Chip Stocks Rally on TSMC’s Strong Forecast and New AI Deals Boost

Chip stocks are rallying once again, and it all started when TSMC (Taiwan Semiconductor Manufacturing Company) shared a strong forecast on January 16, 2025. Investors immediately pushed semiconductor stocks higher across global markets. The reason is simple: when the world’s top chipmaker signals rising demand, especially for AI chip deals, the entire industry pays attention.

TSMC reported solid earnings and raised its 2025 revenue outlook, driven by heavy AI chip orders from companies like Nvidia, Apple, and AMD. At the same time, several new AI deals and data center partnerships were announced this week. These moves prove that global investment in AI infrastructure is accelerating, not slowing down.

This powerful combination of strong guidance and fresh AI contracts boosted confidence across the market. Stocks of foundries, GPU makers, memory suppliers, and chip equipment companies all climbed.

The shift is clear: investors are no longer asking “Is AI the future?” Now they’re asking, “How fast can chipmakers scale to power it?”

What did TSMC announce (Oct 17, 2024 → Jan 16, 2025 → Jul 17, 2025)?

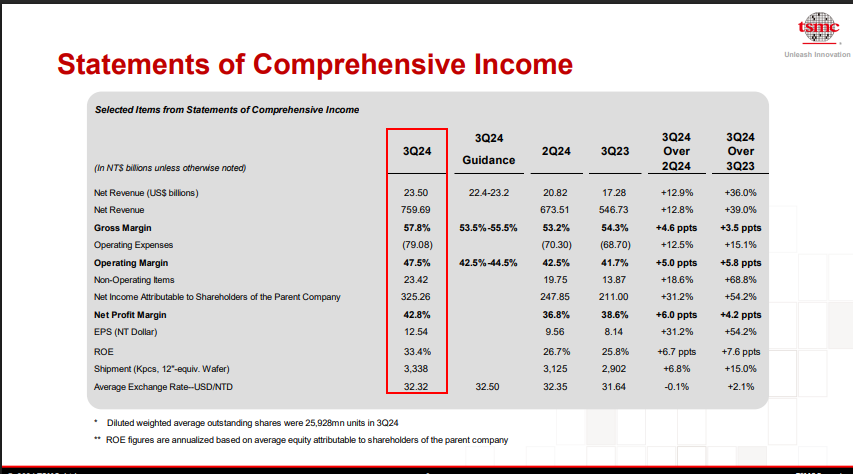

TSMC first surprised markets on October 17, 2024, when it reported a record quarter and raised its sales outlook. That call flagged a sharp rise in AI chip demand and triggered an early sector rally.

On January 16, 2025, TSMC confirmed the trend. The company reported strong Q4 results and guided for robust 2025 growth. Management stated that AI accelerators already accounted for a significant share of 2024 revenue and that demand would remain strong into 2025.

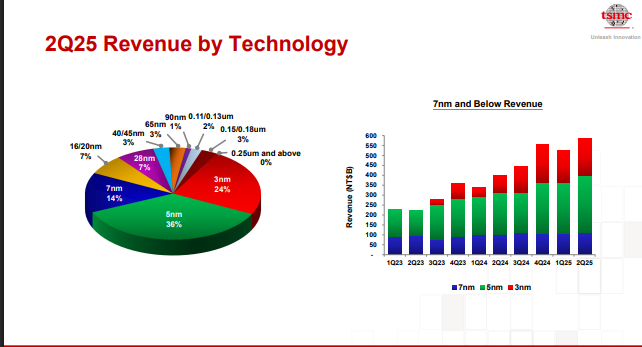

The story continued with the July 17, 2025, Q2 release. TSMC posted NT$933.79 billion in Q2 revenue and NT$398.27 billion in net income, with EPS of NT$15.36. The firm said 3-nanometer shipments accounted for a rising slice of wafer revenue. These results backed the view that AI workloads are driving real, measurable wafer demand.

How Markets Reacted?

Each TSMC update produced immediate market moves. After October 2024, chip stocks surged as investors priced in stronger AI spending. The January 2025 guidance reinforced that rally. The July 2025 quarter pushed the trade further still, as earnings confirmed higher revenue and margins. Traders and fund managers used the reports to reweight portfolios toward foundries, GPU makers, and memory suppliers. Market coverage and intraday flows showed clear sector rotation into AI-exposed names.

The Role of New AI Deals & Cloud Capex

Large cloud providers and hyperscalers announced big AI investments in late 2024 and through 2025. Those deals convert into demand for GPUs, AI ASICs, and high-bandwidth memory. When cloud firms commit racks and data-center megawatts, the foundries that build their chips see longer, firmer order books. That shift changes short-term inventory cycles into longer wafer bookings that support higher utilization and pricing. Public announcements from cloud partners and capital plans provided visible evidence of this conversion from deals to wafer orders.

Why does this Combination matter for Supply and Demand?

Two forces now push the industry: rising AI demand and constrained advanced capacity. Advanced nodes (5nm, 3nm, and below) take years and large capital to expand. TSMC’s capex plans and repeated guidance signal that the company expects multi-year AI demand.

At the same time, increased utilization tightens allocation for cutting-edge nodes. The net effect is more predictable revenue for foundries and stronger order flow for equipment and materials suppliers. However, tight supply also raises lead times and could push customers to lock in capacity early.

Winners and Losers across the Ecosystem

Clear winners include GPU and accelerator designers that sell into hyperscalers. Memory makers also benefit as large AI models need high-bandwidth memory (HBM) stacks. Suppliers of lithography and fab equipment see order flow rise. Foundry-adjacent firms, those that provide packaging, test, and substrate services, can gain too.

On the other hand, companies that lack scale or that focus on older nodes may face slower growth. Geopolitical risks and export controls also create winners and losers by reshaping customer relationships. For investors, the story points to a select group of stocks that are tied tightly to advanced-node capacity and to large cloud contracts.

Risks and Caveats Investors Should Watch

Several risks temper the bullish case. First, capacity ramp timelines are long. New fabs come with execution risk. Second, geopolitical tensions and trade rules could limit where chips move and who can buy them. Third, high valuations for market leaders raise the risk of pullbacks if growth expectations slip.

Fourth, heavy capex across the industry can compress near-term free cash flow, even if it drives long-term revenue. Finally, demand for AI compute could consolidate around a handful of large customers, which changes bargaining power across the chain. These are not fatal problems. But they matter for timing and for which firms truly gain market share.

Analyst Views and What to Watch Next?

Analysts broadly welcomed TSMC’s guidance while pointing to a few key watchpoints. They will track TSMC’s quarterly revenue bands, capex updates, and commentary on order mix between smartphone chips, AI GPUs, and custom accelerators. On the demand side, investors should watch major cloud providers’ capital plans and any multi-GW data-center projects or consortium deals that convert into visible chip orders.

Earnings from major GPU makers will also serve as hard data on AI spending. For active stock research, market participants may use an AI stock research analysis tool to slice customer exposures and model wafer-demand pass-through. Analysts said that if TSMC’s clients keep committing capacity, the secular bull case for AI compute remains intact, but timing will hinge on fabs and the macro backdrop.

Conclusion

The October 17, 2024, alert, the January 16, 202,5, confirmation, and the July 17, 2025, Q2 results together form a clear narrative. AI demand moved from promise to booked business. That shift favors firms tied to advanced nodes and to hyperscaler contracts. Still, execution risks, geopolitics, and valuation matter. Investors should watch order flows, capex execution, and cloud players’ deployment plans when choosing chip stocks to hold or avoid.

Frequently Asked Questions (FAQs)

Chip stocks rose because TSMC’s forecast on January 16, 2025, showed strong demand for AI chips. Investors felt confident that chip sales and profits would keep growing.

New AI deals increase data-center and computing needs. This creates higher demand for advanced chips. Companies then place larger orders with chipmakers to support future AI growth.

GPU makers like Nvidia, memory suppliers like Micron, and foundries like TSMC benefit the most in 2025 because AI workloads require powerful chips and high-speed memory.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.