FTSE 100 Today: Markets Drop as Regional Bank Fears Spread

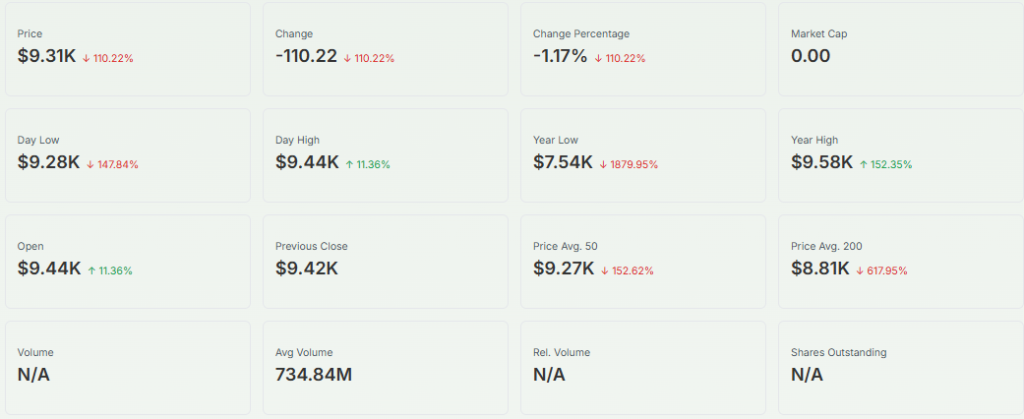

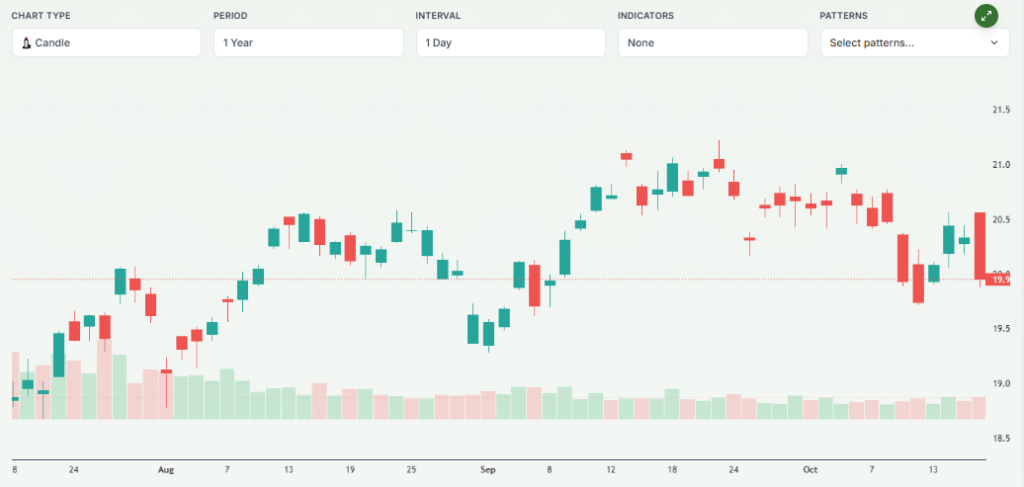

On 17 October 2025, the FTSE 100 fell sharply. Markets were hit by growing fears around U.S. regional banks. Two such banks disclosed large loan losses and fraud risks. This news shocked investors globally.

London’s top index dropped more than 1.5 %, led by banking stocks. These losses spread beyond finance. Energy, industry, and consumer shares joined the slide.

Today’s retreat shows how fragile markets feel. When banks seem unstable, trust falters fast. In this piece, we explore what drove the drop, which sectors were hit hardest, and what might come next.

FTSE 100 Performance Overview

On 17 October 2025, the FTSE 100 fell sharply as investors reacted to fresh banking worries. The index slid about 1.5-1.6% from the previous close. Big banks led the decline. Trading volumes rose as sellers dominated early sessions.

Miners and oil names helped limit losses, but could not stop the slide. The drop made this one of the worst sessions for the index since April. Markets in Europe and the US moved lower on the same news, showing that the shock was global rather than local.

What Triggered the Decline?

The sell-off began after disclosures by a pair of US regional lenders. Both reported loan quality issues and potential borrower fraud. One bank took a multi-million dollar charge tied to irregular loans. Another opened legal action to recover losses. Investors fear this is not just an isolated problem. The worry is that private credit and commercial lending might hide more bad loans.

These signals revived memories of earlier regional bank stress and pushed traders to cut risky positions. An AI stock research analysis tool scanning headlines would likely flag sudden credit risk as a trigger for higher volatility.

Banking Sector in Focus

UK bank shares fell alongside US peers. Barclays, Lloyds, and NatWest moved lower on heavy selling. Some investors sold holdings to reduce exposure to cyclical credit risks. Analysts pointed out that UK lenders have stronger capital cushions now. Still, any sign of wider credit stress can hurt sentiment quickly.

City strategists stressed that exposure levels differ by bank. Some lenders have limited direct contact with the troubled US loans. Others hold similar commercial portfolios that could be vulnerable if defaults rise. Short-term pressure may persist until clearer data on loan losses appear.

Broader Market Reactions

The shock did not only hit banks. Real estate and industrial stocks also fell. Tech names cooled after a week of gains. Investors sought safety in bonds and core commodities. US Treasury yields dropped as traders sought shelter. Gold pushed higher amid the scramble for safe havens.

Currency markets showed typical flight-to-quality moves, with the dollar weakening in some sessions. Global indices, from the DAX to the Stoxx 600, opened lower, reflecting synchronised risk aversion. Volatility indexes climbed, signalling greater fear across markets.

Economic and Policy Backdrop

The move came against a background of still-elevated rates and mixed growth signals. Inflation has cooled slowly in many places, but central banks remain watchful. The Bank of England has signalled caution while weighing growth and price stability.

Any rise in credit losses could complicate policy decisions. Regulators and market participants will watch upcoming bank reports and stress indicators closely. Government and supervisory statements in the near term will be important to calm or buoy markets. Expect attention on liquidity metrics and loan-loss provisions.

Expert Insights and Market Outlook

Analysts offered mixed takes. Some argued the immediate hit is limited and tied to a few problem loans. Others warned about contagion if private credit losses show up elsewhere. Short sellers and volatility traders increased activity. For now, confidence depends on clear figures about loan exposures and collateral.

Key near-term events include upcoming bank earnings, credit updates, and any regulator comments. If fresh evidence points to isolated issues, markets may recover. If not, investors could face a longer correction. Keep an eye on daily volumes and credit spreads for early signs of stress easing or worsening.

Wrap Up

The FTSE 100’s slide on 17 October 2025 shows how fast credit worries can spill into equity markets. The immediate pain centred on bank stocks, but effects rippled across sectors. Clarity on loan losses and regulator responses will guide the next moves. Short-term volatility looks set to remain higher until fresh data calms nerves. Investors should track official updates and bank filings closely in the coming days.

Frequently Asked Questions (FAQs)

The FTSE 100 fell on 17 October 2025 because investors feared new banking risks after U.S. regional banks reported big loan losses and financial instability signs.

On 17 October 2025, shares of Barclays, Lloyds, and NatWest dropped the most as traders reacted to rising global banking worries and weaker investor confidence.

Experts say the FTSE 100 may recover slowly if banking fears ease. Future gains depend on strong earnings reports and clear updates from financial regulators.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.