Driving Customer Experience in Finance with AI Chatbot Solutions

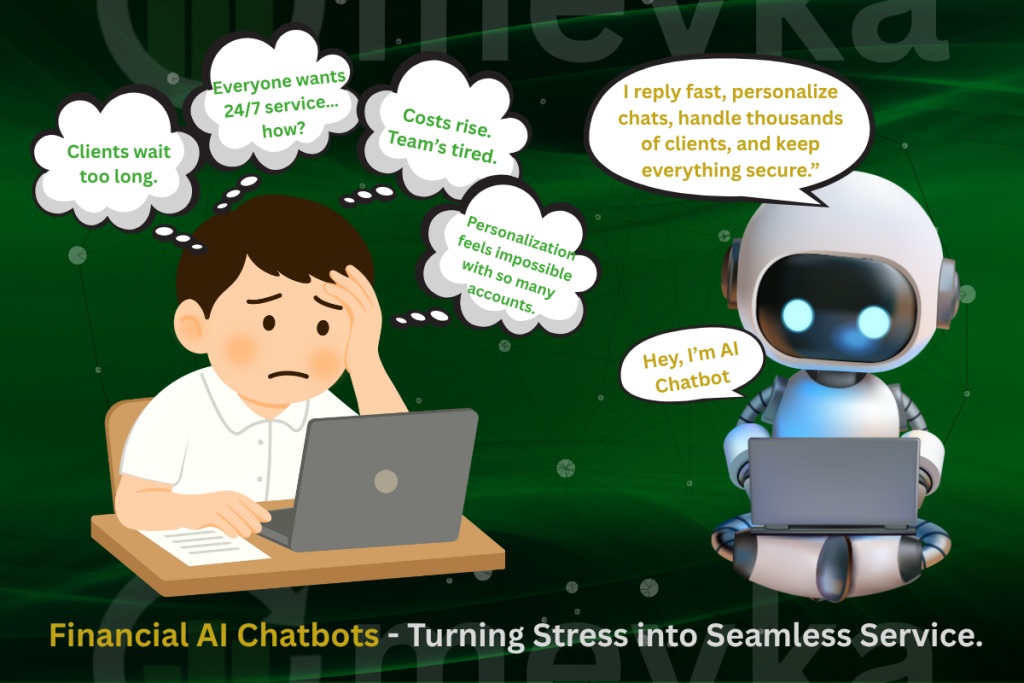

The finance world is changing fast. Customers now expect instant answers, personalized advice, and 24/7 service. Yet, many banks and financial firms still rely on outdated systems that slow things down. At this point, AI chatbots for financial services enter the scene, bridging the gap between client and financial service provider.

In 2025, more than 70% of financial institutions are using or testing AI-driven chatbots to improve client experience and reduce costs. These smart assistants can answer questions, guide users through transactions, and even share real-time insights about markets or investments.

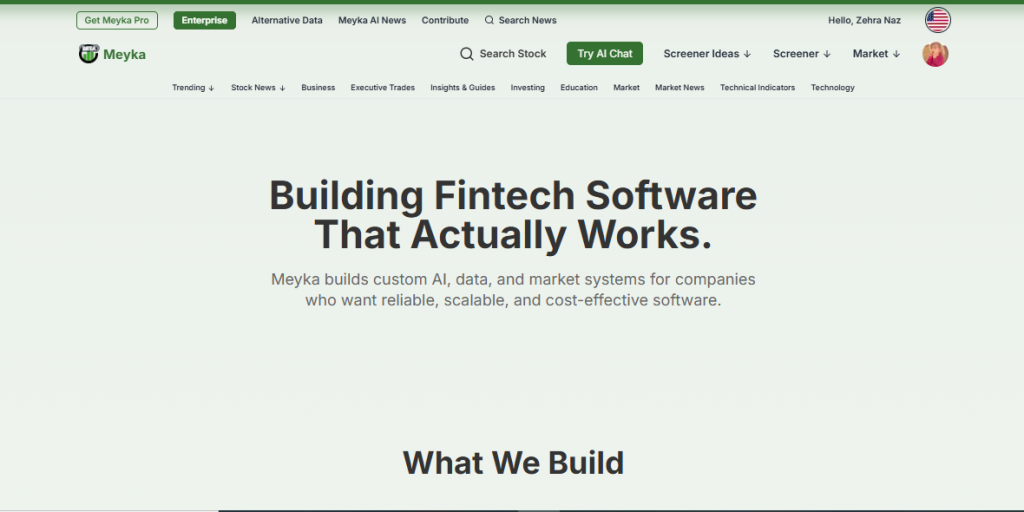

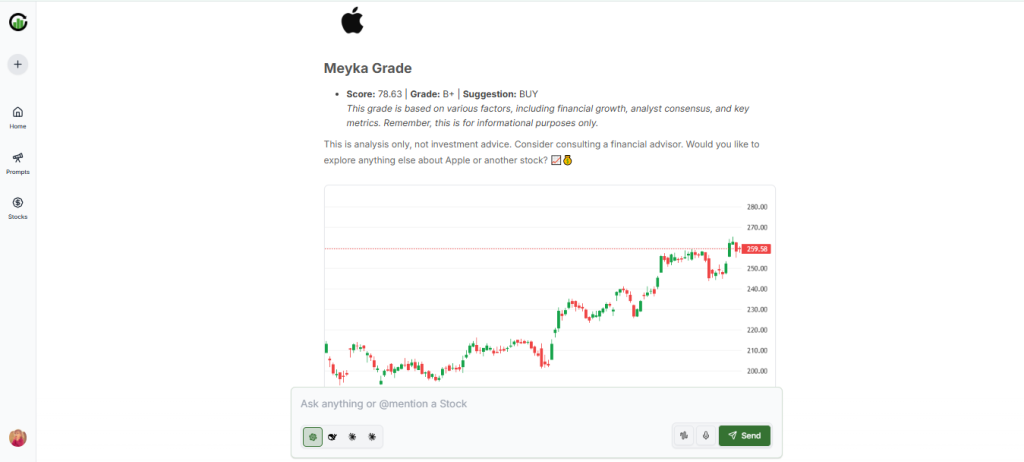

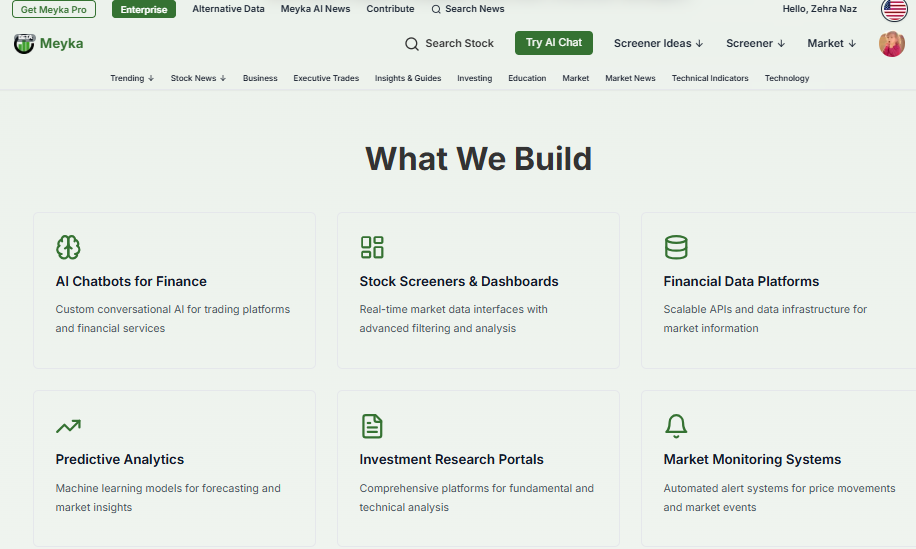

Meyka Enterprise is leading this shift with its advanced financial AI chatbot solutions. Built specifically for finance, Meyka helps institutions offer faster, smarter, and more secure customer interactions. It offers instant support with personalized recommendations, blends intelligence with trust, exactly what modern finance demands.

This article explores how AI chatbots like Meyka are driving customer experience forward and reshaping the future of financial services.

The Case for Chatbots in Financial Services

Customers expect fast, accurate answers. They want help any hour, on any device. Traditional call centers and static FAQs cannot meet this demand at scale. AI chatbots close that gap. They use natural language understanding to read intent. They connect to account systems and return real data.

Chatbots cut hold times and reduce manual errors. This drives a better experience and lower cost for providers. Industry surveys show massive AI investment across banks and finance firms, with many institutions embedding chatbots into customer and employee workflows.

Chatbots also enable proactive service. They can alert customers to unusual transactions can remind users of upcoming payments. They can surface tailored offers based on recent behavior. These proactive touches build trust and keep customers engaged.

At the same time, chatbots must respect privacy and comply with rules. Poorly designed bots can trap customers in loops or give wrong advice. Regulators are watching automated systems closely. Firms must design clear escalation paths to human agents.

Meyka Tip: Automate frequent questions to save time and reduce errors.

Introducing Meyka Enterprise: A Finance-First Chatbot

Meyka positions its platform for financial use cases. The product focuses on secure integrations and financial data flows. Its documentation stresses enterprise architecture, auditability, and role-based access. The platform supports contextual dialogues and multi-step tasks. Meyka also highlights the ability to include market data and generate timely insights for users. Meyka’s blog describes new advances in finance assistant capabilities and tighter data controls.

Meyka aims to reduce friction across common finance tasks. Examples include balance lookups, transaction status checks, and basic onboarding flows. The platform can hand off high-risk or complex requests to human staff. This hybrid model keeps automation safe and useful. Meyka also emphasizes the ability to tune the assistant to a brand voice and compliance needs.

Meyka Tip: Ensure secure system connections and controlled access from day one.

How Meyka’s Chatbot Enhances Customer Experience?

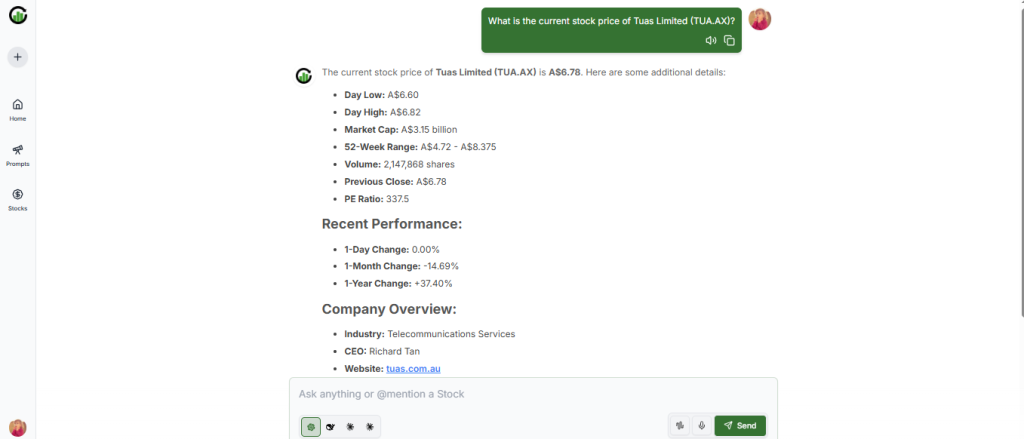

Fast, correct answers improve customer satisfaction. Meyka connects to core systems to return live balances and transaction details. This lowers the chance of stale or misleading replies. Conversation context is preserved, so follow-up questions feel natural. The system can also generate short portfolio summaries and explain recent market moves. For deeper market signals, the platform can ingest analytics from an AI stock research analysis tool and present concise highlights.

Personalization matters. The chatbot can use past behavior to shape replies. For example, a user who often checks savings goals may receive nudges and simple projections. Personalization increases relevance and reduces friction. It also supports smarter cross-sell done ethically and within compliance guardrails. Omnichannel deployment of web, mobile app, and messaging lets customers choose how they interact. Meyka supports these channels to keep the experience consistent.

Automation reduces routine workload. Frontline staff can focus on complex cases. The result is faster resolution for simple queries and more focused human help for hard problems. Key performance metrics include first-contact resolution, average handle time, and customer satisfaction scores. Meyka provides analytics to track these KPIs and guide continuous improvement.

Meyka Tip: Use customer history to deliver relevant and helpful responses.

Real Use-Cases in Finance

Retail banking benefits immediately. Chatbots handle balance checks, card blocks, and payment dates. They can pre-screen loan eligibility and start simple applications. This shortens onboarding and lowers abandonment. Corporate clients use chatbots for treasury queries and invoice checks. That speeds decision cycles and reduces internal email load.

Wealth management firms use chatbots to summarize portfolio performance and surface market news. The assistant can explain basic scenario outcomes in plain language. This helps less experienced investors stay informed without heavy jargon. Fraud detection teams benefit too. Chatbots can notify clients of unusual activity and gather quick confirmations to validate transactions. These quick checks reduce loss and build customer confidence.

Fintechs and neo-banks scale support without proportional headcount growth. The chatbot can handle thousands of routine interactions monthly. Market studies show many institutions now use bots for both customer and internal support. This trend accelerates digital transformation across the industry.

Meyka Tip: Start small, test in one area, then expand gradually.

Implementation Roadmap: From Pilot to Scale

Start with clear goals. Choose one or two high-impact use cases. Common pilots include balance inquiries and card support. Map required data connections early. Core banking, CRM, and identity systems must be linked securely. Define roles and audit trails to meet compliance demands.

Train the assistant on real dialogues. Test with small user groups. Monitor accuracy on intents and entity extraction. Fix common failure paths quickly. Keep a human in the loop for sensitive requests. Gradually add channels and languages after the pilot proves stable. Use analytics to find gaps and priorities for expansion.

Plan governance from day one. Create a review board for sensitive content and regulatory compliance. Document escalation rules and data retention policies. Regular audits and red-team tests reduce legal and operational risk. Regulators want clear records of how automated decisions are made and how customers can reach a human.

Meyka Tip: Monitor results closely and refine the chatbot before full deployment.

Risks and How to Mitigate Them?

Chatbots can give wrong advice. They can also frustrate customers with long loops. To reduce those risks, implement rigorous testing and clear fallbacks. Keep simple, transparent disclosures about capabilities and limits. Make it easy to connect to a human agent. Monitor logs to find systemic errors and remove harmful patterns. Regularly retrain the model with verified transcripts.

Protect data carefully. Encrypt data in transit and at rest. Limit access with role-based controls. Keep audit trails for sensitive operations. These measures protect customers and build regulatory confidence. Meyka’s enterprise design emphasizes these controls as core features.

Meyka Tip: Always provide an easy option to reach a human agent.

Why Choose a Finance-Specialized Vendor like Meyka?

General chat platforms can handle simple FAQs. Finance requires stricter controls and domain knowledge. A finance-specialized solution offers prebuilt connectors, compliance templates, and finance-aware dialogue models. This lowers time to value and reduces costly rework. Meyka focuses on financial workflows, market feeds, and secure enterprise integrations. That makes deployment smoother for regulated institutions.

Market conditions in 2025 show broad AI adoption in finance. Firms that adopt targeted, secure chatbots gain faster service response and better operational efficiency. The competitive edge lies in speed, accuracy, and trust. Vendors that deliver those three aspects help institutions win and retain clients.

Meyka Tip: Use a finance-focused solution to ensure compliance and faster setup.

Closing Note

AI chatbots are no longer experimental. Many banks and fintechs now use them to cut costs and improve customer service. Start with a focused pilot. Link only the systems needed. Test thoroughly. Add human oversight for complex and sensitive tasks. Use analytics to improve over time.

If the goal is better client engagement, a finance-first chatbot platform like Meyka can shorten the path from idea to impact. For the latest updates and technical details, review Meyka’s technical posts.

Frequently Asked Questions (FAQs)

A financial AI chatbot is a software program that uses artificial intelligence to interact with customers, providing assistance with banking services, answering queries, and processing transactions through conversational interfaces.

Yes, advanced AI chatbots can process and respond to complex financial queries by analyzing data, understanding context, and delivering accurate information, though human oversight is often recommended.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.