Cycurion (CYCU) Stock: Pulls Back 3% Following an 11% Surge in 5 Days as CEO Reviews 2025 Strategy

CYCU stock recently jumped by double digits, up roughly 11% over five trading days, only to dip about 3% shortly after. That quick swing caught many investors off guard. The company has been in the spotlight again because its CEO is reviewing CYCU’s 2025 strategy. Behind the volatility lies more than just market mood: CYCU is navigating a major transformation. Its latest backlog of contracts recently climbed above $73.6 million, with new government, healthcare, and public-sector deals fueling optimism.

But with rapid changes come questions. Is this pullback simply a pause or a warning sign for a company converting promises into profits? In this article, we’ll dive into what triggered the rally, why the decline happened, and whether CYCU’s 2025 strategy could pay off for long-term investors.

CYCU Price Action Recap: What Actually Drove the 5-Day 11% Surge?

Cycurion’s shares rose sharply over a few trading sessions after several concrete events. The company issued a shareholder letter on October 28, 2025, that highlighted a $73.6 million contracted backlog. That disclosure gave traders fresh evidence of near-term revenue visibility.

A second driver was a string of contract wins. Cycurion announced new government and telecom awards in November 2025. These wins raised confidence in recurring revenue from public-sector clients.

Finally, exposure from the press and earnings headlines amplified momentum. Q3 2025 results and management commentary reinforced the narrative that operations were gaining traction. The combination of backlog, contract wins, and earnings talk helped push the stock higher by roughly 11% in five trading days.

The 3% Pullback: Natural Cooling or a Sentiment Shift?

A pullback of about 3% after a sharp move is common for small-cap names. Traders often take profits after a rapid run. Algorithms can also trigger short retracements when momentum indicators hit overbought levels.

For Cycurion, the pullback followed two management signals. First, the CEO publicly reviewed the company’s 2025 strategy in interviews and press pieces in early December 2025. Second, the company announced a $500,000 common-share dividend on December 5, 2025, which altered float dynamics and short-term supply. These communications likely caused a mix of profit-taking and position reshuffling.

The decline looks like a normal consolidation rather than a structural reversal. Volume during the dip remained moderate compared with the spike. That suggests shops trimmed exposure instead of exiting entirely.

Inside the CYCU’s CEO 2025 Strategy Review:

Refocus on High-Margin Cyber Intelligence Products

Management emphasized migration toward the ARx platform’s higher-margin modules. The pitch is simple: shift revenue toward recurring managed services and software features that scale. If executed, that could lift gross margins over time and improve cash conversion. The shareholder letter describes the ARx platform as central to future growth.

Budget Reallocation: More R&D, Less Experimental Spend

The CEO outlined tighter capital discipline and targeted R&D spending. The aim is to fund product upgrades that customers will quickly adopt. Focused R&D can shorten sales cycles for new modules and reduce wasted trial investments.

Expanding Partnerships With Public-Sector Agencies

Cycurion highlighted multi-year agreements with municipal and federal customers. Public-sector deals often carry multi-year commitments and higher renewal rates. The company cited a $6 million municipal transportation agreement as part of the second quarter gains. That deal helps validate Cycurion’s ability to sell at scale into government channels.

Potential 2025 Launch Timeline

Management hinted at product rollouts and integrations slated for late 2025 and early 2026. Those milestones matter because they link strategy to revenue recognition and customer retention. Investors will watch product delivery dates closely.

Market Context: Why the Broader Cybersecurity Sector Matters to CYCU

Cybersecurity budgets remain elevated across government and enterprise. Demand for zero-trust architectures, threat analytics, and managed detection services is growing. Smaller vendors like Cycurion can benefit when niche capabilities match large contracts. However, sector momentum can swing quickly with macro shifts or big vendor announcements.

Large incumbents also invest in similar AI and cloud security capabilities. That creates a competitive backdrop. Yet, the public-sector pipeline can favor nimble suppliers with specialized offerings and contract vehicle access.

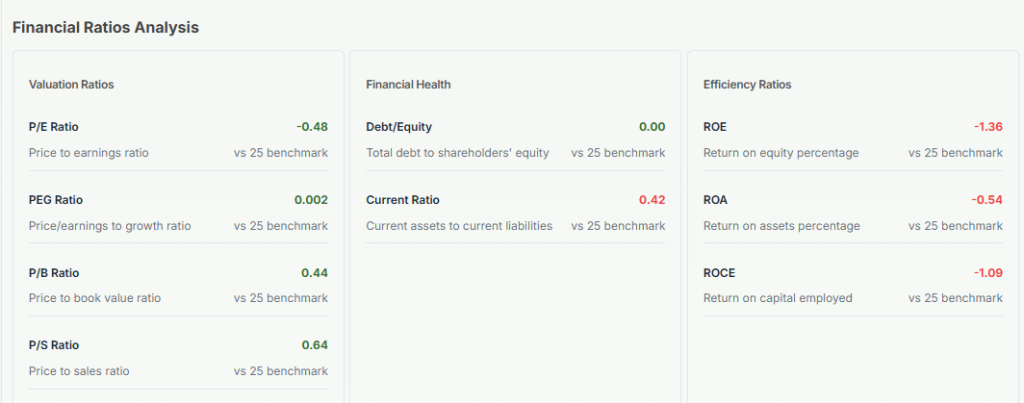

CYCU Stock: Key Metrics Investors are Watching

Investors should track metrics that will confirm the strategy shift. These include:

- Contracted backlog and new awards. The $73.6 million backlog disclosed on October 28, 2025, is a headline metric. It gives revenue visibility across multiple years.

- Run-rate revenue and quarter-over-quarter growth. Management reported momentum into Q4 2025 and a run-rate target for early 2026.

- Cash runway and current ratio. Liquidity will determine how long the company can invest before turning free cash flow positive. Some third-party data flagged liquidity pressure even as revenue grows.

- Gross margins and recurring revenue share. A successful pivot to managed services should lift margins and stabilize topline predictability.

These metrics will show whether the CEO’s reallocation and product emphasis are working.

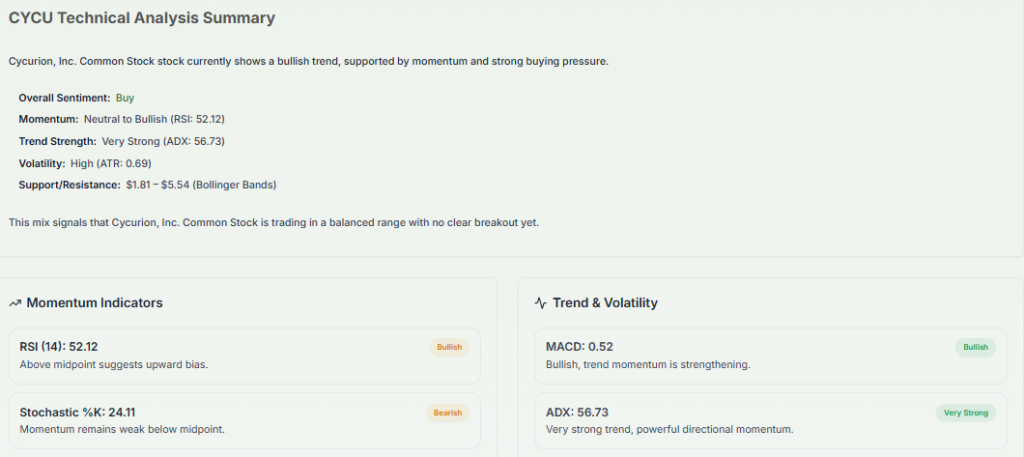

Technical View: Where CYCU Could Go Next

From a technical angle, the recent rally cleared short-term resistance levels. The pullback tested those levels for support. If price forms a higher low on rising volume, the trend can remain bullish. If price falls below the previous support on heavy volume, the move would signal deeper weakness.

Shorter timeframes will matter to traders. Longer timeframes will matter to investors focused on execution, contract delivery, and margin improvement. Watching volume alongside price will provide the best read on conviction.

Risk Factors Most Traders are Ignoring

Several risks deserve attention:

- Low float and limited liquidity. Small-cap moves can amplify both gains and losses.

- Execution risk on product rollouts. Delays can push back revenue recognition.

- Dependence on public-sector deals. Government contracts are durable but slow to negotiate. Loss or delay of a major award could hurt near-term guidance.

- Balance-sheet pressure. Some reports show current ratios below comfortable levels, which amplifies funding risk if cash burn remains elevated.

Investor Sentiment: What Forums & Market Data Reveal

Online forums showed increased chatter after the shareholder letter and contract announcements. Some retail traders focused on the dividend and the reverse split as liquidity events. Analysts and niche outlets emphasized backlog growth. The tone is mixed. Optimists highlight backlog and product focus. Skeptics point to cash metrics and execution risk. Market sentiment can flip quickly for micro-cap stocks.

Outlook: Can CYCU Sustain the Momentum After This Pullback?

The next catalysts are clear. First, delivery on the product timeline. Second, new contract awards and recognition of recurring revenue. Third, clearer cash-flow improvements. If these materialize, the stock could resume an upward trend. Failure to meet milestones would likely magnify volatility.

An AI stock research analysis tool may help quantify the short-term probability for each scenario. Use such tools as part of a broader due diligence approach.

Frequently Asked Questions (FAQs)

CYCU stock is pulling back because traders took profits after a strong 11% jump. Small-cap stocks often move this way. The dip in December 2025 looks like a normal cooling.

CYCU may interest some investors because it has new contracts and a growing backlog. But it also carries risks. It remains a small-cap stock, so price swings are common in 2025.

New contracts, product updates, and better cash flow could lift CYCU again. Investors may also react to earnings in early 2026. Clear progress on goals often drives small-cap moves.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.