Dr Reddys Share Price Update: Company Reports Negative Monthly Returns

As of 26 September 2025, Dr. Reddy’s Laboratories has shown a negative return of -0.68 % over the past month. This drop is drawing attention from investors and analysts alike. We think this decline is more than a short blip; it may reveal deeper challenges in pharma, markets, or company operations.

In many ways, Dr. Reddy’s is a bellwether stock. It blends domestic strength with global reach. From India to the U.S. and Europe, its performance often mirrors bigger sector trends. By watching this one firm, we can see how broader forces are at play.

Let’s walk through the recent share-price fall. We will explore what’s driving it, how the market is reacting, and where things might head next.

Overview of Dr. Reddy’s Laboratories

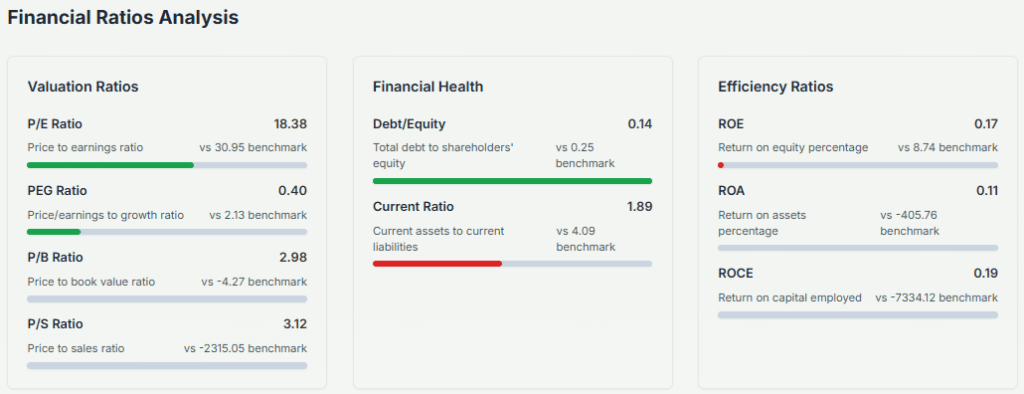

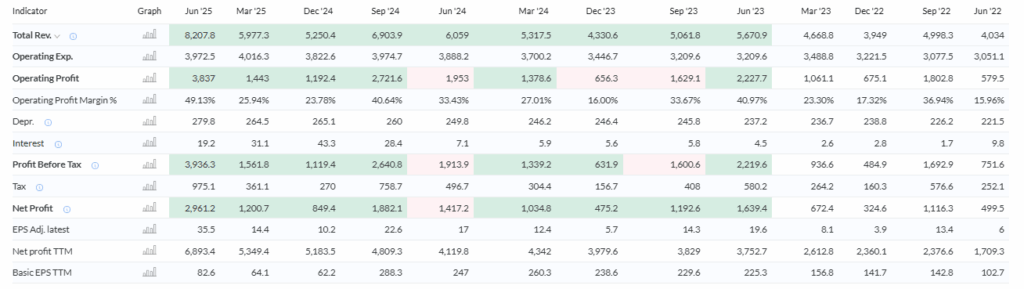

Dr. Reddy’s Laboratories is one of India’s top pharma firms. The company makes generic drugs, active pharmaceutical ingredients (APIs), and biosimilars. It sells products in India, the U.S., Europe, and other markets. The firm often moves with global pharma trends because of its large export revenues and research programs. Its scale and product mix make it a key stock in the pharma sector. Recent results show steady revenue growth, but margins and short-term profit have been pressured in some quarters.

Recent Share Price Performance

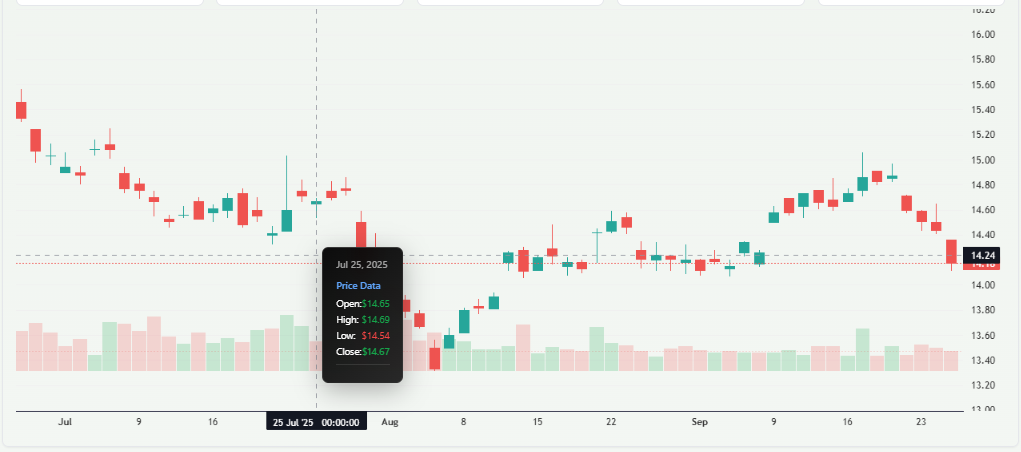

On 25 September 2025, Dr. Reddy’s shares fell about 1.8% and closed near ₹1,274.7. The dip followed weakness across the market and some negative company headlines. Live updates on 26 September 2025 show intraday swings and mixed sentiment among traders. Over the past month, returns turned negative for the stock, reflecting both sector headwinds and company-level concerns. The U.S. ADR also showed declines over recent weeks, adding to pressure on investor sentiment.

Reasons behind the Negative Monthly Returns

One clear trigger was regulatory scrutiny. On 15 September 2025, the U.S. FDA issued a Form 483 with five observations after inspecting a Hyderabad plant. That news pushed selling pressure. Investors worry that regulatory findings can slow U.S. approvals and affect exports. Another factor is the macro picture.

Global trade moves and talk of tariffs on certain drugs added fear in late September 2025. This changed how investors value Indian pharma names that depend on the U.S. market. Finally, quarterly dynamics mattered. While revenue rose in recent quarters, some profit metrics slipped. Higher R&D and operating costs cut into near-term margins. These combined forces explain the recent monthly loss.

Market Reaction and Investor Sentiment

Traders reacted quickly. Volumes spiked on days of negative headlines. Institutional flows showed mixed behavior: some funds trimmed exposure while others used dips to add small positions. Analyst notes varied. A few brokerages flagged the regulatory observation as a reason to await clarity. Others pointed to the company’s pipeline and strong revenue growth as reasons to stay invested for the long term. Social chatter and short-term traders amplified volatility. Overall, sentiment is cautious but not uniformly bearish.

Comparison with Sector and Peers

Compared to peers like Sun Pharma and Cipla, Dr. Reddy’s underperformed in certain sessions in late September 2025. On 25 September 2025, Sun Pharma showed resilience while Dr. Reddy’s fell. This gap suggests part of the move was company-specific, not just sector-wide. Still, the whole pharma pack is sensitive to U.S. regulatory news and any talk of tariffs on drug imports. This creates correlated moves across names. Valuation metrics show Dr. Reddy’s trades at a premium to some peers based on its margins and global reach. That premium can widen swings when bad news arrives.

Long-term Growth Outlook

Long-term, the company has strengths. The drug pipeline includes biosimilars and specialty products that can win market share. The firm also invests in R&D and manufacturing scale. These moves can drive higher revenue in the U.S. and Europe over time. Past quarterly data show revenue growth and healthy EBITDA, even when profit was squeezed in a quarter.

If regulatory concerns get resolved and new product approvals come through, the stock could recover. Investors should watch approvals, launches, and how management controls costs.

Risk Factors Investors Must Watch

Regulatory risk tops the list. Any adverse finding from the U.S. FDA can delay product launches or exports. Currency swings are also a risk. A weaker rupee helps exports but raises raw material costs if those are imported. Pricing pressure in generics and tougher competition in key markets can hit margins. Geopolitical steps like tariffs on certain drug classes also add uncertainty. Finally, pipeline delays or clinical setbacks would hurt confidence and shares.

Expert Views and Near-term Forecast

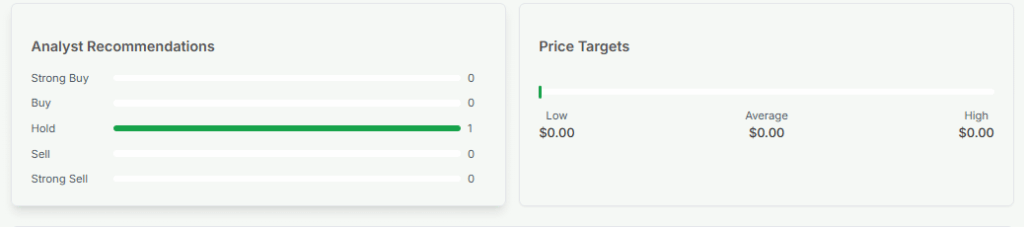

Analysts are split. Some keep a “hold” stance until the company clears regulatory questions. Others view dips as buying chances, citing the firm’s strong revenue base and pipeline. Price targets vary across brokers and depend on assumptions about future approvals and margin recovery. Watch for management updates and the next quarterly report for clearer guidance.

For active traders, short-term volatility is likely to remain until regulatory clarity and macro signals settle. For longer-term investors, fundamentals like pipeline and global reach remain important.

Wrap Up

The negative monthly returns for Dr. Reddy’s in late September 2025 reflect a mix of company and market factors. Key drivers were a U.S. FDA Form 483 on 15 September 2025, macro headwinds, and mixed quarter-to-quarter profit trends. The firm’s long-term story still has merit, but short-term risks are real. Investors should monitor regulatory updates, quarterly results, and any news on drug approvals. That information will show if the recent fall is a short blip or the start of a longer trend.

Frequently Asked Questions (FAQs)

The decline came after the U.S. FDA issued a Form 483 with observations on a Hyderabad plant on 15 September 2025, along with broader market pressure.

Analysts are divided. Some suggest holding until regulatory clarity comes, while others see long-term value due to a strong drug pipeline and global presence.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.