FTSE 100 Today: UK Stocks Mixed as Shop Price Inflation Slows Down

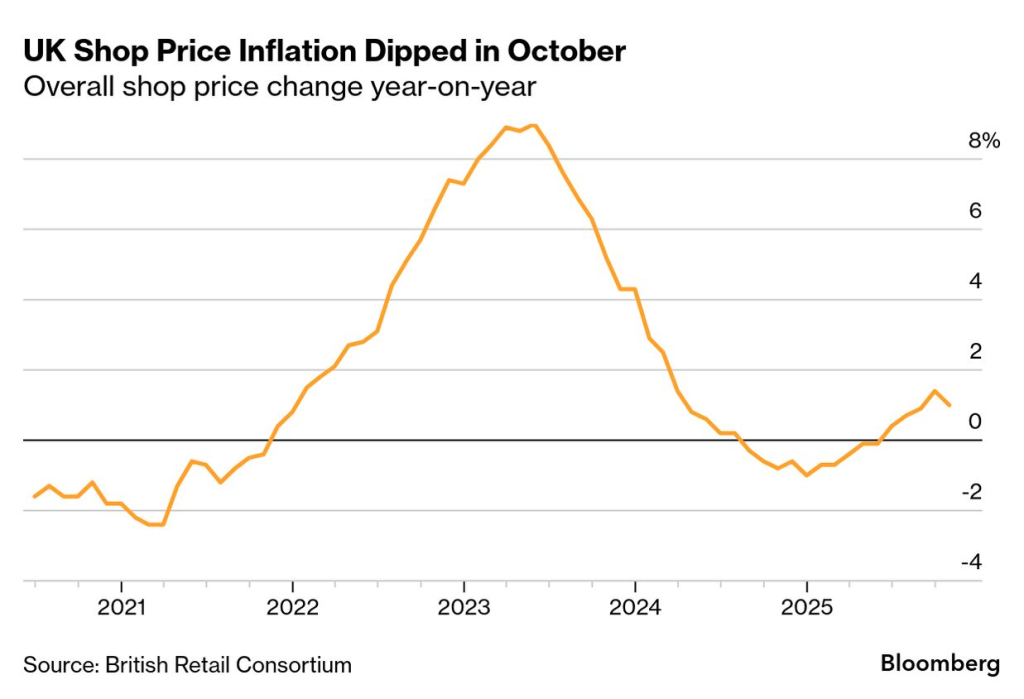

On 28 October 2025, UK shop prices (FTSE 100) fell for the first time since March. British Retail Consortium data show that overall shop prices dropped by 0.3 % in September. Food prices led the way, with a 0.4 % fall, marking their biggest monthly slide since December 2020.

This cooling in retail inflation has sent ripples through the stock market. The FTSE 100, Britain’s leading equity index, traded in mixed fashion today as investors weighed relief for consumers against broader economic caution.

Slower price rises mean households may have more spending power. They also ease pressure on the Bank of England to raise interest rates further. But weaker demand could weigh on companies, especially in retail and services. In short, the inflation story has shifted. What this means for shares, sectors, and the wider economy is now taking centre stage.

FTSE 100 (UK Market): Quick Market Snapshot

The FTSE 100 traded mixed on 28 October 2025. It hovered near recent highs and showed little net direction by late afternoon. Trading was choppy as investors digested fresh retail data and recent record levels for some blue-chip stocks. The index moved in a narrow range, with financials and miners pushing parts of the market higher while some consumer names lagged. Market data showed the FTSE hovering around the mid-9,600s on the day.

Why Shop-Price Inflation Mattered Today?

New British Retail Consortium data on 28 October 2025 showed shop prices fell 0.3% month-on-month. Food prices led the fall with a 0.4% drop, the largest monthly slide since December 2020. Year-on-year shop-price inflation eased to about 1.0% from 1.4% in September. That cooling surprised some traders and shifted the tone on the street.

Lower shop inflation can boost real incomes. It can also ease pressure on the Bank of England to tighten policy further. But the effect is not automatic. Slower price rises can also signal weaker demand for some companies.

How is the Data Fed in Market Moves?

Investors split the news into winners and losers. On the positive side, calmer inflation reduced near-term rate fears. That helped large, interest-sensitive financials and dividend payers that dominate the FTSE 100.

On the negative side, retail volumes remained under strain in other reports. The Confederation of British Industry said retail sales were still weak in late October, pointing to persistent pressure on shop margins and footfall. The mixed signals kept the index from moving decisively.

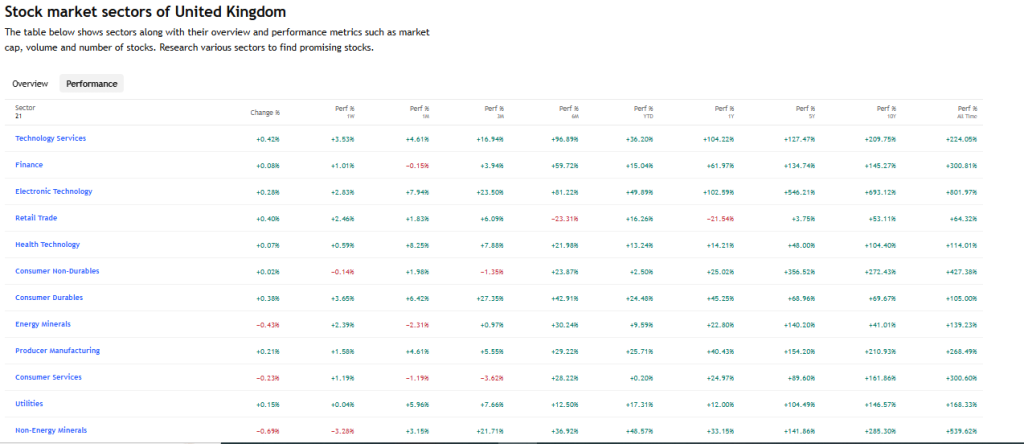

Sector and Stock Impacts Explained

Commodity and energy names stayed strong recently because global commodity prices have firmed. Those gains supported the index and offset weakness in smaller consumer names. Big banks and insurers received a lift from steady net interest income beats and takeover chatter in some quarters. By contrast, domestic-facing retailers and some leisure stocks struggled. This split reflects the FTSE 100’s heavy skew toward multinational miners, oil firms, and banks. These firms benefit from global cycles even when UK consumer demand cools.

Retail Margins Versus Consumer Relief

Discounting and promotions were central to the BRC’s findings. Retailers moved early on seasonal deals, and food suppliers passed on lower commodity costs in some lines. That helped push down prices at the till. But discounting compresses margins.

Retailers that cannot cut costs risk weaker profits even as shoppers gain short-term relief. Analysts warned that margins must recover through better volumes or price discipline. If spending stays muted, that recovery could take longer than markets hope.

Macro Overlay: Bank of England and Global Linkages

Shop-price data feeds into a wider inflation picture. Headline CPI and core measures remain the Bank of England’s priority. Softer shop prices are one input among many. Markets now price a slightly lower chance of further BoE hikes in the near term. Still, global forces matter.

US inflation readings and Federal Reserve guidance can shift risk premia and yields. When US rates move, London often follows, especially for banks and commodity stocks. That cross-border sensitivity explains why the FTSE can rise even when domestic retail indicators soften.

Analyst takes a Modern Research Aid

Analysts point to two themes. First, duration matters: short-term relief for consumers does not always translate to stronger corporate earnings. Second, sector mix drives headline moves. Blue-chip earnings and commodity strength keep the FTSE cushioned. Some brokers used an AI tool during the session to screen earnings signals and reweight short lists of top movers. The tool flagged banks and miners as relative beneficiaries of the day’s data. That small boost to modelled conviction influenced quick trading calls at several desks.

What Investors Should Watch Next?

Look for the next official inflation prints and monthly retail sales. The BoE calendar and any guidance from the Monetary Policy Committee are crucial. Company-level updates matter too. Watch quarterly results from major retailers, banks, and commodity firms. Also track global cues: US CPI, Fed commentary, and oil or gold price swings. Each of these can change the odds on rates and shift which FTSE sectors lead.

Practical Takeaways for Portfolios

Diversification remains key. The FTSE’s composition means exposure to commodities and global banks can smooth domestic shocks. Conservative investors may favour high-quality dividend names with stable cash flows. Risk-tolerant traders can look for cyclical names that benefit if consumer demand returns. Pay attention to earnings guidance and margin trends. Short-term discounting in retail could mean bargains or traps, depending on whether sales recover.

Final Words

Shop-price inflation cooling on 28 October 2025 offered welcome relief to households. The data also made markets pause. The FTSE 100 showed mixed moves because sector dynamics mattered more than any single macro print. Keep an eye on upcoming inflation releases and corporate results. Those will decide whether the calm on shop prices turns into sustained relief for the wider economy, or only a brief pause for retailers and investors.

Frequently Asked Questions (FAQs)

On 28 October 2025, the FTSE 100 stayed mixed as investors reacted to falling shop prices, steady oil stocks, and uncertain global economic signals.

Shop-price inflation shows how prices of goods in stores change over time. It tracks both food and non-food prices paid by shoppers each month in the UK.

High inflation raises business costs and cuts profits, often hurting stock prices. Lower inflation can boost spending and support market growth, improving investor confidence.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.