CrowdStrike Stock: Windows Crash Still Hurts as CrowdStrike Forecasts Weak Quarterly Revenue

The Story Starts Here

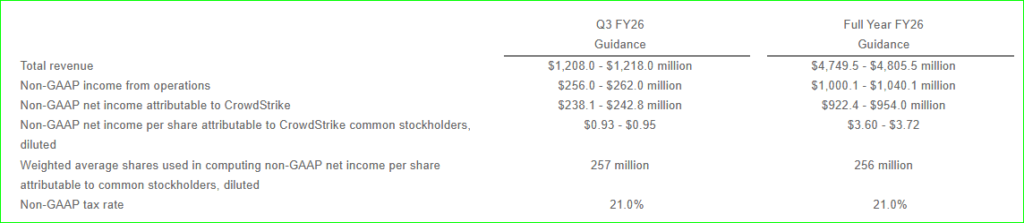

The heart of this update is that CrowdStrike Forecasts softer revenue for Q3 2026, estimating between $1.21 billion and $1.22 billion, slightly below Wall Street’s $1.23 billion target. That cautious outlook follows strong Q2 results but is overshadowed by ongoing fallout from last year’s major Windows outage. This contrast of financial strength and persistent headwinds sets the stage for a deeper look into what is holding the company back.

CrowdStrike Forecasts Weak Growth After Strong Q2

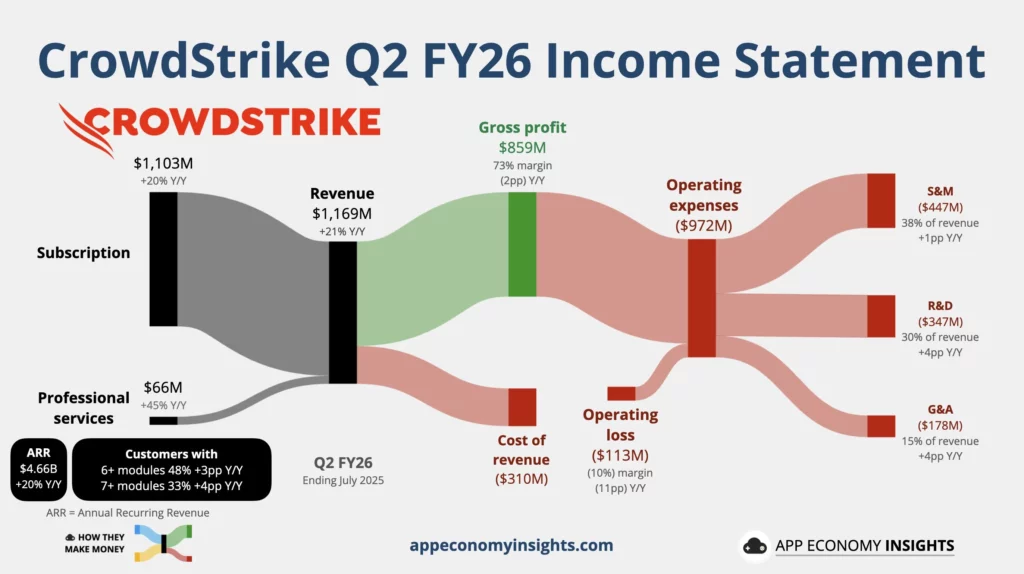

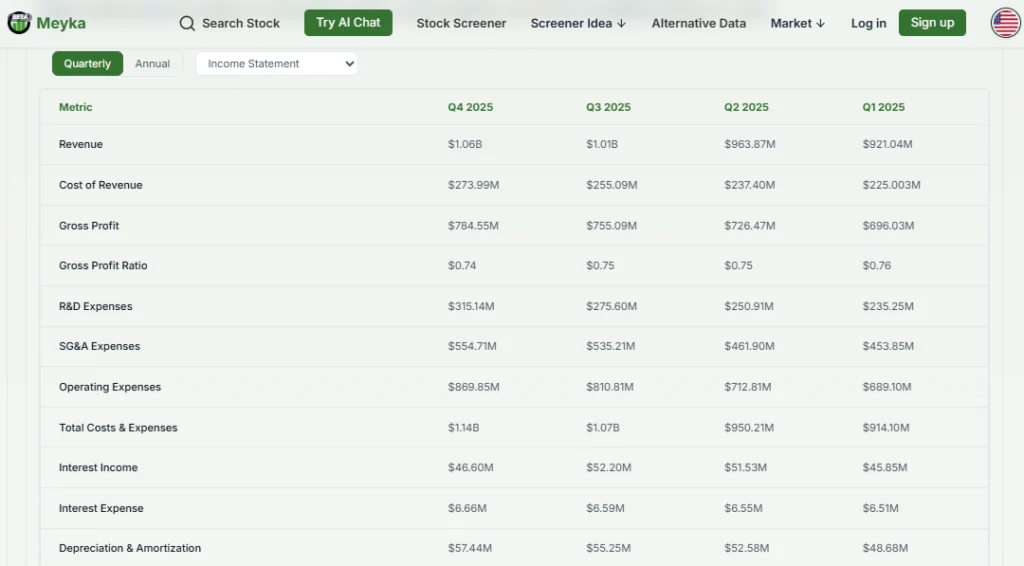

CrowdStrike beat expectations in Q2 of fiscal 2026, posting 21 percent year-over-year revenue growth to $1.17 billion and delivering 93 cents adjusted earnings per share, eclipsing forecasts of 83 cents.

But the company’s forward guidance dampened optimism. Key cost pressures remain, in particular, ongoing customer retention incentives and anticipated $51 million in outage-related cash payouts in Q3.

Why Is the Outlook Softer?

So what is dragging growth now?

Retention incentives launched after the July 2024 Windows failure are forecasted to reduce revenue by $10–15 million per quarter for the rest of the fiscal year. At the same time, CrowdStrike expects to absorb about $51 million in outage-related payments as it continues to manage the fallout from that historic disruption.

The Windows Crash: Still Having an Impact

The July 2024 incident, in which a faulty Falcon sensor update crashed an estimated 8.5 million systems worldwide, remains a defining moment. From airlines to hospitals and banks, the global chaos underlined how deeply CrowdStrike’s software is embedded in critical systems.

Beyond the technical fallout, the incident has dragged on in reputational and legal terms; Delta filed a lawsuit citing gross negligence and service outages.

Market Reaction and Analyst Warnings

How did investors respond?

CrowdStrike’s shares fell nearly 8 percent in extended trading after the revenue forecast fell short of expectations. Analysts and shareholders are clearly rattled by the persistent cost pressures and cautious forward guidance.

Meanwhile, market reports note a slowdown in net new Annual Recurring Revenue (ARR) as clients negotiate softer terms, even as total ARR rose over 20 percent to $4.66 billion. CrowdStrike also announced the acquisition of Onum to enhance security telemetry, but offset by continued litigation exposure and retention incentives.

Is This Urgent, or Part of a Recovery Strategy?

Is this setback temporary?

CrowdStrike’s CFO framed the costs as strategic investments in customer trust and recovery. The incentive program ended previously, but its effects linger, shaping Q3’s subdued outlook.

The company also recently took proactive steps like reducing its workforce by 5 percent to boost efficiency, citing gains from AI-powered productivity initiatives.

What It Means for the Cybersecurity Sector

Why does this matter beyond one company?

CrowdStrike’s outlook serves as a barometer for the broader cybersecurity market. As businesses reassess IT budgets in an uncertain economy, retention-heavy strategies and cautious spending could become the norm, especially if trust has to be rebuilt following high-profile failures.

Competitive Pressure in the Cybersecurity Landscape

CrowdStrike does not operate in isolation. Rivals like Palo Alto Networks, SentinelOne, and Microsoft Security are all pushing deeper into AI-driven cybersecurity solutions. While CrowdStrike’s Falcon platform remains highly respected, customers are increasingly evaluating alternatives after the July incident.

In fact, Palo Alto recently reported stronger growth and guided higher for the next quarter, adding to the pressure on CrowdStrike to prove it can bounce back.

The competitive landscape makes it clear that while CrowdStrike remains a leader, its dominance cannot be taken for granted.

The Role of Artificial Intelligence in Future Growth

A big part of CrowdStrike’s story is its AI-driven Falcon platform, which helps detect and stop cyberattacks in real time. During the earnings call, management emphasized investments in AI-powered threat detection, automation, and cloud-native protection.

However, Wall Street analysts remain cautious. While AI is seen as a long-term growth driver, the near-term issue is execution. Investors want proof that AI tools translate into sustainable revenue growth, not just marketing buzz.

Guidance and Risks Ahead

The most damaging part of the earnings call was the outlook. CrowdStrike forecasted revenue of $1.28 billion–$1.30 billion for Q3, well below Wall Street’s estimate of $1.34 billion. The company also flagged higher costs as it invests in new AI initiatives and strengthens reliability safeguards after the outage.

This guidance points to slowing growth, tighter margins, and ongoing reputational repair. The risks include:

- Lingering customer concerns about stability.

- Rising competition in AI-driven security.

- Broader macroeconomic uncertainty affecting IT budgets.

Until CrowdStrike proves it can overcome these hurdles, investor caution will remain.

Conclusion: A Turning Point

In summary, CrowdStrike Forecasts Q3 revenue that is softer than hoped, hampered by lingering costs and the long shadow of the Windows outage. Q2 results showed resilience, but forward-looking pressures underscore the path to recovery ahead.

Still, CrowdStrike remains a leader in cloud-native security, and strategic actions like acquisitions and staff restructuring signal a plan forward. The road to regaining momentum will require not just innovation, but clear progress in restoring customer and market confidence.

FAQ’S

CrowdStrike forecasts revenue of about $958–$961 million for the next quarter, slightly below Wall Street expectations.

Yes, shares dropped as investors reacted to weaker-than-expected revenue guidance despite solid past earnings.

Many analysts argue CrowdStrike trades at a premium due to its growth potential, though valuation concerns remain.

Institutional investors like Vanguard Group and BlackRock hold the largest stakes in CrowdStrike.

As of August 2025, CrowdStrike’s market cap is around $86 billion.

Its strong position in cybersecurity, rapid customer growth, and recurring subscription model boost its long-term value.

Yes, but its debt levels are considered manageable relative to its revenue and cash flow.

CrowdStrike was co-founded by George Kurtz (CEO) and Dmitri Alperovitch, but it is publicly traded.

Yes, it has achieved consistent profitability in recent quarters, with margins improving year-over-year.

Disclaimer

This content is only for learning. It is not financial advice. Always check facts and do your own research before making financial decisions.