EQT Buyout Group Launches Process to Sell Broadband, Data Assets

EQT Buyout Group, a big private equity firm, plans to sell its broadband and data assets. This news has caught the attention of investors and market watchers. The sale is a way for EQT to focus on its main investments and get money from assets that have grown in value. The assets include broadband networks, data centers, and other digital infrastructure. These are important today because fast internet and reliable data help businesses grow.

Many big companies and investors are expected to be interested. The sale shows more activity in telecom and digital infrastructure. It could change the competition and create chances for new investments.

This article will explain why EQT is selling, what it means for the industry, and how investors may react. The move shows how private equity decisions can affect the whole market.

Background of EQT Buyout Group

EQT is a well-known private equity firm from Sweden. It invests in technology, infrastructure, and healthcare. The company started in 1994. Today, it manages more than €67 billion in different funds. EQT focuses on companies that can grow fast and make steady profits.

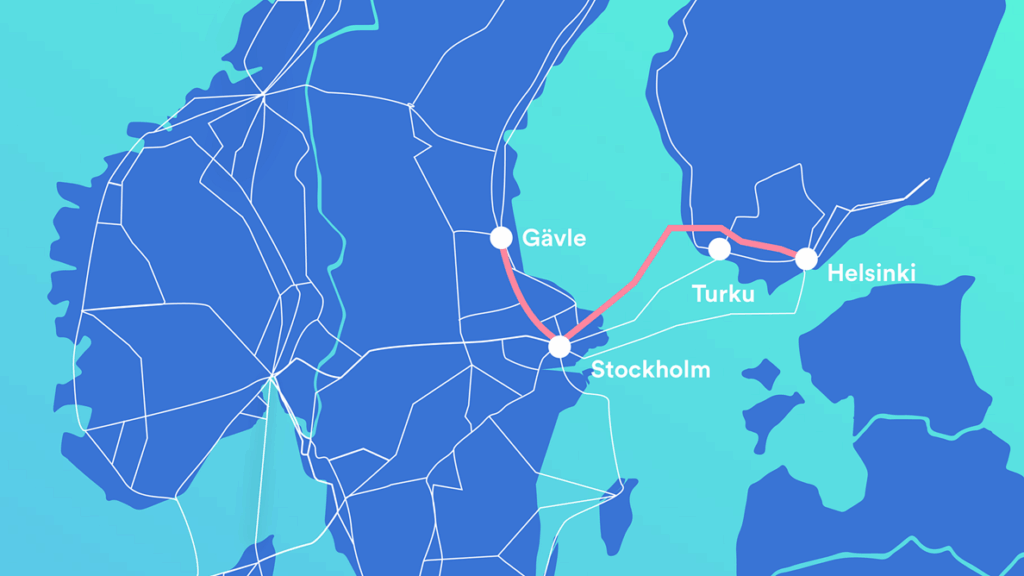

In 2017, EQT bought most of GlobalConnect, a big Nordic digital infrastructure company. This move helped EQT grow in telecom and data centers. GlobalConnect runs a 244,000 km fiber network. It handles over half of the data traffic in the Nordic region. The company serves about 907,000 private customers and 30,000 business clients in Denmark, Norway, Sweden, Germany, and Finland.

Over time, EQT improved GlobalConnect’s network and services. The company became a key part of the Nordic digital world. Now, EQT plans to sell GlobalConnect. This shows EQT’s focus on updating its investments and looking for new opportunities.

Details of the Sale

EQT has started selling its Nordic broadband and data center business, GlobalConnect. The sale is valued at about €8 billion ($9.43 billion). Goldman Sachs is managing the deal. EQT plans to sell the whole business, not parts of it.

GlobalConnect owns 23 data centers, 27 subsea cables, and a large fiber network across several countries. The company serves both homes and businesses. Many buyers are expected to show interest, such as infrastructure funds, telecom companies, and private equity firms. They want to invest in digital infrastructure because demand is growing.

The sale process is already in progress. Interested buyers are reviewing details and doing due diligence. The final terms of the deal are not set yet. Experts say this sale could be an important event for the Nordic digital infrastructure market.

Strategic Rationale

EQT’s choice to sell its stake in GlobalConnect fits its bigger investment plan. The firm wants to improve its portfolio and focus on new market trends. Selling this asset lets EQT free up money. They can use it for opportunities with higher growth.

The digital infrastructure sector has grown fast. More people and businesses need high-speed internet, cloud services, and data storage. By selling GlobalConnect, EQT can put resources into areas likely to grow, like renewable energy, technology, and healthcare.

The sale also helps EQT reduce its risk in the telecom industry, which faces rules and strong competition. The money from the sale will make EQT’s balance sheet stronger. It will also let the firm invest in new projects that match its long-term goals.

Market Implications

The sale of GlobalConnect is expected to have several implications for the digital infrastructure market. Firstly, it underscores the growing appetite for high-quality assets in the sector, as investors seek to capitalize on the increasing demand for data services.

Secondly, the transaction may set a benchmark for future valuations of similar assets in the Nordic region, influencing pricing dynamics in the market. The involvement of prominent financial institutions and infrastructure funds in the bidding process highlights the competitive nature of the digital infrastructure sector.

Lastly, the sale could lead to consolidation within the industry, as acquiring companies seek to expand their networks and service offerings. This trend may result in enhanced efficiencies and improved services for end-users, contributing to the overall growth of the digital economy.

Challenges and Risks

Selling GlobalConnect brings many opportunities, but it also has risks. One challenge is regulatory approval. The deal may need permission from competition authorities in different countries. Getting these approvals can take time and affect the sale terms.

Another challenge is integrating GlobalConnect with a new owner. The companies must align their culture, systems, and processes. Doing this well is key to gaining the expected benefits from the sale.

Market and economic changes are also risks. Interest rates, currency values, and investor confidence can affect how attractive the deal is. These factors could influence whether the sale succeeds or faces delays.

Expert Opinions and Analyst Insights

Analysts see EQT’s sale of GlobalConnect as a smart move. It shows how the digital infrastructure market is changing. Many experts say it fits a trend where private equity firms focus on higher-growth sectors.

The bidding process is competitive. Several buyers are interested in GlobalConnect’s assets. Goldman Sachs is advising on the deal, showing how important it is. The high level of interest highlights the value of the company.

Experts also think this sale could set a standard for future deals in digital infrastructure. It may influence how similar assets are valued and how investment strategies are planned in the industry.

Wrap Up

EQT’s start of the GlobalConnect sale is an important step in the Nordic digital infrastructure market. The move shows EQT’s strategy to manage its portfolio and follow new market trends.

The sale could change the market. It may affect company values, industry deals, and how firms compete. There are risks, but the transaction also brings big opportunities for EQT and buyers. Investors using AI stock analysis tools can track the deal’s impact on related sectors and make informed decisions. The demand for digital infrastructure is growing, and this deal can benefit those involved.

As the sale continues, companies and investors will watch closely. They want to see how it affects the market and future investment plans in the sector.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.