Dow Jones Strengthens as Investors Pivot From Tech to Cyclicals

Dow Jones Strengthens as Investors Pivot From Tech to Cyclicals

The Dow Jones Industrial Average saw a strong upward move recently as investors rotated away from traditional technology stocks and shifted their capital into cyclical sectors, industrial stocks, financials, and energy shares.

This shift reflects a broader change in market sentiment and highlights how major economic signals and Federal Reserve policy are impacting the U.S. stock market in late 2025.

In this detailed report, we break down every key factor that drove the Dow Jones higher, explain why market leadership is changing from tech to cyclicals, and answer the big questions that investors are asking today.

What Happened to the Dow Jones Today?

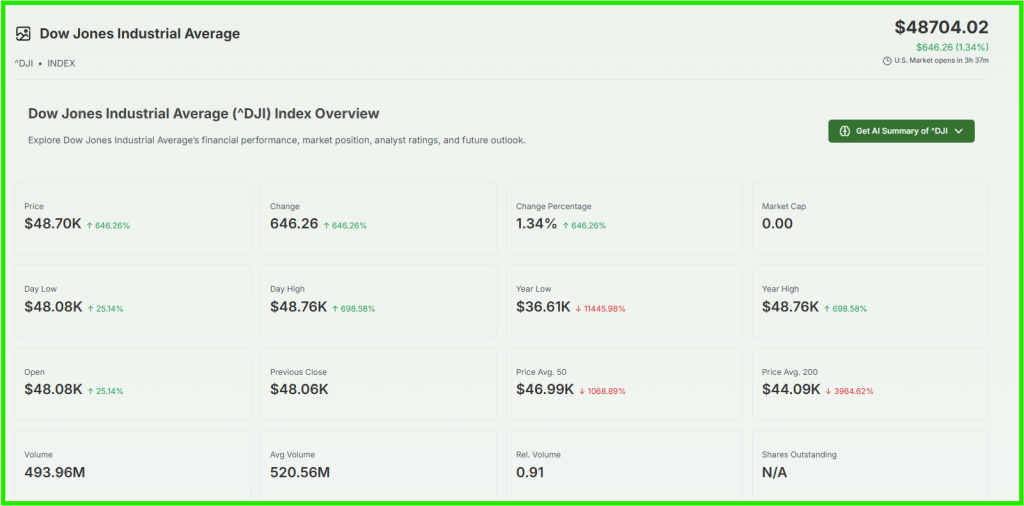

The Dow Jones Industrial Average posted a significant gain, with the index jumping roughly 600 points, driven by strong demand for growth stocks outside of technology and renewed confidence in cyclical industries. The broader market rally was supported by economic data that pointed to sustained corporate earnings in industrial and financial sectors.

According to a market report, investors poured money into companies tied to economic expansion, such as industrial manufacturers, energy producers, banking institutions, and commodity-linked businesses. These moves helped push the Dow Jones up and support broad market strength.

Why Are Investors Pivoting From Tech to Cyclicals?

What Is a Cyclical Stock?

A cyclical stock is tied to the health of the economy. These companies perform better when the economy is growing and consumer spending is strong. Examples include auto makers, industrial equipment companies, materials producers, and energy firms.

Why Are Investors Making This Shift?

Investors are moving capital because:

1. Strong Economic Data

Recent economic indicators showed resilient demand in manufacturing output, consumer spending, and capital investments. This encouraged traders to favour sectors that benefit most from economic expansion.

2. Earnings Growth Outside Tech

Many large cyclical companies have been delivering stronger-than-expected earnings, which boosted confidence in their future performance. Investors often reward companies with improving fundamentals.

3. Tech Stocks Losing Momentum

While technology stocks had led the market for years, valuation concerns and slowing growth in key tech segments made some investors take profits and rotate into value-oriented stocks.

What Role Did Federal Reserve Policy Play in the Market Shift?

A key driver behind market behavior was the Federal Reserve’s dovish pivot, which signaled ongoing monetary support. Reports from market analysts noted that the Fed’s tone was more accommodative, and future rate moves were expected to be gradual, allowing capital to flow into interest rate-sensitive sectors.

A MarketMinute analysis described how the Fed’s dovish stance fueled record rally behavior among major indices, including the Dow Jones:

- The Fed signaled more patience on future rate increases

- This reduced uncertainty about capital costs

- Investors took this as a reason to buy cyclical and value stocks

These developments gave the market confidence to favor financially linked and growth-oriented industrial stocks.

Sector Movement Within the Dow Jones

The current upward trajectory in the Dow Jones was not uniform across all areas. Leading contributors included:

Industrial Stocks

Companies like heavy manufacturers and transportation firms saw strong gains, reflecting expectations of sustained demand in core economic sectors.

Energy Stocks

Energy names rose as global oil and commodity prices remained supportive, benefitting companies engaged in production and refining.

Financial Companies

Banks and financial services firms also posted solid performance as interest rate outlooks stabilized and credit demand held up.

In contrast, many big tech stocks that had previously led market rallies were either flat or saw smaller gains compared to these cyclical sectors.

How Did the Broader Market React?

While the Dow Jones focused on cyclical strength, other major indices responded in different ways:

S&P 500

The broader S&P 500 index also saw gains, though the rotation was more balanced between sectors compared to the Dow.

Nasdaq Composite

Tech-heavy Nasdaq lagged behind on the day due to profit taking and shifting allocations into sectors considered more economically sensitive.

Investor Questions About the Dow Jones Rally

Is This Dow Jones Rally Sustainable?

Why is that happening?

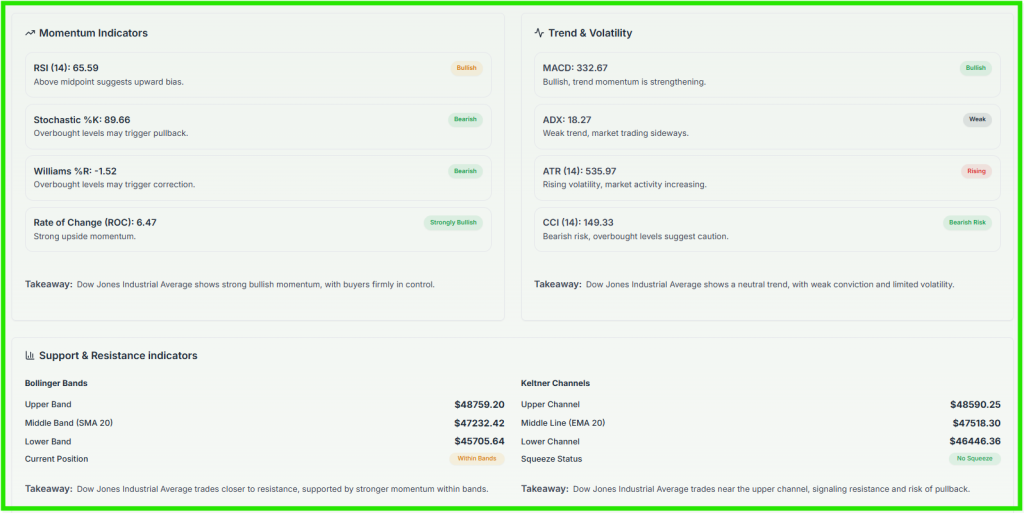

Many analysts believe the shift toward cyclicals is based on real trends, like rising consumer demand and expanding industrial activity. However, sustainability will depend on future economic data, inflation measures, and earnings reports.

Should Investors Shift Away From Tech for Good?

Not necessarily. Some experts say technology still offers long-term growth potential, especially in artificial intelligence, cloud computing, and digital infrastructure. The rotation may be part of a broader market diversification strategy rather than abandonment of tech entirely.

What Traders Are Saying on Social Platforms

Here are reactions from traders and observers on social media platforms:

This highlights how traders are noticing changes within the index’s composition and sector leadership.

This view gives insight into how inflation expectations also play into the rotation narrative.

Historical Context: Rotations in Market Leadership

Historically, markets go through cycles of leadership. At times, investors favor growth-oriented tech stocks, while at other moments they rotate into value and cyclical plays when economic conditions change.

The current shift in the Dow Jones echoes past periods where:

- Rising commodity prices fueled industrial gains

- Broad economic growth favored cyclical sectors

- Investors took profits in sectors that had outperformed for long periods

Understanding these cycles helps investors recognize that shifts in leadership can be normal responses to changing economic signals.

What This Means for Everyday Investors

Diversification Matters

For long-term investors, diversification across sectors can reduce risk and capture gains regardless of which area leads the market.

Understanding Risk and Timing

While buying cyclicals can make sense when economic signals strengthen, timing decisions around market rotations can be challenging. Evaluating individual company fundamentals remains key.

What Analysts Predict Next for the Dow Jones

Stable Growth Outlook

Some analysts forecast that the Dow Jones could continue its upward momentum if economic data remains positive and inflation stays in check.

Tech Stocks Could Reassert

Even with rotation, technology stocks may rebound if earnings surprises or new innovations excite investors.

Market Volatility Possible

Shifts in global economic indicators, trade policy news, or unexpected inflation data could cause volatility across all asset classes.

Conclusion: Dow Jones Strengthens on Sector Rotation

In summary, the Dow Jones strengthened as investors pivoted from tech stocks into cyclical sectors, industrial shares, and value-oriented companies. This rotation was driven by a mix of economic data, Federal Reserve monetary stance, and earnings trends that favored non-tech industries.

Investor sentiment appears to be shifting toward broad market participation, where value and cyclical plays gain prominence. While tech remains significant, the recent move highlights how market leadership can change and why understanding these shifts is important for both short-term traders and long-term investors.

The Dow Jones rally is a reminder of how diverse market strength can emerge when economic conditions evolve. As always, careful research and diversified planning are essential for navigating changing market landscapes.

FAQ’S

The Dow Jones Industrial Average is a major U.S. stock index made up of 30 influential companies from various sectors. It serves as a key barometer of the U.S. economy and stock market strength.

The Dow outperformed because investors moved capital into cyclical stocks, value sectors, and industrials, which benefited from strong economic data and earnings prospects.

No, tech remains a major part of the market. Rotation reflects diversification rather than a rejection of tech as an investment theme.

Investors should assess personal financial goals, risk tolerance, and market conditions. Cyclicals can offer opportunities but carry economic sensitivity.

Future performance depends on economic data, corporate earnings, and investor sentiment. While current trends support cyclicals, conditions can change.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.