Gold Price Forecast: Analysts See 30% Surge as Investors Shift to Safety

Gold is suddenly drawing intense attention again. In early December 2025, global markets are rattled by economic uncertainty, stuttering labor figures, and rising geopolitical tensions. Against this backdrop, many financial analysts believe gold could surge as much as 30 percent over the coming months.

Investors are moving away from risk-heavy assets and looking for stability. Gold, long seen as a safe-haven, is now getting fresh demand from both big institutions and everyday buyers. Low interest rates, inflation fears, and a shaky global economy are fueling this shift.

This renewed appetite for gold isn’t just hype. It reflects real worries about currency weakness, stock market swings, and global political stress. For many, gold is becoming a solid anchor, a way to keep wealth safe when everything else looks uncertain.

The Data Behind the 30% Surge Prediction on Gold

Analysts are pointing to clear drivers for a big move in gold. The World Gold Council (WGC) says gold could rise between 15% and 30% in calendar year 2026 from current levels. This range reflects several scenarios, not a single fixed outcome. The WGC’s outlook was published in early December 2025 and ties its upside case to stronger safe-haven demand, central bank buying, and heavy ETF inflows if those trends continue.

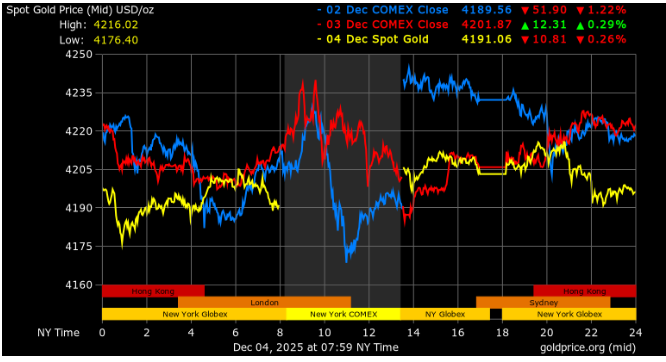

Market data also matters. Gold has already climbed strongly in 2025. By December 4, 2025, spot prices were up sharply year-to-date and had seen a multi-week rally in late November. That momentum is what some models use to project further gains. Recent price swings also track real yields and expectations about U.S. interest-rate cuts, which set the macro backdrop for gold’s path.

Central Banks Buying Gold More Aggressively

Central banks are back in the market. The WGC and its central bank statistics show renewed net purchases by official buyers in 2025. In particular, October data showed a pickup in central bank buying, which tightens available supply for the open market. Countries that have added to reserves include several in Asia and the Middle East. This official demand gives analysts confidence that a structural bid exists beneath prices.

When national banks buy, they do not sell quickly. That locks up metal. It reduces trading float and can amplify price moves when private investors add positions. Analysts say that pattern helps explain why conservative price targets now look more bullish than a year ago.

Safe-Haven Demand from Retail & ETFs

Retail buyers and ETFs are also part of the story. Gold ETFs recorded large inflows earlier in 2025 at a pace not seen for several years and holdings rose materially over the first half of the year. Institutional and retail flows together restored a big chunk of demand after earlier outflows. If ETF demand resumes or accelerates, it could add a meaningful bid to prices.

Retail interest shows up in coin and bar sales, and in sovereign products like India’s Sovereign Gold Bonds. Those channels widen the buyer base beyond funds. That matters, because more buyers means more consistent buying pressure when uncertainty spikes.

Geopolitical Flashpoints Driving Gold Price Outlook

Geopolitics is a big short-term driver. In late 2025, tensions in several regions have added to market nerves. Such events shorten investor time horizons. When fear rises, portfolio managers and private savers look to gold. Gold’s role as a crisis hedge is predictable.

Analysts say even localized shocks can push flows into bullion quickly, tightening the market. Reuters and market commentary in early December reflect this dynamic as traders position ahead of possible escalations and sanctions.

Gold vs Other Assets: Why Investors are Rotating?

Why move from stocks and crypto to gold now? The answer is simple. Gold does not promise growth. It does promise shelter. With equity valuations high in some pockets and bond yields sensitive to Fed signals, investors are trimming risk. Gold becomes attractive when real yields fall or when the dollar weakens.

In 2025, those macro shifts made gold relatively more appealing compared with risk assets and even some alternative stores of value. Several bank research teams and market strategists highlight reallocations into gold as part of portfolios that want stability.

Short-Term Risks: Why Not Everyone Is Fully Bullish

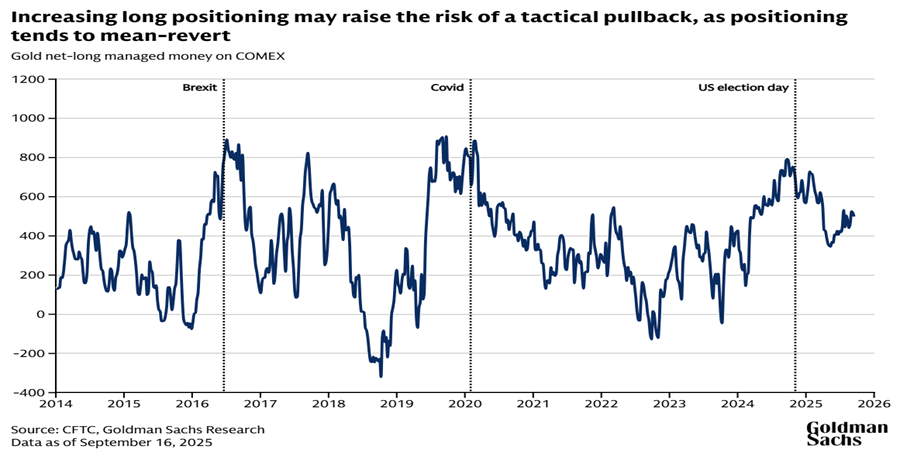

Not every path points up. The main risk is the U.S. dollar and interest rates. If the dollar rallies or if Fed policy stays tighter for longer, gold could stall. Also, profit-taking after a big rally is normal. Short squeezes and rapid reversals can push prices down before they resume any longer trend. Market watchers note that price corrections of 5-10% are possible even in a strong bull environment. Recent daily declines in early December show that traders will react fast to economic prints and Fed signals.

Analyst Price Targets: Where Could Gold Go Next?

Analysts lay out scenario bands rather than single numbers. For example, some major banks revised multi-year targets in 2025 Goldman Sachs raised a long-run target for December 2026 to about $4,900/oz, citing ETF demand and central bank buying.

The WGC’s 15-30% range for calendar 2026 gives a practical “band” for investors to consider. Combining these views, a base case could see gold in the mid-$4,000s within 6-12 months, while a bull case with higher flows and geopolitical shock could push it toward or past $4,900/oz by late 2026. As always, timelines depend on macro moves.

How Investors Might Position Themselves?

Conservative investors often increase gold slowly. They use staggered buys. Some add via sovereign bonds or ETFs. Others hold physical insurance. A few traders use options to limit downside.

Note: one useful modern input that some desks are using is an AI research analysis tool to speed scenario testing. But tools cannot replace judgment. Position size must match goals and risk tolerance.

Conclusion: Safety Is Driving Interest, But Watch the Clues

The case for a big gold move rests on three things. First, central banks that keep buying. Second, sustained ETF and retail demand. Third, a macro mix of lower real yields and geopolitical stress. Those factors created the World Gold Council’s 15-30% outlook for 2026 in early December 2025.

Still, the dollar, Fed policy, and short-term profit taking can cause pullbacks. For cautious investors, a measured, phased approach to adding gold makes sense while watching key data like U.S. jobs, PCE inflation prints, and central bank reports.

Frequently Asked Questions (FAQs)

Gold may rise thanks to strong demand from central banks and investors. Slowing global growth, rate cuts, and safe-haven demand also boost gold’s appeal.

Maybe. If risks like inflation or market trouble grow, gold could gain value. But prices can go up and down. Buy if you accept some risk.

Some experts say gold could reach near or above $4,900 per ounce by late 2026. Others expect a modest rise. Outcome depends on demand and world events.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.