Federal Bank India gets Boost as Blackstone Affiliate acquires 9.99% Stake

On 24 October 2025, the private-equity giant Blackstone Inc. announced it would acquire a 9.99 % stake in India’s mid-sized lender Federal Bank Ltd., via its affiliate Asia II Topco XIII. The deal, valued at about ₹6,196 crore, marks a major vote of confidence in the Indian banking sector.

For Federal Bank, the agreement opens the door to new capital, global expertise, and enhanced market visibility. For investors, it reinforces the growing appeal of Indian banks as destinations for big-ticket foreign investment. The timing is significant: India’s credit demand is rising, fintech adoption is accelerating, and regulatory reforms are making the landscape more open.

This move may reshape the future of Federal Bank’s growth path. It signals not just a minority share purchase, but a potential strategic pivot. In the sections ahead, let’s unpack the deal’s details, the bank’s profile, and what this means for India’s banking story.

Federal Bank India Deal Details, Context, and Implications

About the deal

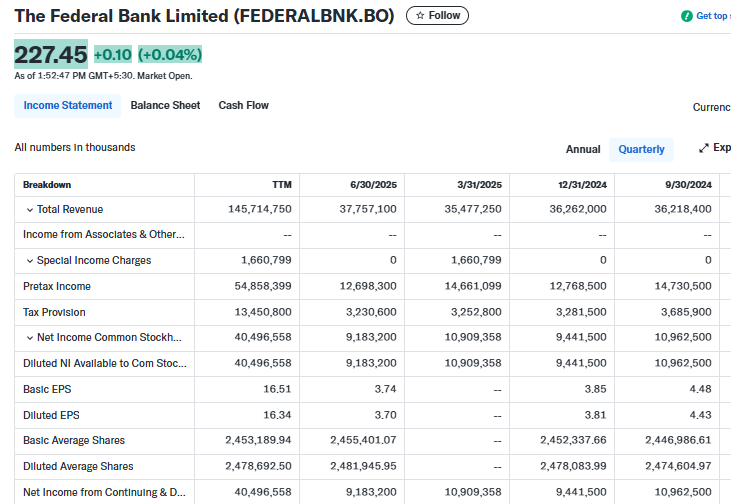

On 24 October 2025, Federal Bank’s board approved the sale of up to 9.99% of the bank to a Blackstone affiliate, Asia II Topco XIII Pte. Ltd. The transaction was structured as a preferential issue of warrants and equity. The headline value reported is about ₹6,196.5 crore (roughly $705 million).

The warrants are priced so that, after conversion, Blackstone would hold the near-10% stake. The share issuance and the right to nominate a non-executive director are subject to shareholder and regulatory approvals. Federal Bank said the board cleared the proposal at a meeting on October 24.

How will the Deal be Executed?

The transaction uses a private placement route. The bank will issue warrants that convert into equity shares. Each warrant gives the investor the right to take one fully paid equity share. The conversion mechanics and timing need approval from shareholders at an extraordinary general meeting.

Federal Bank announced that an EGM is planned for 19 November 2025 to approve the preferential issue and the board nomination. Regulators such as the Reserve Bank of India and competition authorities may also need to sign off.

Federal Bank’s Profile and Recent Performance

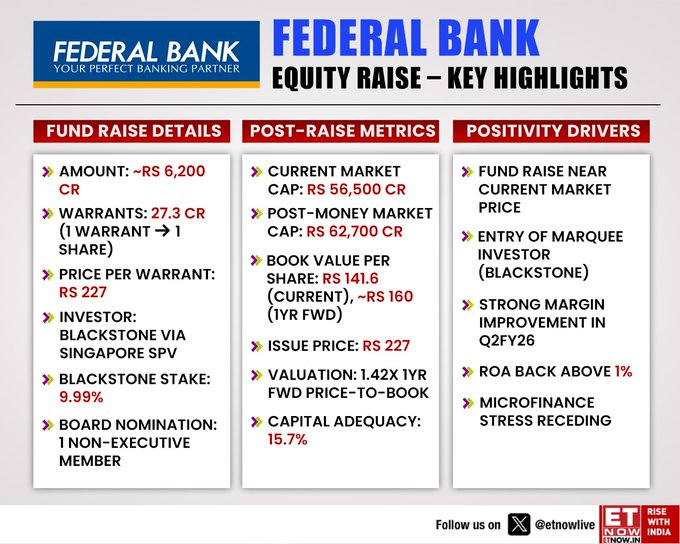

Federal Bank is a mid-sized private sector lender headquartered in Kochi. The bank serves retail, corporate, and NRI customers. Its loan book stands in the range of multiple lakh crore rupees, and it has focused on digital channels and retail franchises in recent years.

In the September 2025 quarter, the bank reported pressure on treasury income and higher provisions, which contributed to a year-on-year dip in net profit. The Blackstone deal arrives as the bank seeks to strengthen capital and support growth plans.

Market Reaction and Investor Views

Markets reacted calmly but positively to the announcement. Federal Bank shares rose on the news, with intraday gains reported in the immediate session after the board decision. Trading volumes expanded, reflecting renewed investor curiosity about private equity backing.

Analysts noted that a marquee investor like Blackstone can improve visibility and valuation multiples. The private equity entry also prompted questions about future strategic moves and corporate governance changes.

Why is Blackstone Interested?

Blackstone’s pursuit of the stake aligns with a broader push by global investors into Indian financial services. The firm has been actively raising Asian capital and targeting sectors with secular growth.

Indian banks are attractive for several reasons: rising retail credit demand, improving digital adoption, and ongoing consolidation in the sector. For Blackstone, a minority stake through warrants gives optionality. The investor can benefit from upside while remaining within regulatory thresholds for foreign holdings in banks.

Strategic Implications for Federal Bank

The capital infusion will boost the bank’s capital base. That support can help fund loan growth and digital investments. A high-profile investor also brings global governance norms. The right to nominate a non-executive director may add expertise to the board. That person could help shape risk management, digital strategy, or capital allocation.

The deal may also open pathways for partnerships, including co-lending or syndicated platforms. Still, the bank must balance outside influence while protecting operational independence.

Regulatory and Governance Considerations

Foreign investment in Indian banks is regulated. The Reserve Bank of India and other authorities review significant share purchases and preferential issues. Approvals will hinge on compliance with foreign ownership caps and fit-and-proper assessments for any nominated directors.

Shareholder approval is also required because the issue is preferential and could dilute existing holders. The planned EGM on 19 November 2025 will be the first formal step in that approval chain. Investors will watch closely for any regulatory conditions attached to final clearance.

Wider Market Context

This transaction forms part of a larger wave of private capital moving into Indian banks during 2025. Several large cross-border and private equity deals have reshaped the landscape this year. The Federal Bank agreement follows other high-profile investments and consolidations that signal investor confidence in India’s retail credit story and digital transformation. For mid-sized banks, the trend offers both opportunity and pressure to scale quickly and meet higher governance standards.

Risks and Caveats

The deal is not final until regulatory and shareholder approvals arrive. Warrant issuance introduces timing risk around conversion. Macroeconomic conditions and interest-rate trends can affect the bank’s asset quality and lending margins. Integration of any strategic inputs from the investor will take time. Market valuations can swing, so early gains in share price are not guaranteed to persist. Finally, dilution concerns may unsettle some minority shareholders until the full terms are visible.

What to Watch Next?

Key milestones to track include the EGM on 19 November 2025, formal filings to regulators, and any further details on the conversion timeline for warrants. Watch for the identity and background of the nominated director, if confirmed. Also, observe quarter-on-quarter operating metrics from Federal Bank to see how it leverages the capital. Analysts and investors may use tools like an AI stock research to model dilution impact and long-term earnings per share scenarios.

Bottom Line

The Blackstone affiliate’s planned 9.99% investment marks a notable endorsement of Federal Bank and India’s private banking sector. The deal offers capital and potential governance uplift. The final outcome will depend on shareholder votes and regulatory clearance. If approved, the transaction could reshape Federal Bank’s strategic path and deepen foreign investor presence in India’s banking system.

Frequently Asked Questions (FAQs)

On October 24, 2025, Blackstone bought 9.99% of Federal Bank to invest in India’s growing banking sector and benefit from the bank’s strong digital progress.

On October 24, 2025, Blackstone invested about ₹6,196 crore to buy a 9.99% stake in Federal Bank, showing trust in India’s private banking market.

The deal increases confidence in Federal Bank. It may bring better global support, new capital, and help the bank grow stronger in the future.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.