Data Center Capacity in Thailand Set to Triple Due to Growing AI Demand

In recent years, Thailand has emerged as a fast-rising hub for digital infrastructure in Southeast Asia. With artificial intelligence (AI) and cloud computing driving increasing demand for storage and computing power, the nation’s data center capacity is poised for a dramatic leap. Spearheaded by significant global investments, both the public and private sectors are rallying to transform Thailand’s digital landscape.

Explosive Growth in Data Center Capacity

Thailand’s data center capacity is projected to nearly triple from approximately 350 megawatts (MW) in 2024 to 1 gigawatt (GW) by 2027, representing a striking surge fueled by AI and cloud demand. Considering that each megawatt demands about $10 million in investment, this expansion implies a capital influx in the ballpark of $6.5 billion.

Hyperscale Projects and Tech Giants Driving Expansion

Leading the charge, major hyperscale projects have been greenlit by Thailand’s Board of Investment (BoI). These include:

- A massive 300 MW facility in Rayong backed by Beijing Haoyang Cloud Data Technology (~72.7 billion baht),

- A 35 MW center in Chonburi by GULF-ST Dynamo (~13.5 billion baht),

- A 12 MW facility in Bangkok by Empyrion Digital (~4.72 billion baht).

Prominent international players such as Google, Amazon Web Services (AWS), Microsoft, Alibaba Cloud, and ByteDance are investing heavily. AWS alone plans around $5 billion over 15 years, while Google’s $1 billion investment in Chonburi and Bangkok is anchored in the nation’s “Cloud First” policy.

Sustainability and Innovation at the Forefront

Thailand isn’t just expanding, it’s growing green. In the Eastern Economic Corridor (EEC), Digital Edge and B.Grimm Power are launching a 100 MW hyperscale, AI-ready data center powered by sustainable energy, scheduled for readiness by Q4 2026. Additional plans include $1.6 billion worth of investment to add ~200 MW more under B.Grimm Power’s development pipeline.

Broader Market Trends and Economic Impact

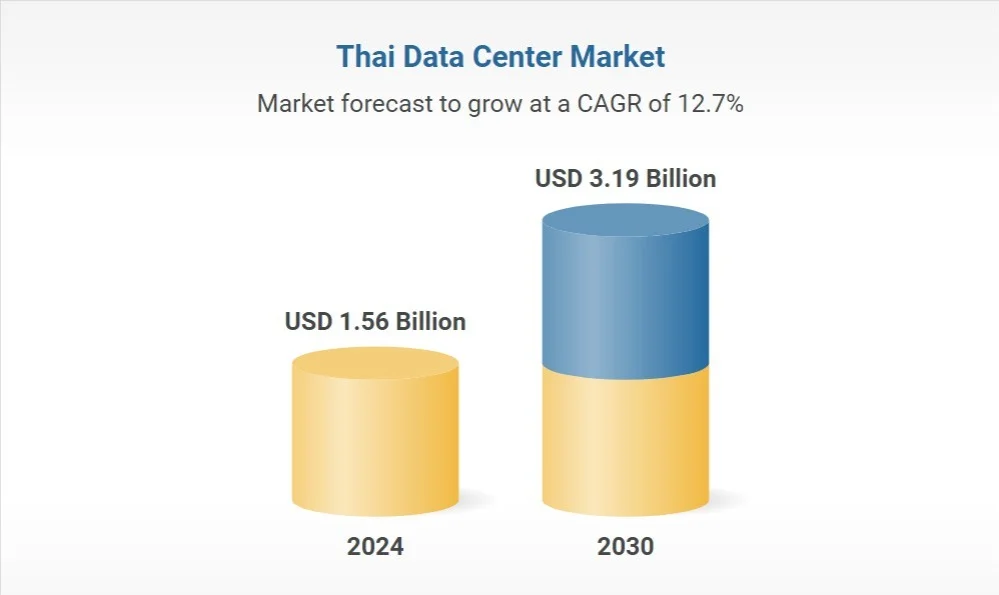

Market Growth Projections

- A market report shows Thailand’s data center industry reached about $1.56 billion in 2024, and forecasts suggest it will grow to $3.19 billion by 2030, representing a compound annual growth rate (CAGR) of ~12.6%.

- Revenue-wise, the sector will grow 7.5–8.5% annually through 2027, as digital transformation drives demand among government and financial institutions.

Digital Economy Multipliers

Thailand’s broader digital economy will grow at roughly 13.8% per year, expanding from 1.6 trillion baht in 2024 to 3.5 trillion baht by 2030. Meanwhile, data traffic will jump 1.75× between 2023 and 2030, reinforcing the need for scalable data center infrastructure.

Regional Competitive Landscape

Currently, Thailand trails peers like Singapore, Malaysia, and Indonesia in data center capacity. However, with favorable policies and investments, it aims to close the gap quickly.

What This Means for AI, Cloud, and Tech Stocks

The data center boom is a fuel injection for AI infrastructure across ASEAN. With Thailand positioned as a regional hub, this surge reverberates across AI stocks, cloud infrastructure firms, and broader stock market indicators tied to the tech sector. Increased demand for power equipment, cooling technologies, and real estate also signals opportunities across ancillary industries.

For stock researchers, Thailand’s data center expansion highlights emerging themes:

- AI infrastructure

- Hyperscale data center development

- Renewable energy integration

- Southeast Asia cloud growth

These are signals that can inform investment strategies, particularly in companies providing technologies and services that support data center ecosystems.

Conclusion

Thailand’s ambition to triple its data center capacity in just a few years marks one of the most aggressive expansions in Southeast Asia. Backed by global technology giants, domestic conglomerates, and a government determined to digitize the economy, this growth cements the nation as a rising digital hub.

Sustainability efforts, AI readiness, and regional competitiveness further enhance its position in the global digital race. For businesses, investors, and policymakers, Thailand’s data center trajectory represents both a technological leap and an economic opportunity with long-term benefits.

FAQs

Thailand offers a combination of strategic geography, supportive government policies, an expanding digital economy, and relatively lower land and electricity costs. These elements attract hyperscalers seeking Southeast Asia capacity beyond Singapore and Malaysia.

By 2027, investors will pour about $6.5 billion into expanding capacity from 350 MW to 1 GW. Additional large-scale projects add billions more, as highlighted by BoI approvals and corporate investment commitments.

Sustainable energy initiatives play a central role. The Digital Edge + B.Grimm hyperscale initiative uses renewable power. Major firms and zones like the EEC are emphasizing green infrastructure to align with global AI sustainability standards.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.