Corona Remedies share price jumps 38% on NSE debut on December 15, 2025

December 15, 2025, turned into a strong debut day for Corona Remedies on the National Stock Exchange. The company entered the market at a time when investors were cautious and selective. Yet, the response was anything but muted. Corona Remedies’ share price jumped sharply on its very first trading session, catching the attention of retail and institutional investors alike.

IPO listings often start with uncertainty. Some struggle to hold their issue price. Others fail to build early momentum. This listing, however, moved in the opposite direction. The sharp price action reflected confidence, not hype. It also highlighted growing interest in India’s pharmaceutical space, especially companies with stable domestic demand.

Pharma stocks are often seen as defensive plays. They tend to perform even when markets feel uneasy. On this December morning, that perception worked in Corona Remedies’ favor. The listing signaled more than a good opening trade. It showed how investors are rewarding businesses with predictable demand, steady growth, and clear positioning in today’s market.

Corona Remedies IPO Listing Key Numbers

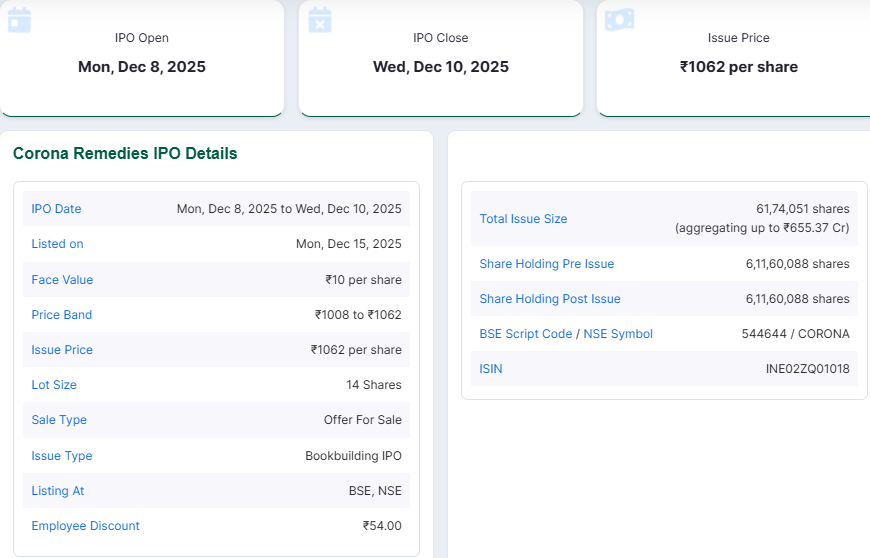

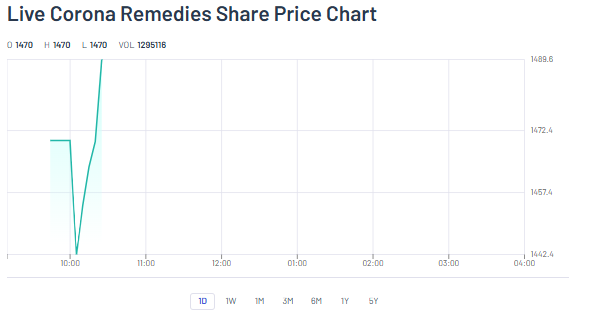

Corona Remedies was listed on the National Stock Exchange on December 15, 2025. The issue price was ₹1,062 per share. The shares opened sharply higher on listing day. On the NSE, the stock debuted around ₹1,470, about a 38% premium to the issue price. BSE listings showed similar strength. The public offer size was about ₹655 crore.

The IPO was subscribed during the window of 8-10 December 2025, with allotment completed on 11 December 2025. These figures reflect strong retail and institutional interest ahead of the debut.

Why the Share Price Surged 38% on Listing Day?

Several concrete forces pushed the listing premium. First, grey market activity signaled high demand. Reports showed a sizeable grey market premium in the days before listing. This hinted at positive listing momentum. Second, investor appetite for defensive sectors grew in late 2025. Pharmaceuticals drew attention as safe, recurring-revenue businesses.

Third, Corona Remedies presented familiar strengths: steady domestic sales and focused product lines. Finally, market makers and anchors had shown support during the offer. The combined effect created a large initial bid at open.

Corona Remedies Business Model

Corona Remedies operates mainly in branded formulations. The company lists therapeutic focuses that include women’s health, cardio-diabeto, pain management, and urology. It emphasizes domestic sales and a strong field force. This model yields predictable repeat demand from physicians and pharmacies.

Investors often value such repeatable revenue streams higher than one-time contract income. The company’s strategy reduces dependence on volatile export markets. That steadiness appealed to buyers on listing day.

Financial Performance Ahead of Listing

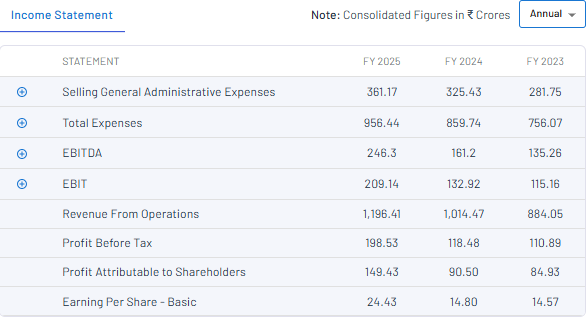

Corona Remedies reported solid revenue growth in its filings. For the twelve months ended June 2025 (MAT June 2025), domestic formulation sales demonstrated robust year-over-year gains. Margins were in line with mid-cap pharmaceutical peers.

The prospectus indicated manageable debt and positive operating cash flow. These metrics framed the IPO valuation as justified by growth, not just future hopes. Investors clearly priced current fundamentals into the listing premium.

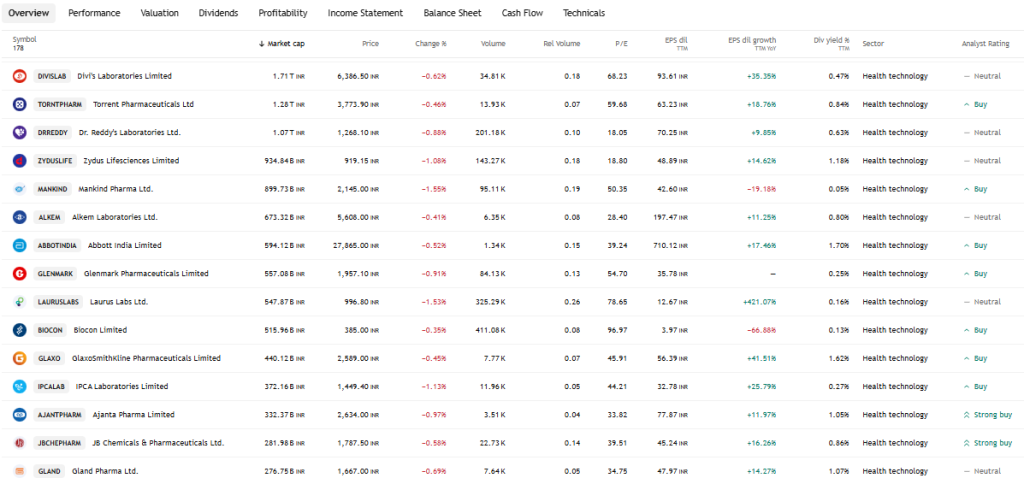

How Corona Remedies Compares With Listed Pharma Peers?

At listing, Corona Remedies traded at a noticeable premium versus some similarly sized peers. That premium reflected market confidence in steady domestic demand and higher revenue visibility. Larger pharma firms typically command scale advantages and export diversification.

Corona Remedies’ edge lies in focused therapeutic segments and faster retail traction in specific states. Valuation comparisons must weigh growth rates against margin sustainability. Analysts noted that investors were choosing growth clarity over pure scale on December 15, 2025.

Short-Term Trading Outlook After a 38% Listing Gain

A strong listing often invites profit-taking. Traders may book quick gains within the first few sessions. Yet, if volumes stay high and earnings signals remain positive, the shares can sustain gains. Liquidity will matter. Early trading volumes on listing day were healthy. Price action after the debut will hinge on the next quarterly numbers and any management commentary on capacity or margin trends. Technical watchers will track the listing price as a new reference level.

Long-Term Investment View: Is Corona Remedies Worth Holding?

For long-term investors, the case rests on execution. The strengths are clear. The company has strong domestic formulations, stable demand, and a focused product mix. Growth can come from deeper penetration in existing states and expansion into new regions. Risks include pricing pressure, regulatory changes, and competition from larger players.

If management sustains margin discipline and expands distribution efficiently, the firm could justify a premium valuation over time. Use of an AI stock research analysis tool can help track early signals and compare evolving metrics against peers.

Key Risks That Could Impact Corona Remedies’ Share Price

Regulatory scrutiny is primary. Pharma firms face approvals, pricing rules, and quality audits. Any adverse compliance news can hit valuations fast. Second, competition in branded generics is intense. Larger rivals can pressure prices. Third, reliance on domestic markets concentrates revenue risk.

A slowdown in demand or new distribution challenges could lower growth. Investors should watch upcoming earnings and any guidance changes from management.

What This Listing Says About India’s IPO Market in 2025?

Corona Remedies’ strong debut fits a recent trend. In 2025, investors showed renewed interest in profitable, fundamentals-oriented offerings. Healthcare and pharma drew buyers seeking defensive exposure.

The market rewarded clarity of earnings and repeatable revenue. This listing may encourage other mid-cap pharma firms to test the public markets, provided they show similar discipline in margins and growth plans. The IPO calendar for December 2025 showed a mix of steady listings and some flat debuts, underscoring selective investor appetite.

Conclusion

The December 15, 2025, listing made a clear statement. Corona Remedies rose sharply on debut. The move reflected demand, a defensive sector tilt, and visible fundamentals. Short-term traders may act fast. Long-term holders must watch execution and regulatory developments. The true test will be consistent quarterly performance and prudent expansion.

Frequently Asked Questions (FAQs)

The share price rose because demand was strong, bids were high, and pharma stocks attract safety buyers. The move happened on listing day, December 15, 2025.

Corona Remedies is listed on NSE near ₹1,470, above its issue price. Trading began on December 15, 2025, reflecting strong opening demand from retail and institutional investors.

After the IPO, investors are watching earnings growth, margins, and price stability. Decisions depend on risk appetite and future results, not just the strong debut.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.