DMart Share Price Falls 1% Post-Earnings; Mixed Outlook on Online Expansion

DMart, one of India’s most trusted retail chains, released its quarterly earnings on October 12, 2025, and the market reaction was immediate. The DMART share price slipped 1% in the next trading session, raising questions about investor confidence. On the surface, DMart reported stable revenue growth and continued store expansion. However, profit margins faced pressure due to rising costs and slower growth in its online platform, DMart Ready.

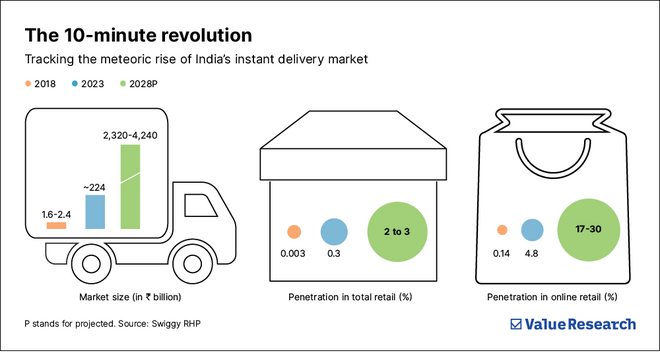

This small dip in share price may look minor, but it signals a deeper debate: Can DMart protect its offline strength while competing in the fast-growing online grocery market? E-commerce players like Reliance Retail, JioMart, and BigBasket are moving aggressively, and investors are watching how DMart responds.

The outlook is mixed. Some analysts believe DMart’s disciplined model will win in the long run. Others warn that slow digital adoption could hold it back. Let’s examine the reasons behind the stock drop, the company’s financial health, and whether its online strategy is a risk or a major opportunity.

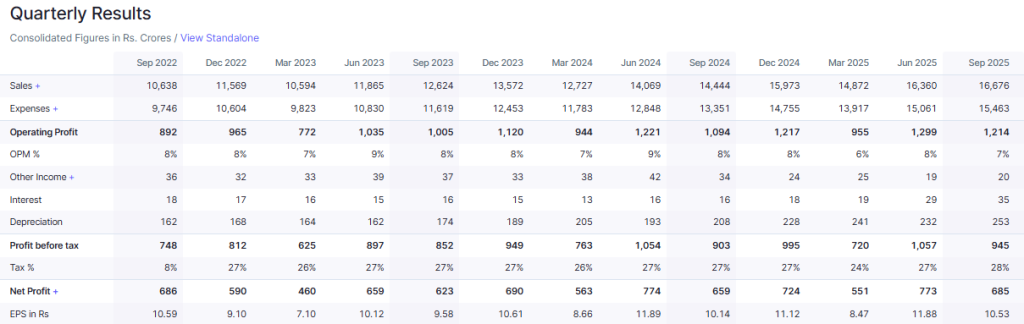

Quick Snapshot of the Earnings Report

Avenue Supermarts (DMart) reported its Q2 results for FY26 on October 12, 2025. Revenue rose about 15% year-on-year. Consolidated net profit grew roughly 4% to around ₹685 crore for the quarter. Same-store sales showed healthy demand in many regions. However, EBITDA margins narrowed slightly as operating costs rose. These numbers point to steady sales but tighter profitability in the near term.

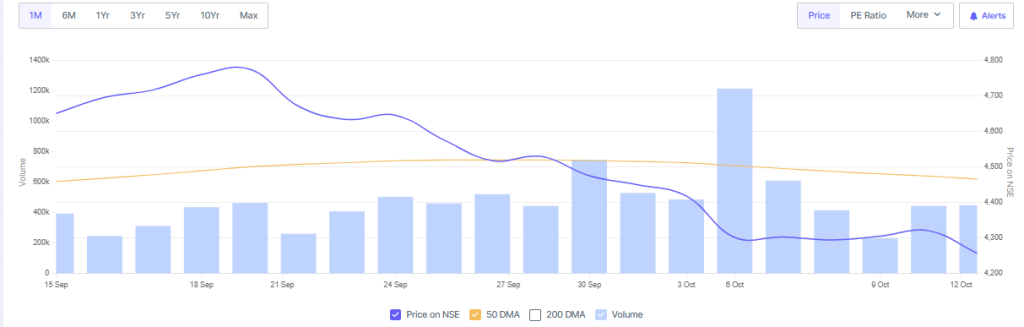

Market Reaction: Why the Stock Slipped?

The stock reacted on the next trading day. On October 13, 2025, shares dipped about 1% in early trade. Some reports even recorded a larger intraday fall later. The drop did not come from weak top-line growth. Instead, investors focused on margins and rising expenses. The short move reflected disappointment versus higher expectations rather than a collapse of fundamentals.

Strengths in the Quarter

The company still showed clear strengths. Footfalls stayed strong at physical stores. Foot traffic pushed daily sales in many locations. Store expansion continued in targeted cities. The balance sheet remains healthy with low net debt for a retailer of this size. Private-label items and value ranges kept shoppers coming back. Those parts of the business remain bright spots amid the pressure on margins.

Main Investor Concerns

Analysts flagged rising operating costs. Employee expenses and logistics costs weighed on margins. Management noted higher outlays to support expansion and operations. Slower same-store growth in some pockets added caution. Brokers highlighted that steady revenue growth was not enough to offset margin headwinds this quarter. That mix triggered analyst downgrades or tempered outlooks from several houses.

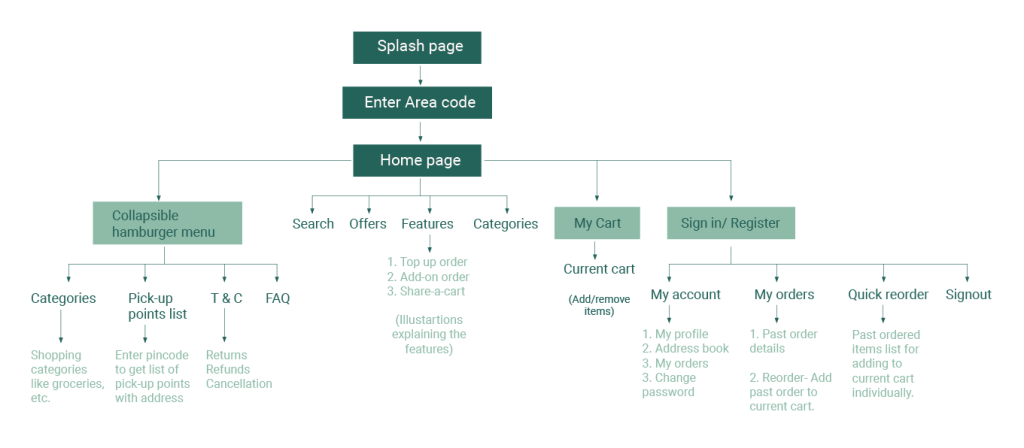

DMart’s Online Strategy: DMart Ready

DMart Ready is the company’s online grocery and pick-up model. The app offers home delivery and pick-up orders. The service aims to mirror store prices online. Growth in online sales has been steady but still small versus in-store revenue. Management has scaled up pick-up points instead of high-burn quick commerce. That approach keeps unit economics tighter but slows market share gains versus deep-pocketed rivals.

Why the Online Outlook Looks Mixed?

On the one hand, the brand has strong price credibility. That helps attract value-seeking online shoppers. On the other hand, grocery e-commerce is costly. Last-mile delivery eats margins. Faster players offer heavy discounts to gain customers. DMart’s conservative play limits cash burn but may lose share versus aggressive rivals. This trade-off is at the heart of the “mixed” view from brokers and investors.

Offline vs Online: Balancing Both

Offline stores still drive most profits. New stores deliver scale and inventory benefits. Online needs different logistics and tech investments. Large rivals are building vast delivery networks and tech stacks. DMart’s cautious online roll-out favors profitable growth over market share grabs. The risk is a slower digital ramp that leaves room for competitors to entrench customers in the online channel.

Industry and Economic Backdrop

India’s retail market continues to expand. Consumer demand is firm in many urban and semi-urban areas. But cost inflation and wage pressures affect margin recovery. Organized retail benefits from scale, but competition is intense. Global macro worries and currency moves can also shape input costs for FMCG and general merchandise. These wider forces add uncertainty to the short term.

What do Analysts and Brokerages Say?

Brokerages gave mixed notes after the results. Some pointed to long-term upside from network growth. Others flagged near-term margin strain and slower online traction. Price targets were adjusted by a few houses to reflect more cautious margin forecasts. The market now prices a trade-off: reliable offline cash flow versus the cost of building a digital arm.

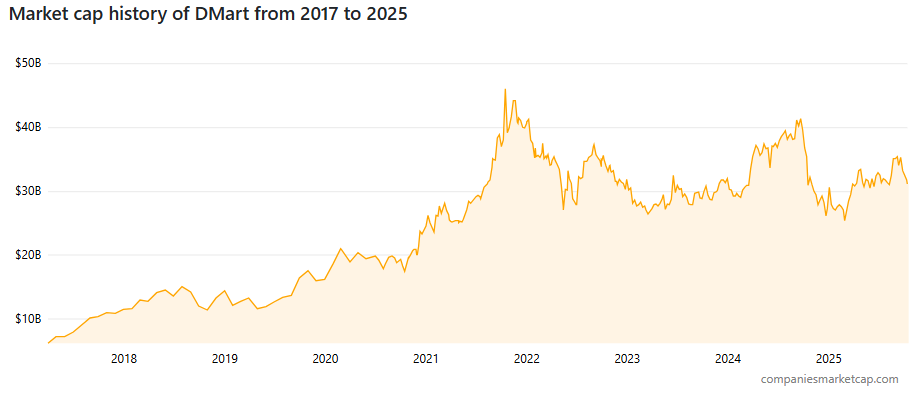

Share Price Performance and Valuation Context

Heading into the quarter, DMart had outperformed many peers year-to-date. The recent dip trimmed some gains but did not erase the long run-up. Valuation multiples remain elevated versus some sector peers. That leaves less margin for error if the company faces sustained margin pressure. Investors weighing buys or sells must balance quality retail execution against a high starting valuation.

Growth Opportunities Ahead

Expansion into Tier-2 and Tier-3 towns remains a major growth lever. Management signaled continued store additions this fiscal year to deepen presence. Private-label and own-brand SKUs can lift margins over time. There is room to optimize the supply chain and use store networks as micro-fulfilment hubs. Success depends on execution speed and cost control.

Risks to Monitor

Key risks include sharper margin compression, faster moves by competitors, and any macro slowdown that hits discretionary spending. A misstep in scaling the online model or a costlier-than-expected expansion could pressure profit growth. Regulatory changes or higher input inflation would also tighten margins. These are the principal downside risks for investors.

Bull vs Bear – The Central Scenarios

Bull case: Strong store economics and disciplined expansion lift long-term profits. Private labels and supply benefits improve margins. Online ramps at controlled cost. Bear case: Online requires a heavier investment. Competition forces discounts. Margins stay compressed, and valuation corrects. The market will price the company based on which path looks likelier over the next 12-18 months. Use of an AI stock research analysis tool can help investors test scenarios and sensitivity to margin and growth assumptions.

Investor Takeaway and Conclusion

The 1%-plus dip after the October 12, 2025, Q2 earnings reflects short-term market fear rather than weakness in DMart’s core business. The company continues to deliver strong in-store sales, expand its physical footprint, and maintain a trusted brand. The key challenge now is restoring profit margins while scaling its online platform, DMart Ready, in a cost-efficient way.

Long-term investors should monitor margin trends, store expansion pace, and the success of DMart Ready without damaging unit economics. Traders may react to every headline, but smart investors should stay focused on fundamentals.

DMart is entering a crucial phase where mastering both offline strength and online growth will define its future. If it balances profitability with innovation, it can maintain its leadership in India’s retail market and reward patient shareholders over time.

Frequently Asked Questions (FAQs)

DMart’s share price fell after the October 12, 2025, earnings because profit margins were lower than expected, and investors worried about rising costs and competition.

DMart Ready is growing slowly and keeps costs low, but it is not highly profitable yet because online grocery delivery has high expenses and thin margins.

DMart has strong brand value and steady growth, but high valuation and margin pressure mean investors should wait and watch before making long-term decisions.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.