Chipotle Stock Tanks 13% After Company Cuts Sales Outlook, Citing Younger Diners

Chipotle Stock plunged after the fast-casual chain warned that consumer demand is cooling, especially among younger diners. The company lowered its sales outlook for the third time in 2025, and the market reacted harshly: shares fell roughly 13% in after-hours trading as investors reassessed growth and margins.

Chipotle Stock: What the earnings showed

Q3 highlights and the numbers

Chipotle reported third-quarter revenue of $3.0 billion, up 7.5% year-over-year, with comparable restaurant sales rising just 0.3%, well below analysts’ ~1.36% expectation. Adjusted earnings per share were $0.29, and restaurant-level operating margin fell to 24.5% from 25.5% a year earlier. The company repurchased about $686.5 million of stock in the quarter.

Why did Chipotle miss expectations? Traffic weakened and transactions fell by about 0.8%, offset only by a 1.1% increase in average check. Management said price increases and menu changes helped checks, but fewer visits hurt total sales.

Chipotle Stock: Why leadership cut the sales forecast

CEO: Younger customers are pulling back

CEO Scott Boatwright and executives told investors that households earning under $100,000, roughly 40% of Chipotle’s sales, have pulled back sharply. Customers aged 25–35 were singled out as especially pressured by rising unemployment, resumed student loan payments, and weak wage growth.

Management now expects full-year comparable sales to decline in the low single-digit range for 2025.

What else is squeezing Chipotle? Chipotle (CMG) cited rising commodity costs, especially beef, and tariffs that pushed input prices higher. The company said it will take a slow, measured approach to price increases in 2026 rather than fully passing costs to consumers, which will weigh on margins. CFO Adam Rymer described the pricing stance as prudent but margin-pressuring.

Chipotle Stock: Market reaction and analyst views

How did investors respond?

Markets punished the guidance quickly. After the results and lowered outlook, Chipotle Stock slid about 13% in after-hours trades, the largest one-day drop in years, as traders priced in weaker near-term growth and margin risk. Social traders and chart watchers amplified the move across X and trading channels.

A sample of social reaction and market commentary captured real-time sentiment: one user highlighted the heavy selling and chart action, while another noted how headlines spread across feeds quickly.

These posts show retail and analyst chatter that followed the print.

What analysts are saying

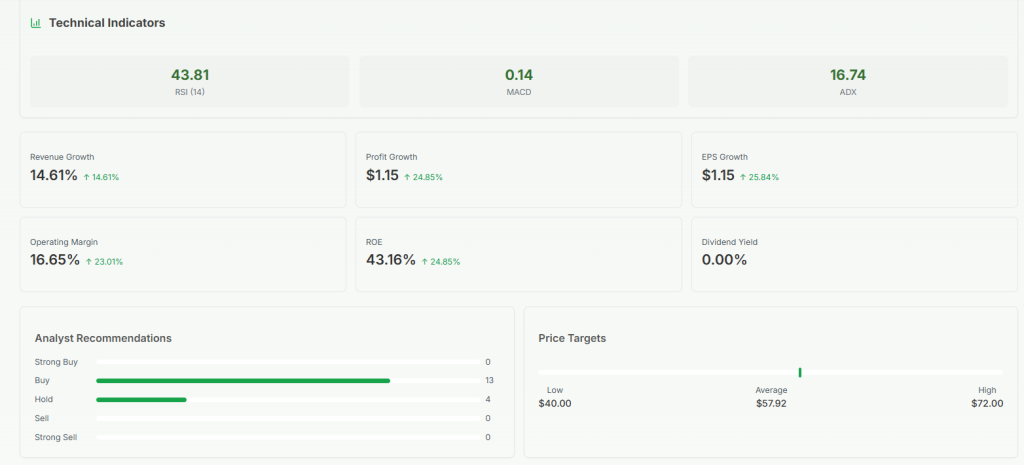

Analysts split between short-term caution and longer-term interest. Some lowered price targets after the guidance cut and flagged traffic weakness; others stressed Chipotle’s (CMG) strong brand and digital mix as reasons to watch for buying opportunities if the company stabilizes execution. Financial outlets and analysts emphasized that the sales revision was the key driver of the sharp sell-off.

For immediate coverage and industry context, major business outlets noted the company’s third straight conservative sales revision and the wide investor reaction.

Chipotle Stock: Consumer trends and macro factors

Younger diners, inflation, and spending shifts

Management said younger diners (25–35) are visiting Chipotle (CMG) less often. Reasons include renewed loan payments, job market softness, and grocery substitution as households cook more at home.

That demographic matters because Chipotle over-indexes on younger customers compared to some rivals.

How much does macro matter? Broadly, inflation, tariff policy, and the risk of a prolonged government shutdown have dented consumer confidence. Food inflation, driven in part by beef and chicken costs, compresses margins and limits Chipotle’s ability to grow checks without losing transactions.

Chipotle Stock: Operational issues and management response

Execution, digital accuracy, and menu steps

Chipotle flagged challenges with digital order accuracy, ingredient availability, and cleanliness. Management is retraining staff, tweaking bonus incentives, and ramping marketing and menu innovation (for example, carne asada rollouts) to win back trips. These tactical moves aim to restore frequency while broader macro headwinds are addressed.

Will these steps help? Investors will look for early signs: improving transactions, steadier digital execution, and successful marketing activations that bring customers back without sacrificing margins.

Chipotle Stock: How the restaurant sector is reacting

Sector peers and broader weakness

The miss reverberated across fast-casual names. Some competitors and broader restaurant stocks also slipped as investors priced a softer dine-out backdrop. Media and analysts compared Chipotle’s guidance cut to other chains that have also grappled with traffic declines and cost pressure.

For broader context and breaking coverage, Forbes posted rapid updates on industry impact and market moves following the print:

That thread captured how headline risk spreads across restaurant equities.

Is this a long-term buying opportunity for Chipotle Stock?

Long-term view vs short-term pain

Long-term bulls point to Chipotle’s strong brand, digital penetration (digital sales ~36.7% of food revenue), and aggressive share repurchases as reasons to consider the dip. Critics say valuation still looks rich relative to growth risk and that fixing traffic is harder than marketing alone.

What should investors watch next? Watch transactions and digital order accuracy in the coming quarters, management’s ability to re-engage younger diners, and how commodity costs evolve. If transactions recover and margins stabilize, some analysts may view recent weakness as a buying window; if trends worsen, downside could persist.

Multimedia: hear the call and market takeaways

For a concise market video summary, CNBC’s brief on the forecast cut and market reaction explains the headlines and analyst calls in under two minutes (CNBC clip on Chipotle’s Q3 reaction). Watching the clip helps clarify why the street punished guidance so quickly.

Bottom line

Chipotle Stock tumbled after a disappointing sales outlook and management’s warning that younger diners are spending less. Q3 showed resilient revenue growth but weak transactions and margin pressure.

The next few quarters are critical: investors will watch traffic, digital execution, and cost pressures closely to judge whether this is a tactical stumble or a sign of deeper demand weakness.

FAQ’S

Chipotle stock is dropping because the company cut its sales outlook for 2025 after reporting weaker spending from younger diners and rising food costs. Investors reacted negatively, causing a 13% fall in shares.

The outlook for Chipotle stock remains cautious in the short term due to slower traffic and margin pressure. However, analysts believe long-term growth could recover as the company improves digital orders and menu innovation.

Chipotle faced a major E. coli outbreak in 2015 that affected customers across multiple U.S. states. The incident led to temporary restaurant closures and significant damage to the brand’s reputation before a full recovery.

Chipotle stock surged about 400% over five years due to strong digital sales, menu expansion, and efficient store growth. The brand’s focus on online ordering and new items like lifestyle bowls boosted investor confidence.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.