Dogecoin News Today: DOGE Drops 5% as Whale Transfers $200M to Binance, Tests $0.21 Support

Dogecoin faces a clear drop. Over 24 hours ending August 29, it slid 5%, from $0.22 to $0.21. This move follows a whale shift of 900 million DOGE worth $200 million to Binance.

Traders watch the $0.21 support level. A break could expose $0.20 next. Meanwhile, Dogecoin’s hash rate is steady at 2.9 PH/s, but open interest in its futures dropped by 8%.

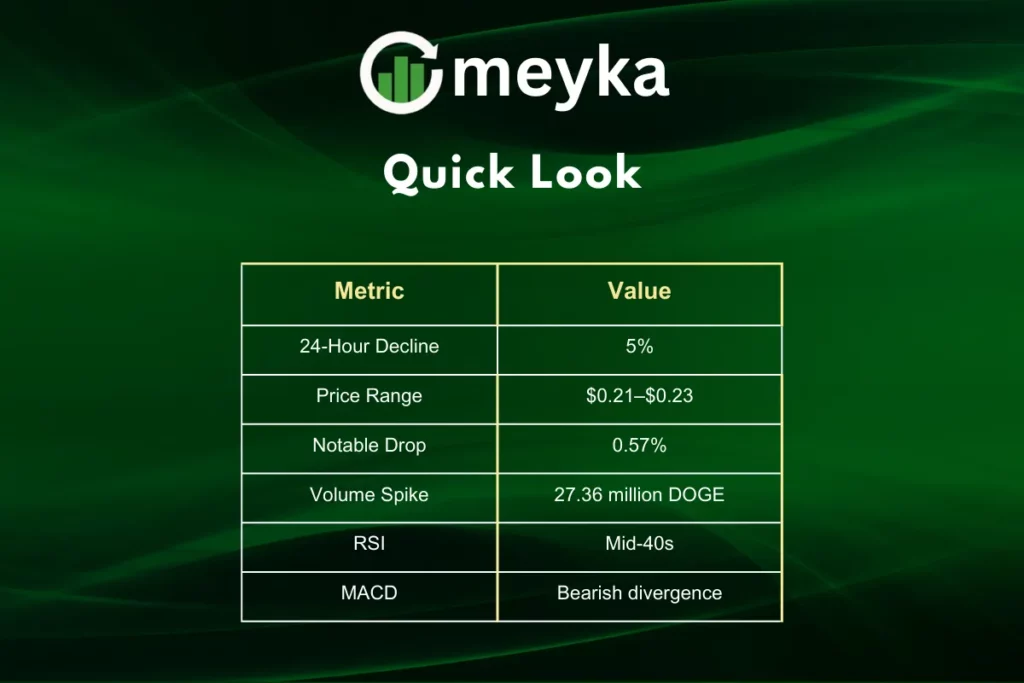

Price Movement and Trading Range

Dogecoin traded between $0.21 and $0.23 all day. A 0.57% drop hit between 07:24 and 08:23 GMT on August 29 on a 27.36 million volume spike. This tight range shows low volatility despite the dip.

Key Stats Table

Whale Transfer and Institutional Selling

A single whale moved 900 million DOGE to Binance. That transfer equates to $200 million at current prices. This shift likely fueled institutional selling pressure.

Caution emerges as big holders reshape positions. Traders in the stock market see correlations between whale moves and price swings. Institutional players may view Dogecoin as a risk asset.

Support Levels and Technical Indicators

The next key floor sits at $0.21. Breaching that line risks a slide to $0.20.

- The RSI is hanging out in the mid-40s, suggesting a neutral to slightly bearish vibe.

- MACD lines diverge downward, hinting at more selling.

These indicators suggest caution until buyers return to defend support.

Mining Health and Network Metrics

Despite price dips, Dogecoin’s network stays strong. Hash rate holds firm at 2.9 petahashes per second. This resilience shows confidence among miners.

Transaction counts remain stable. Steady activity often hints at ongoing real-world usage. Miners continue to secure the network even during pullbacks.

Corporate Growth: House of Doge Initiative

House of Doge, the official company backing Dogecoin, has given the green light to a new treasury company plan, aiming to raise at least $200 million. Elon Musk’s lawyer, Alex Spiro, will take the role of chairman.

This structure may fund development, marketing, and ecosystem projects. A stronger treasury could improve long-term stability and investor confidence.

Impact on the Stock Market

Dogecoin’s ups and downs often spill over into the wider crypto and stock market mood. A large whale sell-off can trigger risk-off moves across digital and traditional assets.

Investors monitoring Dogecoin sometimes adjust equity positions in tech or fintech sectors. Continued volatility in Dogecoin may ripple into selected stock market segments.

What’s Next for Dogecoin?

Traders set alerts at $0.21 and $0.20. Breaking above $0.23 could spark a rebound.

- Watch whale wallets for large outflows or inflows.

- Track futures open interest for shifts in trader conviction.

- Monitor House of Doge announcements for treasury updates.

These signals will guide the next leg of Dogecoin’s journey.

Bottom Line

We see Dogecoin in a tight range after a 5% drop. A whale’s $200 million transfer and neutral technicals shape caution. The $0.21 support is crucial for bulls to hold. Meanwhile, the House of Doge’s treasury plan offers a long-term boost. Traders should watch volume, RSI, and futures open interest for clear signals.

Frequently Asked Questions

A whale moved 900 million DOGE to Binance, sparking selling and a 5% decline.

$0.21 is a psychological floor. Breaking it may lead to testing $0.20.

A strong hash rate shows miner confidence but may not stop price declines.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.