FTSE 100 Today, Nov 26: Markets Rally Ahead of Key Budget Announcement

The FTSE 100 opened higher on November 26, 2025, as investors reacted to fresh economic signals from both the UK and global markets. The index showed early strength, and this rise came at a time when many traders were trying to understand how the next few days might shape the market. Today’s rally is not random. It is tied to growing hopes that the upcoming UK budget will offer support for businesses and help ease cost pressures.

Many investors believe the government may introduce steps to boost growth, and that belief added energy to the market from the start of the session. Global cues also played a role. Stronger performance in the US and Asian markets helped lift confidence in London trading.

Key sectors, especially energy, banking, and consumer stocks, pushed the index forward as the morning progressed. Traders seemed more optimistic than usual, but they also stayed alert. The budget announcement is just ahead, and it could shift momentum quickly.

FTSE 100 Performance Overview

The FTSE 100 traded higher through the session on 26 November 2025. Early gains were modest but persistent. The index rose as global risk appetite improved and sterling firmed. Trading volumes were steady, not frenzied. Heavyweights in energy and mining added the most points. Banks also nudged the index upward. Markets remained sensitive to the Chancellor’s budget statement scheduled for the day.

Key Drivers Behind Today’s FTSE 100 Rally

Three clear forces pushed stocks up. First, overseas markets provided a positive backdrop. Gains in the US and Asia helped sentiment in London. Second, commodity moves lifted miners and oil majors. A rebound in oil prices removed some near-term pressure on energy names. Third, speculation about the budget itself encouraged buying in sectors that could benefit from business-friendly measures. Investors also priced in potential relief from some tax measures that had worried markets in recent weeks.

How the Budget Loomed Over Markets

The budget delivered on 26 November 2025 shaped investor mood all day. Traders tried to balance the need for fiscal repair with the risk of measures that could slow growth. Reports before the speech suggested significant tax cuts. That uncertainty kept sentiment cautious even amid the rally. Markets reacted to the possibility that the government may use targeted hikes and selective reliefs rather than broad austerity. Currency and gilt moves reflected those mixed expectations.

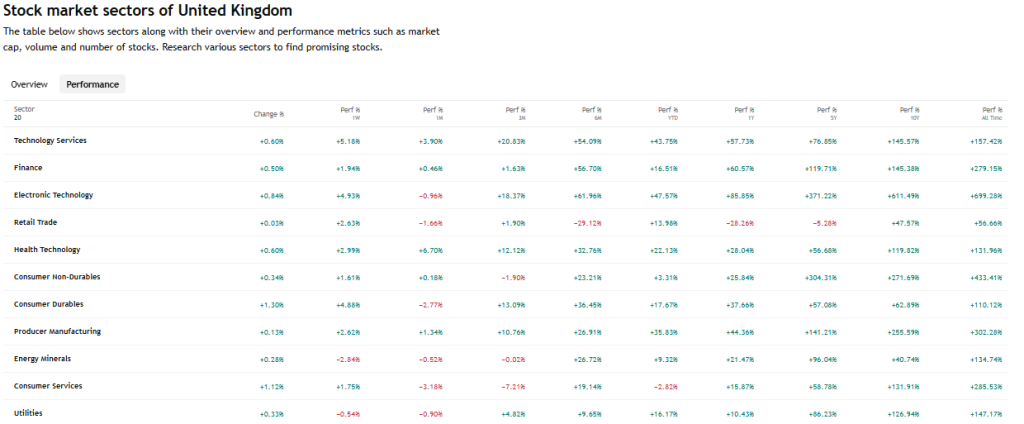

Sector Moves: Winners and Laggards

Banks saw steady gains as the prospect of clearer fiscal policy lowered some tail risks. Standard Chartered and Barclays were notable performers on the session, buoyed by improved expectations for margins and clearer guidance on tax policy. Miners outperformed as gold and copper strengthened, which raised hopes that commodity producers can protect earnings even if growth slows. Energy names had a mixed day.

Oil majors rose on a technical rebound in crude, though traders warned any peace-driven increase in Russian output could reverse gains. Consumer-facing firms showed limited upside. Retailers remain sensitive to wage and tax changes announced in the budget.

Companies to Watch Today

Large-cap oil and gas companies drew attention. BP and Shell showed firm intraday pricing and helped support the index. Miners such as Anglo American gained as metal prices inched higher. Banks and some defense contractors also attracted flows.

Smaller consumer names weighed on performance where earnings or profit warnings surfaced. Market participants focused on firms with high domestic exposure. This focus stemmed from the fact that budget changes often hit home-facing businesses hardest.

Market Mechanics: Sterling, Gilts, and Volatility

Sterling strengthened before the budget. A firmer pound helped some financials by reducing foreign currency risk. Gilts showed mixed moves. Yields fell in some pockets as a stronger U.S. bond market offered relief for UK borrowing costs. Still, gilt volatility rose around the budget hour. The interplay between bond yields and the currency set the tone for short-term equity flows. Active traders watched these indicators as real-time gauges of market trust in fiscal strategy.

Analyst Views and Short-Term Outlook

Analysts stressed two main scenarios. One sees the budget as credible enough to steady bond markets and to allow a gradual equity advance. The other fears heavy tax rises that could dent growth and tilt markets lower. Short-term risk is concentrated in the hours and days after the Chancellor’s speech. If policy surprises are large, expect spikes in volatility. If moves are measured, the rally can extend. Many desks used quantitative models and at least one AI stock research analysis tool to test scenarios and price likely outcomes.

What Traders Should Watch Next?

Watch earnings updates and corporate guidance that arrive in the next week. These will show how businesses respond to fiscal changes. Keep an eye on oil and metal prices. They matter for big FTSE names. Track gilt yields and the pound. Any sharp move there will change sector leadership quickly. Finally, monitor central bank commentary for hints on interest-rate paths. That will affect both banks and long-duration sectors.

Conclusion: Near-Term Takeaway

The FTSE 100 rallied on 26 November 2025 on a mix of global support and budget-driven positioning. The move was steady rather than dramatic. The budget remained the central risk and the main potential catalyst. Short-term trading will likely be choppy. Longer-term trends will hinge on whether fiscal moves support growth without unsettling bond markets. Investors should stay alert to fresh economic data and company updates that can change the story fast.

Frequently Asked Questions (FAQs)

The FTSE 100 rose on November 26, 2025, because global markets improved, energy stocks gained, and investors waited for the UK budget. These factors helped build steady confidence in trading.

The UK budget on November 26, 2025, may affect the FTSE 100 by changing taxes, business rules, or spending plans. These decisions can raise or lower investor interest in different sectors.

On November 26, 2025, top gains often came from energy, mining, and bank stocks. These sectors rose because of strong commodity prices and positive market expectations before the budget.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.