Deven Choksey Recommends Subscription for Jain Resource Recycling Ltd IPO

Investors are watching a key market event unfold. On September 24, 2025, Jain Resource Recycling Ltd opened its initial public offering (IPO) with a price band set at ₹220 to ₹232 per share.

The IPO has drawn added attention because Deven Choksey, a respected market analyst, has recommended that investors subscribe. His endorsement highlights confidence in the company’s fundamentals and industry prospects.

This analysis will review the company’s business model, financial performance, industry outlook, and the rationale behind Choksey’s stance. It will also outline the risks that may influence investor decisions.

About Jain Resource Recycling Ltd

Jain Resource Recycling Ltd is a recycler and producer of non-ferrous metals. The firm processes scrap to make usable metal for industry. It serves clients in the manufacturing, electronics, and automotive sectors. The company has expanded capacity in recent years to meet rising demand for recycled metal. Public records show the firm has grown its revenue sharply in the past two years.

IPO Details

The IPO is sized at ₹1,250 crore. The offer includes a fresh issue of ₹500 crore and an offer for sale (OFS) of ₹750 crore. The price band is ₹220 to ₹232 per share. The issue opened for subscription on 24 September 2025 and closed on 26 September 2025. The minimum lot is 64 shares. The company planned its listing on the BSE and NSE on 1 October 2025. These facts shape how investors view the valuation and timing.

Deven Choksey’s Recommendation

Deven Choksey Research issued a “Subscribe” call on the IPO on 24 September 2025. The note highlighted the company’s market position in non-ferrous recycling and cited expected long-term demand. Broker research emphasized the use of fresh proceeds to cut debt and support capacity growth. Choksey’s backing added credibility among retail and institutional investors.

Industry and Market Outlook

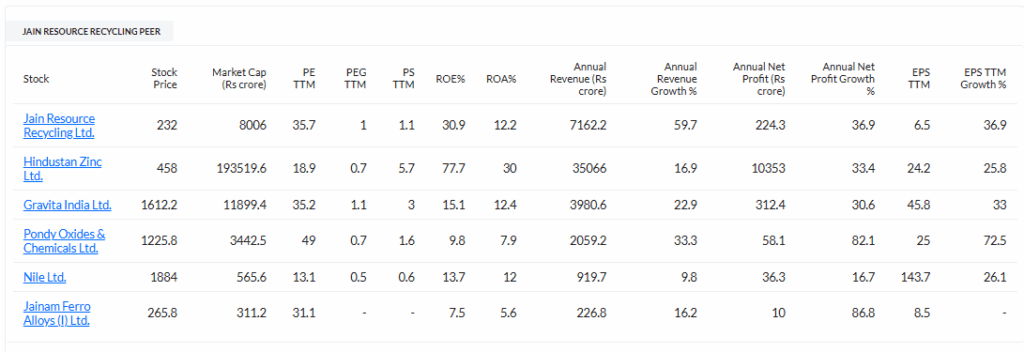

Recycling of non-ferrous metals is gaining importance. Industries want lower raw-material costs and cleaner supply chains. Indian policy also favors circular economy solutions. This creates a steady demand for recycled metals. However, the sector is linked to global commodity swings. Price cycles for copper, aluminium, and zinc can affect margins. Peers in the listed space show high valuations, which set expectations for Jain Resource Recycling’s performance on listing day.

Company Financial Performance

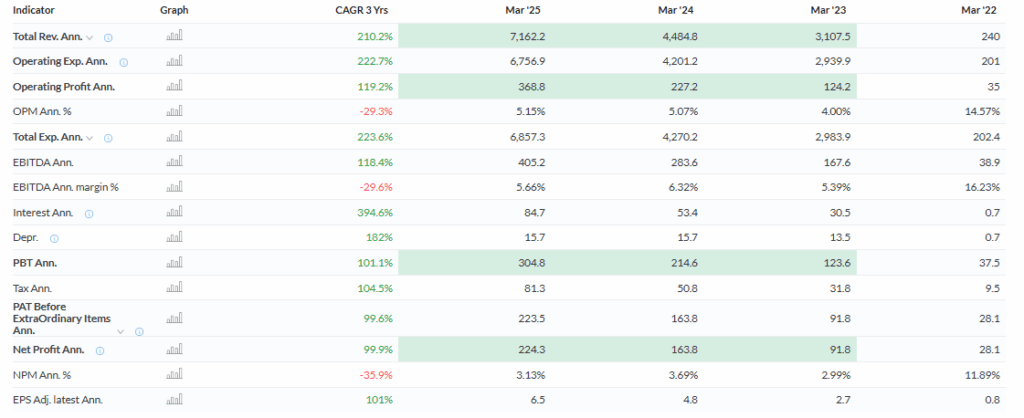

Recent financials show fast top-line growth. Total income rose from the prior year, and profit after tax improved year-on-year. EBITDA and margins improved as capacity utilization rose. The company has used debt to scale operations, but moved to trim leverage using operating cash flow. Analysts note improving return on equity and moderate EBITDA margins compared with close peers. The operational scale now better supports large contracts and bulk scrap processing.

Strengths of the IPO

The company occupies a niche in non-ferrous recycling. Large fresh capital will help reduce debt and fund expansions. A long order book and rising demand for recycled metal improve revenue visibility. Management has experience in sourcing scrap and negotiating off-take deals. Institutional appetite on day one suggested confidence in the business model. These strengths support a buy-and-hold view for long-term investors.

Risks and Concerns

Business depends on commodity cycles. A fall in metal prices can squeeze margins. Supply of good-quality scrap is not guaranteed and can vary seasonally. Regulatory changes or stricter environmental rules could raise compliance costs. The OFS in the IPO means promoters will dilute holdings, which could shift governance dynamics. Valuation at the upper band will be sensitive to market sentiment on listing day. Investors should weigh these downsides against growth prospects.

Expert Views and Market Sentiment

Brokerage reports mostly leaned positive at launch. Deven Choksey and a few research houses recommended a subscription. Grey market activity suggested an 11% premium in informal trading before listing, indicating short-term optimism. Institutional interest showed through early subscription figures and strong QIB demand on day one.

For deeper selection and timing, some traders used an AI stock research analysis tool to compare peer multiples and profit metrics. That helped place the IPO in the context of Gravita India and other recyclers.

Wrap Up

The IPO offers exposure to a growing recycling business. Fresh capital will cut debt and fund growth. Deven Choksey’s “Subscribe” call boosted demand on 24 September 2025. Short-term returns will depend on listing momentum and the grey market premium. Long-term gains hinge on commodity cycles, scrap sourcing, and execution of expansion plans. Investors should check the valuation, read the prospectus, and match the risk profile to personal goals before applying.

Frequently Asked Questions (FAQs)

The IPO of Jain Resource Recycling Ltd opened on September 24, 2025, and closed on September 26, 2025, with a price band of ₹220 to ₹232 per share.

Analysts like Deven Choksey suggested subscription on September 24, 2025, citing strong growth potential. Still, investors should consider market risks, valuations, and personal goals before making any investment decision.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.