Figma Earnings Report: Q2 Revenue Jump Pushes Figma Stock Into Focus

Figma stock has become the center of discussion in financial markets after the company posted its second-quarter earnings. The design platform, known for reshaping collaboration in creative teams, announced a 41 percent revenue jump to $250 million and an adjusted net profit of $11.5 million. These results underline how digital design tools are becoming essential in modern businesses.

But while the numbers highlight growth, the reaction of the market was not entirely positive. Post-market trading saw Figma stock drop nearly 10 percent, raising questions about valuation, forward guidance, and the long-term growth story. Let’s explore every factor that investors and analysts are weighing after this crucial quarter.

Strong Revenue Growth Signals Market Demand

One of the biggest takeaways from Q2 earnings is the revenue surge. At $250 million, this represents a remarkable 41 percent year-over-year growth. Such numbers show how Figma is becoming a must-have platform for both startups and large enterprises.

You can have a detailed look at the official Figma Second Quarter 2025 Financial Results.

Companies are investing heavily in user experience and design collaboration, and Figma has positioned itself as the leader in this space. Its cloud-first architecture and simple user interface are attracting teams migrating from legacy tools.

@AlphaSenseInc shared on X: “Figma’s Q2 results highlight how creative collaboration tools are seeing exceptional demand.”

This shows that Figma stock is not just riding a trend but benefiting from structural shifts in how teams collaborate digitally.

Why Did Figma Stock Fall After Earnings?

With revenue and profit beating expectations, many were surprised to see Figma stock fall. The reason lies in forward guidance. Management set a full-year revenue forecast of $1.021 billion to $1.025 billion, which some analysts considered conservative.

@Finsee_main tweeted: “Good Q2 numbers but cautious full year forecast weighs on Figma stock momentum.”

Investors expected stronger guidance, and when it didn’t arrive, many pulled back, leading to a decline in share price despite strong Q2 growth. This highlights the market’s sensitivity not just to current results but to future outlooks.

The Role of AI in Driving Figma’s Growth

AI is becoming one of the biggest catalysts for Figma stock. The company introduced AI-powered tools that enhance design workflows, such as smart layout suggestions, auto-generated components, and predictive design elements. These innovations reduce time spent on repetitive tasks and allow designers to focus on creativity.

This AI expansion positions Figma not just as a design tool but as a productivity enhancer, which increases its appeal to enterprises looking to scale. Analysts believe these innovations will play a crucial role in sustaining revenue growth in the coming quarters.

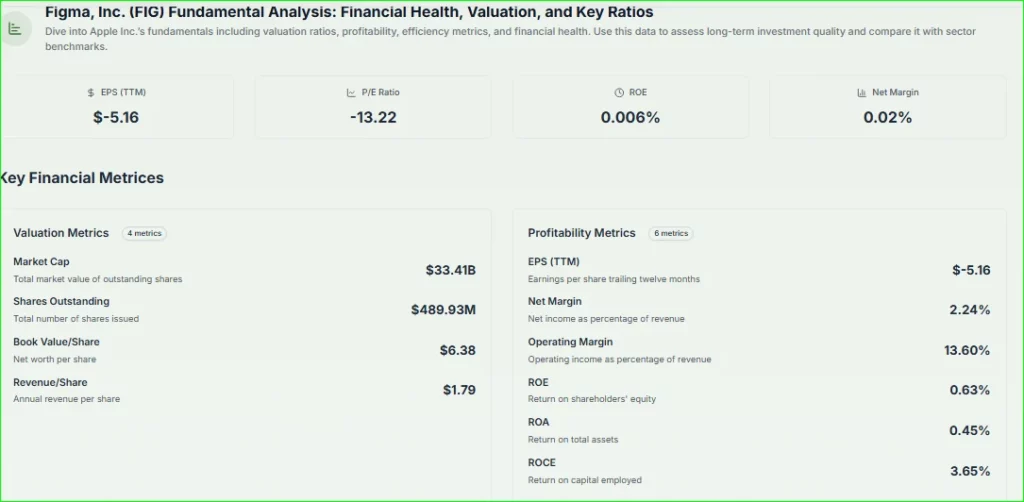

Profitability Brings a New Dimension for Figma Stock

Another highlight was profitability. Figma reported an adjusted net profit of $11.5 million, a sign that the company is moving beyond the high-growth but high-loss phase typical of SaaS firms.

As @Eliane199455 noted: “Finally seeing profit alongside growth in Figma stock is a positive signal.”

This profitability gives investors more confidence, particularly at a time when many SaaS peers are struggling with high costs and weak margins. It could also help stabilize valuation concerns in the medium term.

Market Risks and Competitive Challenges

While the outlook is promising, Figma stock faces risks. Competitors such as Adobe XD, Sketch, and new AI-powered platforms continue to fight for market share. In addition, economic uncertainty and tighter budgets for enterprise software could slow down adoption.

Investors will be watching how Figma balances innovation with customer retention. Expansion within existing enterprise accounts is key, as upselling and seat growth often drive SaaS profitability.

Investor Sentiment and Valuation Debate

Another reason for the mixed reaction is valuation. Figma’s stock trades at high multiples compared to peers. While rapid growth justifies premium pricing, any slowdown or cautious guidance immediately pressures share prices.

As CoinCentral reported, “Even with 41 percent Q2 revenue growth, Figma stock dipped on valuation concerns.”

This tug of war between growth optimism and valuation skepticism is likely to continue in the short term.

Analyst Views Split on Figma Stock

Wall Street analysts remain divided. Some praise the company’s growth story and profitability milestone, while others emphasize caution about competition and guidance.

@EagleInvestors summarized the situation on X: “Strong earnings event but tempered guidance leaves Figma stock sideways near-term.”

This reflects a broader sentiment that while Q2 results were impressive, the next chapters of growth need to be clearer before stock momentum returns.

Key Drivers to Watch Going Forward

For investors monitoring Figma stock, several factors will determine its trajectory:

- AI adoption: The Success of AI-powered design features could drive stronger enterprise spend.

- Customer expansion: Retaining existing accounts while upselling premium features.

- Profitability trends: Maintaining earnings while scaling globally.

- Market conditions: Broader SaaS spending trends could impact future results.

If Figma can manage these well, its stock could recover from the short-term dip and strengthen its long-term investment case.

Figma Stock and the Bigger Picture

Beyond just one quarter, Figma represents a broader shift in digital collaboration tools. Its success highlights how businesses are increasingly relying on platforms that merge design, AI, and real-time collaboration. Investors see it not only as a design company but as a future leader in productivity software.

What drove Figma stock higher?

Figma Q2 reported 41 percent revenue growth to $250 million plus $11.5 million in profit. Strong enterprise adoption and AI features boosted confidence, though conservative guidance weighed on investor sentiment.

Conclusion: Figma Stock After a Defining Quarter

In conclusion, Figma stock is at a crossroads. The company delivered outstanding Q2 numbers, highlighted by strong revenue growth and its first major step into profitability. AI innovations add another layer of long-term potential. However, conservative guidance and valuation concerns led to an immediate market pullback.

Investors now face a decision: treat Figma stock as a long-term growth opportunity fueled by AI and enterprise adoption, or wait for more clarity on guidance and competition. Regardless, one thing is certain: Figma has secured its place as a leading force in design collaboration, and its performance will remain closely watched in the quarters ahead.

FAQ’S

Figma stock gained attention due to a 41 percent revenue jump to $250 million and its first major profitability milestone.

Yes, Figma posted an adjusted net profit of $11.5 million, signaling growth with profitability.

Despite strong results, Figma stock fell nearly 10 percent post-market due to cautious full-year guidance.

AI-powered design tools and predictive features are boosting adoption and making Figma a more attractive platform.

Analysts see potential due to strong enterprise adoption and AI integration, but valuation and competition remain key risks.

Disclaimer

This is for informational purposes only and does not constitute financial advice. Always do your research.