Coal India Q2: Profit Falls 32% to ₹4,263 Crore as Rains Disrupt Output

On October 29, 2025, Coal India Ltd reported a sharp fall in its second-quarter profit: down 32% to ₹ 4,262.64 crore from ₹ 6,274.80 crore in the same quarter last year. Heavy monsoon rains disrupted coal-mine operations and transport, reducing output.

At the same time, sales volume slipped and costs grew, squeezing margins. This outcome matters because Coal India supplies a large share of India’s coal, and any trouble at its operations can ripple through electricity generation and industry demand. Let’s explore what caused the drop, how big the impact is, and what to watch going forward.

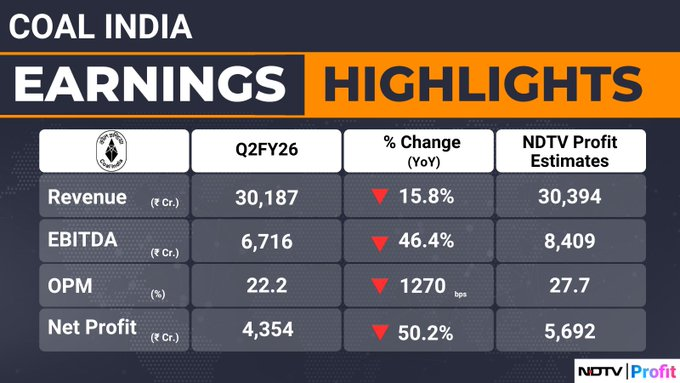

Coal India Q2 Results Snapshot

Coal India Ltd reported consolidated net profit of ₹4,262.64 crore for the quarter ended September 30, 2025. This is about a 32% drop from ₹6,274.80 crore a year earlier. Revenue from operations fell roughly 3.2% to about ₹30,186.7 crore.

Expenses rose by about 7%, reaching ₹26,421.86 crore. Production slipped as well, with September output around 48.97 million tonnes, down nearly 4% year-on-year. The company announced a second interim dividend of ₹10.25 per share even as profit declined.

What Went Wrong this Quarter: Main Causes

Heavy rains in September were a direct cause of reduced mine activity. Flooding and waterlogging delayed excavation. Rail and road movement also slowed. These disruptions hit output and deliveries. At the same time, offtake softened. Power plants and industrial buyers drew on inventories instead of buying fresh supplies. That lowered sales volumes. Lastly, operating costs rose. Fuel, logistics, and maintenance costs put pressure on margins. The combined effect pushed profit sharply lower.

Production and Operational Detail

Monthly data show the slowdown was concentrated in the middle of the quarter. Output fell in two of the three months. Several Eastern mines, which generate a large share of output, saw the biggest disruption. Stockyard congestion and constrained rail slots delayed dispatches. The company’s production target for the fiscal year now faces a clearer risk if heavy rainfall or logistics bottlenecks persist. The mines minister said there was no countrywide shortage of coal, but regional tightness did occur in September.

Financial Effects: Margins, e-auction, and Pricing

E-auction realisations weakened. Premiums fell relative to the year-ago quarter. Reuters reported e-auction realisation of about ₹2,292.40/ton, down from ₹2,453.92/ton a year earlier. Lower e-auction prices cut revenue per tonne.

At the same time, fixed costs did not fall in line with volumes. EBITDA declined and margins compressed. Sequentially, the results were also weak; profit fell sharply from the June quarter. The mix of lower volumes and weaker prices thus hit both the top line and the bottom line.

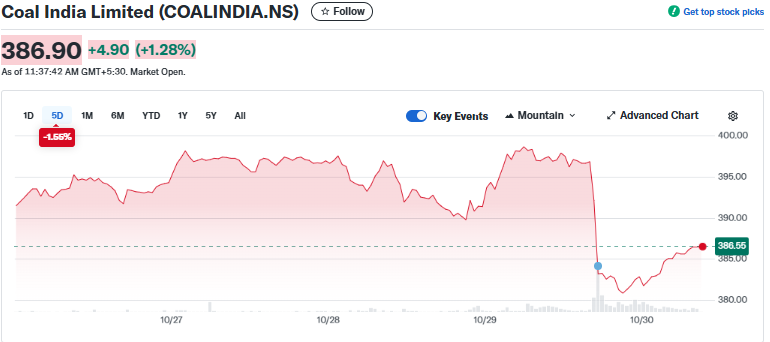

Market Reaction and Investor View

The stock moved down after the results. Traders noted the miss versus analyst expectations. Some investors focused on the dividend as a comfort factor. Others pointed to the slowdown in offtake and flagged margin risks. Analysts flagged two themes:

- near-term weather and logistics risks; and

- whether power utilities will return to buying once inventories normalise.

Sentiment will hinge on both demand recovery and any signs of cost control.

Broader Implications for Power and Industry

Coal India supplies most of India’s domestic coal. Any production hiccup can ripple across power generation. Shortfalls force utilities to draw from stocks or increase imports. That raises costs for thermal power plants. It can also shift buying patterns in the near term. For the industry, a tighter domestic supply may nudge some users to longer-term contracts or alternative fuels. Policy watchers will watch whether the ministry eases logistics constraints or offers relief to mines hit by weather.

What to Watch Next?

Watch four things closely in the coming weeks. First, the management’s guidance for Q3 and the rest of FY26. Second, rainfall and monsoon withdrawal patterns in key mining districts. Third, e-auction premiums and how quickly they recover. Fourth, demand from power plants once inventories run down. Also, watch any operational updates that show quicker clearing of stockyards and improved rail movement. Markets will react to any clear signs of recovery or further downside.

Risk Factors and Longer-term View

The quarter highlights two structural risks. One is weather-driven operational volatility. The other is demand cyclicality from power plants that manage several months of inventory. Coal India has scale and a long pipeline of domestic contracts. But repeated disruptions could slow progress toward production targets and influence earnings growth.

Investors should weigh short-term seasonality against long-term policy support for domestic supply. Use of modern analytics and even AI-driven operational tools can help the firm manage dispatch and reduce delays over time.

Closing Note

The October 29, 2025, results show a clear setback. Weather and weaker demand combined to cut profit by about a third. The dividend helps shareholder returns. But the bigger issue is fixing the operational gaps. If the rains ease and logistics improve, volumes and margins can rebound. If they do not, Coal India may face more quarters of muted growth. Monitor production updates and e-auction trends to judge the real recovery path.

Frequently Asked Questions (FAQs)

Coal India’s profit fell because heavy rains slowed mining, sales dropped, and costs rose during July-September 2025, affecting its overall quarterly performance.

On October 29, 2025, Coal India reported a net profit of ₹4,262.64 crore, showing a 32% fall compared to ₹6,274.80 crore earned last year.

Yes. On October 29, 2025, Coal India announced a second interim dividend of ₹10.25 per share for its shareholders after releasing its Q2 results.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.