Coca-Cola Weighs Sale of Costa Coffee, According to Sky News

Coca-Cola is exploring the sale of its Costa Coffee chain, as reported by Sky News. The company bought Costa in 2019 for £3.9 billion. Now, it works with Lazard to talk with buyers.

This move comes after Coca-Cola aimed to grow in coffee. Costa runs in 50 countries with thousands of stores. A sale might mean a big loss for Coca-Cola.

We see this as part of shifts in the beverage world. Coca-Cola wants to focus on core drinks. Readers get key facts here first.

Background on Coca-Cola’s Acquisition of Costa Coffee

Coca-Cola bought Costa Coffee from Whitbread in January 2019. The deal cost £3.9 billion, or about $5.1 billion at the time. This helped Coca-Cola enter the hot drinks market.

The purchase aimed to compete with Starbucks and Nestle. Costa offered ready-to-drink coffee and machines too. Coca-Cola saw growth in healthier options.

We note that Costa had strong UK roots since 1971. Brothers Bruno and Sergio Costa started it in London. It grew fast under Whitbread from 1995.

Reasons Behind the Original Purchase

Coca-Cola wanted to diversify beyond sodas. Health trends pushed for less sugar. Coffee fit as a premium choice.

The deal gave Coca-Cola over 3,800 stores worldwide. It included vending machines and roasteries. This boosted global reach.

We recall Coca-Cola’s CEO James Quincey called it a “coffee platform.” It aimed to rival big players. Sales grew post-buy.

Current Status of Costa Coffee Operations

Costa Coffee operates in 50 countries today. It has more than 2,700 shops in the UK and Ireland. Globally, over 1,300 more outlets exist.

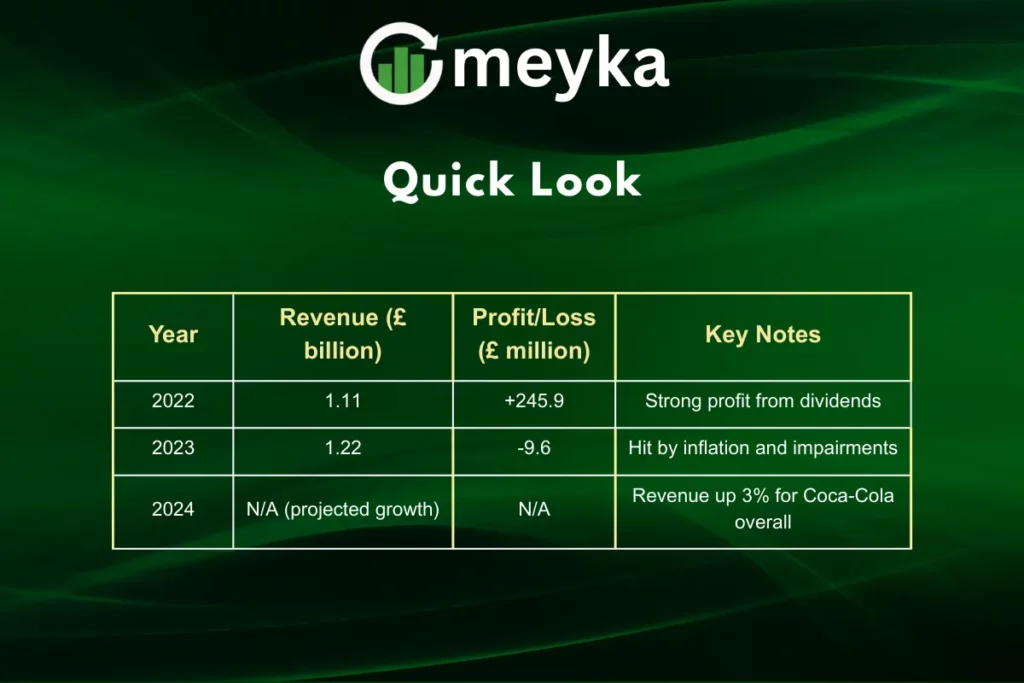

The chain employs about 17,800 people. Revenue hit £1.22 billion in 2023. But it posted a £9.6 million loss that year.

We see challenges from inflation on energy and payroll. Impairments in subsidiaries hurt too. Dividend income fell sharply from 2022.

Financial Performance Overview

Here is a quick look at recent finances:

This table shows ups and downs. Costa grew staff from 17,344 to 17,809 in 2023. Stores expanded too.

Details of the Potential Sale

Sky News reports Coca-Cola explores a Costa sale. Lazard handles talks with bidders. Private equity firms show interest.

Indicative offers come in early autumn. Coca-Cola might not sell after all. This is exploratory now.

We understand the sale price could be half the 2019 cost. That means a major loss. But Coca-Cola’s 2024 revenue was £47 billion.

Potential Buyers and Implications

Private equity might buy Costa. They could cut costs and grow it. Other chains or investors may bid.

A sale lets Coca-Cola focus on core brands. It faces pressure from health campaigns. Trump noted cane sugar use in July.

We think this reflects industry changes. Coffee market is competitive. Starbucks leads with innovations.

Strategic Shifts at Coca-Cola

Coca-Cola adapts to consumer tastes. It pushes low-sugar drinks and water. Coffee was part of that.

Now, selling Costa might streamline operations. The company invests in energy drinks too. Acquisitions like BodyArmor show this.

We observe Coca-Cola’s global strategy. It operates in over 200 countries. Diversification remains key.

Competition in the Coffee Market

Costa competes with Starbucks, which has 38,000 stores. Nestle owns Nespresso and partners with others.

- Starbucks focuses on experience and loyalty apps.

- Costa emphasizes quality beans and UK heritage.

- Independent cafes grow with specialty brews.

This list highlights rivals. Coca-Cola aimed to challenge them via Costa.

Impact on Employees and Markets

A sale could affect 17,800 workers. Private equity often restructures. Jobs might change.

In the UK, Costa is a high street staple. Over 2,000 stores serve millions. Global outlets add value.

We consider market reactions. Coca-Cola stock might dip short-term. But long-term, it frees capital.

Broader Economic Context

Inflation hit food costs hard. Energy prices rose post-2022. Payroll increased with wages.

Costa’s 2023 loss shows this. Revenue grew, but profits fell. A new owner might fix efficiencies.

Future Prospects for Costa Coffee

If sold, Costa could thrive independently. New investment might expand. Digital sales and sustainability matter.

Coca-Cola might keep some ties, like supply deals. This keeps brand links.

We see potential in emerging markets. Asia and Middle East grow fast for coffee.

Frequently Asked Questions

Coca-Cola acquired Costa in January 2019 from Whitbread for £3.9 billion.

To focus on core beverages and possibly due to recent losses at Costa.

Over 2,700 in the UK and Ireland, plus 1,300 globally in 50 countries.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.