GIFT Nifty Rises 80 Points as Markets Eye Today’s Trading Setup

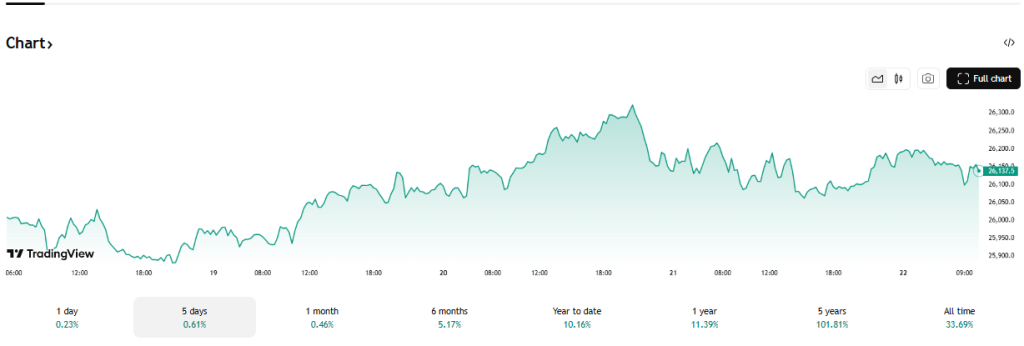

GIFT Nifty opened the day with an 80-point jump on 24 November 2025, and this early move has caught every trader’s attention. This rise matters because GIFT Nifty often hints at how the Indian market may start its session. When it moves higher, it usually shows a stronger global mood and better risk appetite. Today, the setup looks interesting.

Global markets had a mixed night, yet investors seem more hopeful. Many traders are watching the US tech rally, steady Asian markets, and stable oil prices. These cues are shaping early expectations for India. At the same time, domestic factors are also in play. Earnings updates, policy signals, and sector news may guide the day’s trend.

The rise in GIFT Nifty gives a positive start, but the market still needs support from strong volumes and steady global flows. Traders want clarity, and today’s setup may offer that. With many triggers lined up, the session could turn active and offer quick opportunities. This makes today an important day for both short-term and long-term players.

What Today’s GIFT Nifty Movement Signals?

GIFT Nifty jumped about 77 points to 26,155 in early trade on 24 November 2025. This pre-market gain signals a positive start for Dalal Street. Such a move often reflects a better global mood. It also shows that traders may prefer risk assets at the open. Yet a single pre-market rise is only a hint. The real test will be market breadth and trade volumes after the bell.

Global Market Cues Shaping Sentiment

Overnight moves in the US set the tone for Asia. Wall Street advanced on hopes of an easier monetary policy. Investors priced in possible Fed easing in the coming weeks. This pushed futures and risk assets higher. At the same time, strong US jobs data earlier this week complicated the rate outlook. Oil and currency moves also affected the mood before the Indian open. Traders are watching these global levers closely.

Domestic Factors to Watch in Today’s Trading Setup

Domestic data and news will decide the intraday trend. Earnings updates from large-cap firms could direct sector rotations. Policy signals or government announcements may trigger quick flows. Local liquidity and DII buying remain important buffers. Foreign institutions have shown net outflows in November, but domestic long-term buyers have stayed active. That mix can keep sessions choppy. Keep an eye on any major corporate releases or RBI-related commentary due during the day.

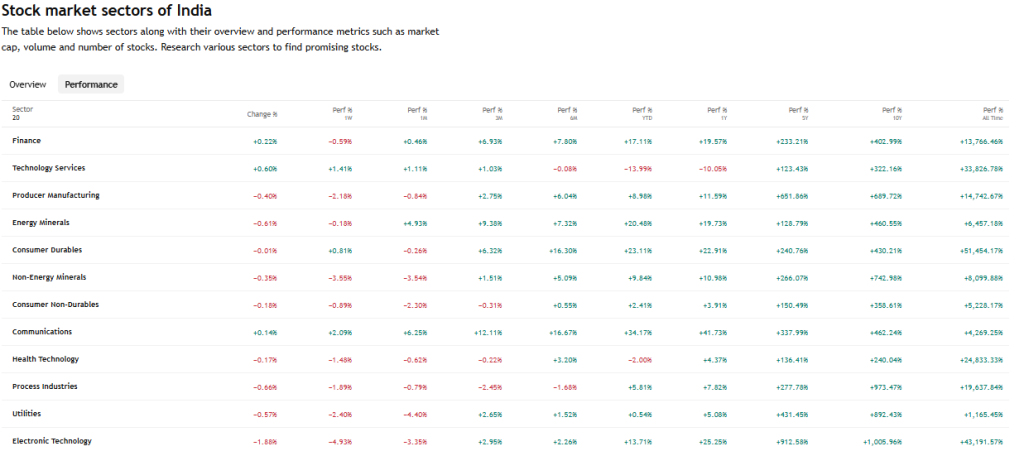

Sector-Wise Outlook for Today

Banking and financials often lead when global liquidity looks supportive. Banks could react to bond yield moves. IT names may track the dollar and global tech cues. Auto stocks may get interest from recovery narratives and expected policy tailwinds. Metals follow commodity prices and China’s demand. Consumer names stay defensive if volatility rises. Each sector needs a clear trigger to sustain gains. Analysts highlight autos as poised for recovery over the next 2-3 years, which may influence today’s flows.

Stocks in Focus

Large-cap, liquid stocks will drive headline moves. Look for names with fresh earnings, guidance, or major announcements. Export-linked firms will mirror global demand and currency swings. Banks and NBFCs will be active if bond yields change.

Technology stocks could react to US tech momentum. Watch for sudden block trades or promoter actions, as these create sharp intraday swings. Traders should also track news on fuel prices, commodity orders, and large deals announced before or during market hours.

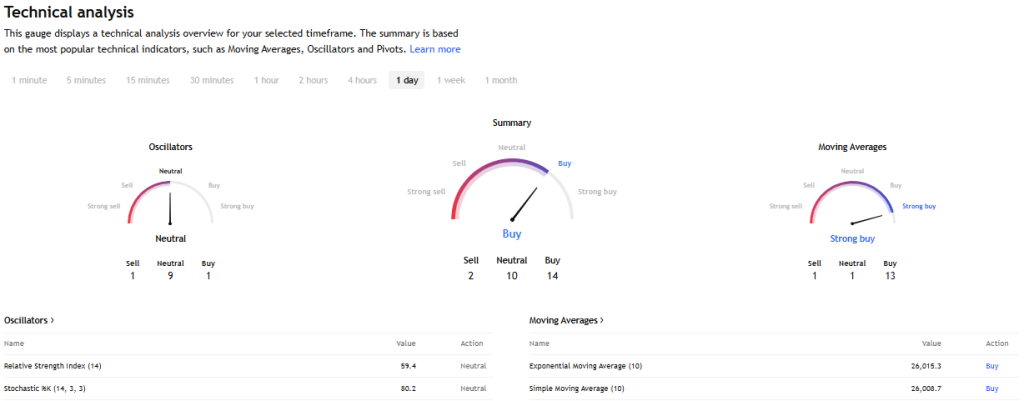

Technical Outlook for Nifty & Bank Nifty

Technical structure matters in fast markets. Nifty found a support zone near 26,000–25,850 in recent calls. Immediate resistance sits close to 26,250-26,300. A clear break above those levels may open the path to higher targets.

Conversely, failure to hold 26,000 could invite fresh selling. Bank Nifty will react to financial sector flows and bond yields. Traders commonly use RSI, MACD, and open interest to time entries. Short-term traders should watch intraday support and resistance for quick scalp trades.

Trading Strategies for Today

Short-term traders should keep targets tight. Use stop losses and scale positions. For momentum plays, confirm strength with volume. For swing trades, watch daily closes above resistance or below support. Options traders can use spreads to limit risk in choppy markets. Long-term investors should avoid panic selling on intraday noise.

If the market tests key supports, buyers can add selectively to fundamentally strong names. For quick scanning of headlines and sentiment, an AI tool scan can help filter urgent news, but always validate alerts before trading.

Risk Factors and Event-Driven Triggers

Several events can change the session quickly. Sudden global headlines. Macroeconomic releases. Corporate earnings surprises. Large FII flows in either direction. Volatility spikes in global markets. Geopolitical news or currency shocks. Traders must expect quick reversals. Position sizing and stop discipline remain crucial. News flow between 9:00-11:30 AM IST often sets the tone for the rest of the day. Keep alerts active for any high-impact releases during this window.

What Traders Should Keep in Mind?

Market breadth will confirm strength. Strong advance-decline ratios matter more than index moves. Volume must back any rally for conviction. Manage risk with clear stops. Avoid chasing thin momentum late in the session. For intraday plays, respect technical levels and news flow. For positional trades, stick to quality names with good balance sheets. Remember that global cues can override local positives in the afternoon session.

Bottom Line

The 80-point rise in GIFT Nifty on 24 November 2025 gives a positive bias at the open. Global cues, domestic earnings, and institutional flows will determine if the move lasts. Traders should use clear rules. Keep risk tight. Watch key supports, resistance, and sector triggers. If markets confirm strength with volume and breadth, moves can extend. If not, expect chop and quick reversals. Stay alert and trade with discipline.

Frequently Asked Questions (FAQs)

GIFT Nifty is up today because global markets showed positive momentum, and early economic signals improved trader confidence. Overnight US and Asian cues also supported the rise.

Yes. GIFT Nifty often indicates how the Nifty 50 may open. A sharp move in GIFT Nifty can signal early sentiment, but the real trend depends on volumes and intraday news.

Traders should track global cues, FII flows, sector news, and key support and resistance levels. These factors help confirm whether the early rise will hold after the market opens.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.