DMart Share Price Drops 9%, But Motilal Oswal Sees Buying Opportunity

The DMart Share has slipped about 9 percent over the past month, rattling short-term traders on the NSE and the BSE. Yet, leading brokerage Motilal Oswal Financial Services has maintained a Buy call, arguing the correction creates a buying window for long-term investors.

The brokerage flagged margin pressure and muted same-store sales growth, but it still backed Avenue Supermarts Ltd. because of steady revenue growth, cash generation, and an ongoing store rollout.

Why Did the DMart Share Price Fall?

The immediate cause of the DMart Share slide is investor concern over margin compression and productivity weakness in the recent quarter. Motilal Oswal noted margins have been capped around 7 to 9 percent for some time, and reported productivity metrics showed strain in the second quarter of FY26. That combination has made traders nervous about near-term earnings momentum.

Why did DMart shares fall? Rising input costs, slower same-store sales growth, and investor caution on margins pushed the DMart Share lower in the short term. The issues look operational rather than structural.

Motilal Oswal’s Outlook on the DMart Share

Motilal Oswal kept its Buy rating after reviewing the numbers. The broker acknowledged that growth and margins were not as strong as expected, but it emphasised that Avenue Supermarts continues to expand and generate cash.

The firm highlighted DMart’s disciplined expansion strategy and resilient grocery sales as reasons to stay constructive on the DMart Share.

What Motilal Oswal sees

The brokerage expects margin pressure to persist in the near term, but it believes the long-term story remains intact. The DMart Share correction, in the brokerage’s view, reflects temporary concerns that will ease as consumption picks up and new stores mature.

DMart Share: Recent Financial Performance

Avenue Supermarts reported standalone revenue of Rs 16,200 crore in Q2 FY26, a year-on-year increase driven by store additions and a weak base last year. The company added eight stores in the quarter, taking the total to 432 outlets, and recorded mid-single-digit same-store sales growth.

These operating metrics are central to understanding the DMart Share movement.

Is DMart still growing? Yes. Revenue growth continues, with new store openings supporting top-line expansion even as margins face headwinds.

What Analysts Are Saying about DMart Share

Most analysts referenced by market reports view the correction as temporary. Motilal Oswal specifically pointed to the company’s low leverage, steady cash flow and proven retail model. They see the DMart Share as attractively valued relative to its execution capabilities, and expect margin recovery as inflationary pressures ease and festive demand returns.

AI Stock research groups tracking Indian retail names note that DMart’s financial discipline differentiates it from many peers, and institutional interest often stays resilient through short-term volatility.

DMart Share: Expansion and Strategy

Motilal Oswal underlined the importance of store additions for medium-term growth. The brokerage estimates roughly 60 net store additions for FY26, up from 50 a year earlier, and flagged acceleration in openings as a monitorable for the DMart Share outlook.

Continued expansion into Tier II and Tier III markets is a core growth lever for Avenue Supermarts.

Why store growth matters

New stores bring revenue, but they also need time to reach mature margins. Investors watch the cadence of openings because faster rollout can lift sales, while slower productivity can temporarily pressure margins and the DMart Share.

Market Reaction and Price Moves in the DMart Share

The DMart Share has seen recent volatility, including a 5.5 percent fall across the last five trading sessions and an overall 9 percent drop in the past month. While short-term traders reacted quickly, larger funds and long-term investors have largely maintained positions, reflecting confidence in Avenue Supermarts’ long-term model.

Should traders panic after a 9 percent fall? Not necessarily. A disciplined long-term investor may view the correction as an opportunity, while shorter-term traders should wait for clearer signs of margin recovery or stabilising sales.

DMart Share in the Broader Retail Market

India’s retail landscape is competitive, with players such as Reliance Retail and supermarket chains expanding rapidly. Yet DMart’s low margin, high volume model has historically delivered resilient profits and cash generation.

This operating edge supports Motilal Oswal’s recommendation, even as the DMart Share weathers cyclical pressures. AI Stock Analysis of retail peers shows DMart’s profitability metrics remain among the strongest in the sector.

Risks and What Could Change the DMart Share Outlook

The two main risks to the DMart Share thesis are prolonged margin pressure and a slowdown in store productivity. If same-store sales weaken further or input costs remain elevated, margins could compress more than expected.

Conversely, a rebound in consumption during the festive season and improved input cost trends would likely support margin recovery and a rebound in the share price. Investors should watch quarterly updates for signs of recovery.

Should Investors Buy the DMart Share Now?

Motilal Oswal’s view is that the DMart Share correction presents a buying opportunity for those with a multi-year horizon. The case rests on strong cash flow, disciplined expansion, and a low leverage profile. For shorter horizons, patience is advised until margins show signs of stabilizing. AI Stock insights reinforce that quality and execution often win over time in consumer staples and retail names.

Conclusion DMart Share: Short-Term Wobble, Long-Term Case

The DMart Share has clearly faced short-term pressure, driven by margin concerns and modest productivity weakness. Still, Motilal Oswal’s Buy stance highlights the company’s durable strengths: steady revenue growth, strategic store expansion, robust cash flow, and a conservative balance sheet.

For investors focused on long-term returns, the current dip may offer an attractive entry point, while traders should monitor upcoming quarterly data for margin signs before adding exposure.

FAQ’S

The DMart Share slipped amid concerns over margin pressure and slightly slower revenue growth reported in recent quarterly results. Rising input costs and competitive pricing weighed on investor sentiment, triggering the short-term drop.

Motilal Oswal recommends a Buy stance, viewing the correction as a buying opportunity for long term investors. If you have a 2 to 3 year horizon, analysts see attractive upside, but short-term volatility remains possible.

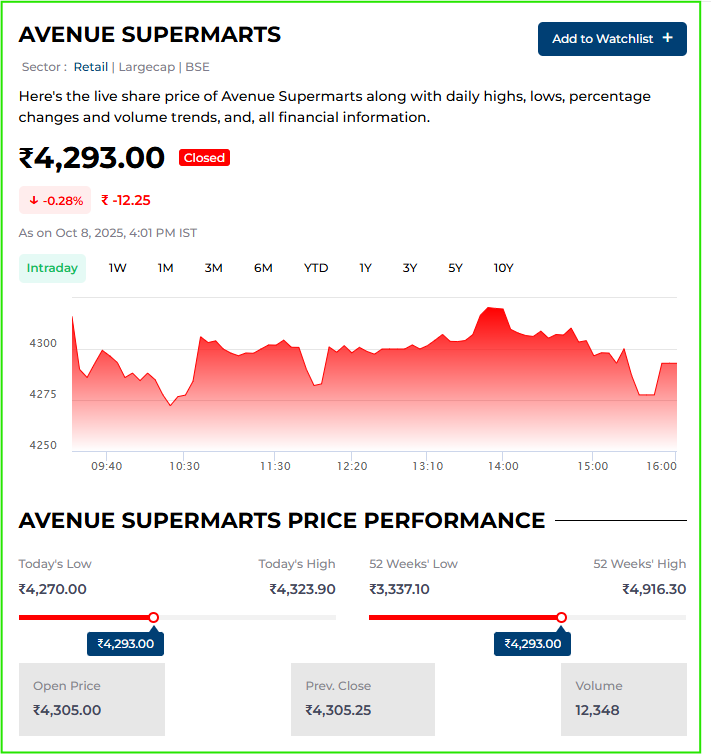

Motilal Oswal set a target price of around ₹4,300 for the DMart Share, citing store expansion, cash flow strength, and operational efficiency as support for upside from current levels.

Avenue Supermarts reported revenue growth with modest margin compression, yet the company retained positive cash flow and low debt. Analysts say these metrics support recovery once input costs stabilise.

Long term investors may consider accumulating on dips given DMart’s execution track record, while traders should wait for clearer signals such as margin recovery or festive season demand confirmation.

Disclaimer

This is for information only, not financial advice. Always do your research.