Financial Virtual Assistants: The Next Frontier of AI in Finance

AI is changing finance fast. An AI-powered financial virtual assistant can filter data, answer questions, and automate key tasks. Enterprises and investment firms want speed and accuracy. Meyka builds enterprise-grade assistants that bring AI into core finance workflows.

This blog explains what these assistants do, why they matter, and how Meyka helps firms scale AI with security and real business value.

The Rise of AI-Powered Financial Virtual Assistants in Modern Finance

An AI-powered financial virtual assistant is a software agent that uses machine learning, natural language processing, and business rules to support finance teams. It can answer questions, run reports, reconcile accounts, flag anomalies, and surface market insights in seconds.

Firms use them to reduce manual work, speed decisions, and maintain audit trails.

Why are financial virtual assistants gaining attention now?

Data volumes grew, decision windows shrank, and demand for real-time insights rose. Enterprises need tools that blend speed, accuracy, and governance. Financial virtual assistants deliver all three.

What do they typically do? They automate routine tasks like invoice matching, produce on-demand dashboards, and help analysts by summarizing reports or market moves. This frees human teams for high-value strategy and oversight.

How Meyka Is Leading the AI Transformation in Finance

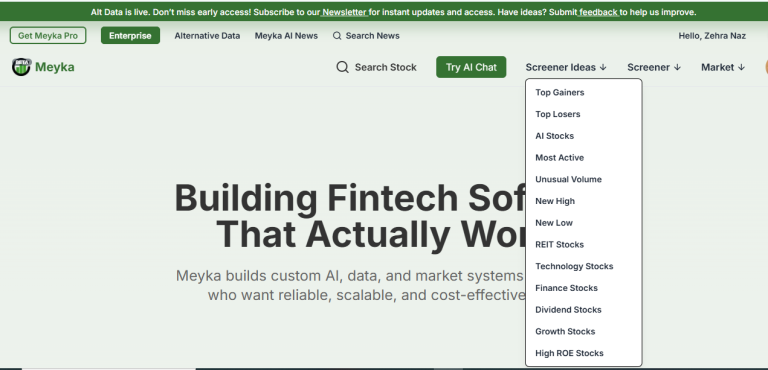

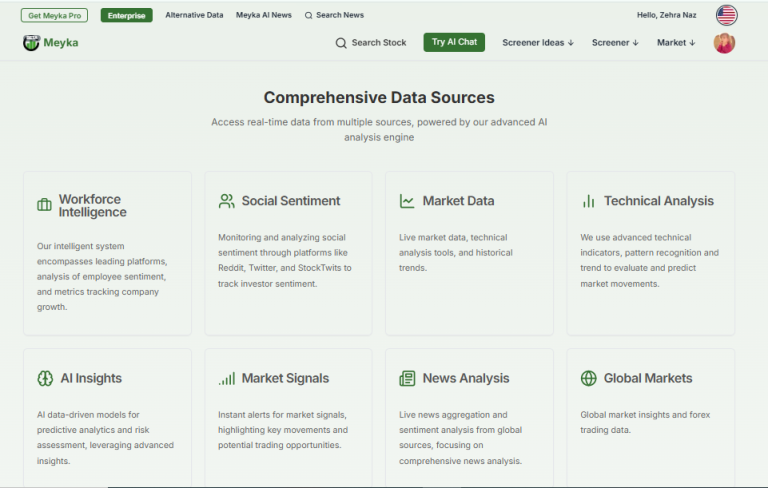

Meyka offers a secure, enterprise-ready platform that delivers custom AI assistants for financial teams. Meyka’s solutions combine a conversational interface, deep integrations, and configurable workflows.

The platform supports private deployments, enterprise authentication, and data governance frameworks required by banks and large firms.

Key strengths of Meyka’s approach include:

- Enterprise-grade architecture, tuned for security and scale.

- Custom AI integrations, meaning assistants are trained on firm data and policies.

- Secure chat interface that fits into existing workflows and tools.

Meyka’s About and Enterprise pages emphasize partnerships, tailored deployments, and a practical focus: deploy fast, protect data, and drive measurable ROI.

Key Benefits of Using an AI-Powered Financial Virtual Assistant for Enterprises

Adopting an AI-powered financial virtual assistant delivers immediate and lasting benefits:

- Cost efficiency and scalability: Automate repetitive work, reduce cycle times, and scale support without linear headcount increases.

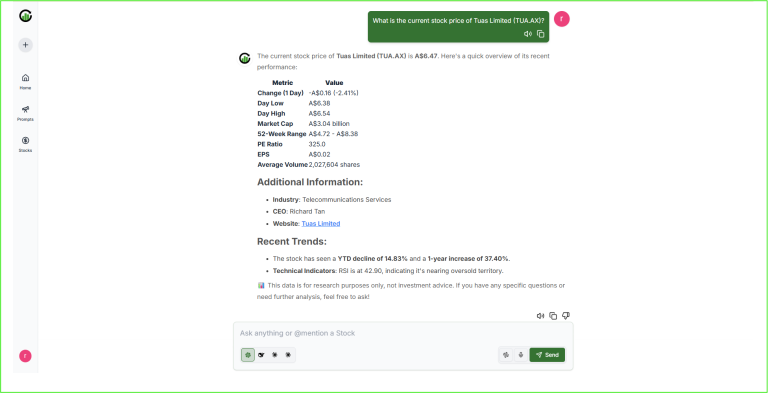

- Real-time market intelligence: Get instant answers about portfolio exposure, FX movements, or credit lines.

- Automated analysis and forecasting: Produce scenario runs and early warning signals for cash flow or credit stress.

- Enhanced customer and analyst service: Faster responses, consistent answers, and 24/7 availability for client queries.

Meyka helps firms manage workflows, predict risks, and automate reporting. That reduces errors and improves the speed of execution across treasury, investor relations, and accounting teams.

Can AI-powered assistants replace human analysts? No. They augment analysts. Humans set strategy, verify models, and make judgment calls. AI assistants handle data, surface insights, and free experts for higher-value work.

Opportunities for Investors and Financial Institutions

Investors and institutions benefit in several ways. AI assistants help portfolio managers tighten decision cycles, run faster backtests, and access consolidated data from multiple custodians. Wealth managers use assistants to generate client-ready summaries, model scenarios, and screen for compliance flags.

Meyka’s integrations connect to analytics, trading systems, and data feeds, enabling seamless workflows.

For investment teams focused on equity or fixed income research, AI tools can accelerate pattern detection and signal generation. In that context, terms like AI Stock become relevant as models ingest market and company signals to support informed decisions.

Meyka’s Enterprise AI Features and Capabilities

Meyka’s platform fuses conversational UX with enterprise features:

- Custom AI development tailored to finance workflows.

- Real-time virtual assistance for CFOs, portfolio managers, and analysts.

- Integration with corporate databases, ERPs, and CRM systems to pull verified data on demand.

- Compliance and audit trails, ensuring every query and action is logged.

The Meyka chat page showcases how a conversation with an assistant can generate instant KPI summaries, exportable reports, or alerts tied to custom business rules. That speed is critical in markets where minute-by-minute information matters.

Why Enterprises Trust Meyka for AI-Powered Financial Virtual Assistants

Security and governance are key. Meyka emphasizes encryption, private deployments, and strict access controls suited to regulated financial environments. The company tailors AI behavior to match internal policies and compliance needs.

Meyka’s enterprise practice helps firms define scope, train models on approved data, and maintain long-term governance.

How does Meyka ensure data safety? Meyka uses secure APIs, encryption, and private model deployments. Enterprises keep control over data flow and can audit every action. Meyka’s implementation teams work closely with clients to align security and compliance controls with corporate standards.

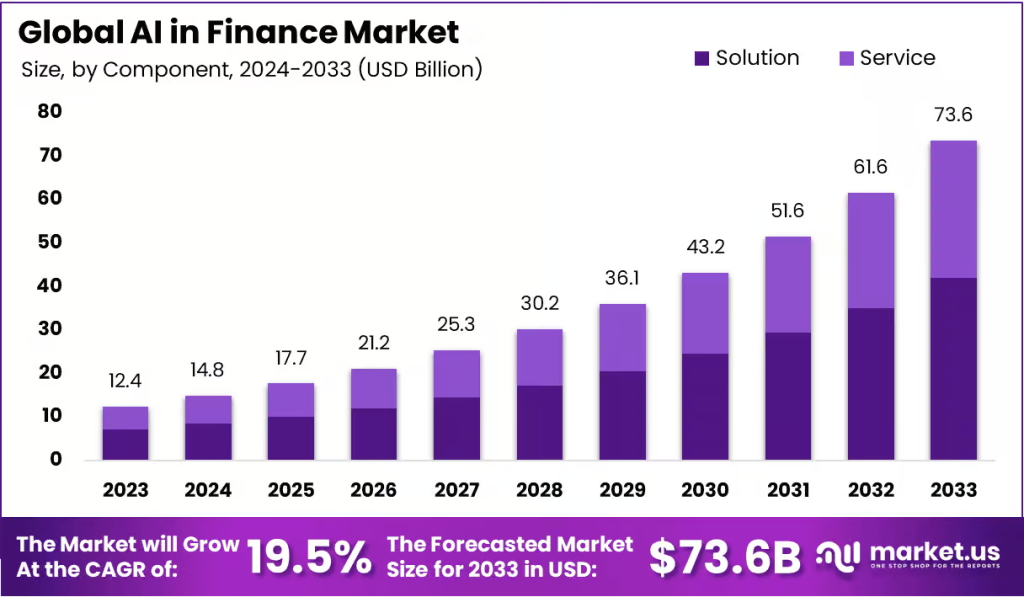

The Growing Market for AI-Powered Financial Solutions

Demand for AI in finance is rising across banks, asset managers, and corporate treasuries. Firms want faster research, better risk signals, and tools that scale. AI-driven virtual assistants are now a central part of digital transformation in finance, replacing manual lookups and slow reporting with instant, actionable answers.

Meyka positions itself as the partner that helps enterprises adopt AI quickly and responsibly. The platform supports rapid pilots, structured rollouts, and enterprise-grade scaling to thousands of users with role-based controls.

How do firms measure ROI? Typical metrics include reduced time-to-insight, lower costs per transaction, faster close cycles, and improved client response times. Meyka’s deployments focus on these measurable outcomes.

In investor analytics, solutions often pair with AI Stock Research tools to improve signal extraction and trend detection for institutional teams.

The Role of AI in Financial Analytics and Decision-Making

AI assists in areas such as:

- Predictive cash flow management to forecast liquidity needs.

- Automated reporting to generate regulatory or board-ready summaries.

- Market forecasting, to model scenarios and stress tests.

Data-driven models improve with scale. For investors, AI Stock Analysis can help interpret earnings signals, sentiment, and supply-chain risk. Meyka’s assistants bring these algorithms into a conversational layer, analysts ask for a scenario, the assistant runs it, and the result is presented with sources and assumptions.

How Meyka’s AI Empowers Businesses and Investors

Meyka’s virtual assistants help enterprises and investors in three pillars:

- Operational efficiency — automating reconciliation, reporting, and routine queries.

- Decision support — surfacing insights, scenarios, and risk indicators on demand.

- Client engagement — delivering faster, consistent responses that enhance customer experience.

Meyka’s approach combines human expertise with automated speed. Teams collaborate with the AI, using it to prepare briefings, flag anomalies, and speed reconciliations.

Real-World Applications and Industry Examples

Banks use Meyka for treasury automation and compliance checks. Asset managers deploy assistants to summarize research notes and track liquidity. Fintechs tap Meyka for customer support, KYC automation, and instant portfolio summaries. These applications reduce time spent on repetitive tasks and improve consistency across teams.

What makes Meyka different from other AI providers? Meyka focuses on enterprise fit: custom-built assistants, secure deployments, and finance-specific workflows that map to real business processes. The company pairs technical expertise with domain knowledge in finance for fast, safe adoption.

The Future of AI in Finance: What Enterprises Should Expect

Over the next five years, we expect:

- Deeper integration of AI assistants into core finance systems.

- Personalized assistants for CFOs, treasurers, and portfolio chiefs.

- Stronger governance frameworks and clearer regulatory guidance.

- Cross-technology linking, including blockchain for secure data provenance and automated settlement flows.

Meyka is positioned to support these trends, evolving its platform to meet demands for higher security, auditability, and enterprise control.

How to Partner with Meyka

Ready to modernize finance? Meyka offers enterprise consultations, custom development, and secure deployments. Learn more and schedule a demo at Meyka’s Contact Page. Meyka’s team guides organizations from pilot to production, ensuring alignment with risk, compliance, and business goals.

Visit Meyka’s Enterprise page to explore case studies and feature details, or request a tailored consultation to see how an AI-powered financial virtual assistant can transform your workflows.

Conclusion: Meyka, Powering the Future of Financial Intelligence

An AI-powered financial virtual assistant is not a nice-to-have; it is a strategic tool for efficiency, accuracy, and scale. Meyka delivers secure, customizable assistants that help enterprises and investors work smarter.

By combining intelligent automation, strong governance, and domain expertise, Meyka enables finance teams to focus on strategy, not data wrangling.

For firms that want to lead in the digital age, partnering with Meyka is a practical step toward higher productivity, better insights, and measurable ROI.

FAQ’S

A Financial Virtual Assistant is an AI-powered tool that helps users manage budgets, track spending, and make smarter financial decisions automatically.

They automate customer support, provide real-time insights, and enhance decision-making, making financial services faster and more personalized.

Yes, most use advanced encryption and AI security protocols to protect user data and ensure safe transactions.

Absolutely, companies use them to improve client engagement, reduce operational costs, and deliver 24/7 financial guidance.

They are expected to become smarter and more predictive, offering personalized investment advice and integrating deeply with banking ecosystems.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”