FTSE 100 today, Nov 25: Guidance Up for B&Q Owner; easyJet Pushes Holiday Expansion

The FTSE 100 saw a steady mood on November 25, 2025, as traders focused on two big stories shaping the day. One came from the home-improvement space. The other came from the travel sector. Both offered a quick look into how UK consumers are spending and what big companies expect in the months ahead.

Kingfisher, the owner of B&Q, caught attention early. The company lifted its profit guidance, which is a rare bright sign in a slow retail year. Investors like seeing a firm raise expectations instead of cutting them. It hints that some parts of the UK retail market are stronger than they look.

At the same time, easyJet pushed forward with its fast-growing holiday business. Travel demand stayed solid despite higher costs, and the airline leaned into this trend. Its move showed how travel companies are shifting toward higher-margin holiday packages for growth.

Together, these updates shaped the FTSE 100’s tone for the day. They also reminded investors that even in a mixed economy, some sectors still find room to outperform.

Market Snapshot: What Happened Today?

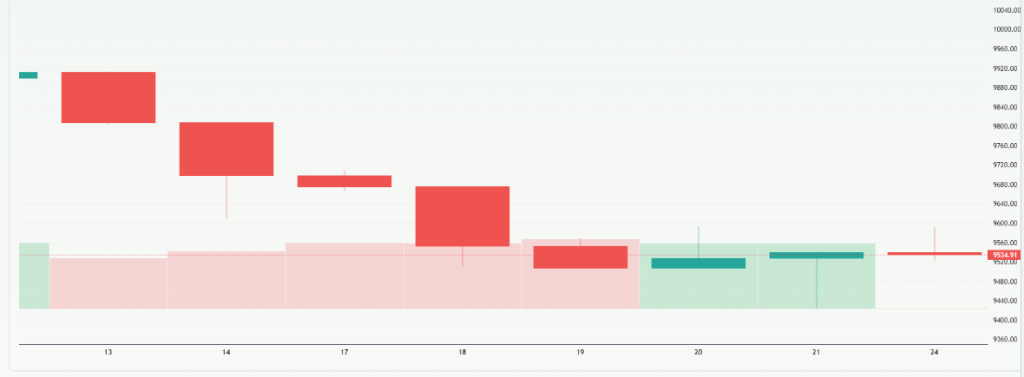

On 25 November 2025, the FTSE 100 rose modestly at the open, buoyed by gains in retail and banking. According to Proactive Investors, the index climbed about 12 points early in trading, reaching around 9,547. Kingfisher led the rally, jumping over 5%, while major UK banks also gained amid speculation over the upcoming UK Budget. The boost from Kingfisher showed how corporate-level surprises in domestic companies can influence broader market sentiment.

Kingfisher: Guidance Upgrade and Why It Matters

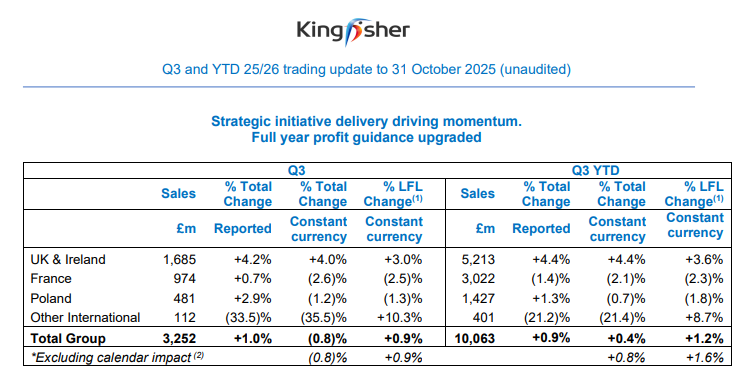

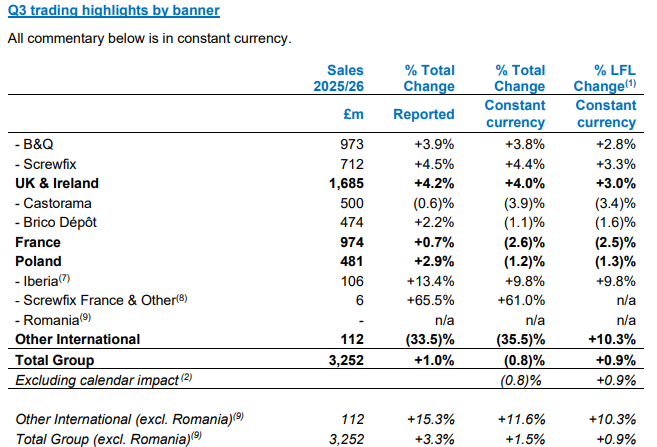

Kingfisher, the parent of B&Q and Screwfix, raised its full-year adjusted profit outlook today. The company now expects profit before tax between £540 million and £570 million, up from a prior top end of £540 million. This upgrade comes as a result of surprisingly strong performance in the UK and Ireland. In the third quarter (to 31 October 2025), Kingfisher reported a 0.9% increase in like-for-like sales, largely driven by a 3% rise in the UK and Ireland.

The company credited strategic initiatives in e-commerce and trade, plus solid demand for “big-ticket” items, for its positive tone. According to Forbes, the CEO, Thierry Garnier, emphasized that the firm’s volume-led growth reflects both market share gains and better execution.

However, not all regions are strong. Kingfisher warned that demand remains soft in France and Poland. Consumer sentiment in France is weak. There have also been political uncertainties and strike risk. Still, the upward guidance shows that Kingfisher feels confident in its UK franchise, a meaningful signal for domestic-focused retailers on the FTSE.

easyJet: Expanding the Holiday Business: Strategy and Scale

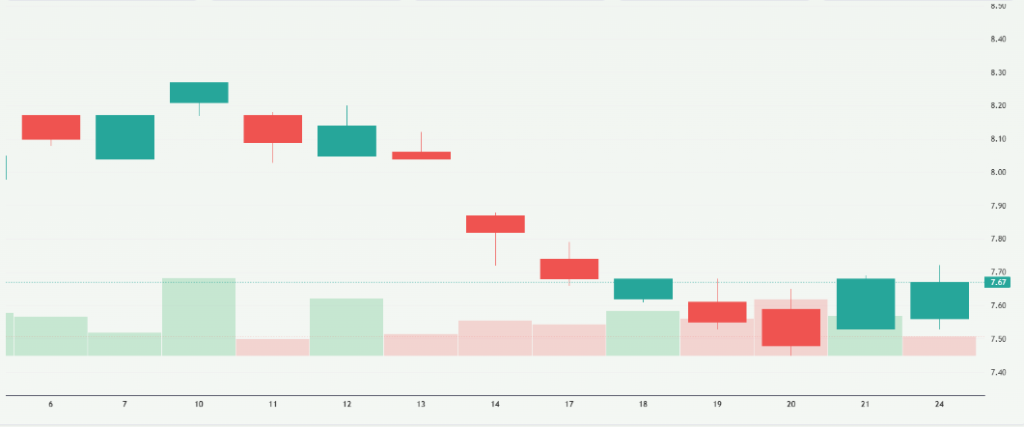

At the same time, easyJet reported strong full-year results driven by its growing holidays division. For the year ending 30 September 2025, its headline pre-tax profit rose 9% to £665 million. Within that, its holiday arm delivered £250 million PBT, meeting its previous target ahead of schedule. Because of this success, easyJet raised its long-term profit target for the holidays business to £450 million by 2030.

The boost came from solid demand for package holidays. More people flying with easyJet are now also booking their hotels or full holiday packages. The Guardian reports that average selling prices rose by roughly 5%, while customer numbers increased by about 20%. This helped revenue and margins in the holiday unit.

But easyJet also sounded a caution note. It said winter trading has been tougher than expected. Reasons include geopolitical tension in some markets and delays in aircraft deliveries, especially from Airbus. Still, management remains confident in its strategy. The core airline business is improving, punctuality is better, and customer satisfaction in the holiday arm hit its highest level in over a decade.

How do the Two Stories Connect to FTSE 100 Performance?

These two very different stories, a home-improvement retailer upgrading guidance and a low-cost airline leaning into holidays, link up to shape today’s FTSE 100 mood. Kingfisher’s upgrade shows that over here at home, consumers are still buying hardware, big-ticket items, and trade products. easyJet’s holiday boom, on the other hand, shows demand for travel is still resilient, even with cost pressures.

For the FTSE, which is often dominated by global exporters and energy firms, such domestic plays matter a lot. When companies like Kingfisher and easyJet surprise on the upside, they provide a lift to the whole index. Their success also hints at where investor bets may lie: not just on international growth, but on UK consumer trends and structural shifts in business models.

Risks and Caveats

Even with today’s upbeat news, there are risks. For Kingfisher, the company itself notes trouble in France and Poland. Weak consumer sentiment, political instability, and labor strikes could hurt those markets. There’s also the broader macro risk: inflation, a softening labor market, and uncertainty over the UK government’s next budget could strain its outlook.

EasyJet’s holiday business is scaling, but macro and geopolitical risks remain. Winter margins could remain under pressure. Delivery delays from Airbus may cap capacity growth in the near term. Plus, competition in the package holiday space is fierce, and any drop in consumer confidence could weigh on demand.

What to Watch Next?

Looking ahead, investors should eye several key things:

- Retail data: consumer spending and confidence surveys will show whether Kingfisher’s strong UK demand is sustainable.

- Budget week: the upcoming UK Budget could usher in policy changes that affect consumer behavior and corporate earnings.

- Airline bookings: easyJet’s holiday bookings, especially for 2026, will be a major bellwether. Reports say about 80% of the 2026 capacity is already sold.

- Aircraft deliveries: any delays or cost issues with Airbus could pressure easyJet’s capacity plans.

- Macro risks: inflation, wage growth, and geopolitical tensions remain major wildcards.

Final Words

Kingfisher’s upgrade and easyJet’s holiday push are more than just headlines. They reflect how certain UK-facing companies are finding strength amid uncertainty. For the FTSE 100, these stories bring both hope and caution. The question now is whether this momentum can last or whether bigger macro risks will drag it down.

Frequently Asked Questions (FAQs)

On November 25, 2025, the FTSE 100 moved because Kingfisher raised its profit outlook and easyJet reported strong holiday results. These updates improved the market mood for the day.

On November 25, 2025, Kingfisher raised its full-year profit guidance. The company said its UK and Ireland sales were stronger than expected, so it increased its earnings outlook.

easyJet is growing its holiday business because demand for package trips is rising. Holiday packages also offer better profit margins, so the airline sees it as a smart long-term strategy.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.