Cipla Share Price: Analysts Weigh Mixed Technicals and Stable Fundamentals

As of 31 October 2025, Cipla Ltd (CIPLA) is attracting fresh attention. The share recently reached around ₹1,670, hitting its 52-week high. At the same time, its earnings are showing steady growth; profit and revenue both rose in the quarter ended September 2025.

Yet, analysts are sounding some caution flags. The technical signals are mixed. Some charts look strong, others suggest a pause. Meanwhile, the company’s fundamentals remain quite solid.

Let’s dig into both sides. We’ll look at what the numbers say, what the charts show, and where CIPLA might head next.

Cipla’s Current Share Price Snapshot and Market Context

The Cipla share traded around the ₹1,500-₹1,580 band in late October 2025. Recent intraday swings moved the stock from roughly ₹1,590 down to about ₹1,510 on October 30–31, 2025. These moves followed the company’s quarterly update and some broader market weakness in mid- to late-October.

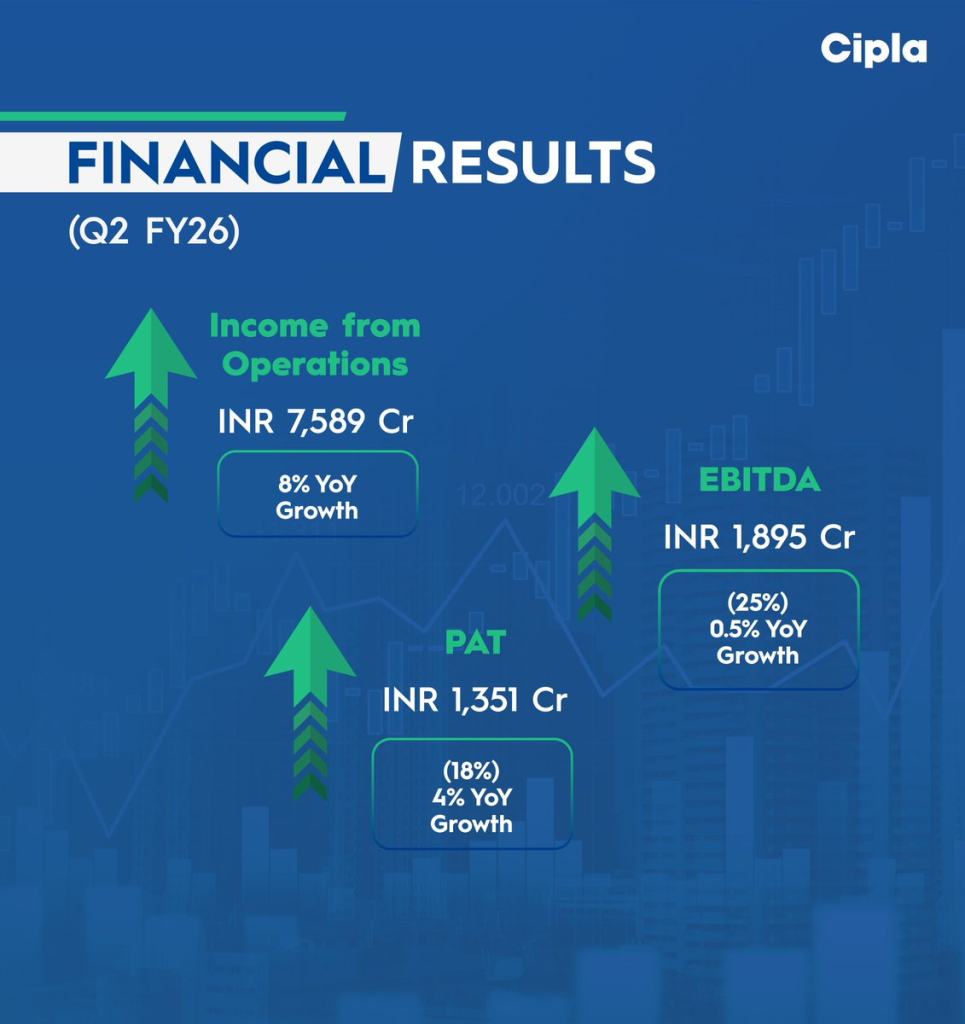

The company posted a record quarterly revenue of ₹7,589 crore for Q2 FY26. Consolidated net profit rose about 4% year-on-year to ₹1,351 crore for the quarter ended 30 September 2025. These numbers show steady top-line growth, even as margins came under some pressure.

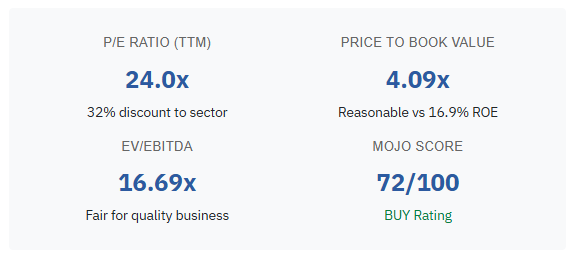

On valuation, consensus targets hover near the mid-₹1,600s to low-₹1,700s range across broker reports. That implies modest upside from current prices for investors who focus on fundamentals.

Recent Market Performance and Short-Term Drivers

The stock rose through October but reversed in the last week of the month. Trading volumes spiked on the earnings release day. The reversal suggests some traders used the earnings print as an opportunity to book profits. Charts show a mix of higher highs earlier in the month and a short pullback into support zones later.

Key near-term drivers include U.S. generics demand and the branded business in India. The Q2 presentation noted growth across focused markets and cited One-India branded prescription strength. Any positive clarity on the U.S. approvals pipeline or stronger domestic demand could lift sentiment. Conversely, regulatory observations or slowing pricing in generics would pressure returns.

Technical Analysis: Mixed Signals from Charts

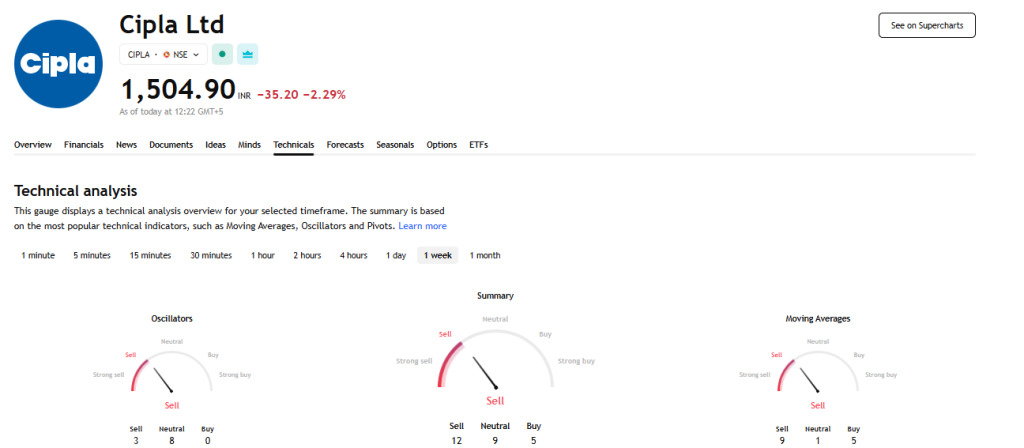

Daily indicators give mixed messages. The 50-day moving average has acted as support at times this month. The 200-day moving average remains below the current price, which suggests the longer trend is still intact. Yet momentum tools like RSI and MACD show cooling momentum after the October rally. TradingView’s aggregated technical rating recently skewed toward “sell” on a short window, while weekly reads leaned toward consolidation. This split explains why technicians are cautious.

Volume patterns also matter. High volume on down days during the latest pullback points to distribution by shorter-term holders. If volume dries up during falls and rises on advances, that pattern would favor a healthier rebound. For now, chartists will watch the support near the mid-₹1,400s and resistance around the mid-₹1,600s as key levels.

Fundamental Analysis: Stability beneath the Noise

Cipla’s balance sheet appears stable. The company reported healthy cash flow and maintained manageable debt levels in the latest filing. Return ratios remain competitive within the Indian pharma pack. The business mixes domestic branded prescriptions, international generics, and APIs. This diversification reduces reliance on one revenue channel.

R&D spending and pipeline activity matter for long-term valuation. Cipla continues to invest in specialty areas and respiratory franchises. The firm also flagged operational efficiencies in the investor presentation. Such investments support future earnings growth and can justify a premium multiple over time.

Key Growth Drivers That Could Push the Cipla Share Higher

U.S. generics remain a principal growth engine. Market share gains and timely launches can drive outsized revenues in specific quarters. The branded prescription segment in India provides steady, recurring cash flow. Expansion into biosimilars and niche therapies offers multi-year upside if execution is disciplined. Manufacturing scale and global distribution help the company serve large markets quickly. Any favorable regulatory outcomes in major markets will be a near-term catalyst.

Challenges and Risks to Monitor

Regulatory risk is persistent for pharma companies. Observations from regulators in any major market can delay approvals and dent near-term earnings. Pricing pressure in generics is another structural challenge. Competition from other Indian and multinational players is intense. Currency volatility can also compress margins on export revenue. Finally, any unexpected leadership changes may create temporary uncertainty, even when succession plans exist. (Cipla announced a planned leadership transition to take effect in April 2026.)

Analysts’ Views and Market Outlook

Brokerage houses show a range of calls from Buy to Hold. The average target from several analyst reports sits around ₹1,700. That reflects belief in medium-term earnings resilience but also caution over margin swings. Some brokerages emphasize Cipla’s steady cash flows and pipeline. Others point to short-term technical weakness and margin sensitivity as reasons to stay neutral. Investors should read individual reports to understand each firm’s thesis.

One convenient way to cross-check these views is by using an AI stock research analysis tool to aggregate broker forecasts and highlight divergence in assumptions. Use that insight as one of many inputs, not the sole basis for a trade.

Investor Takeaway and Strategy Notes

For long-term investors, Cipla’s fundamentals look steady. The business is diversified and cash generative. Q2 FY26 results showed record revenue and modest profit growth. Market noise could continue in the short term. Traders should watch technical support and volume behavior closely. Holders with a multi-year view can use weakness to add slowly. Short-term traders may prefer to wait for a clear technical confirmation near resistance before buying.

Conclusion and What to Watch Next

Key near-term signals include upcoming regulatory updates, new U.S. launches, and the quarterly margin trajectory. Also, monitor the leadership succession set for April 1, 2026, for any change in strategic tone. The balance of strong fundamentals and mixed technicals keeps the risk-reward profile moderate. Traders and investors should align their time horizon with the known risks and the company’s steady growth story.

Frequently Asked Questions (FAQs)

As of October 31, 2025, Cipla’s share price is around ₹1,550. Its 52-week high is about ₹1,670, showing steady growth in recent months.

Cipla’s Q2 FY26 results on October 30, 2025, showed higher profit and revenue. Analysts see stable performance, but some advise waiting for better entry points.

Most analysts expect the Cipla share to move between ₹1,600 and ₹1,750 in 2026. They see long-term strength, but short-term movements may stay mixed.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.