EssilorLuxottica Today: Stock Soars as Meta Partnership Lifts Q3 Earnings

On October 17, 2025, EssilorLuxottica stunned the markets. Its stock jumped after the company announced record third-quarter results. The surge came largely because of its partnership with Meta Platforms, which has given new life to smart eyewear.

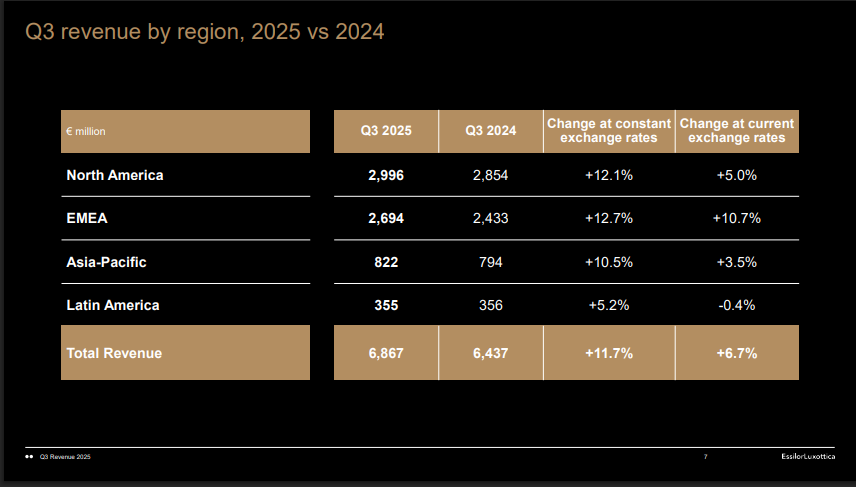

EssilorLuxottica is best known for brands like Ray-Ban and Oakley. But now it is also a tech innovator. In Q3, the firm posted €6.9 billion in revenue, rising nearly 11.7 percent year-on-year. Much of that growth traced back to sales of its Ray-Ban Meta AI smart glasses.

Investors cheered. They saw a company that blends fashion and technology. The Meta tie-up positions EssilorLuxottica not just as an eyewear giant, but as a contender in wearables. Now, analysts are watching closely. Can this momentum carry into 2026 and beyond?

EssilorLuxottica: Company Overview

EssilorLuxottica formed after the 2018 merger of lens maker Essilor and frame giant Luxottica. The group combines fashion, optics, and retail. Famous brands include Ray-Ban, Oakley, Persol, and several luxury labels. The company also owns retail chains such as Sunglass Hut and LensCrafters. It operates across EMEA, North America, and Asia-Pacific.

The business mixes prescription lenses, sunglasses, and now wearable tech. The firm has shifted from pure eyewear to a tech-fashion company in under five years. This move changed investor expectations about growth and margins. The company publishes detailed financials and investor presentations that show the transition.

EssilorLuxottica Today: Q3 2025 Earnings Highlights

EssilorLuxottica reported third-quarter revenue of about €6.9 billion for Q3 2025. That was an 11.7% rise year-on-year and the company’s best quarterly result to date. Management said online sales and direct-to-consumer channels accelerated strongly during the quarter.

North America and EMEA delivered double-digit growth. The company noted that wearables, especially the Ray-Ban Meta line, contributed meaningfully to the uptick. The Q3 results were published on October 16, 2025, in the press release and presentation for investors.

The company said wearables added more than four percentage points to group growth in the quarter. That is a sizable swing for a company long driven by fashion and lenses. EssilorLuxottica also reaffirmed medium-term guidance, while indicating plans to expand production capacity for smart glasses faster than previously planned.

EssilorLuxottica-Meta Partnership Boost

The partnership with Meta Platforms has been the headline. The collaboration produced the Ray-Ban Meta smart glasses family. These products combine classic Ray-Ban styles with AI features and sensors developed with Meta. The second-generation models launched in September 2025. They include a base model priced around $379 and a premium $799 model with a built-in display and advanced gesture controls. Initial sales were concentrated in select stores and online channels. The rollout to Canada, France, Italy, and the UK is planned for early 2026.

Management described the smart-glasses category as “exponential” in growth. Analysts noted that the product helps EssilorLuxottica reach new tech-centric consumers. The smart glasses also pull customers into the company’s digital ecosystem. That raises the lifetime value of each customer and opens subscription and services opportunities in the future. Several broker reports and company commentary noted a rapid ramp in demand and a decision to accelerate capacity to meet it.

Stock Performance Analysis

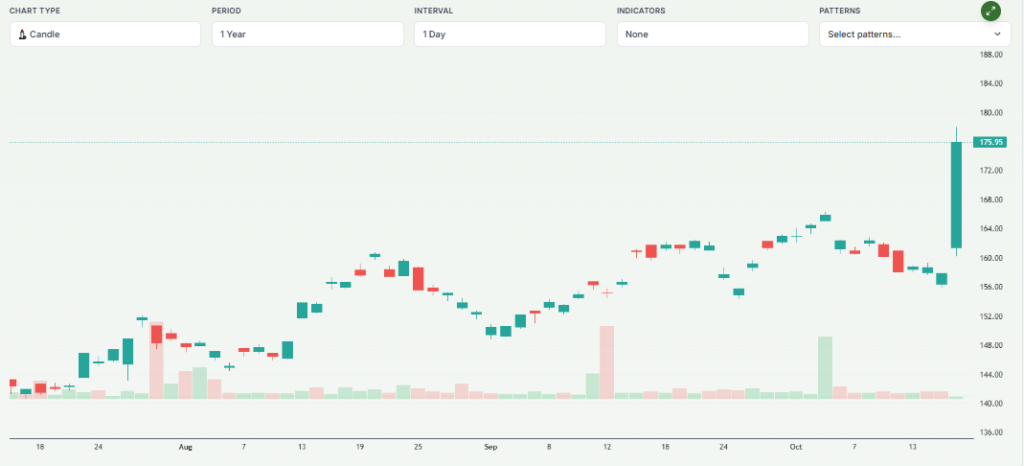

Markets reacted quickly. On October 17, 2025, shares rose sharply and hit record highs. The jump added roughly €15 billion to the market value as traders priced in the wearable growth story. The stock gain reflected both the beat in revenue and the credible path for wearables to become a durable revenue stream. Analysts from banks such as J.P. Morgan and Equita raised near-term estimates for wearable revenue after the results. Investor focus shifted from cyclical eyewear trends to recurring tech revenue potential.

Traders compared EssilorLuxottica’s move to peers in the luxury and eyewear sectors. The market treated the Meta tie-up as a structural advantage. That partly explains why the stock outperformed broader indices in the immediate aftermath of the announcement.

Key Growth Drivers

- This is the clearest new growth engine. The Ray-Ban Meta line brought both volume and price-mix improvement. Sales momentum pushed the company to accelerate capacity building for millions of units per year.

- Ray-Ban.com, Oakley.com, and SunglassHut.com saw faster e-commerce growth. Online channels improved convenience and margins. The digital push also supports product launches and rapid geographic rollouts.

- Global retail footprint. Physical stores still matter for fitting and premium purchases. The blended model strong online plus experiential stores, helps convert tech interest into sales. The company emphasized both channels in its Q3 materials.

- Beyond current smart models, EssilorLuxottica presented a roadmap of new wearables and improved lens technologies. The pipeline reduces the risk that early success is a one-off. The company also highlighted R&D cooperation with Meta.

- The company pointed to product approvals and clinical support for new lens technologies. Such milestones improve credibility for premium pricing and prescription sales.

For professional investors using an AI stock research analysis tool, the new product revenue and capacity commitments will be crucial inputs in revenue and unit-sales forecasts.

Industry and Market Outlook

The global eyewear market blends fashion, health, and technology. Demand for prescription lenses remains stable. Sunglasses are tied to fashion cycles. Wearables are now an emerging sub-segment that could reshape long-term growth. Analysts forecast a multi-billion-euro wearables market over the next decade if consumer adoption continues. Competition will intensify from tech players and nimble start-ups. But EssilorLuxottica’s brand power and distribution network give it an edge in scale and retail access.

The AR/VR and broader wearable ecosystem also matters. If apps and services around smart glasses take off, margins could improve via software and subscription revenue. That would materially change the company’s valuation model over time.

Risks and Challenges

The smart-glasses opportunity has clear risks. First, supply and capacity constraints could limit early sales. The firm said it will speed up capacity plans, but execution risk remains. Second, competition from other tech firms or fashion houses could pressure prices and margins.

Third, consumer adoption of always-on wearable devices is still uneven. Privacy concerns and regulatory scrutiny of cameras and sensors in eyewear could create headwinds. Fourth, macroeconomic slowdowns can hit discretionary spending on premium eyewear. Finally, rapid product launches may expose the company to quality and warranty costs. These risks were flagged in analyst commentary and company disclosures.

Wrap Up

EssilorLuxottica’s Q3 2025 results mark a turning point. The company achieved record quarterly revenue and showed that wearables can be a meaningful growth driver. The Meta partnership gave the new product line credibility and distribution reach. Markets rewarded the news with a sharp stock move on October 17, 2025. Execution now matters.

If production expands smoothly and demand holds, wearables could reshape the company’s growth profile. If not, the good quarter could be a temporary spike. Investors should watch unit production plans, geographic rollouts, and early retention metrics for smart-glasses buyers as the next signals of sustainability.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.