Coforge Share Price Jumps 5% After Analysts Raise Targets on Re-Rating Hopes

On 27 October 2025, Coforge Ltd saw its share price jump by around 5-6 % after analysts raised their target prices. The reason: the company posted a stellar quarter with revenue and profit growth shining through. In the July-September period, it reported revenue of ₹3,986 crore and a net profit of ₹376 crore, a massive 86 % year-on-year jump.

Analysts now believe Coforge is due for a “re-rating,” meaning the market may value it more richly going forward. They point to stronger margins, big deal wins, and faster growth in travel and banking sectors. This fresh optimism has lit up investor sentiment and brought new momentum to the stock. Let’s explore what triggered the move, what the analysts are seeing, and what investors should watch next.

Coforge Share Price Performance

The Coforge share price jumped about 5-6% on 27 October 2025 after brokers raised price targets. The stock hit an intraday high near ₹1,866 as investors reacted to the company’s quarterly numbers.

The rally pushed the year-to-date gains into positive territory. Trading volumes rose on the news, showing fresh buying interest. Some traders said momentum picked up as doubts about margins and cash flow eased.

What Triggered the Analyst Upgrades?

Coforge released strong Q2 results for the quarter ended September. Revenue climbed about 32% year-on-year to ₹3,986 crore. Net profit surged 86% to ₹376 crore. Management also declared an interim dividend. These numbers beat many expectations and gave brokers reason to revise forecasts.

Brokerages updated target prices within days. Nuvama raised its target and highlighted a healthier 12-month executable order book at roughly $1.6 billion. Jefferies bumped its target to about ₹2,180, citing a stronger margin outlook. Other houses, such as JM Financial and Nuvama, also issued positive notes. These upgrades signalled greater confidence in earnings quality and cash flow.

Re-rating Hopes: Why Analysts are Bullish?

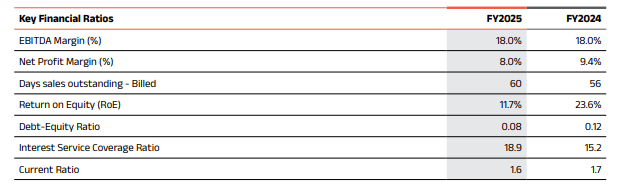

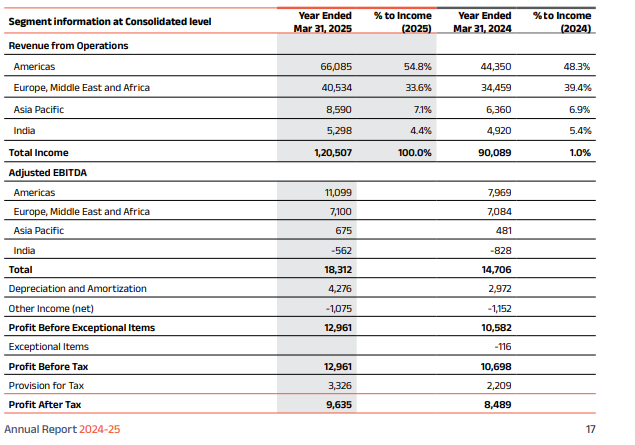

Analysts argue the stock could be re-rated if growth stays steady and margins expand. The quarter showed a meaningful margin improvement. That suggested better operating leverage and disciplined cost control. Large contract wins and a growing digital pipeline bolstered visibility.

Brokers pointed to faster demand in travel, banking, and insurance verticals. They also noted that the company’s order book gives at least 12 months of revenue visibility. If management sustains execution, investor perception could shift, and valuations could rise. Some research teams even used proprietary AI models to rework upside scenarios, though judgment still matters.

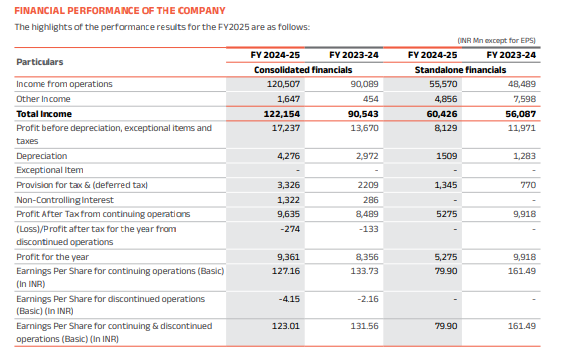

Coforge Ltd Financial Snapshot

Quarterly revenue at ₹3,986 crore marked a sharp rise versus the prior year. PAT of ₹376 crore represented a strong profitability improvement. EBIT margins expanded sequentially, helping convert sales into cash. The company also declared an interim dividend of ₹4 per share, underlining robust cash flow in the quarter.

Free cash flow looked healthier after recent quarters of working-capital pressure. The 12-month executable order book near $1.6 billion provides near-term revenue support. Balance-sheet metrics remain reasonable with manageable leverage and healthy cash balances reported. These elements combine to improve the risk-reward view for many analysts.

Risks and Challenges for Coforge Ltd

Risks remain. Global IT spending can slow unexpectedly. A soft patch in BFSI, a key vertical, would hit growth. Currency volatility could pressure reported numbers in rupee terms. Talent costs and wage inflation remain a persistent headwind for Indian IT firms. Competition is intense; peers may win larger deals or put pressure. Finally, any slip in execution or a surprise on margins could reverse sentiment quickly. Investors should weigh these risks against the recent positive signals before making decisions.

Expert Views and What Investors Should Watch?

Analysts will track a few clear items. First, management commentary on deal wins and pipeline health in the next quarterly call. Second, the margin trajectory over the coming two quarters. Third, the pace of large-ticket contract signings and the mix between digital and legacy services. Fourth, cash-flow trends and working-capital movement.

Finally, any guidance changes from brokerages after the October results will be important. Market participants will also watch whether multiple brokers converge on a higher valuation band. Together, these indicators will decide if the current optimism is durable or merely short-lived.

Final Words

The October 2025 quarter gave Coforge clear momentum. Strong revenue growth and a big jump in profit eased earlier concerns. Broker upgrades and a fuller order book fuel hopes of a valuation re-rating. Yet risks stay real. Execution, margins, and macro demand will determine whether this run continues. Investors should follow quarterly updates closely and weigh the upside forecasts against the operational risks cited by analysts.

Frequently Asked Questions (FAQs)

The Coforge share rose on 27 October 2025 because strong quarterly results were shared. Analysts raised price targets. Investors liked the higher profit and order book growth.

Analysts expect better growth in the next few quarters. They think margins can improve. Some raised target prices. But they still watch market demand and business risks.

The outlook looks positive after the October results. Still, risks exist in global demand and costs. Investors should check updates and decide based on their plan.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.