FOMO Drives US Tech Stocks to ‘Stretched’ Levels, ECB Notes

US tech stocks have been on a wild run in 2025, rising faster than many experts expected. Investors are pouring money into big tech because they do not want to miss the next big rally. This fear of missing out, or FOMO, is now one of the strongest forces in the market. Even the European Central Bank (ECB) highlighted this trend in its latest financial stability review released in November 2025. The ECB warned that US tech valuations look “stretched” and may not fully match real company performance.

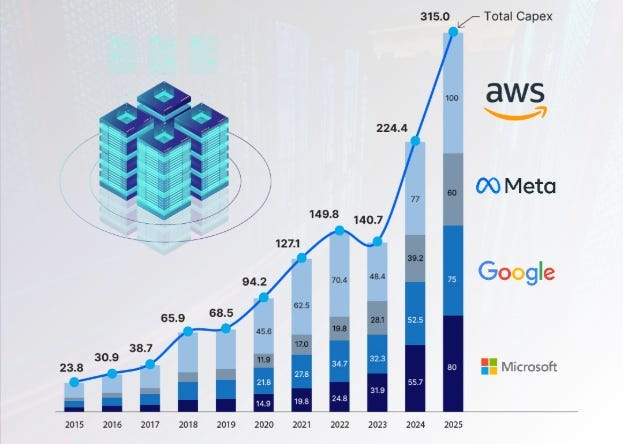

This warning comes at a time when AI stocks are hitting new highs almost every week. People see huge progress in AI chips, cloud tools, and automation. So they rush to buy shares, hoping for quick gains. But fast price growth also brings risk. When prices rise mainly because everyone else is buying, the market can become unstable.

This article looks at why FOMO is driving tech stocks so high, why the ECB is worried, and what investors should watch next.

ECB Flags “Stretched” Tech Prices and Why it Matters?

The European Central Bank named a key worry in its November 2025 Financial Stability Review. Large US tech stocks now trade at prices that look far ahead of current profits. The ECB warned that high prices driven by investor excitement could raise risks for financial stability. The bank noted that private markets and leveraged positions add to the danger if sentiment changes suddenly. The review was published on 17 November 2025.

How FOMO Pushes Shares Well Beyond Fundamentals?

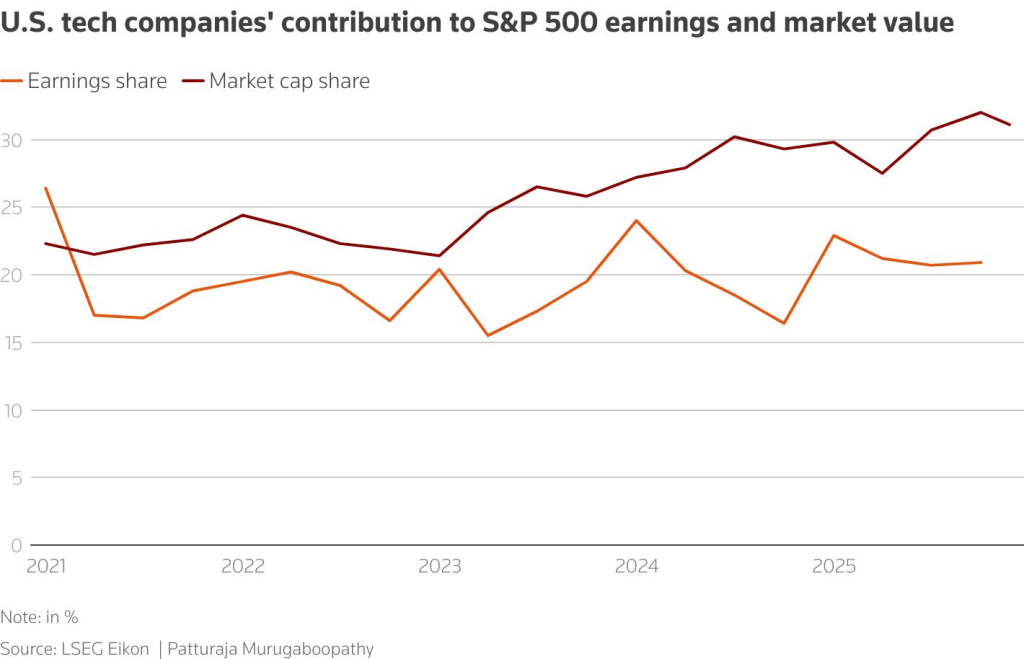

Fear of missing out now shapes many buying decisions. Retail traders and some funds buy momentum stocks on sight. Headlines about AI breakthroughs and big quarterly beats fuel more buying. Social channels amplify calls to “not miss the next AI winner.” This combination lifts demand fast. Prices can outpace earnings growth. That makes indexes more fragile to any bad news. Reuters data shows tech’s market share rising while its share of S&P 500 earnings has fallen in 2025. That gap hints at a valuation stretch.

AI Hype, Rate-Cut hopes, & The Earnings Backdrop

Artificial intelligence remains the main narrative. Big firms report rising AI revenue and new product launches. These stories support the idea of durable growth. At the same time, traders grew hopeful about future Fed rate cuts. Lower rates push investors toward growth stocks. Some companies continue to post strong numbers. Yet, much future profit is priced in already.

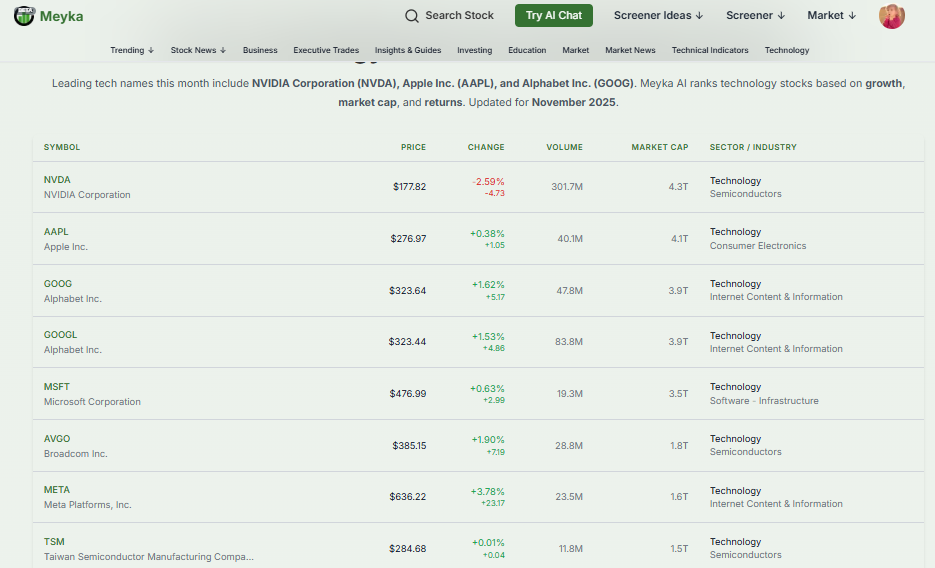

A handful of firms now carry outsized influence on market moves. Recent reports show mega-cap names surging on AI wins while others lag. Mention of specialized analytics is common; some investors even rely on an AI stock research analysis tool to spot trends and risks.

The Valuation Gap: Data and Danger Signals

Key valuation metrics look elevated. The Nasdaq’s forward P/E rose well above its ten-year average by late November 2025. Several high-flying names trade at full valuations relative to expected growth.

Reuters found that tech’s market cap share hit about 31.1% of the S&P 500 while their earnings share fell to near 20.8% in Q3 2025. That means prices may be buying future hopes more than current profits. History shows such gaps can shrink fast when expectations shift. Investors should note that stretched multiples raise the risk of sudden corrections.

Why Europe is Watching Closely?

A sharp fall in US tech could ripple into global markets. European funds hold large positions in US tech through ETFs and cross-listed shares. The ECB’s concern is that a US correction could reduce risk appetite in Europe. That might tighten credit conditions and hurt asset prices beyond equities. The ECB also flagged political and sovereign risks that could amplify market stress. For euro-area policymakers, the timing and size of any US pullback matter for financial stability.

Market Structures that Could Worsen a Drop?

High concentration in a few mega-cap stocks increases systemic sensitivity. Passive funds that mirror indexes may force selling if prices collapse. Leveraged vehicles and some private-market positions can amplify moves. Short-term traders chasing momentum add volatility.

If a major tech name posts a weak quarter or guidance, forced position changes could create a larger swing than fundamentals alone justify. Central banks have warned that private-market growth and leverage can act as transmission channels in a shock.

Practical Signs to Watch for Traders and Investors

Track five clear signals: (1) Fed messaging on inflation and rate paths; (2) next earnings cycles for mega-cap AI players; (3) flows into and out of tech ETFs; (4) changes in forward P/E ratios across indexes; (5) credit spreads and liquidity in private markets. Rising volatility or widening credit spreads often precede broader corrections. Also watch headline risk from geopolitics or trade policy. Strong news can quickly change sentiment in a market driven by FOMO.

How to Think about Risk Now?

High valuations do not prove a bubble. Many tech firms have real revenue growth from AI, cloud, and software services. But prices now include heavy expectations. That creates a thin margin for surprises. Prudence matters. Diversify holdings.

Avoid concentrating exposure in a single theme. Use stop-loss rules or size positions to manage downside. Follow company-level fundamentals, not just headlines. Monitor liquidity and margin requirements that can force rapid selling.

Final Perspective

FOMO remains a strong short-term force. The ECB’s November 2025 review is a reminder that macro and market structure can turn sentiment into risk. Tech’s future may be bright. Still, elevated prices mean the market is sensitive to errors in expectation. Careful risk management and attention to hard data can help protect capital if optimism cools.

Frequently Asked Questions (FAQs)

The ECB warned on 17 November 2025 that US tech stocks look “stretched.” This means their prices are rising faster than company profits, which can increase market risk.

Yes. Many investors buy tech shares because they fear missing new AI gains. This FOMO trend grew stronger in 2025, even when prices moved ahead of real performance.

A drop is possible if earnings slow or interest rate plans change in late 2025. High prices make tech stocks react quickly when any negative news appears.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.