Defence Rally Adds Rs 43,000 Cr in a Day; GRSE Among Gainers

India’s defence sector is on a powerful growth path. In just one trading session, defence stocks together added nearly ₹43,000 crore to their market value. This sharp rally turned the spotlight on companies like Garden Reach Shipbuilders & Engineers (GRSE), which emerged as one of the key gainers. The move is not just about numbers on a screen; it reflects how the market is reacting to rising demand, government support, and global interest in India’s defence industry.

We are watching a sector that is no longer only dependent on government orders. New defence exports, larger budgets, and a push for self-reliance are shaping the future. For investors, this rally gives a glimpse of the sector’s long-term strength. For the country, it highlights how defence firms are becoming engines of both security and economic growth. GRSE’s rise in this rally is a signal of the growing trust in shipbuilding and naval defence capabilities.

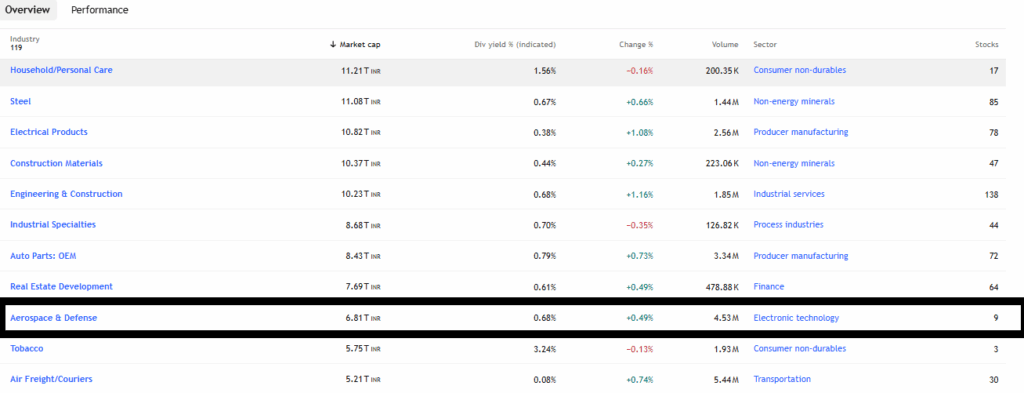

Overview of the Defence Rally

The defence sector saw a sharp boom in one trading session. Stocks in the space added about ₹43,000 crore in market value on that day. The Nifty Defence index jumped to an eight-week high as investors piled into the space. Analysts pointed to fresh orders, a longer MoD modernisation plan, and higher exports as key triggers for the move. The volume on many defence counters rose sharply, showing strong market interest.

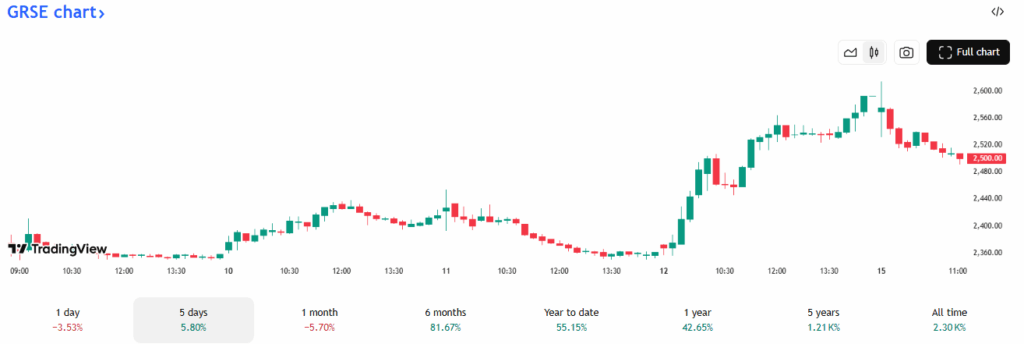

Spotlight on GRSE

Garden Reach Shipbuilders & Engineers (GRSE) stood out during the rally. The stock rose sharply on higher trade volumes and positive news flow. Traders noted GRSE among the top gainers on the Nifty India Defence basket. GRSE builds warships, patrol vessels, and support ships for the navy and coast guard. Recent contract wins and an improving order book pushed investor focus toward the shipbuilder. Short-term moves were also helped by corporate events such as dividend record dates and fresh supply deals mentioned in market updates.

Drivers of the Defence Sector Rally

Multiple forces came together to lift the sector. First, India’s defence production reached a record high of about ₹1.50 lakh crore in FY 2024-25. That data added credibility to the growth story and showed the industry is scaling up.

Second, the Ministry of Defence has shared longer-term modernisation roadmaps. These plans gave markets confidence about steady order flows for the next several years. Third, fresh submarine and naval orders were reported in market coverage. Big naval deals often lift shipbuilders and related suppliers. Fourth, exports are on the rise. Higher overseas sales reduce dependence on a single buyer and widen revenue streams for private and public firms. Analysts argued that this mix of policy support and real orders made valuations suddenly look more justified.

Institutional and Retail Interest

Mutual funds and foreign institutional investors showed increased buying in the sector. Some funds added defence names to their portfolios after recent positive data on production and exports. Retail investors also jumped in, chasing momentum. The pattern was typical of a sector rotation, where money moves from defensive or overvalued pockets into areas with fresh growth signals. Still, some market commentators warned that rapid inflows can raise short-term volatility.

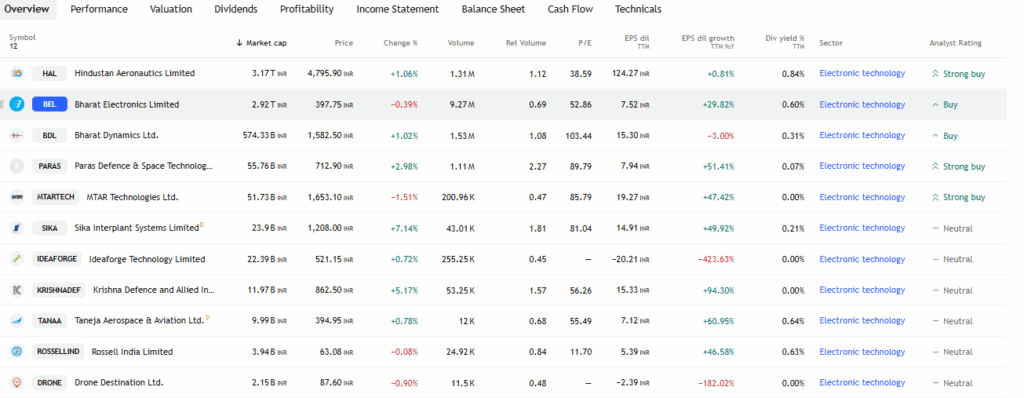

Comparative Performance: Other Gainers

The rally was not limited to GRSE. Firms such as HAL, BDL, Mazagon Dock, Astra Micro, MTAR Technologies, Paras Defence, and BEML also gained. Each firm had its own trigger. HAL benefits from aircraft and helicopter programmes. Mazagon Dock gains on submarine and shipbuilding orders. BDL sees lift from missile deals and supply contracts. Smaller system suppliers such as Astra Micro and MTAR moved on strong order pipelines and positive analyst notes. The widespread gains made the rally look sector-wide rather than stock-specific.

Orders, MoUs, and Corporate Actions That Mattered

Several companies announced order wins, contract renewals, or dividend record dates around the rally. These announcements created fresh buying interest. For GRSE, specific contract flows and shareholder actions, such as dividend eligibility, helped attract volume. For other names, MoUs with private partners and state support for new defence hubs also played a role. Such corporate signals often act as immediate catalysts in a sector driven by big-ticket contracts.

Risks and Challenges

The defence sector still faces clear risks. Execution delays remain common on large defence projects. Many contracts require long delivery timelines and complex testing. Budget cycles matter; a future slowdown in government spending would hit order flow. Export markets present their own unique hurdles, including foreign certification, competition, and political risk. Valuations also stretched after the sudden rise. Investors should watch delivery performance and order-to-revenue conversion closely.

Outlook for Defence Stocks and GRSE

The long-term story for India’s defence makers looks positive on policy grounds. The push for indigenisation, defence industrial corridors, and private sector integration points to steady growth. If production and exports continue at current growth rates, defence firms should see stronger order books over time.

For GRSE specifically, consistent contract execution and expansion of yard capacity will be key. Market attention may stay high as long as quarterly updates show order inflows and timely deliveries. Still, sharp rallies often lead to short corrections, so a cautious approach may be prudent.

Final Takeaway

The one-day addition of approximately ₹43,000 crore underscored the market’s renewed confidence in defence stocks. The move reflected real policy and production gains, not just short-term speculation. GRSE’s rise showed how shipbuilders benefit when the navy and ship orders gain traction. The sector can offer strong long-term returns. However, careful stock selection and attention to execution risks remain essential.

Frequently Asked Questions (FAQs)

Indian defence stocks rose in September 2025 due to higher orders, record defence production, export growth, and a strong government push for indigenisation, boosting investor confidence.

On September 13, 2025, key gainers included GRSE, HAL, BEL, Mazagon Dock, and BDL, with rising volumes and fresh contracts driving strong investor interest.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.