Dollar Holds Firm as Inflation Data, Central Banks Dominate Focus

The global market is turning its attention once again to two major forces: inflation data and central bank decisions. The U.S. dollar continues to hold firm, showing resilience even as investors look for clues about future policy. With inflation numbers shaping expectations and central banks guiding market sentiment, both traders and long-term investors are watching closely.

Why Inflation Data Matters for the Dollar

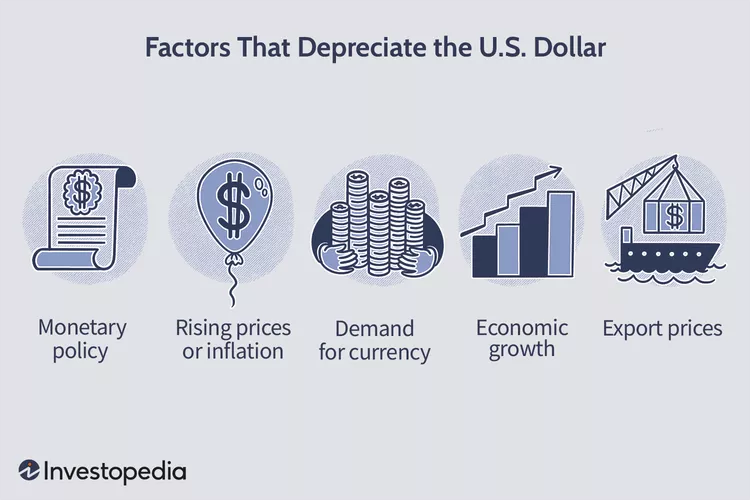

Recent inflation data has had a direct impact on the strength of the U.S. dollar. When consumer prices rise faster than expected, central banks often keep interest rates high. This makes the dollar more attractive for global investors because higher rates deliver stronger returns.

Stable or falling inflation usually has the opposite effect. It allows central banks to ease their stance, which may reduce dollar demand. For now, inflation remains high enough to keep the dollar supported.

Central Banks Lead Market Sentiment

The role of central banks in global markets cannot be overstated. Every major decision from the Federal Reserve, the European Central Bank (ECB), or the Bank of England (BoE) impacts currencies and stocks worldwide.

The Fed, in particular, is in the spotlight. Policymakers look at inflation closely before making rate changes. If inflation stays elevated, the Fed is less likely to cut rates, which strengthens the dollar. If inflation cools, the Fed may signal a shift, creating room for a softer dollar.

The ECB and BoE face similar challenges, balancing slow growth with price stability. Their decisions influence the euro and the pound, both of which trade heavily against the dollar. This interplay shapes overall currency flows and investor sentiment in the stock market.

Dollar Strength and Its Effect on the Stock Market

A firm dollar has mixed effects on stocks. For multinational firms, a stronger dollar can hurt exports, as goods become more expensive overseas. This may reduce corporate earnings, particularly in manufacturing and technology sectors.

However, the same strength also provides stability. Global investors see the U.S. market as a safe haven during uncertain times, and this often directs capital toward Wall Street.

The growing appeal of AI stocks highlights this balance. Investors remain attracted to innovation, but rising costs tied to inflation and a firm dollar add pressure. Careful stock research is vital to identify which companies can thrive despite a strong currency environment.

How Inflation Data Shapes Investor Choices

Every new release of inflation data changes the market mood. If inflation cools, stocks tied to growth and innovation rally. If inflation stays stubborn, defensive sectors like healthcare, energy, and utilities gain more attention.

This is why investors rely heavily on stock research before making moves. Analyzing inflation trends alongside corporate earnings helps determine which sectors will perform best.

For example, AI stocks continue to attract heavy investment because of long-term growth potential. But in high-inflation periods, they are sensitive to rate hikes, making research and timing critical.

Global Trade and Currency Pressures

The firm dollar also reshapes global trade. For countries that borrow heavily in dollars, repayment becomes harder when the currency strengthens. This puts extra pressure on emerging markets, which may need central bank support to stabilize their own currencies.

Commodities are another area impacted. Since oil, gold, and many raw materials are priced in dollars, a stronger dollar raises costs for other economies. This can increase inflation abroad, adding another layer of complexity for global policymakers.

Stock Research as a Key Investment Tool

In times of uncertainty, stock research becomes even more important. The dollar’s stability is only one part of the bigger picture. Investors also need to understand sector dynamics, corporate performance, and broader policy shifts.

For example, when the dollar is strong, exporters may face challenges. On the other hand, domestic-focused companies in utilities or healthcare may show more resilience. Growth-driven sectors like AI stocks still hold potential, but they require patience and close monitoring.

Long-term investors who combine inflation analysis with deep research can spot opportunities even in volatile times. This approach allows them to balance risk while capturing value in different market cycles.

The Outlook for Dollar and Global Markets

The dollar is expected to remain steady as long as inflation pressures stay high. The balance between inflation and central bank policy will decide its next move. If inflation eases more clearly, the Fed and other central banks could begin shifting to a softer stance, leading to some weakness in the dollar.

However, persistent inflation would keep rates higher for longer, reinforcing dollar strength. This would continue to affect global trade, commodity prices, and investor flows into the U.S. market.

For investors, the message is clear: stay flexible. Monitoring inflation updates, central bank signals, and stock sector trends will help navigate the months ahead.

Conclusion

The U.S. dollar’s strength is a direct result of inflation data and central bank actions. As long as inflation remains a challenge, the dollar is likely to hold its ground. This trend influences not only the stock market but also global trade, commodity prices, and investment strategies.

Investors should focus on combining stock research with economic indicators to make informed decisions. Whether looking at defensive plays or innovative AI stocks, the key is to adapt strategies to a fast-changing environment.

FAQs

Because inflation guides decisions on interest rates, which directly impact the value of the dollar and investment flows.

It makes U.S. exports more expensive and increases the cost of dollar-priced commodities for other countries, pressuring emerging markets.

AI stocks have long-term potential but can be volatile when rates are high. Careful stock research is needed before investing.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.