Firefly Expands Defense Tech Portfolio With $855 Million SciTec Acquisition

On October 5, 2025, Firefly Aerospace announced a bold move: it will acquire SciTec, a national security tech firm, for approximately $855 million. This deal marks a major shift for Firefly. They are no longer just a space launch company. They are entering the defense technology arena.

We see real value here. SciTec brings deep skills in missile warning, tracking, intelligence, and defense analytics. By combining Firefly’s space assets with these capabilities, they’ll offer more integrated, smart solutions for national security.

This acquisition isn’t just about growth. It’s about becoming a stronger partner to defense agencies. It signals that Firefly aims to span the gap between space services and high-end defense systems. We expect this move to reshape how we compete and how we support missions that keep nations safe.

Overview of Firefly Aerospace

Firefly Aerospace grew from small beginnings into a serious space company. The firm offers launch vehicles, in-space services, and lunar systems. Firefly listed on Nasdaq in 2025 and saw strong investor interest. The company has been moving from pure launch work into mission services and defense contracts. The October 5, 2025, deal for SciTec is part of that shift.

About SciTec

SciTec is an R&D firm that builds sensors, data systems, and defense software. The company focuses on missile warning, tracking, and space domain awareness. SciTec works with U.S. military programs and holds multiple contracts tied to missile-warning processing and remote sensing. The firm is employee-owned and keeps facilities near key defense customers. These assets add a strong software and analytics layer to any space provider.

Strategic Rationale Behind the Acquisition

Firefly bought SciTec to pair hardware with advanced software. Launchers and satellites create data. SciTec can turn that raw data into fast, usable intelligence. The deal adds low-latency processing, big-data handling, and AI tools for defense missions. Firefly gains both new products and deeper entry to military programs. This move aims to offer customers end-to-end services: from launch to the actionable insight that commanders need.

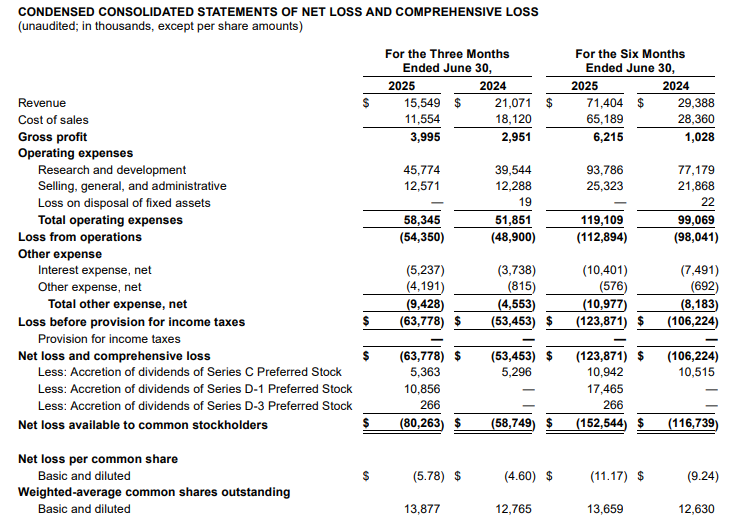

Financial and Operational Details

The deal is valued at about $855 million. Firefly will pay roughly $300 million in cash and the rest in stock. The transaction is expected to close by the end of 2025, pending approvals. SciTec will operate as a Firefly subsidiary and keep its leadership team. Recent filings show SciTec had meaningful revenue and won sizable Space Force work earlier in 2025, which adds predictable government revenue to Firefly’s books.

Impact on the U.S. Defense Tech Sector

The acquisition tightens the link between space launch firms and defense analytics. A company that launches satellites and also processes their data is more valuable to defense buyers. Firefly’s move puts it alongside firms that sell both hardware and software to national security customers. It may spur competitors to seek similar mergers. Policymakers and agencies will watch how integrated solutions change procurement and mission design.

Technological Synergies and Future Projects

SciTec’s sensor processing and target detection software will slot into Firefly’s existing services. Expect faster end-to-end tasking of satellites. That means quicker missile warning, improved space domain awareness, and stronger battlefield surveillance. The combined group can also bid on complex programs that require both launches and ground processing. This gives an edge for responsive missions. Partnerships with Space Force programs and NASA could expand. The marriage of launch capability and analytics could also enable new commercial offerings.

Market and Investor Perspective

Investors reacted to the deal with interest. Firefly’s post-IPO valuation rose earlier in 2025. Buying SciTec shows a push to lift long-term revenue and win more government contracts. Analysts will test how fast the companies can integrate. Some investors will view the move as a smart way to diversify revenue away from pure launch and into higher-margin software and services. For retail or institutional research, using an AI stock research analysis tool could help track changes in contract wins and revenue projections after the deal.

Challenges and Integration Risks

Merging two firms is not simple. Tech stacks may need heavy adaptation to work as one system. Culture and processes must align. Firefly has also had recent technical setbacks in rocket testing, which put extra pressure on execution. Regulatory review is needed because this deal touches national security systems. Data security and compliance are top concerns when moving sensitive defense processing into a larger corporate framework. If integration slows, expected synergies and contract wins could be delayed.

Wrap Up

The SciTec purchase on October 5, 2025, marks a clear step for Firefly. The company moves beyond launch to offer full mission solutions. If integration succeeds, Firefly could become a go-to provider for both launch and mission data services. Much will depend on execution, regulatory approvals, and how quickly the teams merge their tech. The deal also signals a wider trend: space firms are becoming data firms, and defense customers want both capabilities in one partner.

Frequently Asked Questions (FAQs)

Firefly announced on October 5, 2025, that it will buy SciTec for $855 million, including $300 million in cash and $555 million in Firefly stock.

The deal between Firefly and SciTec is expected to close by the end of 2025, after receiving all needed government and regulatory approvals.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.