Fed Rate Cut: U.S. Lowers Rates by 0.25 Points

The U.S. Fed cut interest rates by 0.25 percentage points, a move that instantly caught global attention. Rates now stand lower, and this shift is more than just numbers on a chart. It shapes how we borrow, invest, and even save.

When the Fed acts, it sets the tone for the entire economy. Cheaper credit can encourage spending and business growth. At the same time, it can spark concerns about inflation and financial stability. We cannot ignore the fact that every household and company feels this impact in some way.

This decision comes at a critical moment. Inflation is cooling, but uncertainty about future growth remains. Global trade, energy prices, and shifting investor confidence all play a role. By cutting rates, the Fed aims to balance growth with caution.

Let’s break down why the rate cut matters, how markets are reacting, and what it means for us in daily life. The goal is to make sense of a policy move that reaches far beyond Wall Street.

Background: Why the Fed Cut Rates?

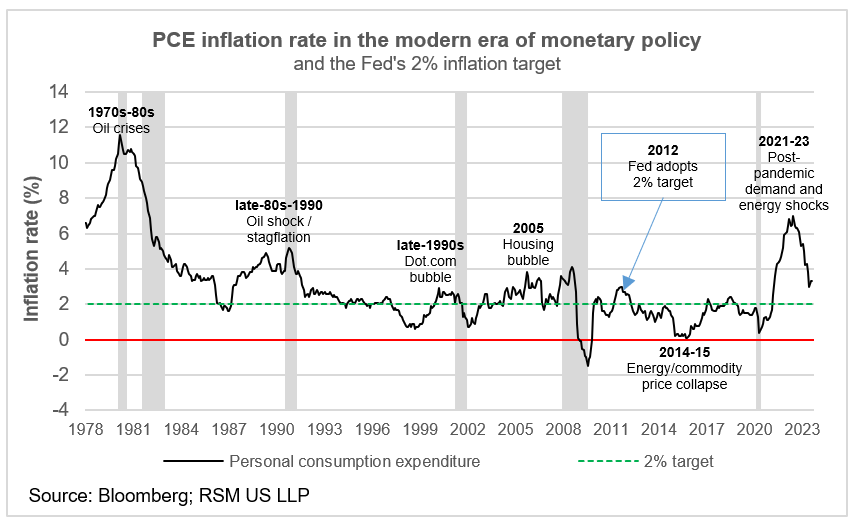

Inflation has eased but remains above the Fed’s 2% goal. Job growth has slowed, and some hiring indicators show weakness. Policymakers called attention to increased downside risks to employment. Those signs pushed the Federal Open Market Committee to shift priorities toward keeping growth intact. The Fed’s statement noted elevated uncertainty in the outlook and said downside risks to jobs have risen.

Fed Rate: Key Details of the Decision

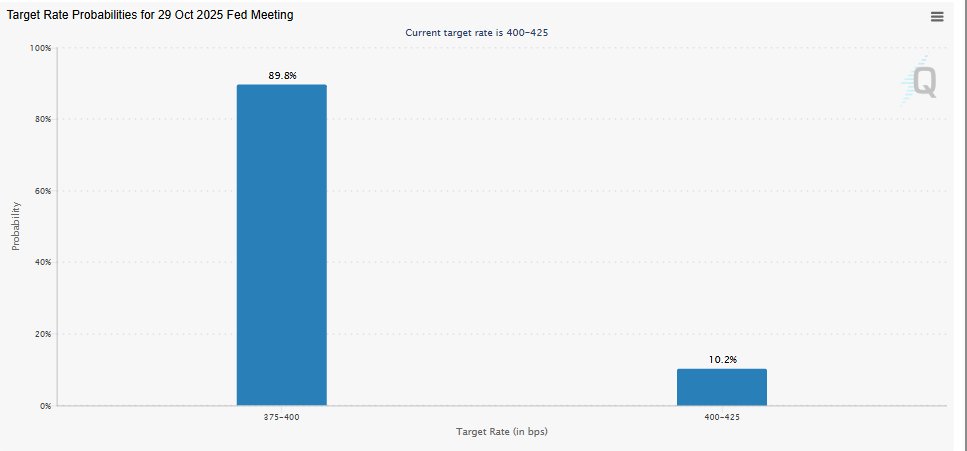

The Fed cut the target federal funds rate by 25 basis points. The new range is 4.00%-4.25%. Policymakers also projected further easing, with dots showing additional quarter-point cuts this year. Fed Chair Jerome Powell spoke at the press conference and stressed caution about automatically assuming more cuts. One member dissented, calling for a larger cut. The official FOMC statement and Powell’s remarks explain the technical basis for the move.

Immediate Market Reaction

Markets moved fast after the announcement. Stocks hit new highs in some sessions, though trading was choppy. U.S. Treasury yields shifted, with short-term yields falling and some longer-dated yields rising. The dollar gained versus several peers. Traders said the cut signaled the start of an easing cycle and also left room for debate about how fast further cuts will follow.

Impact on Borrowing and Lending

A 25-basis-point cut lowers the cost of short-term bank funding. Lenders may pass some of the savings to consumers. Mortgage rates could ease, but not by the full quarter point immediately. Many long-term rates depend on bond markets and inflation expectations. Auto loans, business loans, and some adjustable-rate debt will likely see modest declines. Still, real borrowing costs will depend on how fast the Fed follows up with more cuts.

Effect on Consumers and Households

Cheap credit helps those seeking loans. Homebuyers with adjustable-rate mortgages may notice lower monthly payments over time. Small reductions in loan rates can free up cash for spending. But savers and retirees face lower returns on bank deposits and short-term investments. The balance between cheaper loans and lower savings income will shape household budgets over the next year.

Business and Investment Consequences

Lower rates often nudge firms to borrow and hire. That can lift capital spending and support hiring in the medium term. Sectors that rely on financing, like real estate and construction, typically benefit. Tech and growth stocks may see renewed interest because future earnings are worth more at lower discount rates. However, banks can see narrower net interest margins. Companies with heavy debt may breathe easier, but firms tied to consumer spending will still depend on demand.

Broader Economic Trade-offs

A cut aims to slow a slide toward recession. It can bolster confidence and spending. Yet easing also risks rekindling inflation if demand rises too fast. The Fed must balance those outcomes. The committee’s projections suggest a path of gradual cuts rather than aggressive easing. That approach tries to support jobs while keeping inflation anchored. Observers caution that policy errors could either choke off growth or let inflation resurge.

Global Repercussions

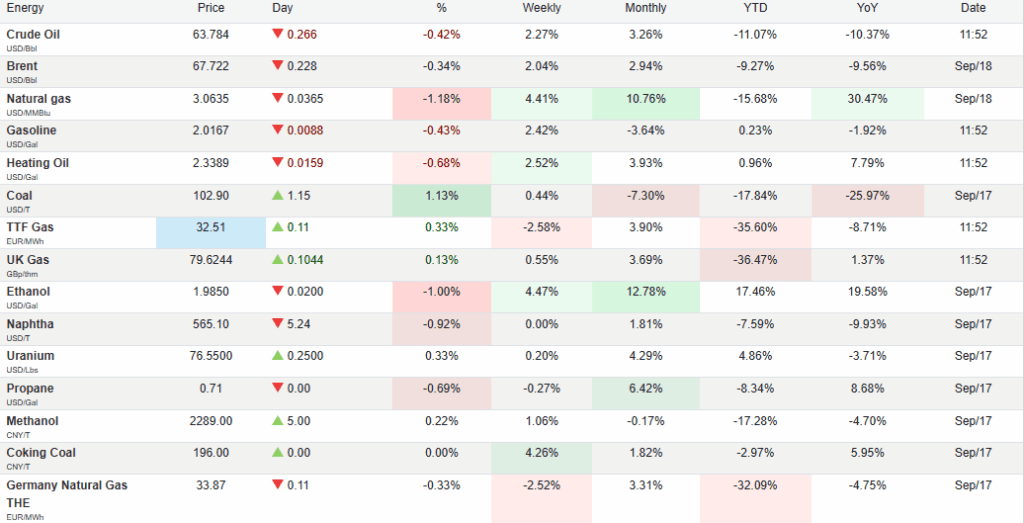

A U.S. rate cut changes global capital flows. A softer U.S. rate tends to weaken the dollar over time, though short-term currency moves can be mixed. Emerging markets may see relief in financing costs if global rates ease. Central banks abroad will watch closely. Some may follow with a looser policy to avoid currency gains that harm exports. Commodity prices also react, with oil and gold reflecting shifting demand and safe-haven flows.

What Analysts and Economists are Saying?

Views are split among experts. Some see the move as timely and modest. Others warn the Fed may have acted too late or too little. Major banks updated forecasts to include more cuts later in the year. Analysts point to labor market data and inflation readings as key triggers for future decisions. The consensus leans toward more easing, but timing and size remain uncertain.

Outlook: What Comes Next?

The Fed signaled additional cuts this year in its projections. Market odds also moved to favor more easing at upcoming meetings. Watch inflation readings, payroll reports, and consumer spending. If jobs weaken further, the Fed may speed up cuts. If inflation heats up again, the Fed could pause. Investors should expect volatility as forecasts and data evolve.

Practical Takeaways for Individuals

Borrowers may find slightly cheaper loans soon, so it’s smart to shop around for mortgage and refinance offers. Savers should review cash positions and consider laddering deposits or using diversified income strategies. Businesses may need to reassess financing plans and capital projects in light of changing rates.

At the same time, investors can use AI stock research tools to track market shifts and uncover new opportunities. Keeping an eye on Fed updates and high-frequency data will help in making timely decisions.

Final Words

The Fed’s 0.25-point rate cut is more than a technical move. It signals a cautious shift toward supporting growth while watching inflation closely. For consumers, it means slightly cheaper loans; for businesses, it offers easier access to capital. For markets, it sets the tone for volatility and new opportunities.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.