the same time, austerity pressures exist. The government balances budget constraints with social welfare. Critics argue that while increases help, they fall short of covering full costs for many people.

Impact on Pensioners and Beneficiaries

For many, the boost will bring some relief. An additional $29.70 every two weeks for a single pensioner helps with small but essential bills electricity, groceries. The increase may not resolve housing cost stress, but it softens the blow.

Some will feel more benefit than others. Those close to asset or income thresholds might move into full pension eligibility. Others might face lower gains if deeming rates raise their assumed income. Beneficiaries with few assets gain more.

Still, the rise is modest compared to runaway costs in rent, power bills, and fuel. People with children face extra costs. Single parents, for example, see a small bump in Parenting Payment, but everyday expenses often outstrip that increase.

Reactions and Criticism

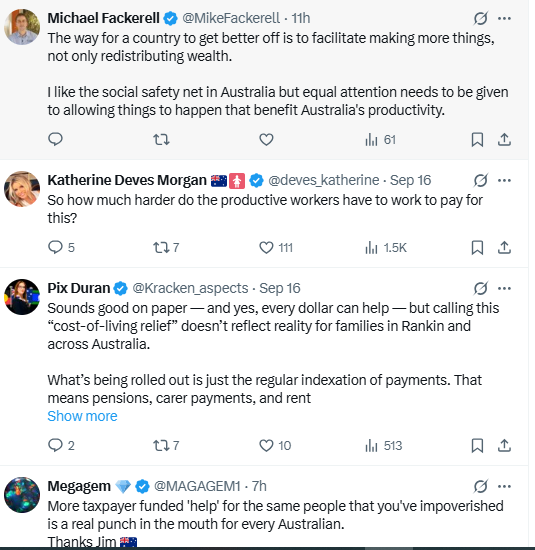

Many community groups welcome the changes. They see indexation as a necessary shield against inflation. Pensioners who have struggled with rising costs usually view even small increases as important.

But critics say the government is being too cautious. They argue that payments remain too low. Some say the increase does not allow recipients to live above the poverty line or manage unexpected expenses.

Another concern comes from the rising deemed rates. While increasing rates may reflect economic conditions, they also reduce net gains for people with assets. Critics say this penalises those who have saved.

Comparison With Past and International Trends

In past years, increases have similarly followed inflation. But inflation in recent times has been higher than many forecasts. That means recent indexation has to catch up more.

Compared to other developed nations, Australia’s approach to welfare indexation is fairly standard. Many countries adjust pensions with inflation or wages. Some use “triple lock” systems. Australia does not use exactly that model but uses inflation, wage growth, or a cost-of-living index.

In international rankings, income support in Australia remains moderate. It helps a lot of people, but benefits often lag behind rising costs of housing and healthcare when inflation is high.

Future Outlook

Further increases are possible, especially at the next scheduled review in March 2026. If inflation continues, or wages rise sharply, new adjustments may follow.

Policy changes might address deeper issues. For example, reforms to how deeming works, adjustments to asset or income thresholds, or more frequent reviews. Some push for payments to better track actual living-cost baskets instead of generic inflation.

Also, transparency matters. Recipients will benefit if the government clearly explains how indexation calculations work. That helps people plan.

Final Words

The September 2025 increase in Centrelink payments offers some relief, but it is modest. Pensioners, job seekers, and parents will see a little more support in their accounts. Yet higher food, rent, and power bills still limit the impact. The adjustment shows the system is working, but it also highlights the gap between payments and real costs. Future reviews will be important to keep pace with inflation. Long-term, stronger reforms may be needed to ensure dignity and stability for Australians who rely on Centrelink.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.