ECB Alert: Stablecoins Could Siphon Off Major Euro Zone Bank Deposits

Stablecoins are growing fast across the world. In 2025, global stablecoin supply crossed major levels as more people used them for payments and savings. This rise has now caught the attention of the European Central Bank (ECB). On 24 November 2025, the ECB warned that stablecoins could pull a huge amount of deposits out of eurozone banks. This is not a small issue. Bank deposits help support loans, daily payments, and financial stability. If a large part moves into digital tokens, banks may face a new kind of pressure that they have never seen before.

The ECB believes people might shift their money for speed, low fees, or better returns. That shift looks simple on a phone screen, but it can change how Europe’s financial system works. The concern is not about crypto hype. The concern is about the safety and control of the euro. As stablecoins become more common in Europe, the ECB wants to make sure they do not weaken the region’s core banking system.

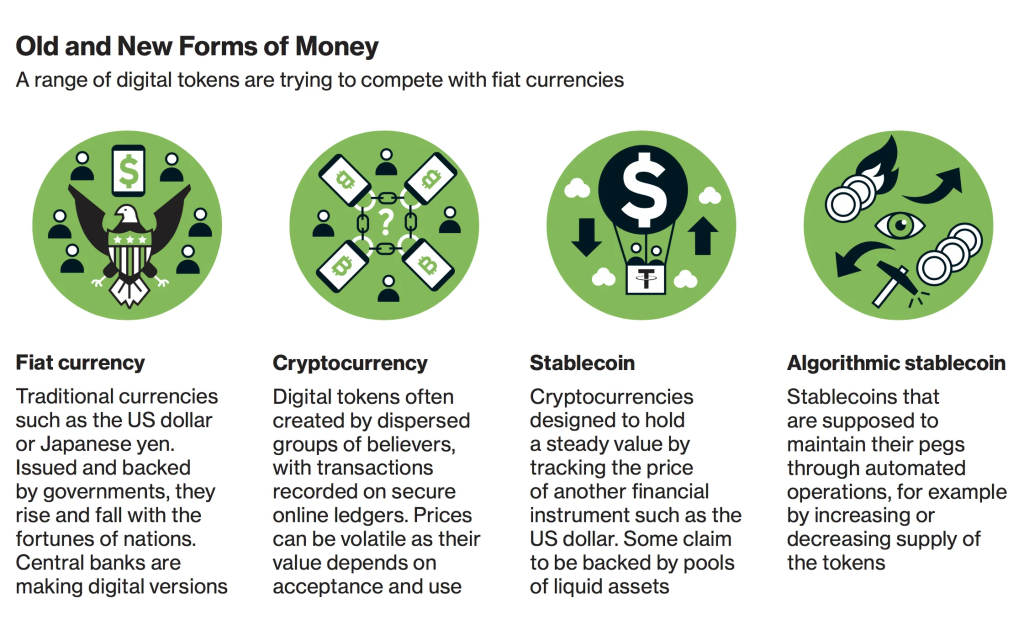

What are Stablecoins?

Stablecoins are digital tokens designed to maintain a stable value against currencies like the euro or dollar. Some are backed by cash and short-term government bonds, while others rely on crypto collateral or algorithms.

People use stablecoins for fast payments, online transfers, and as a gateway into crypto markets. Issuers promise quick redemptions and low fees, which makes them attractive to both consumers and businesses. Their popularity has surged globally, catching the attention of regulators and central banks alike.

ECB’s Warning: The Risk to Euro-Zone Banks

On 24 November 2025, the European Central Bank (ECB) issued a warning. It stated that stablecoins could pull significant deposits out of euro-area banks.

Bank deposits are a core source of funding for loans, payments, and the broader financial system. If a large portion moves into digital tokens, banks may face unexpected liquidity pressure. The ECB highlighted that sudden withdrawals could destabilize both smaller and larger banks.

How Stablecoins Could Drain Bank Deposits?

Consumers may shift money from bank accounts to stablecoin wallets for speed, lower fees, or higher perceived returns. Fintech apps and digital platforms make this process very simple.

When deposits fall, banks lose a stable source of funding. They might have to borrow at higher costs, which could reduce lending. Lower lending could slow economic activity and increase credit risk.

Possible Scenario: Large-Scale Deposit Flight

A large migration to stablecoins could impact smaller and regional banks first, as they rely heavily on local deposits. Market reports indicate that the global stablecoin supply exceeded $280 billion in 2025. Analysts warn that a rapid run could force banks to sell government securities quickly, affecting financial markets.

Standard Chartered predicts that stablecoins could pull significant deposits from emerging-market banks by 2028. Such scenarios show how digital tokens can create systemic risk if left unchecked.

Euro-Denominated Stablecoins: A New Challenge

Euro-backed stablecoins are emerging rapidly. They allow users to hold euros outside traditional banks. Cross-border companies may prefer euro-stablecoins for fast settlements. Retail adoption could reduce the role of banks in daily payments. If a stablecoin is issued by multiple entities inside and outside the EU, redemption pressures may disproportionately affect EU banks. This situation raises both legal and liquidity concerns for the region.

Regulatory Concerns and the ECB’s Pushback

The ECB and other regulators are pressing for stricter oversight. They are concerned about reserve quality, transparency, and running risk.

The EU’s Markets in Crypto-Assets (MiCA) framework aims to cover many gaps. However, regulators argue that oversight should match the potential scale of stablecoins. They also emphasize the need to protect consumers and prevent destabilizing financial flows.

Impact on Payments and the Wider Financial System

Stablecoins can make payments faster and cheaper. This is a real advantage for consumers and businesses. However, a large shift could weaken the ECB’s ability to conduct monetary policy. Banks’ deposits are key tools for transmitting policy to the economy.

If deposits fall, money supply management may be less effective. A growing stablecoin sector could reduce central banks’ control over short-term liquidity, which may affect euro stability.

The Digital Euro: ECB’s Strategy to Counter Stablecoins

The ECB is accelerating the digital euro project. On 30 October 2025, the ECB announced moving to the next preparation phase. A pilot is expected by mid-2027, with a potential full rollout by 2029, subject to EU legislation. The digital euro is designed to provide a safe, public digital payment option. It aims to reduce incentives for large deposits to shift to private stablecoins while maintaining monetary control.

Industry Response

Crypto companies argue that stablecoins improve efficiency and reduce costs. They also highlight better access for unbanked populations.

Banks, however, see stablecoins as a competitive threat. They call for similar regulatory treatment for issuers and banks. Market participants are also pushing for more transparency and audited reserve disclosures to build trust in stablecoins.

What does this mean for Consumers and Investors?

Stablecoins provide speed and convenience, but they are not insured like bank deposits. Redemption depends on the issuer’s reserve quality. Retail users should carefully review backing assets and transparency reports. Investors need to monitor regulatory developments and issuer audits. Tools like an AI stock research analysis tool can help track market trends and potential risks in this evolving sector.

Final Words

Stablecoins bring innovation in payments but also present risks to traditional bank deposits. The ECB’s warning on 24 November 2025 signals urgency for policymakers.

Balanced regulation can allow innovation while protecting financial stability. The likely future is one of coexistence: banks, regulated stablecoins, and a digital euro working together to support secure, efficient payments in Europe.

Frequently Asked Questions (FAQs)

On 24 November 2025, the ECB said stablecoins could pull money out of eurozone banks. This may make banks weaker and cause problems in lending and payments.

Yes. If many people move money to stablecoins for speed or lower fees, banks could lose deposits fast. This may create stress for banks and affect the financial system.

The ECB plans to launch the digital euro by 2027. It gives a safe digital option for payments and may reduce people moving money to private stablecoins.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.