Ethereum News Today: ETH Transactions Hit 2025 Peak, While Bitcoin Whale Dumps $2.7B

Ethereum reaches new heights in August 2025 as transaction volumes surge to $320 billion, marking the third-largest monthly volume in its history. Meanwhile, the stock market experiences ripple effects from a massive Bitcoin whale selling 24,000 BTC worth $2.7 billion, creating significant volatility across cryptocurrency markets.

The cryptocurrency landscape witnessed dramatic shifts in August 2025, with Ethereum demonstrating remarkable strength while Bitcoin faced unprecedented selling pressure. These contrasting developments highlight the evolving dynamics between major digital assets and their impact on traditional financial markets.

Ethereum Surges to Historic Transaction Levels

Ethereum achieved its highest transaction volume since May 2021, processing $320 billion in August 2025. This represents the third-largest monthly volume in the network’s history, demonstrating robust demand and network utilization.

The surge reflects several key factors driving Ethereum adoption:

- Unique transactions over 30 days reached an all-time high

- Active addresses hit the second-highest level in network history

- Total Value Locked (TVL) remained near peak levels throughout the month

Daily transaction volumes averaged 1.74 million, representing a 43.83% year-over-year increase. This growth pattern indicates sustained institutional and retail engagement with the Ethereum ecosystem.

Institutional Adoption Accelerates

Institutional involvement reached new milestones as corporate treasuries actively accumulated Ethereum holdings. Spot ETH ETFs accounted for over 5% of the circulating supply, while public companies increased their ETH holdings from $4 billion to $12 billion by month-end.

Ethereum ETF inflows surged dramatically, with BlackRock’s ETHA recording net inflows of 57,584 ETH valued at $265.74 million on August 27 alone. Over five trading sessions, Ethereum ETFs attracted $1.83 billion in inflows, compared to just $171 million for Bitcoin ETFs during the same period.

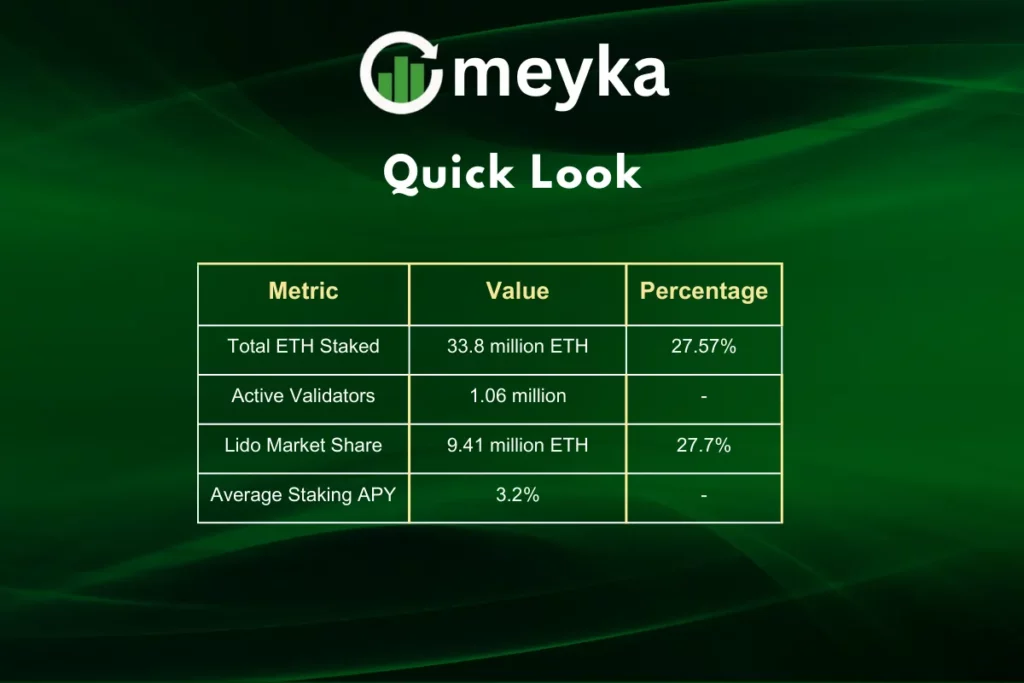

Staking Dominance Strengthens Ethereum’s Position

Nearly 30% of Supply Staked

Ethereum staking reached unprecedented levels with 33.8 million ETH staked, representing approximately 27.57% of the total supply. This high staking ratio demonstrates long-term confidence in the network’s future prospects.

The staking ecosystem includes over 940 distinct entities and 1.06 million active validators. Lido maintains its position as the largest staking provider with 27.7% market share, controlling 9.41 million ETH.

Key staking statistics include:

Network Security and Yields

Validators earn an average APY of 3.2% in 2025, with yields remaining stable despite increased participation. The high staking participation rate enhances network security while providing consistent returns for holders.

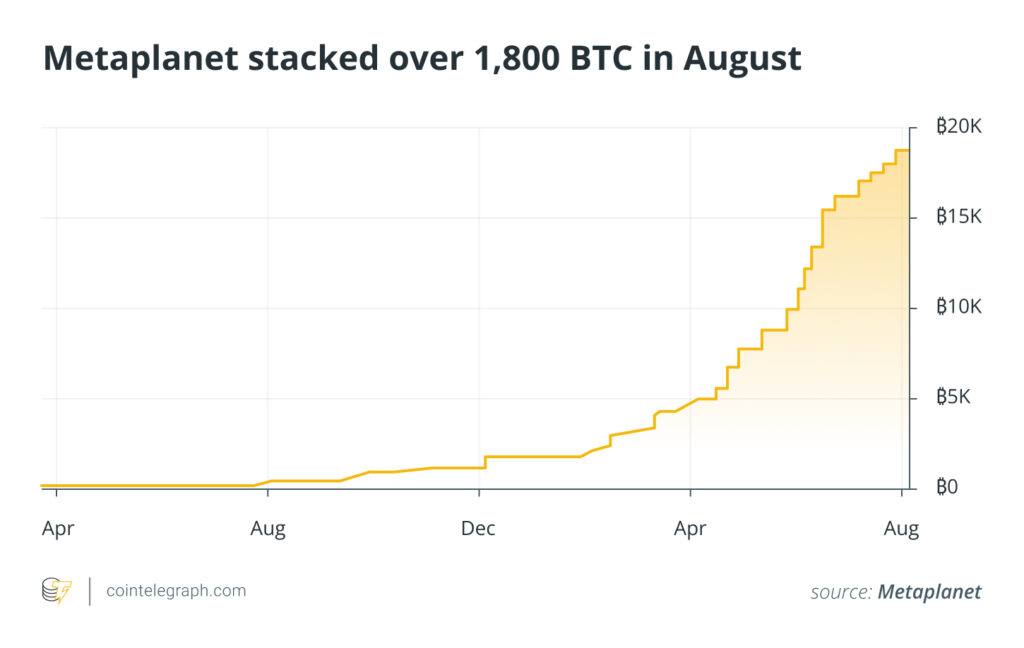

$2.7 Billion Dump Triggers Flash Crash

A Bitcoin whale shocked markets by selling 24,000 BTC worth $2.7 billion over a weekend in August. The massive sell-off caused Bitcoin to crash by $4,000 within minutes, triggering widespread liquidations across the cryptocurrency market.

The whale’s wallet had remained dormant for over five years before sending the entire balance to Hyperunite trading platform. Despite the massive sale, the entity still holds 152,874 BTC valued at more than $17 billion.

Market Impact and Liquidations

The Bitcoin dump created a cascade of liquidations totaling over $900 million. More than 205,000 traders were liquidated as leveraged positions unwound rapidly. The total cryptocurrency market capitalization fell by $205 billion in 24 hours.

Bitcoin dropped to around $110,500 before recovering to approximately $112,692. The RSI-7 reading of 40.72 indicated oversold conditions, though no clear reversal signals emerged immediately.

Regulatory Developments Shape Market Structure

Rhode Island and Wisconsin introduced comprehensive legislation regulating crypto ATMs in August 2025. These developments bring the total number of states with crypto ATM regulations to 13, reflecting growing concerns about fraud targeting vulnerable populations.

Key regulatory provisions include:

- Daily transaction limits of $1,000 to $2,000

- Mandatory ID verification and user data collection

- Warning labels about fraud risks

- Full reimbursement requirements for fraudulent transactions

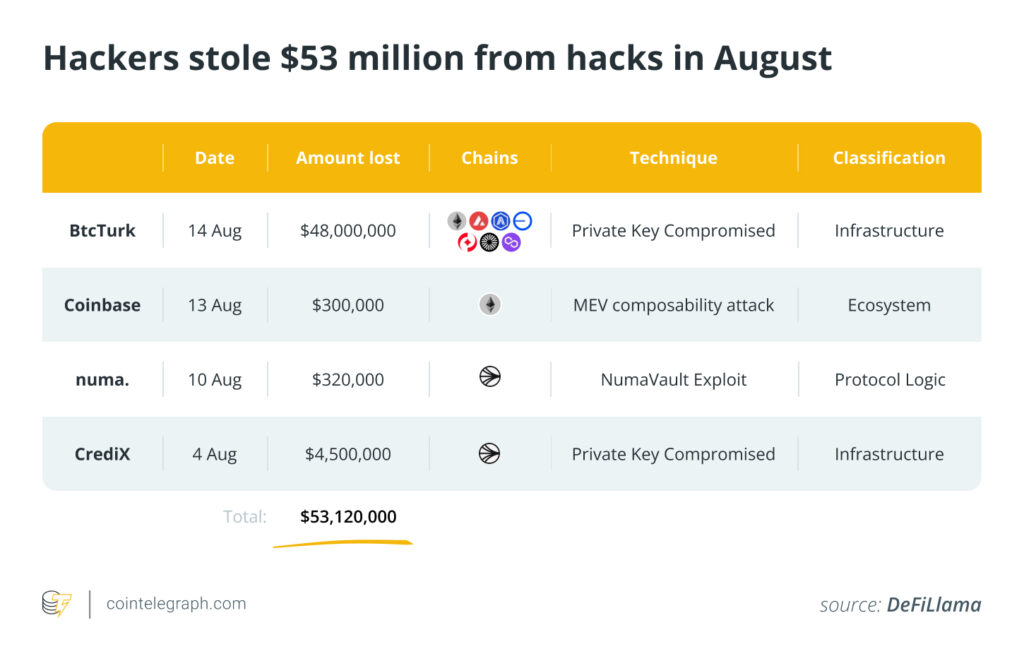

DeFi Security Challenges Continue

Cybercriminals stole $53 million from DeFi exploits in August, highlighting persistent security vulnerabilities. The Radiant Capital hack exemplified sophisticated attack methods, with hackers subsequently doubling their gains through strategic Ethereum trading.

The stolen funds were converted to 21,957 ETH and later sold for massive profits as Ethereum prices surged. This incident underscores the need for enhanced security measures across DeFi protocols.

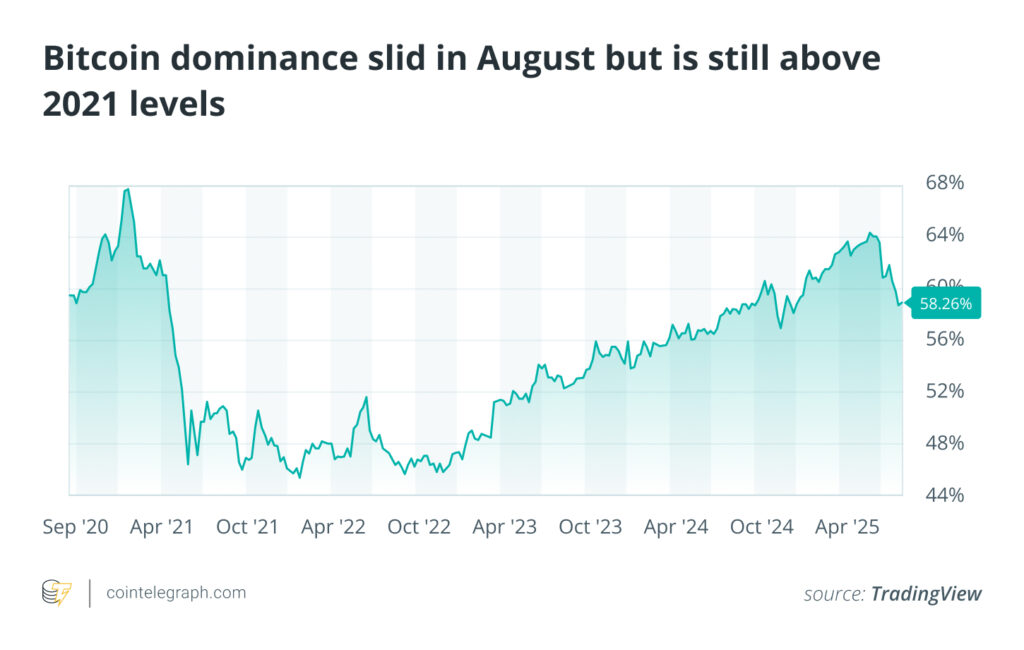

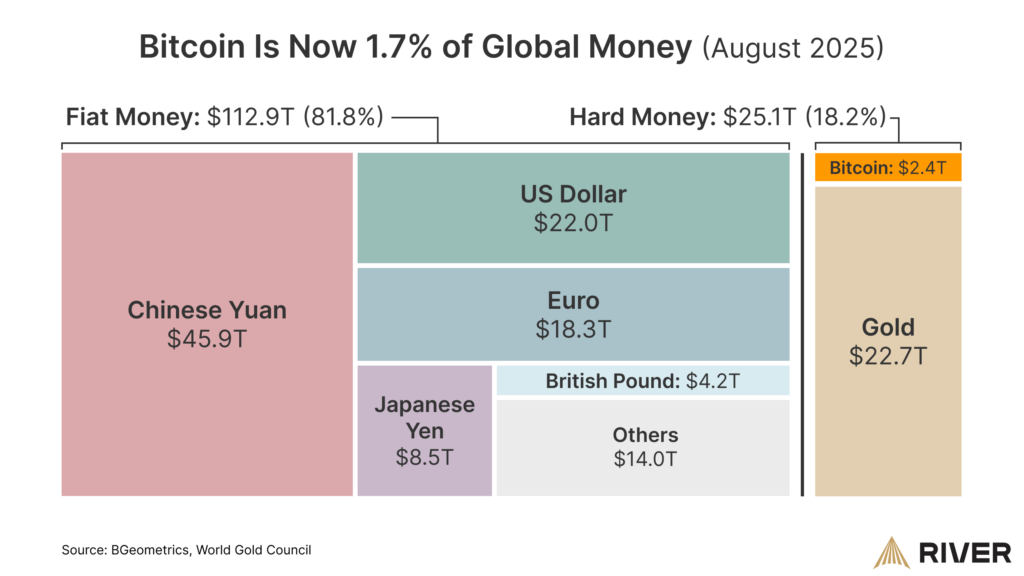

Bitcoin’s Growing Share of Global Money Supply

Bitcoin reached a significant milestone by comprising 1.7% of the global money supply in August 2025. This calculation compares Bitcoin’s $2.4 trillion market capitalization against $112.9 trillion in fiat currencies and $25.1 trillion in gold.

The achievement reflects 16 years of growth against traditional monetary systems. Central bank money printing continues driving investors toward hard money alternatives, benefiting both Bitcoin and Ethereum.

Ethereum’s Tech Stock Alignment

Ethereum demonstrates a stronger correlation with technology stocks compared to Bitcoin, with correlation coefficients of 0.7 with the DAX and 0.77 with the Nasdaq. This alignment positions Ethereum more like a tech stock than a traditional store of value asset.

The correlation suggests Ethereum responds more sensitively to factors affecting technology companies and growth stocks. This relationship has implications for portfolio diversification and risk management strategies.

Cross-Market Trading Patterns

Long-time Bitcoin holders redirected funds toward Ethereum, with one whale selling 18,142 BTC worth $2.04 billion and reinvesting significantly in ETH. A total of 416,598 ETH worth $1.98 billion was acquired, with 275,500 ETH valued at $1.3 billion subsequently staked.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.