CSX Earnings Drop Amid One-Time Charges and Weak Coal Demand

On October 16, 2025, CSX released its third-quarter results and sent a jolt through the markets. Revenue slipped to about $3.59 billion, down nearly 1 % year over year. Net earnings dropped by around 22 %, hit in part by a $164 million goodwill impairment tied to its trucking arm. At the same time, coal revenue plunged 11 % as demand weakened further in a shifting energy landscape. These two headwinds, a one-time accounting charge and soft coal shipment, turned what could’ve been a steady quarter into a clear warning sign.

In the sections ahead, we’ll break down how CSX fared across its business segments, see how investors reacted, and explore whether these challenges are temporary or structural.

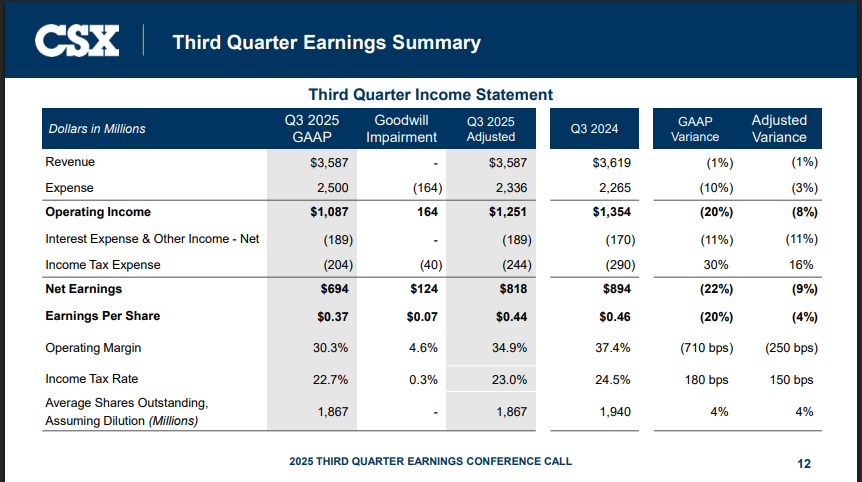

Financial Performance Snapshot

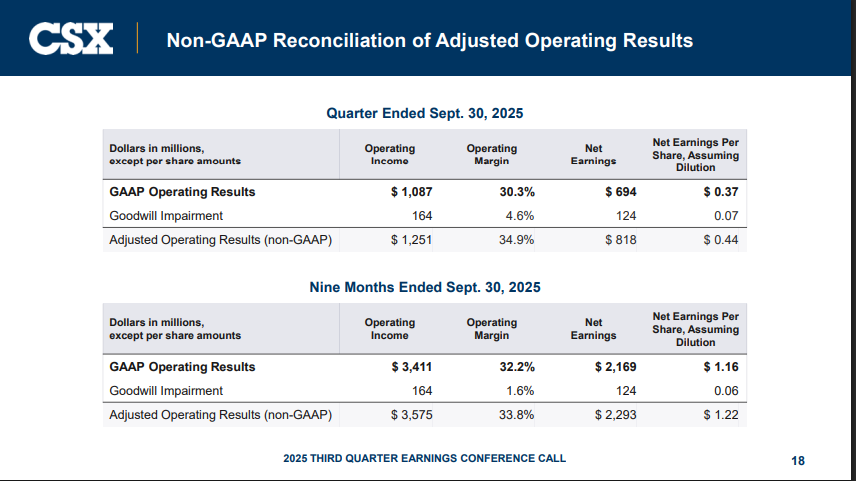

CSX reported third-quarter revenue of $3.59 billion. Net earnings fell to $694 million, or $0.37 per share. Excluding a non-cash goodwill impairment of $164 million, adjusted net earnings were $818 million, or $0.44 per share. Operating income was $1.09 billion on a GAAP basis and $1.25 billion adjusted. Revenue slipped about 1% year-over-year. Analysts had expected roughly $3.58 billion, so adjusted results narrowly beat on the profit line. These figures show the quarter was uneven.

One-time Charges and their Impact

The headline hit came from a $164 million goodwill impairment tied to Quality Carriers. That charge is non-cash. Still, it lowered GAAP operating income and net profit. Management flagged the impairment in its October 16, 2025, press release. When removed, core operating results appear stronger. But investors and media focused on the charge. The accounting hit masked better performance in some operating streams.

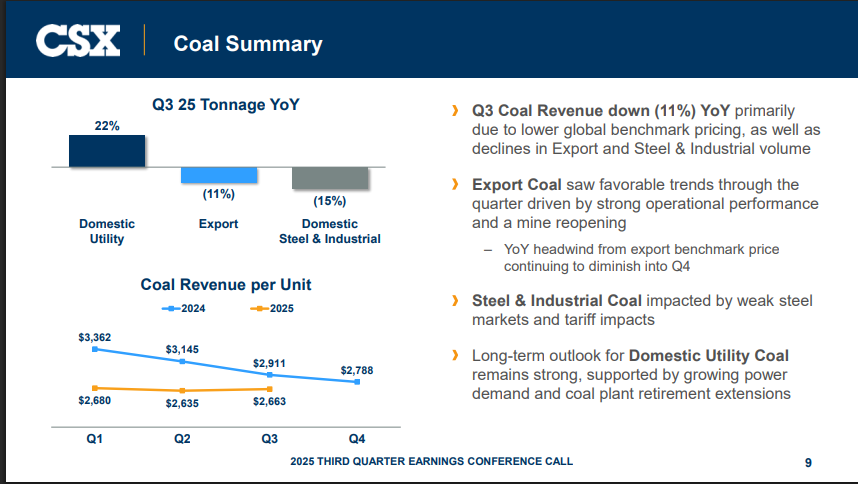

Weak Coal Demand: A Continuing Drag

Coal revenue fell roughly 11% in the quarter. Total coal volume slipped about 3% year-over-year. Lower export prices and weaker domestic demand were key factors. The energy mix keeps shifting toward gas and renewables. Utilities continue to burn less coal. That trend cuts freight for eastern rails like CSX. The coal slump reduced overall revenue despite gains elsewhere.

Performance in Other Segments

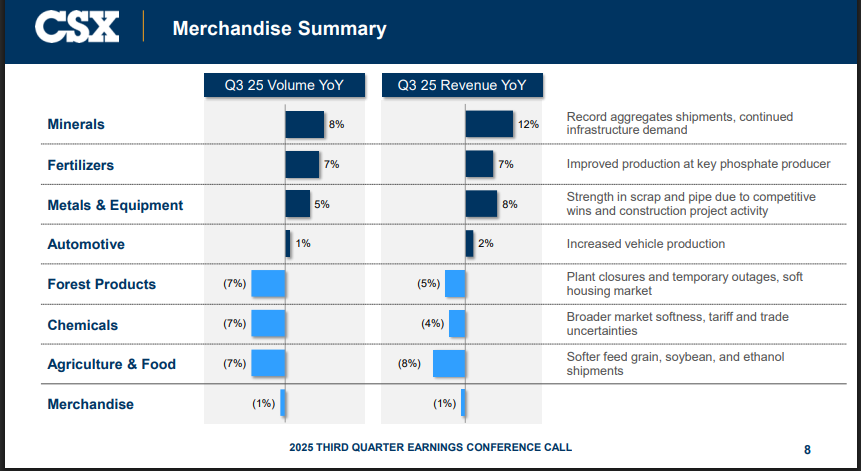

Intermodal freight grew. Intermodal revenue rose around 4%, with volumes up about 5%. This helped offset some coal weakness. Merchandise pricing also improved in pockets. Chemical, automotive, and agricultural shipments showed mixed results. Some customers moved cargo back to rail from truck. The company pointed to service gains and new interline agreements to boost future intermodal flows. Still, intermodal strength was not large enough to fully replace lost coal revenue this quarter.

Management Commentary and Strategic Response

CEO comments in the earnings call stressed operational improvement. The company cited higher train speeds and better on-time performance. Management emphasized capital spending plans for 2025. The firm reaffirmed investments in network resilience and technology. Cost controls and efficiency moves are a focus. The leadership noted interest in strategic options, but did not commit to mergers. Public statements sought to balance realism about headwinds with confidence in long-term plans.

CSX Earnings: Market and Investor Reaction

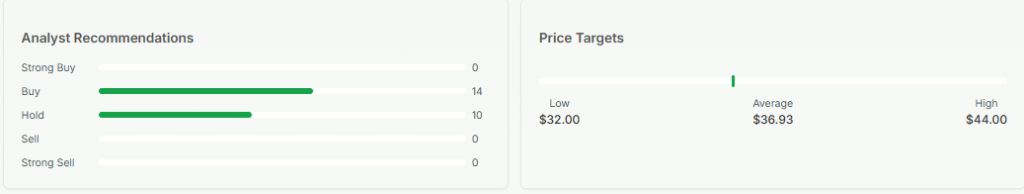

The stock reacted modestly. Some traders focused on the adjusted EPS beat. Others fretted over structural declines in coal. Analysts issued mixed notes. A few highlighted CSX’s intermodal gains and improved operating metrics.

Others noted the company faces tougher competition if large rail mergers reshape the sector. Investors used tools such as an AI stock research analysis tool to compare peers and scenario outcomes. Overall sentiment leaned toward cautious optimism.

Broader Industry Context

The U.S. rail industry faces a changing freight mix. Coal volumes have been falling for years. Intermodal growth depends on consumer demand and port throughput. Labor issues and fuel costs matter, but service quality is a primary differentiator.

Possible large mergers in the rail sector could alter pricing power and route access. Regulators and shareholders will watch consolidation closely. Macroeconomic trends like industrial output, trade policy, and energy prices will shape rail volumes into 2026.

Outlook and Conclusion

CSX offered cautious guidance after October 16, 2025. Capital spending for 2025 remains elevated as the company rebuilds and upgrades. Management expects intermodal growth to continue. Coal is likely to stay under pressure near term. If energy prices or policy shift, coal demand could recover somewhat.

For now, the quarter shows two clear messengers: one-time accounting charges can distort GAAP profits, and weak coal demand is a real operating drag. CSX’s ability to grow other freight categories and improve network efficiency will determine whether this episode is short-lived or structural. Investors should track monthly volume trends and management’s next quarterly update for clearer signs of recovery.

Frequently Asked Questions (FAQs)

CSX earnings fell in Q3 2025, announced on October 16, due to a $164 million one-time charge and lower coal demand across U.S. markets.

CSX is focusing on intermodal freight, cost savings, and better rail efficiency to balance the drop in coal shipments seen during its October 2025 earnings report.

On October 16, 2025, CSX reported $3.59 billion in revenue and $694 million in net profit, showing a small yearly decline due to weaker coal and one-time charges.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.