Federal Bank Share: Analysts Hike Target; Jhunjhunwala, Zerodha Likely to Gain

As of 27 October 2025, the shares of Federal Bank are drawing strong attention. Analysts have raised their price targets significantly. One firm nudged its recommendation from “Hold” to “Buy” and now projects a target of around ₹266 per share. Behind this surge lies the bank’s planned capital raise of about ₹6,200 crore via a preferential warrant issue to a major PE firm. On top of that, big names like the Jhunjhunwala family and the founders of Zerodha hold stakes in the bank, which adds weight.

Let’s unpack why analysts are upbeat. We’ll explore how the bank’s performance is shaping up. We’ll also examine what this means for large shareholders and what risks remain if things go off track.

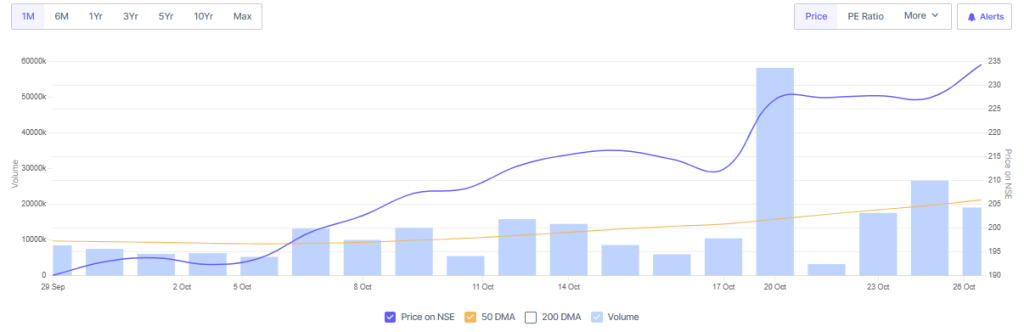

Federal Bank Recent Share Price Movement

As of 27 October 2025, Federal Bank shares trade at an elevated interest. The stock jumped after the board approved a preferential warrant issue to a Blackstone affiliate on 24 October 2025. This deal and the bank’s quarterly numbers pushed the price to multi-month highs. Trading volumes rose around the announcement day.

The stock beat some peers on short-term returns. Institutional flows also picked up after the Blackstone news. Short-term momentum looks strong. Long-term holders show patience. Retail traders are watching support and resistance levels closely.

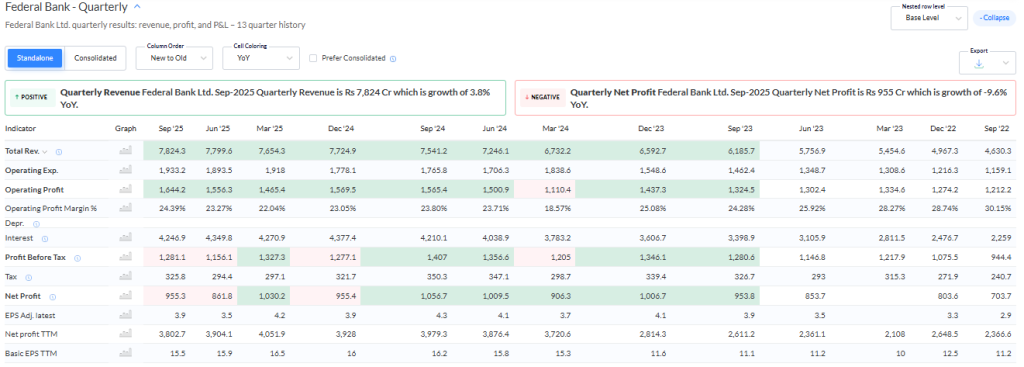

Q2 Financial Performance Highlights

Federal Bank reported quarterly results for the period ended 30 September 2025. Net interest income (NII) hit a record high of about ₹2,495 crore. Net profit stood at roughly ₹955 crore. This marked a quarter-on-quarter rise of around 10.8% but a year-on-year dip near 9.6%. Total deposits rose, and loan books showed steady growth.

The CASA ratio improved to about 31.01%. Asset quality moved in the right direction. Gross non-performing assets eased to near 1.83% and net NPAs fell below 0.5%. Management cited better core income and stable credit trends as positives. Margin expansion and higher fee income helped offset lower treasury gains. These results gave analysts comfort despite the yearly profit drop.

Analysts’ Upgraded Ratings and Target Prices

Several brokerages refreshed their outlook after the quarterly print and the Blackstone transaction. Analysts raised target prices and shifted tone toward buy in some reports. The key reasons were higher core earnings, stronger CASA, and a sizable capital infusion that reduces dilution risk. Some firms reran models using real-time inputs.

A few also used an AI stock research analysis tool to refine estimates. Consensus targets vary across houses. The implied upside from current levels looks meaningful for some analysts. Caution remains on the execution and timing of warrant conversion. Readers should check the latest broker notes for exact targets and timeframes.

Major investors: Jhunjhunwala Family and Zerodha Founders

High-profile holders add credibility. Rekha Rakesh Jhunjhunwala, representing the Jhunjhunwala family, held about 2.42% of the bank at the end of September 2025. The stake gave the stock an emotional support level among some investors. Zerodha founders and other retail-facing founders also appear among notable shareholders in recent filings.

Large backers gain when a PE firm like Blackstone shows interest. The Blackstone deal would, on conversion, make the firm a near-10% shareholder. That changes the ownership mix. It also brings the potential for board representation and strategic guidance. Institutional backing tends to attract more institutional interest if governance and performance stay on track.

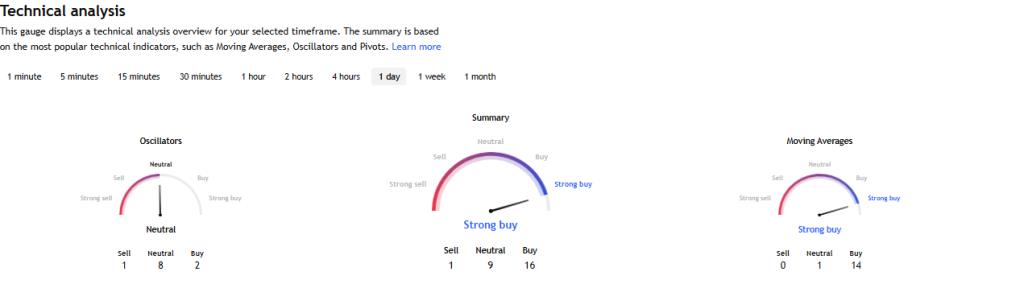

Technical and Market Outlook

Technically, the stock broke some short-term resistance after the October announcements. Moving averages point to a bullish cross in the near term. Relative strength indicators show momentum, but some readings edge toward overbought. Support levels lie near the conversion price and recent consolidation zones.

Volume spikes around corporate action dates confirm buyer conviction. Foreign institutional investors and domestic institutions have rotated into the stock at times. Short sellers reduced their exposure after the board approval. For traders, buying on minor dips could be attractive. For investors, holding through one business cycle and watching capital deployment plans is prudent.

Risks and Challenges

The story has risks. Warrant conversion timing could dilute equity if done at low volumes. RBI and regulatory approvals are required for large stake sales. Macro shifts, such as a sudden rise in interest rates, can hit margins. Treasury income can swing year to year and affect headline profit. Credit cycles may tighten and raise provisions. Blackstone’s future intentions for board influence or strategic direction could bring change. These factors can alter valuations quickly.

Bottom Line

Federal Bank now sits at an important inflection. Strong core income and a ₹6,196.5 crore preferential warrant deal with Blackstone are central to the outlook. Improved CASA and record NII support the positive tone. High-profile shareholders add weight, while analysts raise targets on clearer capital buffers.

Still, conversion mechanics, regulatory approvals, and macro risks require close tracking. Monitor official filings and broker notes dated 24-27 October 2025 for the most accurate updates.

Frequently Asked Questions (FAQs)

The Federal Bank share rose after the October 24, 2025 deal with Blackstone worth ₹6,196 crore and stronger Q2 FY26 financial performance.

Analysts raised the target price to around ₹250-₹270 on October 27, 2025, due to better profits, strong deposits, and improved loan growth.

As of September 2025, key investors include Rekha Rakesh Jhunjhunwala, Zerodha founders, and Blackstone, which plans to hold about a 10% stake after approval.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.