GME Cash Reserves Surge to Nearly $9B in Q2

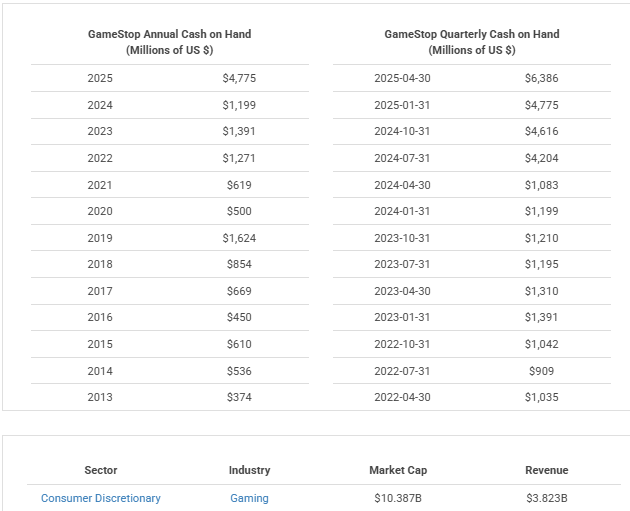

GameStop has surprised the market once again. In its second-quarter update, the company revealed cash reserves close to $9 billion. That number is huge for a retailer that was once written off as a dying brand. A few years ago, we saw GameStop making headlines as the face of the “meme stock” frenzy. Many thought it was just hype. Today, the numbers tell a different story.

Cash reserves at this scale change the game. They give a company room to breathe, invest, and survive downturns. For GameStop, this pile of cash could mean more than just safety. It can open doors for growth, new strategies, and bold bets. But it also raises questions. What will they do with this money? Can strong reserves translate into a real turnaround?

We, as observers, know one thing: money alone does not guarantee success. Markets move fast, and retail gaming faces heavy competition. Yet, the $9B figure forces us to look again at GameStop. The company may not be the same risky bet it once was. Instead, it now sits on a foundation that few expected.

The GME $9B Cash Reserve Milestone

GameStop closed the quarter with about $8.7 billion in cash, cash equivalents, and marketable securities. That figure is more than double the $4.2 billion held a year earlier. This cash pile puts GameStop in a rare place for a retail chain. Many retailers carry tight cash buffers. GameStop now has options that many peers do not.

Historical Context: From Meme Stock to Stability

GameStop shot into public view during the 2021 meme-stock surge. At that time, headlines focused on retail traders and sharp price swings. The business still had real problems then. Stores were closing and sales were shifting online. Since that moment, the company has moved away from crisis headlines. Management worked on profit, inventory, and new lines of business. The cash buildup shows a shift from hype to financial strength. Analysts now must weigh legacy retail issues against the company’s stronger balance sheet.

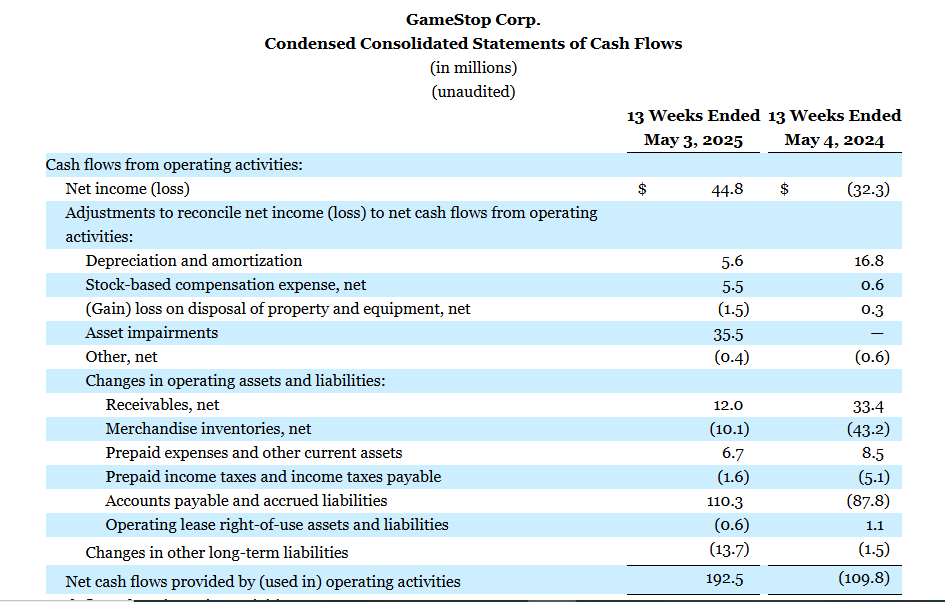

Sources of the Cash Surge

Several moves explain the cash jump. First, the company raised capital through equity and securities offerings in recent quarters. Second, operations improved. Sales rose in hardware, accessories, and collectibles. Third, the firm cut some costs and focused on higher-margin areas. Fourth, the company holds digital assets, including Bitcoin, which are now sizable on the balance sheet. Finally, careful treasury management and marketable securities also boosted the reported cash figure. Together, these actions created a large liquidity cushion.

How GME Is Using Its Cash?

The company has several clear options for using the cash. One path is investment in digital transformation. That can mean better online sales, logistics, and tech partnerships. Another path is mergers and acquisitions. GameStop can buy niche gaming or collectibles firms. The firm could also return value to shareholders through buybacks or special dividends.

Management flagged potential uses in the earnings release and supplementary filings. Holding cash also acts as a safety net if retail sales slow. The key will be turning liquidity into long-term revenue growth.

Market & Investor Reaction

Markets reacted with cautious optimism. Shares rose modestly on the results. Analysts praised the profit and revenue beats. Some investors see the cash as a major risk reducer. Others worry about idle cash that sits unused. Retail communities that first made GameStop famous reacted with renewed interest. Yet, sentiment remains mixed. Many now ask for clear plans on capital deployment and growth moves.

Comparison with Competitors

Compared to large gaming ecosystems, GameStop’s position is unique. Tech giants like Microsoft and Sony have deep pockets. Yet those rivals invest heavily in content and cloud gaming. Traditional retailers such as Best Buy keep smaller cash reserves. GameStop’s near-$9B chest is unusual for a specialty retailer. However, scale and access to content remain the real advantages of Microsoft and Sony. Cash can buy time and options. It cannot buy an instant place in the cloud gaming market. The challenge will be using cash to bridge that gap.

GME: Risks & Challenges Ahead

Several risks still loom. First, store traffic could fall further as consumers shift to digital. Second, the company must convert cash into profitable projects. Holding cash too long may hurt returns. Third, competition is intense. Giants and digital platforms have scale and exclusive content. Fourth, regulatory or market shocks could affect digital asset values on the balance sheet. Finally, investors expect transparency on how the money will be used. Failure to show a credible plan could trigger a downside in the stock.

What does this mean for GME’s Future?

The cash gives the company choices. Executed well, these choices could fund a real shift to a modern gaming retailer. That could include digital services, collectibles expansion, exclusive partnerships, and selective acquisitions. If management fails to use the capital well, the firm may only preserve the status quo. The next few quarters will reveal if the firm can turn liquidity into consistent growth. The market will watch capital deployment plans and the firm’s ability to sustain higher revenue.

Bottom Line

GameStop’s near-$9 billion cash balance is a clear turning point. It reduces short-term financial risk. It also raises the bar for management action. The company now needs smart moves. Strategic investment and clear execution will decide if the cash turns into lasting value. For investors, the key is watching how the cash gets used in the coming quarters.

Frequently Asked Questions (FAQs)

GameStop built its cash through stock sales, better cost control, improved sales, and gains from assets. By Q2 2025, reserves reached nearly $9 billion.

GameStop has not shared a clear plan. Possible uses include digital growth, acquisitions, or shareholder returns. Investors expect updates in upcoming reports during 2025.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.